Title: Understanding the New Jersey Complaint for Repletion or Repossession Without Bond and Agreed Order Keywords: New Jersey, Complaint for Repletion, Repossession Without Bond, Agreed Order, legal process, property repletion, secured creditor, collateral, lawsuit, expedited relief, types Introduction: The New Jersey Complaint for Repletion or Repossession Without Bond and Agreed Order is a legal procedure that allows secured creditors to swiftly recover possession of collateral from a debtor who has defaulted on their loan. This article aims to provide a detailed description of this process, explaining its importance, different types of complaints, and the role of an agreed order. 1. Importance of the Complaint for Repletion or Repossession Without Bond: Repletion or repossession without bond gives secured creditors the opportunity to reclaim their collateral when a debtor fails to make timely payments or breaches their loan agreement. This process allows creditors to protect their interests and recover their assets swiftly, reducing financial losses caused by defaulting debtors. 2. Understanding the Complaint for Repletion: The Complaint for Repletion is a legal document filed by a secured creditor in a New Jersey court. It states that the debtor has failed to comply with the terms of the loan and requests the court's authorization for the repossession of the collateral. The complaint explains the details of the collateral, establishes the debtor's default, and outlines the reasons for seeking repossession. 3. The Repossession Without Bond and Expedited Relief: Repossession without bond refers to the circumstance where a secured creditor does not need to provide a bond to the court as security against potential damages or losses during the repossession process. This provision allows creditors to expedite the repossession process, gaining a quicker resolution to their case. 4. Different Types of New Jersey Complaint for Repletion or Repossession: a) Automobile Repossession Complaint: Specific to auto loans, this type of complaint focuses on the repossession of vehicles when the debtor defaults on their car loan payments. b) Property Repletion Complaint: This complaint type pertains to the repossession of non-vehicle collateral such as equipment, machinery, or other tangible assets used as security for the loan. 5. The Role of an Agreed Order: An agreed order is a mutual agreement between the secured creditor and the debtor, which can be submitted to the court, outlining the specifics of repossession. An agreed order spells out the terms and conditions upon which the repossession can take place, including timeframes, access to the collateral, and any outstanding obligations between the parties. Conclusion: The New Jersey Complaint for Repletion or Repossession Without Bond and Agreed Order serves as an essential legal mechanism for secured creditors to reclaim their collateral in cases of default or breach of loan agreements. By understanding the types of complaints available and the role of agreed orders, individuals and businesses can take appropriate action to protect their financial interests. It is advisable to consult an attorney familiar with New Jersey's repletion laws to navigate the process effectively.

New Jersey Complaint for Replevin or Repossession Without Bond and Agreed Order

Description

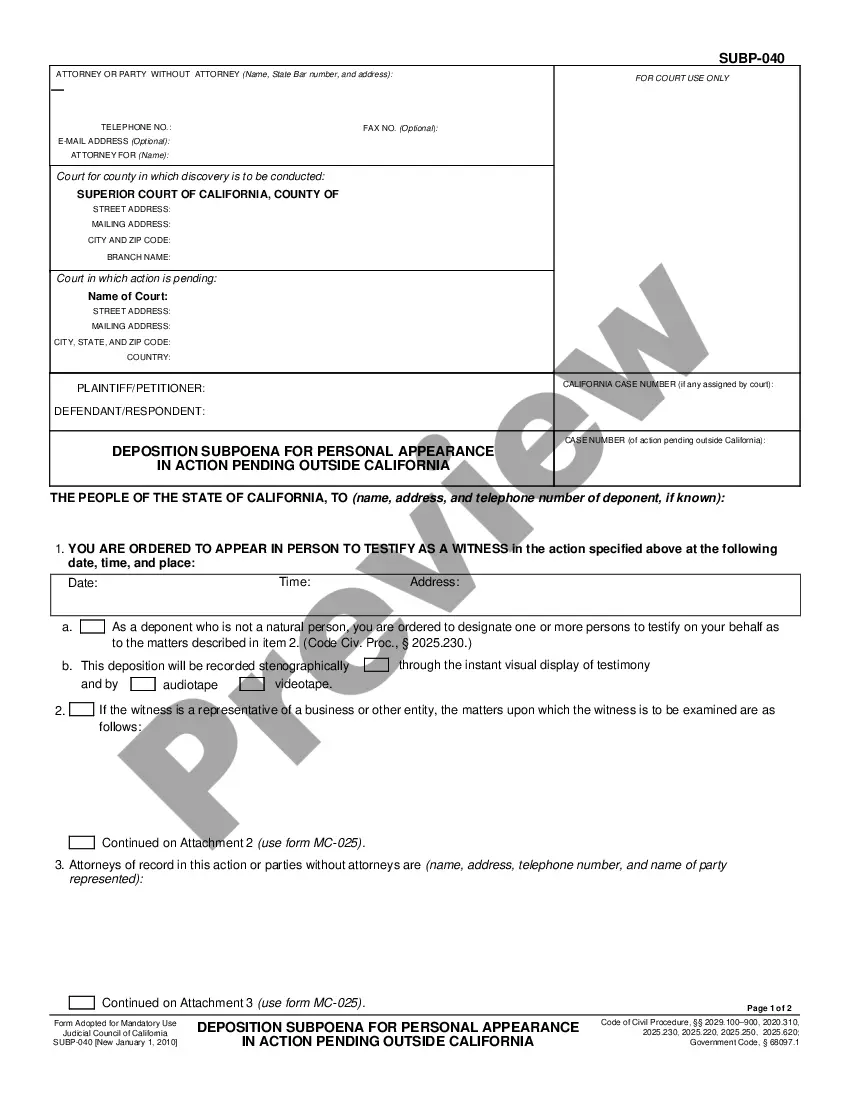

How to fill out New Jersey Complaint For Replevin Or Repossession Without Bond And Agreed Order?

US Legal Forms - one of many biggest libraries of legitimate forms in the USA - delivers an array of legitimate papers web templates you can down load or print. While using internet site, you may get a large number of forms for organization and personal functions, categorized by groups, states, or keywords.You will find the most up-to-date versions of forms such as the New Jersey Complaint for Replevin or Repossession Without Bond and Agreed Order within minutes.

If you already possess a monthly subscription, log in and down load New Jersey Complaint for Replevin or Repossession Without Bond and Agreed Order from the US Legal Forms library. The Obtain key will show up on every form you look at. You gain access to all in the past acquired forms inside the My Forms tab of the profile.

If you would like use US Legal Forms for the first time, listed below are straightforward guidelines to get you started off:

- Make sure you have selected the proper form for your town/area. Click on the Preview key to examine the form`s information. Read the form explanation to actually have chosen the correct form.

- When the form does not match your requirements, take advantage of the Look for industry towards the top of the monitor to get the one which does.

- If you are satisfied with the shape, validate your selection by clicking on the Get now key. Then, opt for the pricing program you favor and supply your qualifications to sign up on an profile.

- Procedure the deal. Use your bank card or PayPal profile to complete the deal.

- Pick the structure and down load the shape on your own device.

- Make adjustments. Complete, modify and print and sign the acquired New Jersey Complaint for Replevin or Repossession Without Bond and Agreed Order.

Each web template you added to your account does not have an expiration day which is the one you have forever. So, if you want to down load or print an additional copy, just go to the My Forms portion and click about the form you need.

Obtain access to the New Jersey Complaint for Replevin or Repossession Without Bond and Agreed Order with US Legal Forms, one of the most comprehensive library of legitimate papers web templates. Use a large number of expert and status-specific web templates that meet up with your company or personal requires and requirements.

Form popularity

FAQ

This Note explains who may file a motion to dismiss, when they may file the motion, and the available defenses (grounds) to assert, including lack of subject matter or personal jurisdiction, insufficient process or service of process, failure to state a claim on which relief may be granted, and failure to join a ...

Replevin, also known as "claim and delivery," is an action to recover personal property that was wrongfully taken or detained. Unlike other forms of legal recovery, replevin seeks the return of the actual thing itself, as opposed to monetary damages (the more commonly sought-after remedy).

A party served with a pleading stating a counterclaim or crossclaim against that party shall serve an answer thereto within 35 days after the service upon that party. A reply to an answer, where permitted, shall be served within 20 days after service of the answer.

, "plaintiff" includes any party asserting a claim in a complaint, counterclaim, cross-claim, third-party complaint or any other pleading, upon whose application a writ of attachment is issued. "Defendant" includes any party against whom any such claim is asserted.

. (a) Issuance of Writ on Notice. A writ of replevin shall issue only upon court order on motion of a party claiming the right to possession of chattels.

?Replevin? is a process whereby seized goods may be restored to their owner. In a replevin case, the Plaintiff claims a right to personal property (as opposed to real property/real estate) which has been wrongfully taken or detained by the defendant and seeks to recover that personal property.

Rule -1 is the mechanism through which a party obtains relief under N.J.S.A. 2B:50-2. Rule -1 echoes the standard set forth in N.J.S.A. 2B:50-2, that relief may be granted merely by showing ?a probability that final judgment will be rendered in favor of the movant.?

A person seeking recovery of goods wrongly held by another may bring an action for replevin in the Superior Court. If the person establishes the cause of action, the court shall enter an order granting possession.