The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

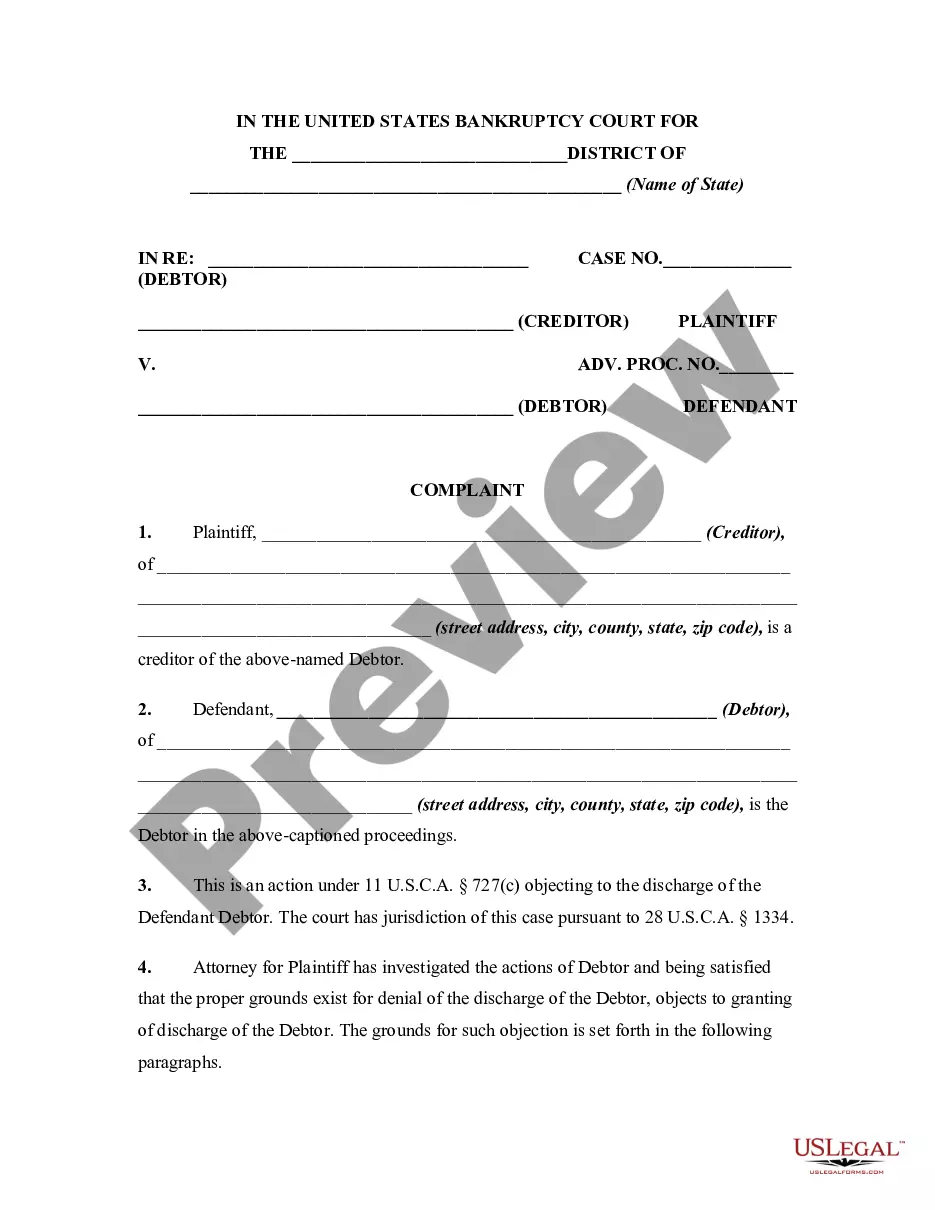

New Jersey Complaint Objecting to Discharge in Bankruptcy Proceedings for Concealment by Debtor and Omitting from Schedules Fraudulently Transferred Property

Description

How to fill out Complaint Objecting To Discharge In Bankruptcy Proceedings For Concealment By Debtor And Omitting From Schedules Fraudulently Transferred Property?

Are you presently within a position the place you will need documents for either enterprise or personal purposes almost every day? There are plenty of authorized record web templates available on the Internet, but finding types you can rely on is not simple. US Legal Forms provides 1000s of type web templates, such as the New Jersey Complaint Objecting to Discharge in Bankruptcy Proceedings for Concealment by Debtor and Omitting from Schedules, that happen to be created to satisfy state and federal demands.

If you are already acquainted with US Legal Forms internet site and also have a free account, basically log in. Afterward, you can download the New Jersey Complaint Objecting to Discharge in Bankruptcy Proceedings for Concealment by Debtor and Omitting from Schedules design.

Should you not have an bank account and would like to begin to use US Legal Forms, follow these steps:

- Find the type you require and ensure it is for the right town/county.

- Use the Preview switch to review the form.

- See the description to actually have selected the correct type.

- In the event the type is not what you are trying to find, use the Lookup area to find the type that suits you and demands.

- When you discover the right type, click on Acquire now.

- Opt for the costs plan you want, submit the required info to create your bank account, and pay money for an order making use of your PayPal or bank card.

- Pick a convenient paper formatting and download your copy.

Find all of the record web templates you possess bought in the My Forms menu. You may get a additional copy of New Jersey Complaint Objecting to Discharge in Bankruptcy Proceedings for Concealment by Debtor and Omitting from Schedules whenever, if possible. Just select the needed type to download or print out the record design.

Use US Legal Forms, one of the most substantial collection of authorized varieties, in order to save time and prevent errors. The assistance provides expertly created authorized record web templates which can be used for an array of purposes. Generate a free account on US Legal Forms and commence creating your way of life a little easier.

Form popularity

FAQ

If you had a Chapter 7 that resulted in discharge of your debts, you must wait at least eight years from the date you filed it before filing Chapter 7 bankruptcy again. While Chapter 7 is typically the quickest form of debt relief, the eight-year period to refile is the longest waiting time between cases.

Section 523 complaints focus on specific debts to a single creditor. A Section 727 complaint may be filed if the creditor or bankruptcy trustee believes that the debtor has not met the requirements for a discharge under Section 727. Section 727 complaints address the discharge of a debtor's entire debt obligations.

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.

An objection to discharge is a notice lodged with the Official Receiver by a trustee to induce a bankrupt to comply with their obligations. An objection will extend the period of bankruptcy so automatic discharge will not occur three years and one day after the bankrupt filed a statement of affairs.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

Another exception to Discharge is for fraud while acting in a fiduciary capacity, embezzlement, or larceny. Domestic obligations are not dischargeable in Bankruptcy. Damages resulting from the willful and malicious injury by the debtor of another person or his property, are also not dischargeable in Bankruptcy.

The debtor knowingly made a false oath or account, presented a false claim, etc. Failure to comply with a bankruptcy court order.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...