Generally, a debtor may demand a receipt for payment of an obligation. No particular form is necessary for a valid receipt. However, a receipt should recite all facts necessary to substantiate the tender and acceptance of payment.

New Jersey Receipt for Payment of Salary or Wages

Description

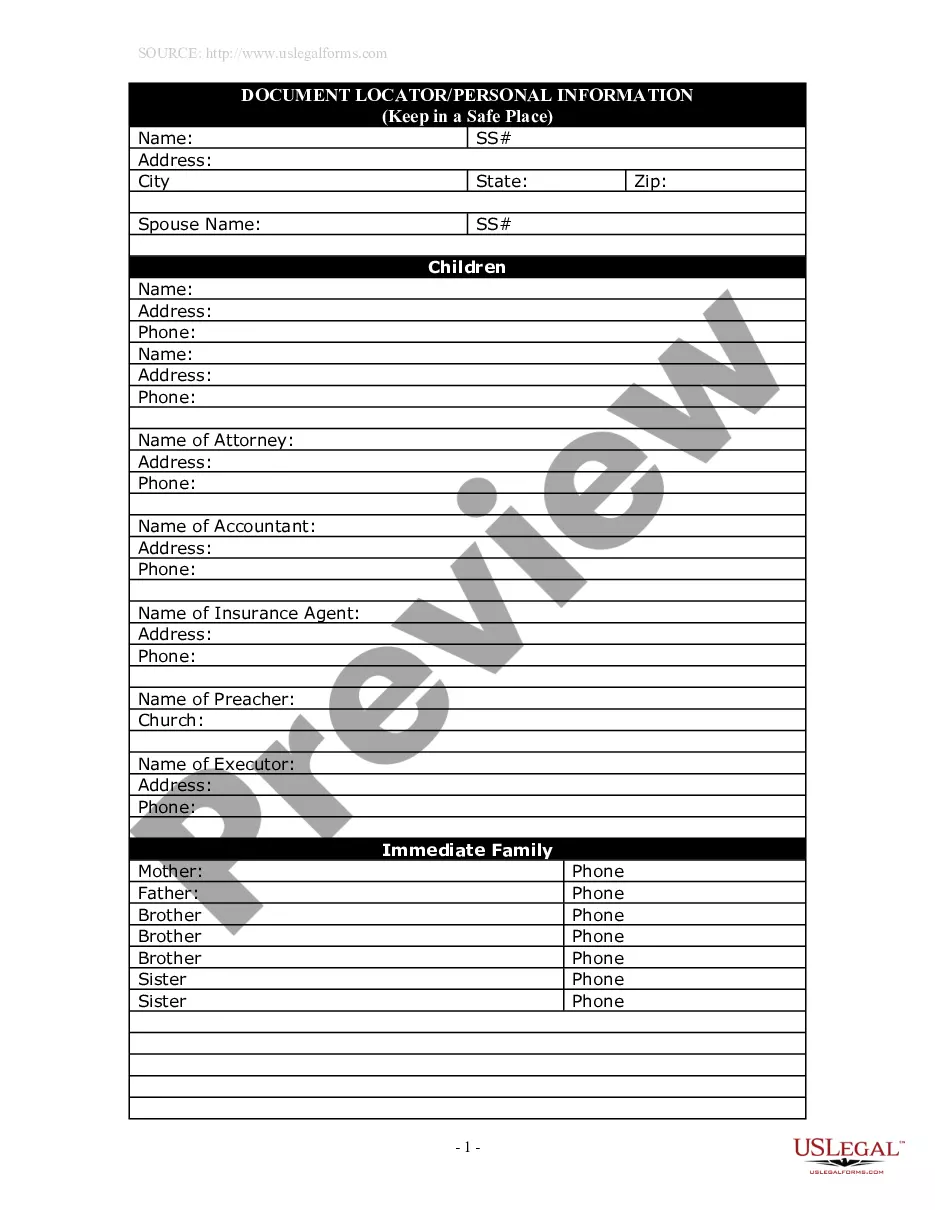

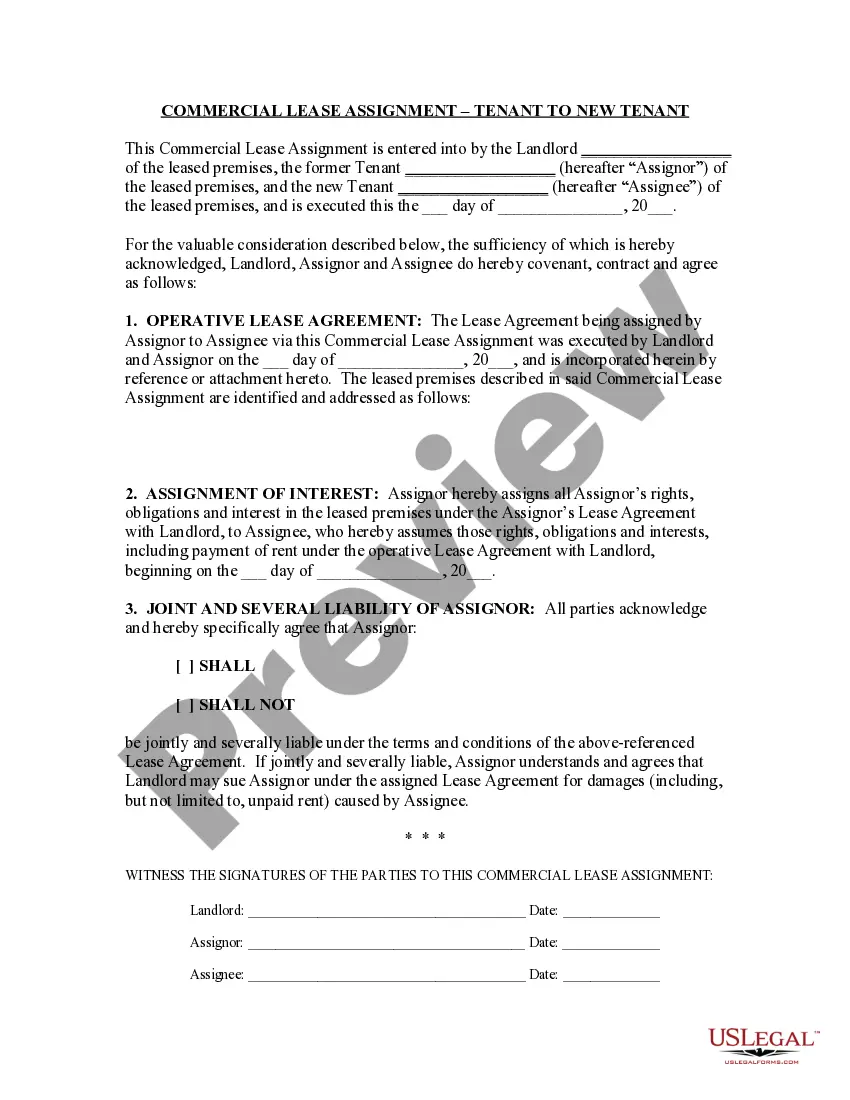

How to fill out Receipt For Payment Of Salary Or Wages?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal form templates that you can download or print out.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most current versions of documents such as the New Jersey Receipt for Payment of Salary or Wages in just a few seconds.

If you currently hold a subscription, Log In and download the New Jersey Receipt for Payment of Salary or Wages from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded forms from the My documents tab in your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make changes. Fill out, modify, print, and sign the downloaded New Jersey Receipt for Payment of Salary or Wages. Each template you added to your account has no expiration date and is yours permanently. So, if you want to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the New Jersey Receipt for Payment of Salary or Wages with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Ensure you have selected the correct form for your local area/state.

- Click the Review option to examine the contents of the form.

- Check the form outline to confirm that you have selected the right form.

- If the form does not meet your needs, use the Search field at the top of the page to find one that does.

- When satisfied with the form, confirm your selection by clicking the Buy now button.

- Next, select your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

NJ 1040 is the resident income tax return form for individuals who live in New Jersey, while NJ 1040 NR is for non-residents earning income within the state. Both forms are essential for individuals claiming their income for tax purposes, including income reflected on the New Jersey Receipt for Payment of Salary or Wages. Knowing which form to file ensures that individuals meet their tax obligations correctly. USLegalForms can offer clarification and assistance for filling out these forms accurately.

The NJ-927 form is a quarterly report summarizing total employee wages and tax withholdings, while the WR 30 details individual employees' wages and related deductions. Both documents relate to the New Jersey Receipt for Payment of Salary or Wages, yet serve different reporting purposes for compliance. Understanding these differences helps ensure accurate reporting and tax submissions. If you need assistance, USLegalForms can provide templates and guidance for both forms.

The New Jersey wage payment law outlines the requirements for timely wage payments to employees. This law emphasizes the rights of workers to receive their wages without unnecessary delays. Employers must provide a New Jersey Receipt for Payment of Salary or Wages to ensure clear documentation and compliance with this law.

For estimated tax payments in New Jersey, you can use the New Jersey Division of Taxation's online services. Their platform allows you to file and manage your tax payments efficiently. Remember, maintaining accurate records, such as the New Jersey Receipt for Payment of Salary or Wages, is crucial to ensure you adhere to state tax regulations.

The NJ-927 is a monthly reporting form that summarizes wages and taxes withheld for employees, while the WR-30 specifically details individual wage payments made to each employee. Essentially, the NJ-927 provides a broader picture of payroll activity for taxation purposes, whereas the WR-30 focuses more on each employee's earnings. Utilizing both forms helps you maintain accurate records in line with the New Jersey Receipt for Payment of Salary or Wages.

The NJ W3 form is a summary of employee wages and tax withheld during the calendar year for New Jersey employers. It consolidates the total payments submitted for all employees, effectively linking them to the individual WR-30 forms. Utilizing the New Jersey Receipt for Payment of Salary or Wages helps ensure that your records align with the W3 form, making tax filing more straightforward.

Filing the NJ WR-30 is a simple process. First, gather your employee payroll information, including all applicable earnings and deductions. Then, you can complete the form online or through your tax provider. Remember, the New Jersey Receipt for Payment of Salary or Wages must be correctly maintained for your records.

Taxable wages in New Jersey primarily include salaries, tips, and commissions that you receive from employment. Generally, all forms of compensation for services rendered will be taxed. Being aware of what constitutes taxable wages will help you plan your finances wisely. Your New Jersey Receipt for Payment of Salary or Wages is key for accurate reporting.

In New Jersey, specific types of income such as child support payments, life insurance benefits, and veterans' benefits are not taxable. This distinction can help you better manage your taxable income. Consulting a tax professional can provide you with further clarity, especially regarding your New Jersey Receipt for Payment of Salary or Wages.

Not all income is taxable in New Jersey, including municipal bond interest and certain social security benefits. Additionally, some gifts and inheritances may not be subject to tax. Understanding what income is non-taxable can help you strategically plan your finances. Referencing your New Jersey Receipt for Payment of Salary or Wages can help clarify any questions.