A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to add property to the trust. This form is a sample of a trustor amending the trust agreement in order to add property to the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

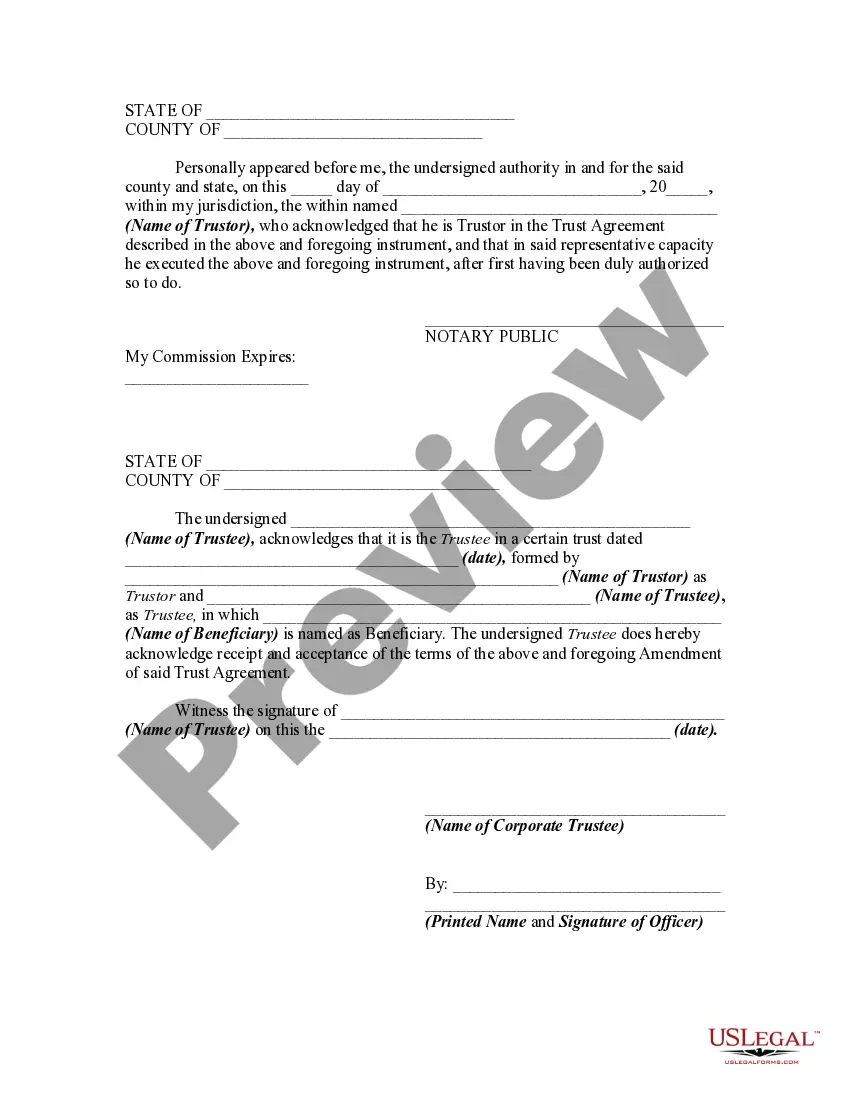

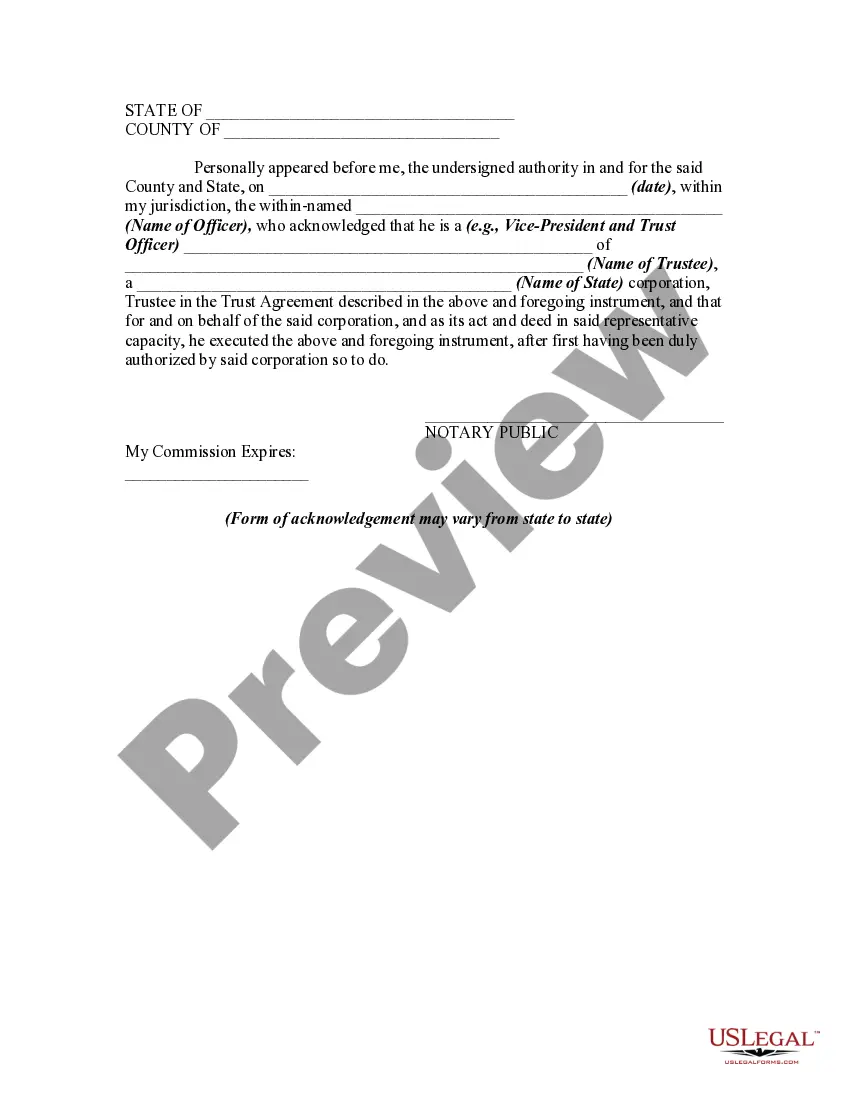

A New Jersey Amendment to Trust Agreement in order to add property from an inter vivos trust and obtain the consent of the trustee is an important legal document that allows for the modification of a trust established in the state of New Jersey. This amendment serves to include additional assets into the existing trust by transferring or allocating property from another trust, known as an inter vivos trust, with the approval of the trustee. There are several types of New Jersey Amendments to Trust Agreement that can be used to add property from an inter vivos trust. They include: 1. Irrevocable Trust Amendment: This type of amendment is used when the existing trust is irrevocable, meaning it cannot be altered or revoked without the consent of the beneficiaries and the trustee. Adding property from an inter vivos trust to an irrevocable trust requires the consent of all interested parties involved. 2. Revocable Trust Amendment: A revocable trust amendment is appropriate when the existing trust is revocable, allowing the granter to make changes or amendments to the trust during their lifetime. Adding property from an inter vivos trust to a revocable trust typically needs the approval of the granter, as they retain control over the trust assets. 3. Testamentary Trust Amendment: This form of amendment applies to a testamentary trust, which goes into effect upon the death of the granter. Adding property from an inter vivos trust to a testamentary trust may require court approval or the consent of the executor or personal representative administering the estate. To draft a New Jersey Amendment to Trust Agreement in order to add property from an inter vivos trust and obtain the consent of the trustee, certain details need to be included. These details often consist of: 1. Identification of the trust: Provide the full legal name of the trust, including the date it was established. 2. Parties involved: Identify the granter, trustee(s), and beneficiaries named in the existing trust agreement, as well as any additional parties involved in the inter vivos trust. 3. Property description: Clearly describe the property or assets being transferred or allocated from the inter vivos trust to the existing trust. This can include real estate, financial accounts, stocks, or any other assets. 4. Consent of the trustee: Obtain written consent from the trustee of the inter vivos trust, acknowledging their agreement to transfer or allocate the specified property to the existing trust. 5. Effective date: Specify the date upon which this amendment becomes effective and is legally binding. 6. Signatures and notarization: All parties involved in the amendment, including the granter, trustee(s), and witnesses, must sign the document in front of a Notary Public to ensure its authenticity. Remember to consult with an experienced attorney specializing in trusts and estates to ensure all legal requirements are met and to tailor the amendment to your specific circumstances.A New Jersey Amendment to Trust Agreement in order to add property from an inter vivos trust and obtain the consent of the trustee is an important legal document that allows for the modification of a trust established in the state of New Jersey. This amendment serves to include additional assets into the existing trust by transferring or allocating property from another trust, known as an inter vivos trust, with the approval of the trustee. There are several types of New Jersey Amendments to Trust Agreement that can be used to add property from an inter vivos trust. They include: 1. Irrevocable Trust Amendment: This type of amendment is used when the existing trust is irrevocable, meaning it cannot be altered or revoked without the consent of the beneficiaries and the trustee. Adding property from an inter vivos trust to an irrevocable trust requires the consent of all interested parties involved. 2. Revocable Trust Amendment: A revocable trust amendment is appropriate when the existing trust is revocable, allowing the granter to make changes or amendments to the trust during their lifetime. Adding property from an inter vivos trust to a revocable trust typically needs the approval of the granter, as they retain control over the trust assets. 3. Testamentary Trust Amendment: This form of amendment applies to a testamentary trust, which goes into effect upon the death of the granter. Adding property from an inter vivos trust to a testamentary trust may require court approval or the consent of the executor or personal representative administering the estate. To draft a New Jersey Amendment to Trust Agreement in order to add property from an inter vivos trust and obtain the consent of the trustee, certain details need to be included. These details often consist of: 1. Identification of the trust: Provide the full legal name of the trust, including the date it was established. 2. Parties involved: Identify the granter, trustee(s), and beneficiaries named in the existing trust agreement, as well as any additional parties involved in the inter vivos trust. 3. Property description: Clearly describe the property or assets being transferred or allocated from the inter vivos trust to the existing trust. This can include real estate, financial accounts, stocks, or any other assets. 4. Consent of the trustee: Obtain written consent from the trustee of the inter vivos trust, acknowledging their agreement to transfer or allocate the specified property to the existing trust. 5. Effective date: Specify the date upon which this amendment becomes effective and is legally binding. 6. Signatures and notarization: All parties involved in the amendment, including the granter, trustee(s), and witnesses, must sign the document in front of a Notary Public to ensure its authenticity. Remember to consult with an experienced attorney specializing in trusts and estates to ensure all legal requirements are met and to tailor the amendment to your specific circumstances.