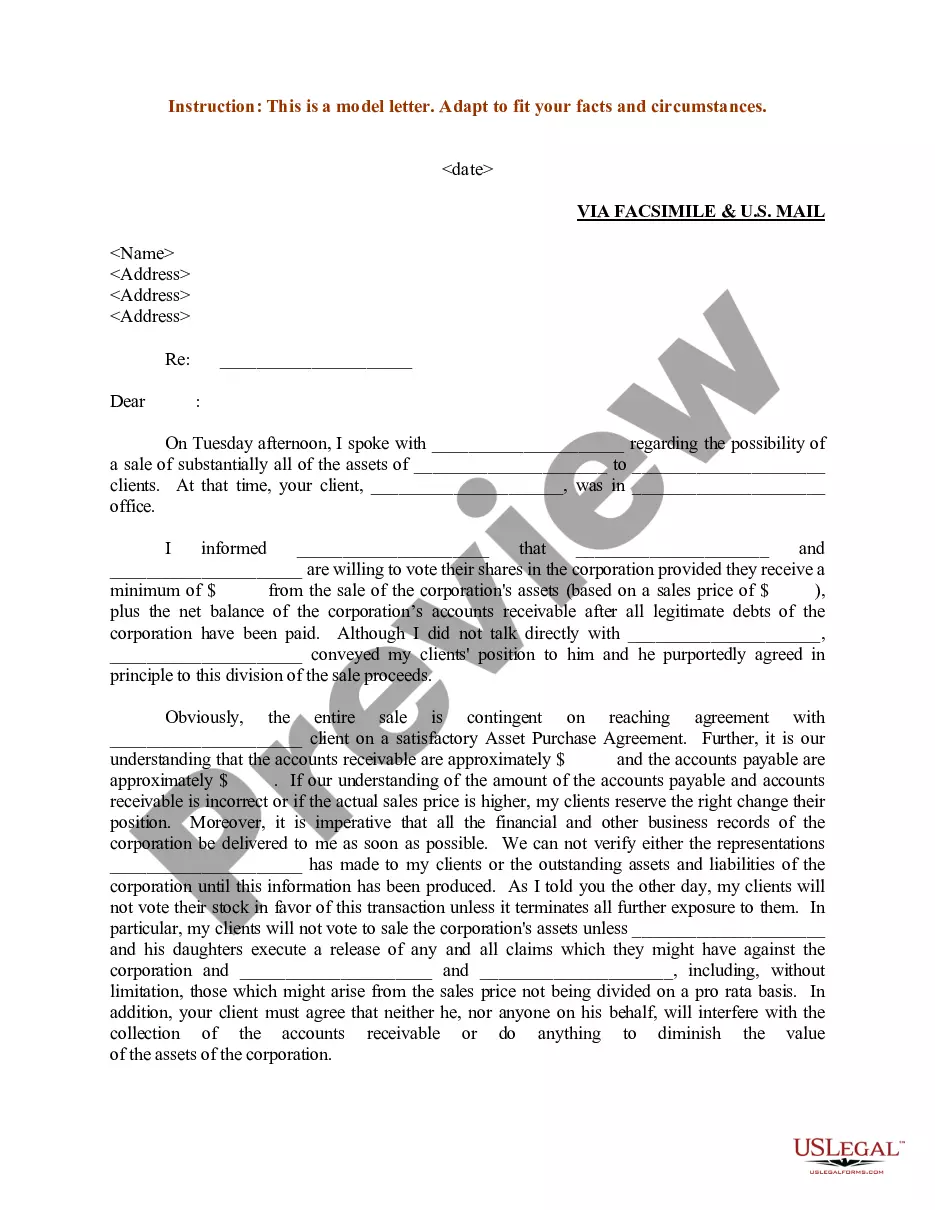

New Jersey Sample Letter for Sale of Corporate Assets

Description

How to fill out Sample Letter For Sale Of Corporate Assets?

If you need to comprehensive, obtain, or printing authorized record themes, use US Legal Forms, the greatest selection of authorized forms, which can be found online. Use the site`s easy and convenient research to find the paperwork you will need. A variety of themes for organization and individual functions are categorized by groups and suggests, or keywords. Use US Legal Forms to find the New Jersey Sample Letter for Sale of Corporate Assets with a number of clicks.

When you are already a US Legal Forms customer, log in for your account and click on the Obtain option to get the New Jersey Sample Letter for Sale of Corporate Assets. You can even entry forms you earlier acquired inside the My Forms tab of your own account.

If you use US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have chosen the form to the right metropolis/land.

- Step 2. Use the Review option to look over the form`s information. Never forget to read through the information.

- Step 3. When you are unhappy with the develop, take advantage of the Research industry near the top of the screen to get other versions of the authorized develop template.

- Step 4. Upon having found the form you will need, click the Get now option. Select the rates program you choose and put your credentials to register for an account.

- Step 5. Procedure the transaction. You should use your bank card or PayPal account to complete the transaction.

- Step 6. Select the structure of the authorized develop and obtain it on your own device.

- Step 7. Comprehensive, edit and printing or sign the New Jersey Sample Letter for Sale of Corporate Assets.

Each authorized record template you buy is yours for a long time. You may have acces to each and every develop you acquired inside your acccount. Click the My Forms section and choose a develop to printing or obtain again.

Be competitive and obtain, and printing the New Jersey Sample Letter for Sale of Corporate Assets with US Legal Forms. There are thousands of specialist and condition-distinct forms you may use to your organization or individual needs.

Form popularity

FAQ

6 Important Tips for Your Letter of Intent to Sell Your Business Hire a Lawyer. ... Think It Through. ... Keep Your Negotiating Power in Mind. ... Include Some Provisions That Are Binding. ... Make Clear Which Provisions Are Binding and Which Are Not. ... Consider Including Basic Legal Terms as Well as Business Sale Terms.

9600. 1099, R6. This form is to be used to notify the Director of the Division of Taxation, of any bulk transfer in ance with Section 22(c) of the New Jersey State Sales and Use Tax Act and Section 15 of the New Jersey Business Personal Property Tax Act.

How to write a marketing letter Define your target audience. ... Envision your brand voice. ... Determine the purpose of your letter. ... Use an attention-getter. ... Introduce your business and services. ... Highlight the benefits of doing business. ... Reference your qualifications. ... Create a sense of urgency.

Assets not subject to bulk sale include: Retail sales to customers; Any sales made in the ordinary course of business; and. Any single or two family residential unit owned by an individual, estate, or trust including any combination of or multiples of individuals, estates and trusts.

These default statuses are pass-through taxes at the federal level: revenue is distributed to members and filed on their personal income tax at the 15.3% federal self-employment tax rate (12.4% for Social Security and 2.9% for Medicare), while the LLC itself pays no federal corporate income tax.

Six ways to improve how you write sales letters: Write a catchy hook. Integrate case studies. Bring in statistics. Make it time-sensitive. Speak to the audience's desires and pain points. Make it easy to read.

The current bulk sales law, N.J.S.A. -38, applies to any sale, transfer or assignment in bulk of any part or all of a person's ?business assets,? other than in the ordinary course of business (e.g. the bulk sales law would not apply to a homebuilder selling homes as they would be considered inventory).

Follow these steps when writing an LOI: Write the introduction. ... Describe the transaction and timeframes. ... List contingencies. ... Go through due diligence. ... Include covenants and other binding agreements. ... State that the agreement is nonbinding. ... Include a closing date.

Nonresident Taxpayers: Nonresident sellers are required to pay estimated Gross Income Tax in the amount of 2% of the consideration or 8.97% of the net gain from the sale, before or at the time of closing.

NJ Taxation A bulk sale is the sale, transfer, or assignment of an individual or company's business asset(s). This can be in whole or in part. To collect the proper taxes, the purchaser must notify the Division anytime there is a bulk sale.