The New Jersey Agreement to Arbitrate Disputed Open Account is a legal contract used to resolve disputes arising from open accounts in the state of New Jersey. An open account refers to a credit arrangement where the creditor sells goods or services on credit to the debtor, creating an ongoing debtor-creditor relationship. This agreement is designed to facilitate a fair, efficient, and cost-effective resolution of disputes, outside traditional court proceedings. By including arbitration clauses in open account agreements, both parties agree to submit any disputes to an impartial arbitrator, whose decision will be binding and final. Keywords: New Jersey, Agreement, Arbitrate, Dispute, Open Account, Legal contract, Credit, Creditor, Debtor, Relationship, Fair, Efficient, Cost-effective, Resolution, Court proceedings, Arbitration clauses, Impartial arbitrator, Binding, Final. There are several types of New Jersey Agreement to Arbitrate Disputed Open Account, depending on the nature of the open account and the parties involved. Here are few examples: 1. Consumer Agreement to Arbitrate Disputed Open Account: This type of agreement is used between consumers and creditors or service providers. It ensures that any disputes arising from open accounts between individuals and businesses are resolved through arbitration. Keywords: Consumer, Creditor, Service provider, Individuals, Businesses. 2. Business-to-Business Agreement to Arbitrate Disputed Open Account: This agreement is specifically tailored for disputes between business entities. It is commonly used when one business extends credit to another, such as when a supplier provides goods or services to another business on credit. Keywords: Business, Business entity, Credit, Supplier. 3. Financial Institution Agreement to Arbitrate Disputed Open Account: This type of agreement is relevant for open accounts maintained with banks, credit unions, or other financial institutions. It outlines the process for resolving disputes arising from financial transactions, including fees, charges, or unauthorized transactions. Keywords: Financial institution, Bank, Credit union, Financial transactions, Fees, Charges, Unauthorized transactions. 4. Medical Facility Agreement to Arbitrate Disputed Open Account: This agreement is specific to disputes between medical facilities, such as hospitals or clinics, and patients. It covers billing disputes, insurance claims, or disagreements related to payment for medical services rendered. Keywords: Medical facility, Hospital, Clinic, Patients, Billing disputes, Insurance claims, Medical services. These are just a few examples of the various types of New Jersey Agreement to Arbitrate Disputed Open Account that exist, each tailored to the specific context of the open account and the relationship between the parties involved.

New Jersey Agreement to Arbitrate Disputed Open Account

Description

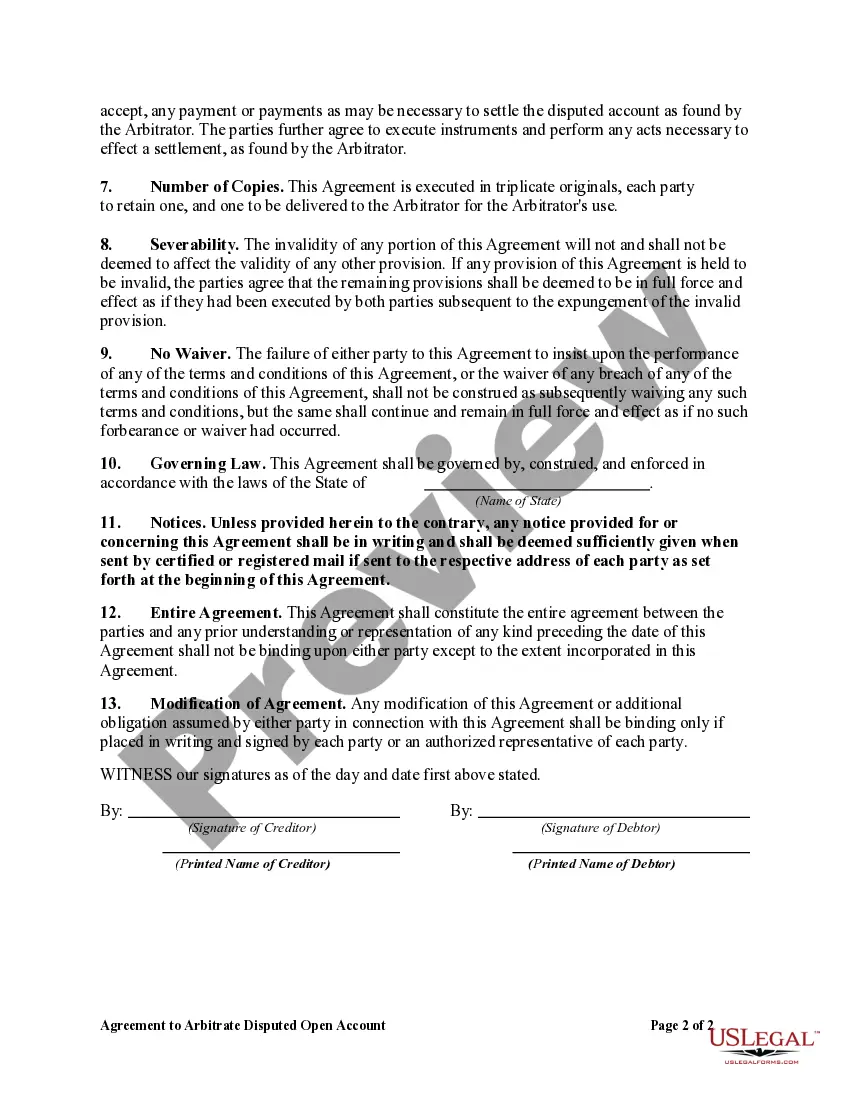

How to fill out New Jersey Agreement To Arbitrate Disputed Open Account?

You may devote time on the web attempting to find the legitimate document format that suits the federal and state requirements you will need. US Legal Forms provides 1000s of legitimate forms which are analyzed by specialists. You can actually obtain or produce the New Jersey Agreement to Arbitrate Disputed Open Account from the services.

If you have a US Legal Forms profile, you may log in and click on the Download switch. Afterward, you may total, modify, produce, or sign the New Jersey Agreement to Arbitrate Disputed Open Account. Each and every legitimate document format you purchase is the one you have eternally. To obtain another version for any obtained form, proceed to the My Forms tab and click on the related switch.

If you use the US Legal Forms website the very first time, stick to the straightforward guidelines beneath:

- First, make certain you have chosen the proper document format for the state/metropolis of your choosing. Look at the form information to make sure you have picked the proper form. If available, use the Preview switch to appear with the document format too.

- In order to get another edition of the form, use the Research industry to find the format that suits you and requirements.

- When you have found the format you need, click on Purchase now to carry on.

- Find the costs program you need, enter your qualifications, and sign up for an account on US Legal Forms.

- Full the deal. You should use your Visa or Mastercard or PayPal profile to pay for the legitimate form.

- Find the format of the document and obtain it for your system.

- Make adjustments for your document if required. You may total, modify and sign and produce New Jersey Agreement to Arbitrate Disputed Open Account.

Download and produce 1000s of document themes making use of the US Legal Forms site, that offers the most important collection of legitimate forms. Use skilled and condition-specific themes to deal with your small business or person needs.