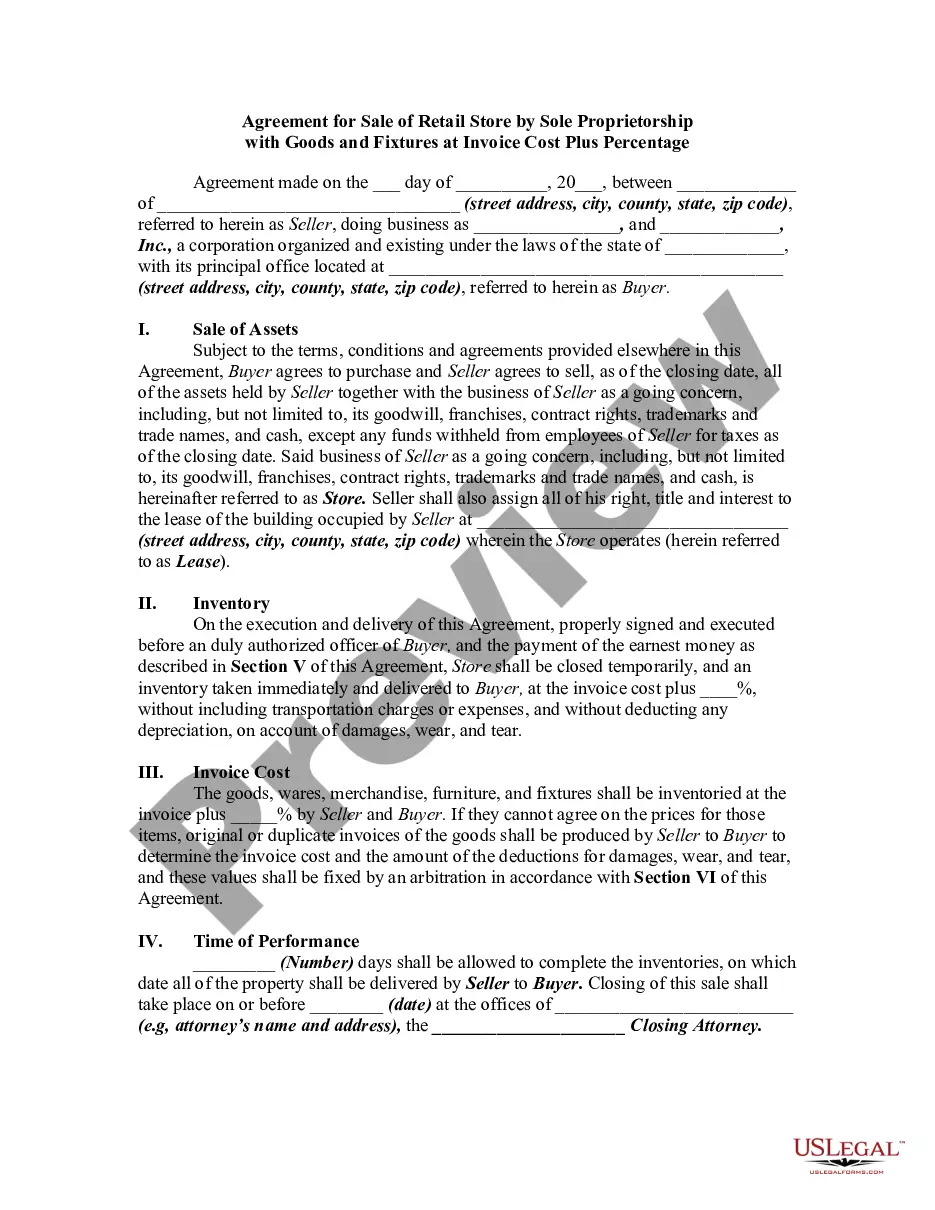

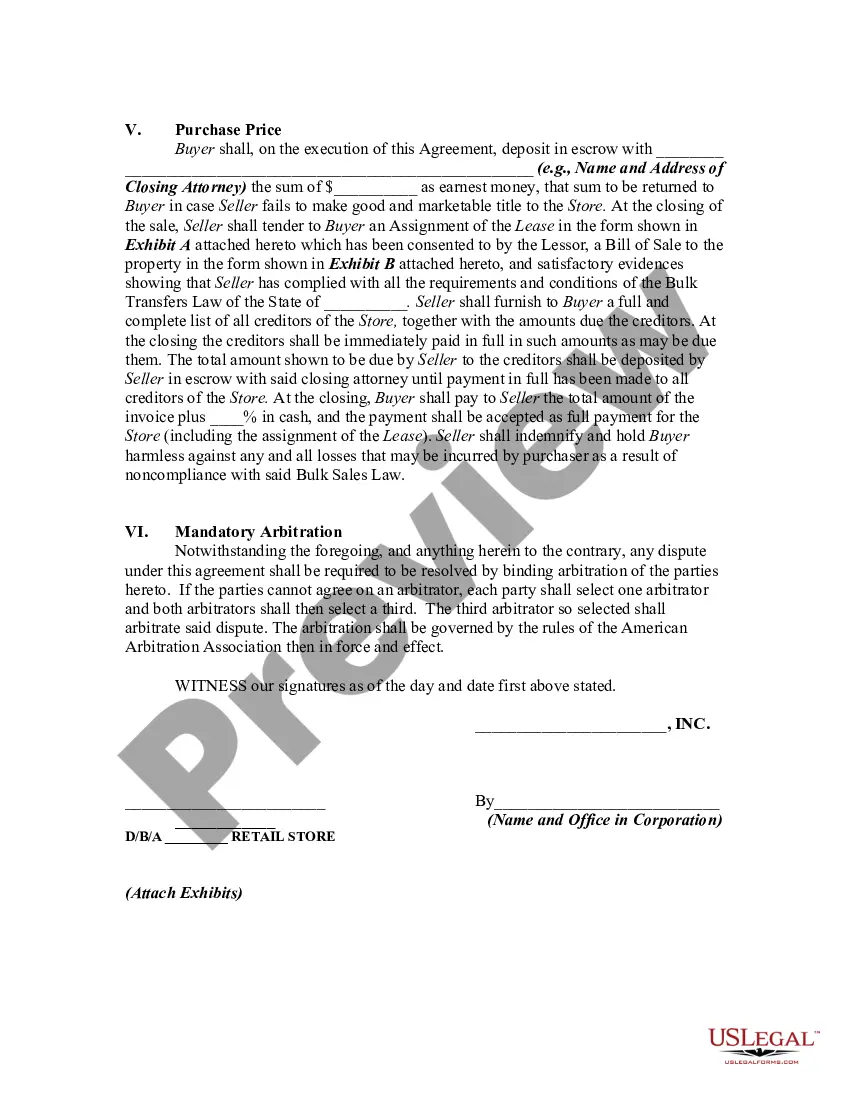

Title: New Jersey Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage Introduction: The New Jersey Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legally binding contract that outlines the terms and conditions for the sale of a retail store owned by a sole proprietor. It specifically focuses on the sale of goods, inventory, and fixtures, with pricing based on the invoice cost plus a percentage. Key Elements of the Agreement: 1. Parties Involved: The agreement identifies the buyer (purchaser) and the seller (sole proprietor) involved in the transaction. It ensures that both parties are legally competent to participate in the sale. 2. Description of the Retail Store: A detailed description of the retail store, including its name, location, and any additional relevant information, is included. It may also outline the type of store, such as a food market, boutique, or convenience store. 3. Goods and Inventory: The agreement outlines the goods and inventory included in the sale, specifying the invoice cost, the quantity, and the quality of the goods to be transferred. This section ensures that both parties consider the exact items involved in the transaction. 4. Fixtures: The contract includes a comprehensive list of fixtures within the retail store, such as shelving, display units, cash registers, signage, or technological equipment. These items should be accounted for in the agreement, stating their condition and their provision to the buyer. 5. Pricing: The agreement establishes the pricing structure for the sale of the goods and fixtures. It typically includes the invoice cost (the cost incurred by the sole proprietor to acquire the goods) plus a predetermined percentage profit. This percentage profit can be negotiated between the buyer and the seller. 6. Payment Terms: This section specifies the payment schedule, including any down payment, installments, or lump-sum payments, as agreed upon by both parties. It may also outline any potential methods of financing or payment contingencies. 7. Representations and Warranties: The agreement contains representations and warranties made by both parties to assure the buyer that the goods and fixtures are being sold in good faith and as described. It may cover factors such as ownership, marketable titles, and absence of liens on the assets being transferred. Types of New Jersey Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage: — Standard New Jersey Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage. — Modified New Jersey Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage (for customization/additional terms). Conclusion: The New Jersey Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a crucial legal document that protects the rights and interests of both buyers and sellers involved in the sale of a retail store. It ensures clarity regarding goods, inventory, fixtures, pricing, and payment terms, providing a smooth transition of ownership from the sole proprietor to the purchaser.

New Jersey Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

How to fill out New Jersey Agreement For Sale Of Retail Store By Sole Proprietorship With Goods And Fixtures At Invoice Cost Plus Percentage?

Discovering the right legal file format can be a battle. Obviously, there are a lot of layouts accessible on the Internet, but how would you discover the legal kind you will need? Make use of the US Legal Forms site. The support provides thousands of layouts, for example the New Jersey Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage, which you can use for company and personal needs. Every one of the forms are inspected by pros and satisfy federal and state requirements.

Should you be already signed up, log in to your profile and click on the Download button to find the New Jersey Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage. Make use of your profile to check with the legal forms you have purchased earlier. Go to the My Forms tab of the profile and obtain an additional version of your file you will need.

Should you be a new customer of US Legal Forms, listed here are easy recommendations for you to comply with:

- Initially, be sure you have selected the right kind for your personal metropolis/region. It is possible to look over the form utilizing the Review button and look at the form description to ensure it will be the best for you.

- If the kind will not satisfy your requirements, take advantage of the Seach field to find the proper kind.

- When you are certain that the form is suitable, go through the Purchase now button to find the kind.

- Pick the costs plan you would like and type in the necessary information and facts. Build your profile and purchase your order making use of your PayPal profile or charge card.

- Select the file format and obtain the legal file format to your gadget.

- Full, edit and print and signal the obtained New Jersey Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage.

US Legal Forms will be the most significant library of legal forms where you can find a variety of file layouts. Make use of the company to obtain professionally-produced paperwork that comply with condition requirements.