In today's tax system, estate and gift taxes may be levied every time assets change hands from one generation to the next. Dynasty trusts avoided those taxes by creating a second estate that could outlive most of the family members, and continue providing for future generations. Dynasty trusts are long-term trusts created specifically for descendants of all generations. Dynasty trusts can survive 21 years beyond the death of the last beneficiary alive when the trust was written.

New Jersey Irrevocable Generation Skipping or Dynasty Trust Agreement For Benefit of Trustor's Children and Grandchildren

Description

How to fill out Irrevocable Generation Skipping Or Dynasty Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

If you wish to compile, acquire, or print verified document templates, utilize US Legal Forms, the leading collection of legal forms, available online. Use the site's straightforward and user-friendly search function to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to obtain the New Jersey Irrevocable Generation Skipping or Dynasty Trust Agreement For the Benefit of Trustor's Children and Grandchildren in just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click on the Download button to receive the New Jersey Irrevocable Generation Skipping or Dynasty Trust Agreement For the Benefit of Trustor's Children and Grandchildren. You can also access forms you previously downloaded from the My documents tab of your account.

Each legal document template you purchase is yours indefinitely. You will have access to all the forms you have downloaded in your account. Select the My documents section and choose a form to print or download again.

Be proactive and download, and print the New Jersey Irrevocable Generation Skipping or Dynasty Trust Agreement For the Benefit of Trustor's Children and Grandchildren with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are using US Legal Forms for the first time, follow the instructions below.

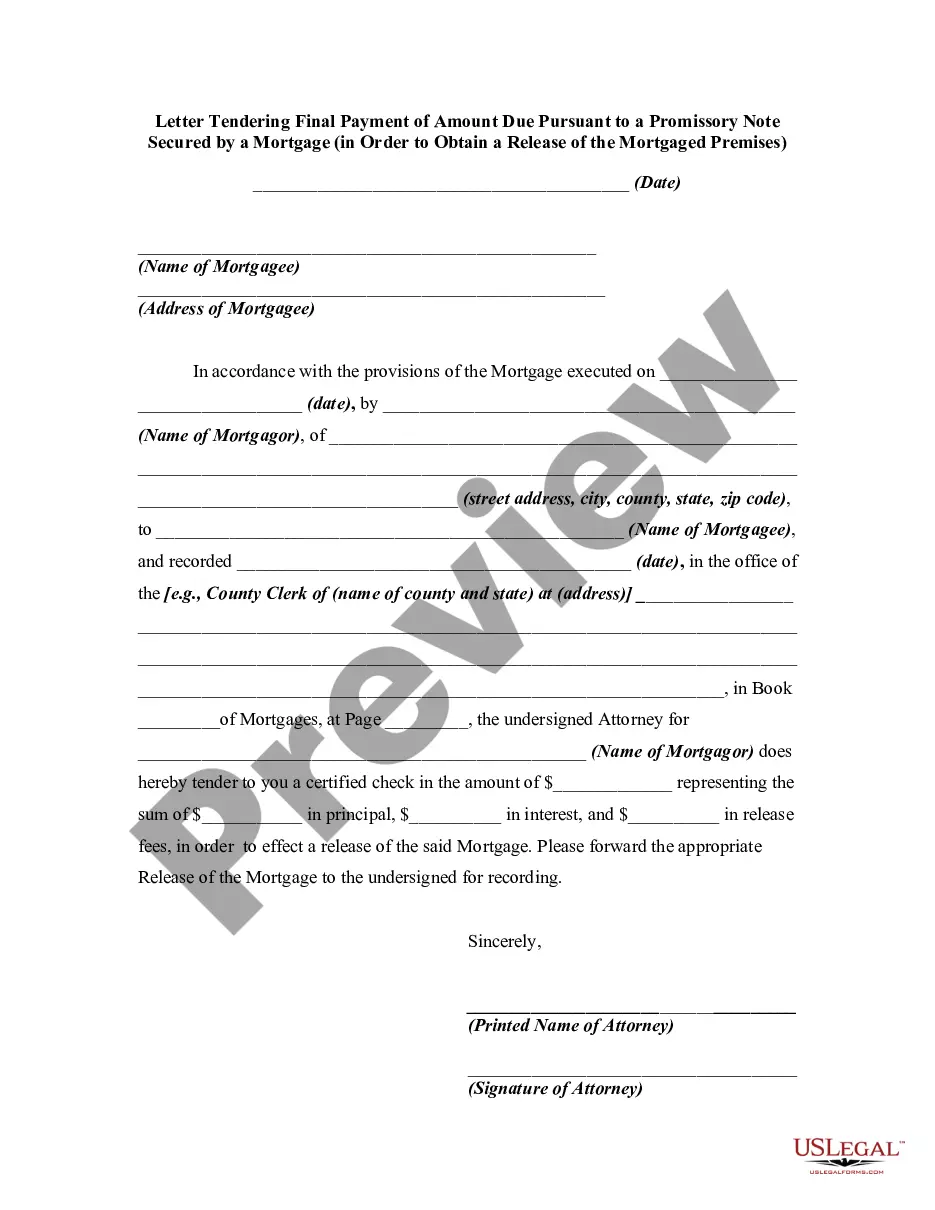

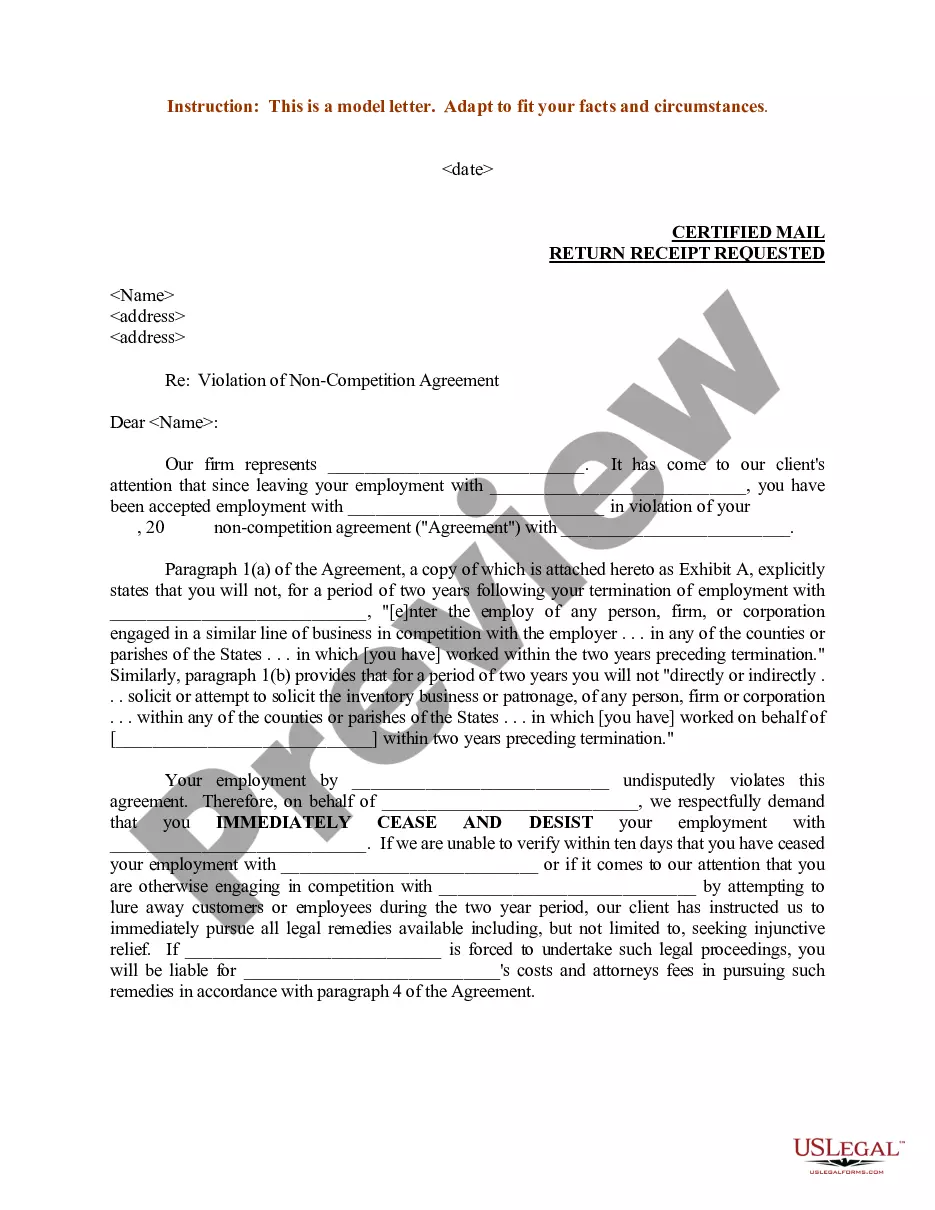

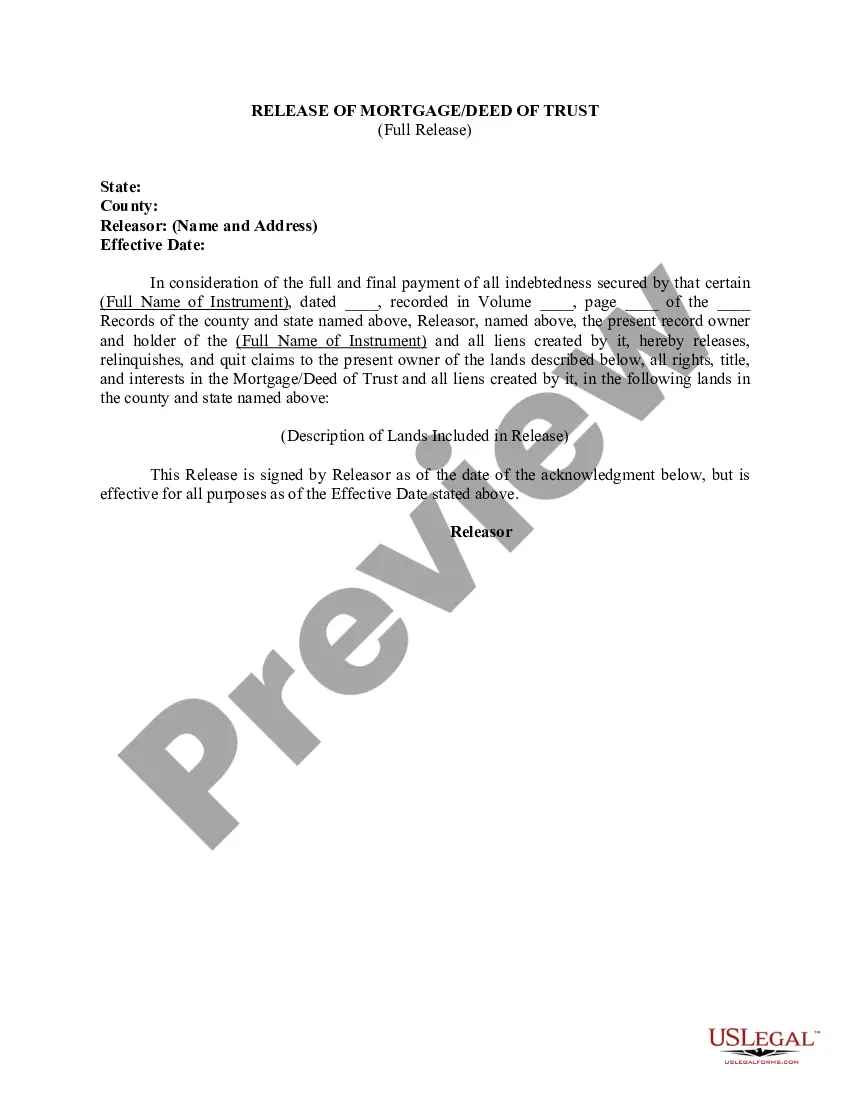

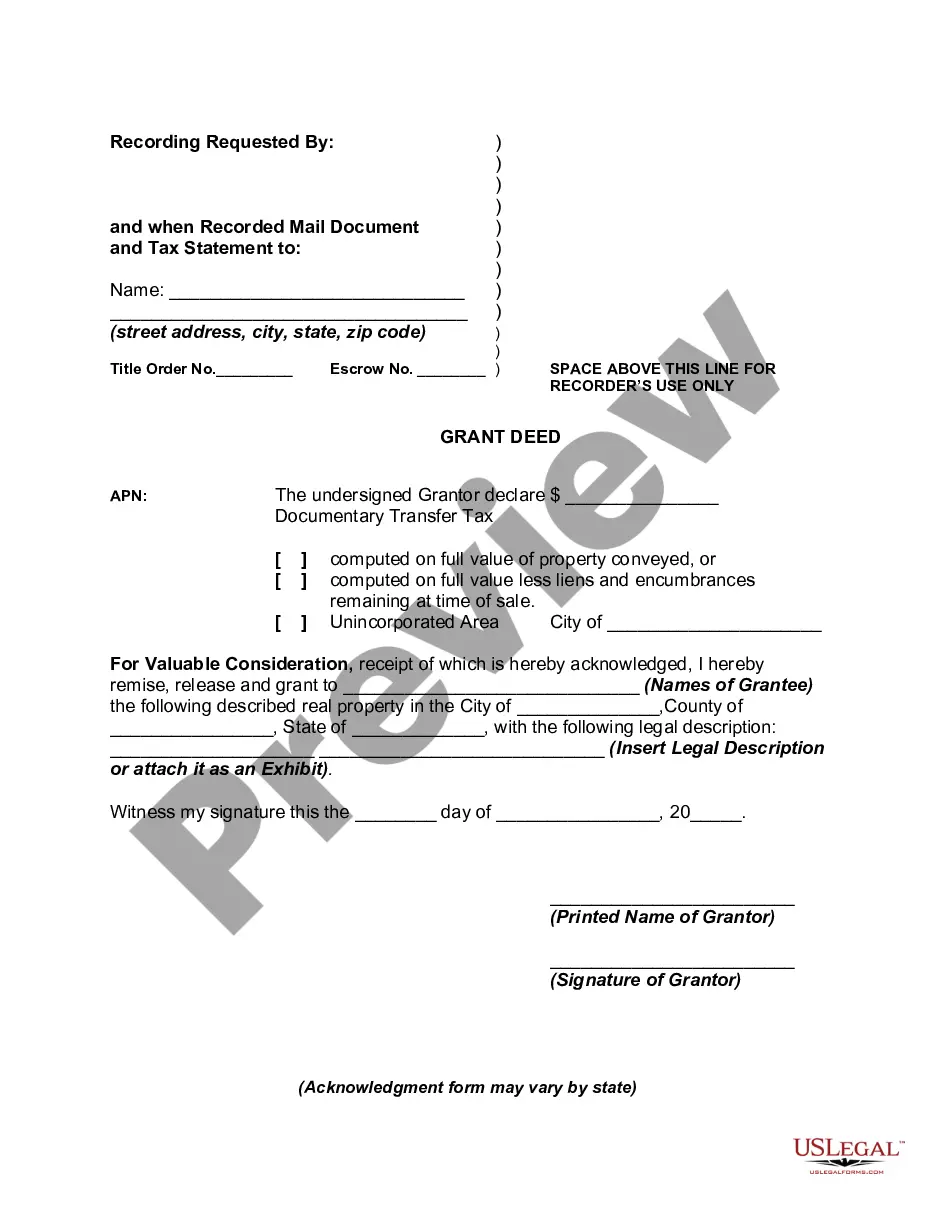

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Use the Preview option to view the form's content. Don't forget to read the details.

- Step 3. If you are dissatisfied with the document, use the Search field at the top of the screen to find other types in the legal form template.

- Step 4. Once you have identified the form you need, select the Buy now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify and print or sign the New Jersey Irrevocable Generation Skipping or Dynasty Trust Agreement For the Benefit of Trustor's Children and Grandchildren.

Form popularity

FAQ

In the United States, a bypass trust is an irrevocable trust into which the settlor deposits assets and which is designed to pay trust income and principal to the settlor's spouse for the duration of the spouse's life.

What Is a Generation-Skipping Trust? An irrevocable trust that assigns a beneficiary who is younger than the settlor by at least 37 ½ years is called a generation-skipping trust.

A dynasty trust is a long-term trust created to pass wealth from generation to generation without incurring transfer taxessuch as the gift tax, estate tax, or generation-skipping transfer tax (GSTT)for as long as assets remain in the trust. The dynasty trust's defining characteristic is its duration.

Because a generation skipping trust is irrevocable, the trust cannot be broken, modified, revoked or dissolved like a revocable trust, which can be changed or amended any time.

A generation-skipping trust (GST) is a legally binding agreement in which assets are passed down to the grantor's grandchildrenor anyone at least 37½ years youngerbypassing the next generation of the grantor's children.

A dynasty trust is a great option for families that are seeking to transfer wealth from generation to generation. If you have a sizable estate and wish to transfer wealth without triggering certain estate-planning taxes, a dynasty trust could be a great option. As a reminder, dynasty trusts are irrevocable.

An effective way to pass wealth to future generations is through the use of a Dynasty Trust. A Dynasty Trust (sometimes also referred to as a Generation-Skipping Trust), is an irrevocable trust that continues for as long as the applicable state law allows.

A generation-skipping trust is used to transfer money or other assets to someone who is at least 37.5 years younger than you. The primary purpose of a generation-skipping trust is to minimize estate taxes and generation-skipping transfer taxes.

A dynasty trust allows wealth to be available to each generation while never being reduced by transfer taxes. In 2020, the generation-skipping transfer tax exemption amount is $11,580,000 per person and is the same as the lifetime gift and estate tax exemption amount.

A dynasty trust is a special kind of trust that allows you to pass wealth on to your descendants. These trusts can allow a family to save on estate tax or transfer tax across generations while also protecting assets from a variety of situations.