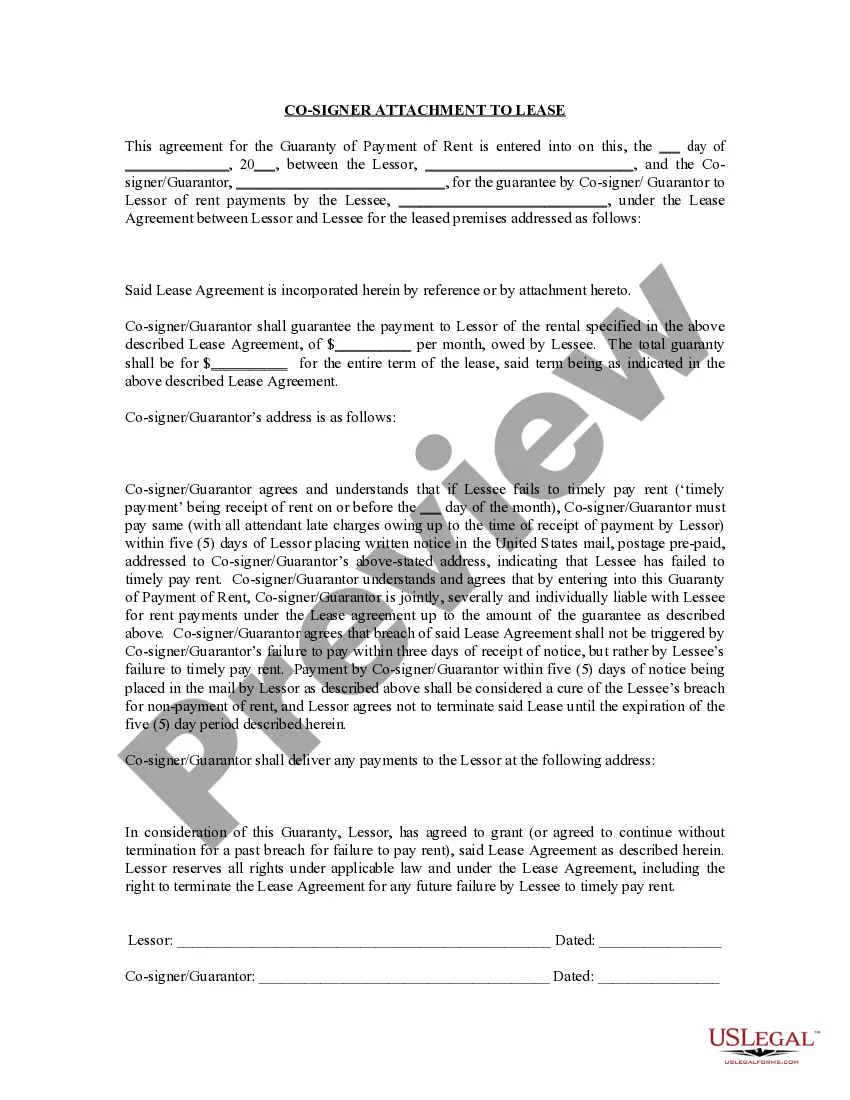

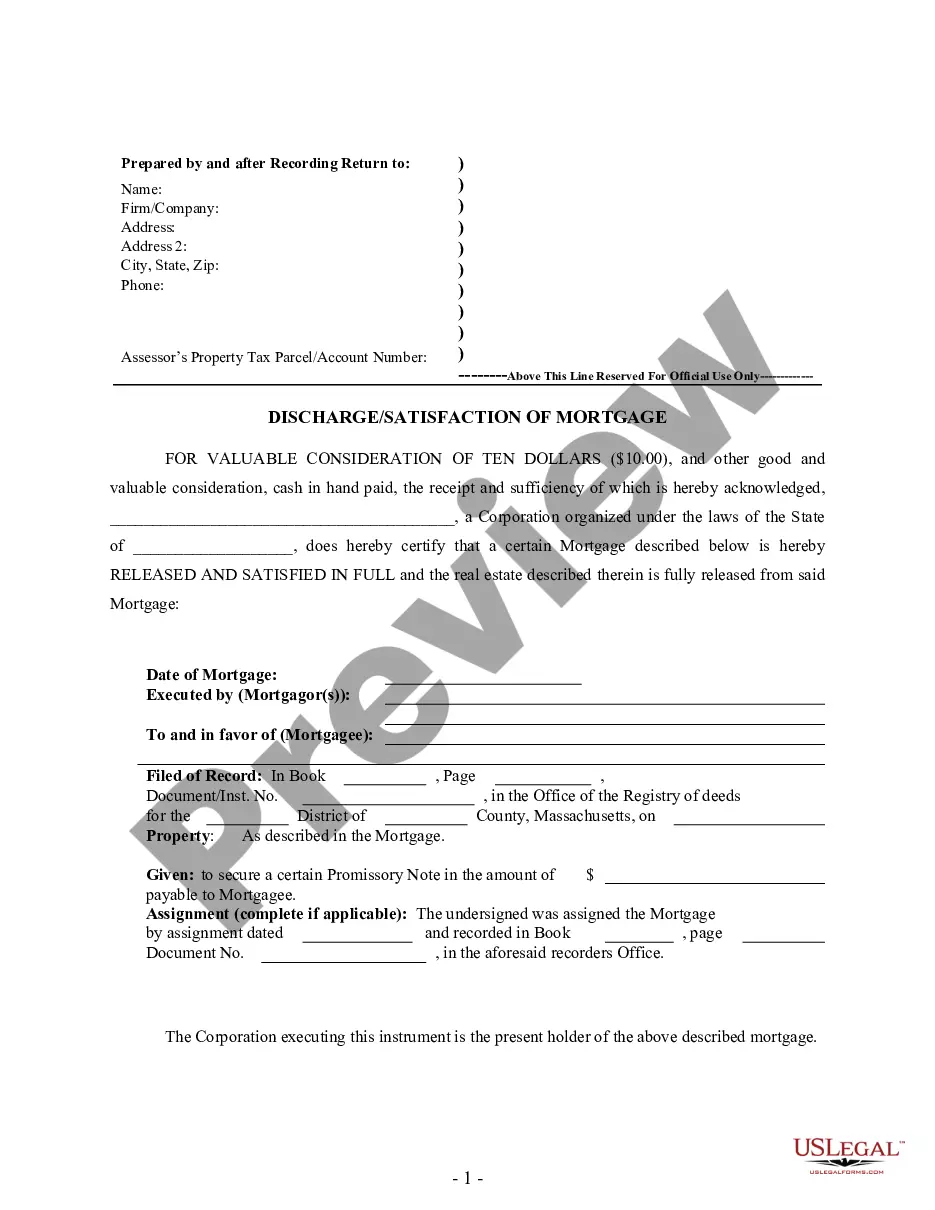

New Jersey Lease to Own for Commercial Property is a unique option available to individuals and businesses looking to acquire commercial property in the state of New Jersey. It provides an opportunity for tenants to lease a property with the option to purchase it at a later date. The concept of Lease to Own allows potential buyers to secure a property by signing a lease agreement, typically for a fixed period, with the intention of eventually buying it. This arrangement is especially beneficial for individuals or businesses looking to establish themselves in a specific area or acquire a property in a competitive market without the immediate financial resources to make a traditional property purchase. In New Jersey, there are several types of Lease to Own arrangements for commercial properties, each with its own unique characteristics and terms: 1. Lease Purchase Option: This type of Lease to Own agreement usually involves a separate purchase option within the lease contract. The tenant has the right to buy the property at a predetermined price within a specified timeframe, typically after a certain number of years. The option fee paid upfront is often non-refundable and serves as a down payment credit towards the purchase price. 2. Lease Purchase Agreement: This type of Lease to Own arrangement outlines the terms and conditions of the lease contract and the purchase agreement in a single document. It provides the tenant with the opportunity to lease the property while simultaneously making arrangements for its eventual purchase. A portion of the monthly rent may be credited towards the purchase price. 3. Contract for Deed: Also known as a land contract or installment sale agreement, this type of agreement allows the tenant-buyer to occupy and use the property while making regular payments directly to the property owner. Unlike traditional financing, the tenant does not obtain immediate ownership of the property. Instead, the property title is transferred upon completion of the agreed-upon payment terms. These Lease to Own options offer various advantages to both tenants and property owners. For tenants, it provides an opportunity to test the viability of a business or determine the suitability of the location before committing to a full purchase. It also allows them to build equity through rent credits or installment payments towards the eventual purchase price. Property owners benefit from continuous rental income during the Lease to Own period and the possibility of a future sale without marketing the property extensively. It is important for both parties involved in a New Jersey Lease to Own for Commercial Property to carefully review and negotiate the terms and conditions of the agreement. Consulting with legal and real estate professionals is highly recommended ensuring that the lease agreement and purchase terms cover all necessary aspects and protect the interests of both the tenant and the property owner.

New Jersey Lease to Own for Commercial Property

Description

How to fill out Lease To Own For Commercial Property?

It is feasible to invest numerous hours online trying to locate the appropriate legal record template that meets the federal and state standards you require.

US Legal Forms offers a vast array of legal forms that have been reviewed by professionals.

You can easily download or print the New Jersey Lease to Own for Commercial Property from their services.

If available, utilize the Preview option to view the record template at the same time.

- If you possess a US Legal Forms account, you can Log In and then select the Download option.

- After that, you can complete, modify, print, or sign the New Jersey Lease to Own for Commercial Property.

- Every legal record template you receive is yours indefinitely.

- To obtain another copy of any downloaded form, navigate to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct record template for the county/city of your choice.

- Review the form description to verify that you have chosen the accurate form.

Form popularity

FAQ

How long is a typical commercial lease? Commercial leases are typically three to five years. That guarantees enough rental income for the landlords to recoup their investment.

However, it is usually the tenant who covers the cost regarding the lease document and requests the terms. Having said that, both parties should have legal representation and the particularities of the contract can be negotiated by their legal teams.

If the tenant or landlord does not renew the lease and the lease was for a term of more than one month and the tenant holds over (stays after the expiration of the lease), the tenancy will become a month-to-month tenancy, if the landlord continues to accept the rent and there is no other agreement between the landlord

In New Jersey a landlord is not allowed to refuse to renew a lease with a tenant without grounds for good cause. Grounds for good cause may sound obvious, but they include the following reasons: Failing to pay rent when due or owed. Disorderly conduct that disturbs the peace and quiet of neighbors.

In most situations, a landlord is not required to extend or renew a lease. They can change any of the terms and conditions, including the rent price. They can also end ask you to leave the property when your lease is over and they don't need a reason.

No, a standard lease agreement in New Jersey does not need to be notarized. The landlord and tenant can choose to have the lease notarized for additional legal protection, but it is not required.

Under this cause of not renewing the lease, a three month notice to quit must be given if an at will tenancy or year-to year tenancy exists. A one-month notice to quit is required for a month-to-month tenancy. lockouts made by the landlord are illegal in New Jersey.

If the lease has expired, it automatically becomes a month-to-month contract with its former terms still intact, according to N.J.S.A. Section -10. A holdover renter can remain in their unit indefinitely if the landlord does not have good cause to evict them as long as they pay their rent.

Acknowledgments are not required to properly execute a lease. However, acknowledgments are required in order to properly record a lease or memorandum of lease. There are no countersignature requirements in a commercial lease.

A lease is automatically void when it is against the law, such as a lease for an illegal purpose. In other circumstances, like fraud or duress, a lease can be declared void at the request of one party but not the other.

Interesting Questions

More info

Address 1111 Monte Vista St. Los Angeles, California 90033 (hereinafter referred Landlord and Tenant (hereinafter referred to as “the parties”)) in consideration for and as consideration for and on behalf of the United States Postal Service of the U.S. Department of the Treasury of the United States and the State of California a term limited right to acquire 1,827.5 acre parcel of agricultural land located at 1201 Monte Vista Street, Los Angeles County, California, 90033 known as the “Dominguez Bend Agricultural Land Site” (hereinafter referred to as “the property”) from TELUS Inc. the owner (“the Subscriber”) for a total of 3,000,000 .00 and 25,000.00. (hereinafter referred to as “the Agreement”) The Parties have entered into the Agreement on behalf of Subscriber and the Agreement shall become operative immediately by operation of law without the intervention of any court.