New Jersey Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause

Description

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Limitation Of Liability Clause?

Are you located in a spot where you need documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable forms is not easy.

US Legal Forms offers thousands of template designs, including the New Jersey Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, which are tailored to meet state and federal specifications.

Once you find the right form, click on Buy now.

Choose the pricing plan you prefer, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Jersey Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/region.

- Utilize the Review option to evaluate the form.

- Check the summary to confirm that you have chosen the correct document.

- If the document is not what you are looking for, use the Search section to find the form that meets your needs.

Form popularity

FAQ

A 1099 worker can find it difficult to claim unemployment benefits in New Jersey. Typically, independent contractors must demonstrate a loss of work and have sufficient earnings in their base period to qualify. If you are navigating the complexities of your employment status, consider utilizing a New Jersey Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause for clarity and support.

Contract law in New Jersey is based on the principles of common law, which governs the creation, execution, and enforcement of contracts. Essential elements of a valid contract include an offer, acceptance, and consideration. A New Jersey Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause falls under this legal framework, and understanding these principles can help safeguard your interests.

An independent contractor in New Jersey is usually defined as a person or entity that provides services to another under a work contract, but retains control over how those services are performed. They operate independently and are not considered employees of the company. When drafting a New Jersey Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, it is vital to ensure your classification is clear to avoid legal complications.

In New Jersey, several factors can disqualify you from receiving unemployment benefits, such as voluntarily quitting your job without a good reason or being discharged for misconduct. Other reasons include refusing suitable work offers. If you are operating under a New Jersey Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, it is essential to ensure compliance with all contractual obligations to avoid disqualification.

In New Jersey, a 1099 employee, often referred to as an independent contractor, can face challenges when trying to collect unemployment benefits. Typically, independent contractors do not qualify for traditional unemployment benefits. However, during certain circumstances, such as a pandemic, programs like PUA may provide relief. A well-structured New Jersey Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause may clarify your status and rights.

If you make $1,000 a week in New Jersey, your potential unemployment benefits may depend on various factors, including your previous earnings and your work history. New Jersey typically calculates benefits based on the highest earning quarter in your base period. Understanding the implications of a New Jersey Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can help you navigate these financial matters more effectively.

In New Jersey, independent contractors are generally not required to carry workers' compensation insurance unless they have employees. However, it is prudent for all independent contractors to consider having coverage for their own protection. A New Jersey Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can help outline risk management strategies while defining the liabilities of both parties.

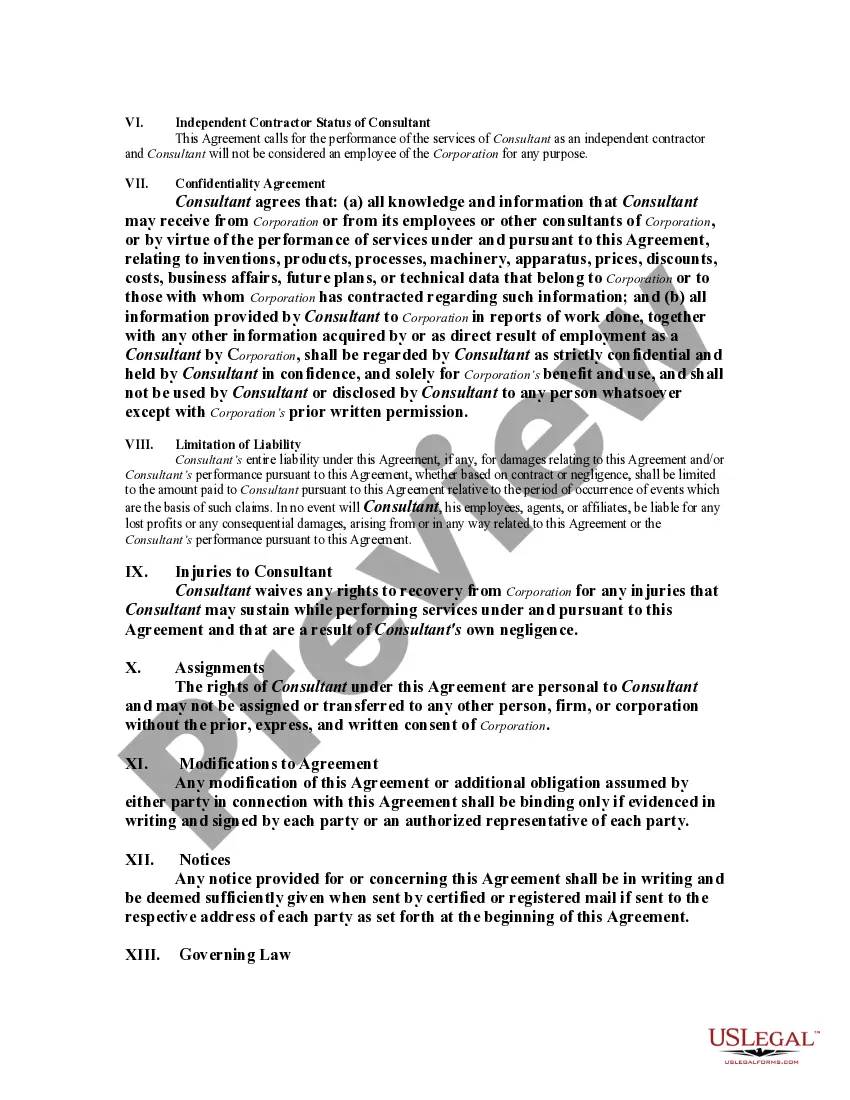

The standard limitation of liability clause specifies the maximum financial responsibility one party has towards another in a contract. In the context of a New Jersey Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, it often limits liability to direct damages only, excluding indirect damages like loss of profits. Understanding this clause equips you with the knowledge necessary to negotiate fair terms while minimizing potential losses.

To protect yourself as a consultant, it's crucial to have a well-drafted New Jersey Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. You should consider including clear terms on payment, scope of work, and liability limitations in your contract. Moreover, utilizing a platform like uslegalforms can help you create customized contracts that safeguard your interests.

In a consulting agreement, the limitation of liability clause aims to restrict the amount recoverable by one party from another in the event of damages or losses. Specifically, in a New Jersey Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, it often limits damages to a predefined monetary amount. This approach effectively balances the interests of both parties and provides a clear framework for risk management.