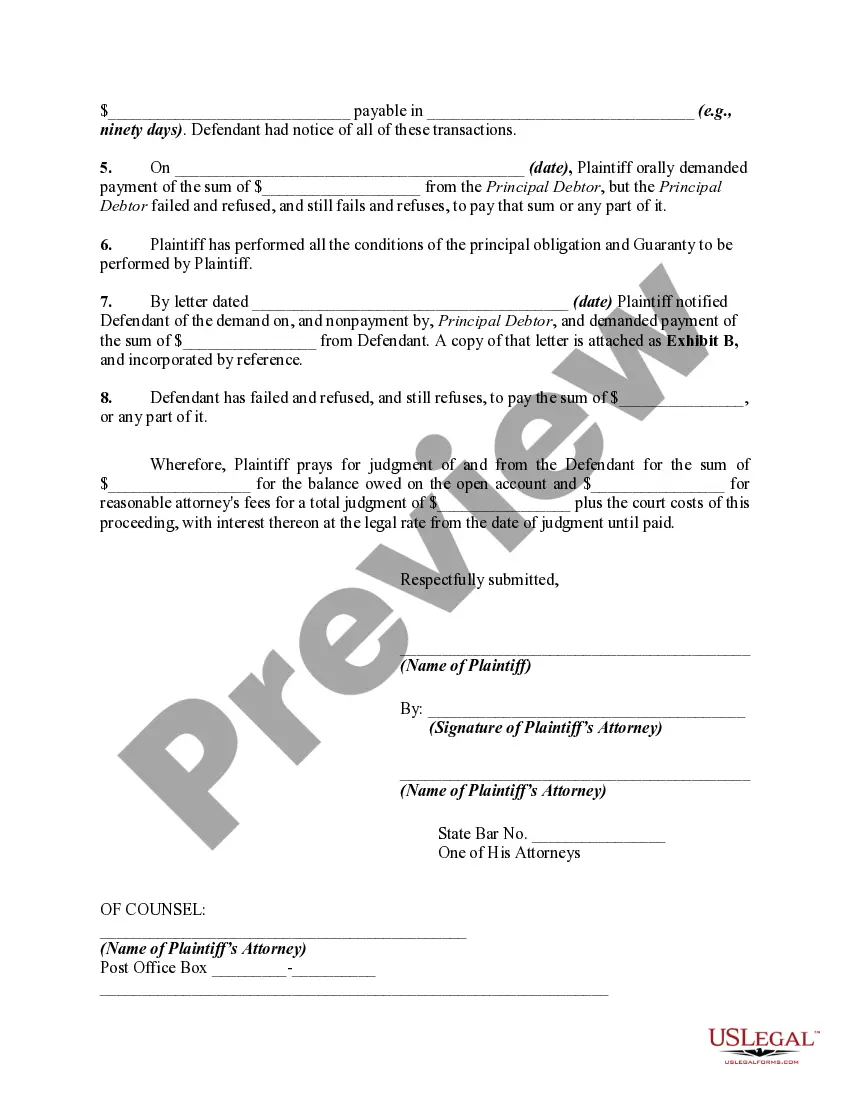

An open account is an account based on continuous dealing between the parties, which has not been closed, settled or stated, and which is kept open with the expectation of further transactions. An open account is created when the parties intend that the individual items of the account will not be considered independently, but as a connected series of transactions. In addition, the parties must intend that the account will be kept open and subject to a shifting balance as additional related entries of debits and credits are made, until either party decides to settle and close the account. This form is a complaint against a guarantor of such an account.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Keywords: New Jersey, Complaint, Guarantor, Open Account Credit Transactions, Breach, Oral Contracts, Implied Contracts. Title: Understanding New Jersey Complaint Against Guarantor of Open Account Credit Transactions: Breach of Oral or Implied Contracts Introduction: In the state of New Jersey, when a guarantor fails to fulfill their responsibility of open account credit transactions, a complaint can be filed against them. This legal action is taken in cases where the guarantor breaches either oral or implied contracts. In this article, we will explore the types of complaints that can be filed against a guarantor in New Jersey and the legal implications they may face. Types of Complaints Against Guarantor of Open Account Credit Transactions: 1. Breach of Oral Contracts: When a guarantor enters into binding agreements verbally to guarantee open account credit transactions, they are obliged to honor their verbal commitments. However, upon failure to fulfill these obligations, the affected party may file a complaint for breach of oral contracts against the guarantor. The complaint will outline the terms of the oral agreement, the actions taken by the guarantor, and the damages caused as a result of their breach. 2. Breach of Implied Contracts: Besides oral contracts, guarantors can also be held accountable for breaching implied contracts. Implied contracts are formed based on the parties' actions and conduct, rather than explicitly stated terms. In these cases, a complaint can be filed against the guarantor if they fail to fulfill their implicit obligations, leading to financial losses for the concerned party. The complaint will document the circumstances that establish the existence of an implied contract and the reasons why the guarantor's actions amount to a breach. Legal Considerations and Potential Consequences: When filing a complaint against a guarantor for breach of oral or implied contracts in New Jersey, it is crucial to consider the legal elements required to establish a valid claim. These may include demonstrating the existence of a contract, the terms of the contract, the guarantor's breach, and the resulting damages incurred. If the complaint is successful, the guarantor may be held liable for various legal remedies, such as compensatory damages to cover the losses suffered by the affected party. In some cases, punitive damages may also be awarded by the court to deter similar breaches in the future. Additionally, the court may impose injunctions or other equitable remedies to prevent the guarantor from further damaging the open account credit transactions. Conclusion: New Jersey provides a legal avenue for individuals or businesses seeking recourse when a guarantor fails to uphold their obligations in open account credit transactions. Whether it involves a breach of an oral contract or an implied contract, filing a complaint against the guarantor can help recover damages and prevent future breaches. Understanding the types of complaints and the corresponding legal implications is crucial when addressing such issues in the state of New Jersey.Keywords: New Jersey, Complaint, Guarantor, Open Account Credit Transactions, Breach, Oral Contracts, Implied Contracts. Title: Understanding New Jersey Complaint Against Guarantor of Open Account Credit Transactions: Breach of Oral or Implied Contracts Introduction: In the state of New Jersey, when a guarantor fails to fulfill their responsibility of open account credit transactions, a complaint can be filed against them. This legal action is taken in cases where the guarantor breaches either oral or implied contracts. In this article, we will explore the types of complaints that can be filed against a guarantor in New Jersey and the legal implications they may face. Types of Complaints Against Guarantor of Open Account Credit Transactions: 1. Breach of Oral Contracts: When a guarantor enters into binding agreements verbally to guarantee open account credit transactions, they are obliged to honor their verbal commitments. However, upon failure to fulfill these obligations, the affected party may file a complaint for breach of oral contracts against the guarantor. The complaint will outline the terms of the oral agreement, the actions taken by the guarantor, and the damages caused as a result of their breach. 2. Breach of Implied Contracts: Besides oral contracts, guarantors can also be held accountable for breaching implied contracts. Implied contracts are formed based on the parties' actions and conduct, rather than explicitly stated terms. In these cases, a complaint can be filed against the guarantor if they fail to fulfill their implicit obligations, leading to financial losses for the concerned party. The complaint will document the circumstances that establish the existence of an implied contract and the reasons why the guarantor's actions amount to a breach. Legal Considerations and Potential Consequences: When filing a complaint against a guarantor for breach of oral or implied contracts in New Jersey, it is crucial to consider the legal elements required to establish a valid claim. These may include demonstrating the existence of a contract, the terms of the contract, the guarantor's breach, and the resulting damages incurred. If the complaint is successful, the guarantor may be held liable for various legal remedies, such as compensatory damages to cover the losses suffered by the affected party. In some cases, punitive damages may also be awarded by the court to deter similar breaches in the future. Additionally, the court may impose injunctions or other equitable remedies to prevent the guarantor from further damaging the open account credit transactions. Conclusion: New Jersey provides a legal avenue for individuals or businesses seeking recourse when a guarantor fails to uphold their obligations in open account credit transactions. Whether it involves a breach of an oral contract or an implied contract, filing a complaint against the guarantor can help recover damages and prevent future breaches. Understanding the types of complaints and the corresponding legal implications is crucial when addressing such issues in the state of New Jersey.