The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

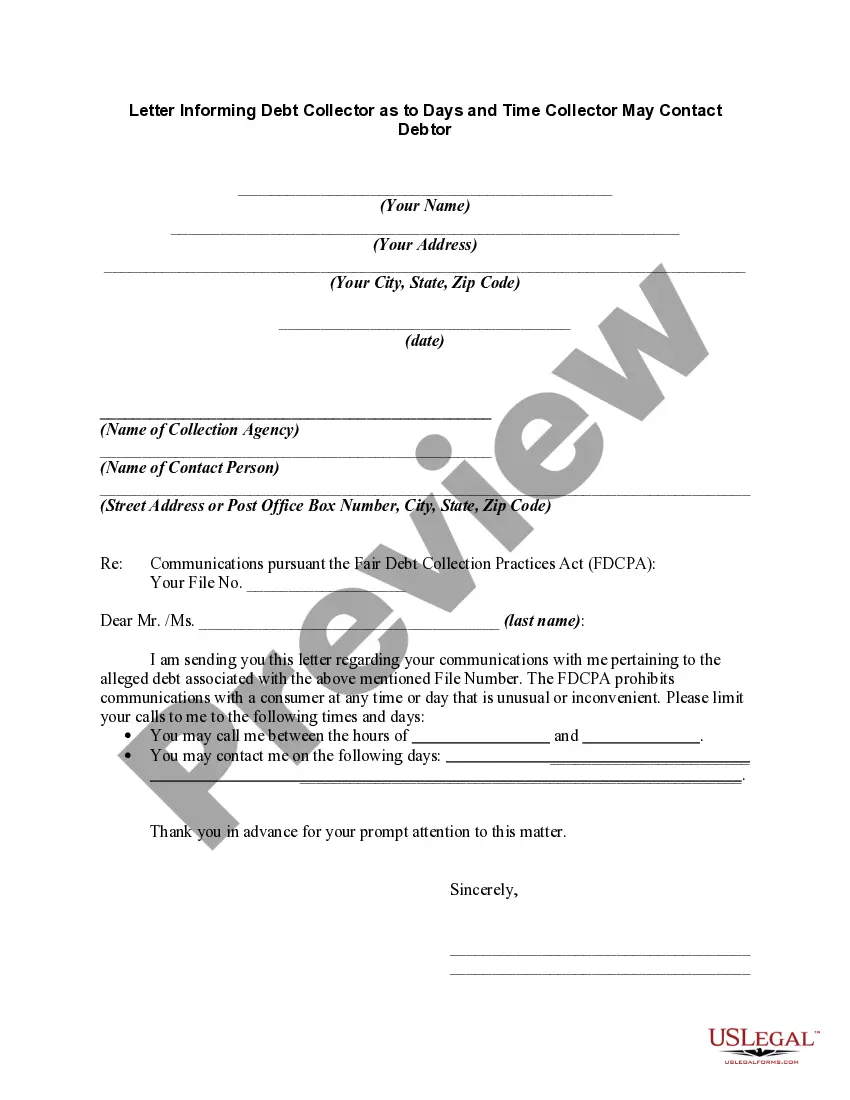

In New Jersey, the Fair Debt Collection Practices Act (FD CPA) provides guidelines for debt collectors regarding the days and times they can contact debtors. As a debtor, it is essential to be aware of your rights and communicate your preferences to debt collectors through a formal letter. This letter, known as the "New Jersey Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor," allows you to express your desired contact schedule and ensures that the debt collector abides by your preferences. There are various types of New Jersey Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor, depending on the specific circumstances and preferences of the debtor. These can include: 1. Standard Letter: This type of letter is used when a debtor wants to restrict the time and days a debt collector can contact them. It will typically include a general limitation to weekdays or specific hours on weekdays when they prefer not to be contacted. 2. Night Shift Worker Letter: If you work night shifts and need to sleep during the day, a Night Shift Worker Letter is more suitable. This letter informs debt collectors that you can only be contacted during specific hours when you are available. 3. Emergency Only Letter: This type of letter sets strict limitations on the debt collector's contact, allowing them to reach out only in case of emergencies. Debtors who are going through difficult situations or personal crises may opt for this level of contact restriction. 4. Limited Contact Letter: A Limited Contact Letter specifies that the debt collector may only contact the debtor via mail or email, eliminating phone calls altogether. Debtors who prefer written communication or want to avoid phone conversations may choose this option. Regardless of the type, the New Jersey Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor should include the following information: a) Personal Information: Begin the letter by providing your full name, address, and contact details. Make sure to use the same information associated with the debt in question. b) Account Information: State the account or reference number, the name of the original creditor, and the current outstanding balance to ensure accurate identification of the debt. c) Preferred Contact Schedule: Clearly specify the days of the week and the time frame during which you agree to be contacted by the debt collector. If you have different preferences for weekdays and weekends, be sure to include that information as well. d) Communicating Preferences: If you have a preferred method of contact, such as email or mail, indicate it in the letter. You can also choose to exclude certain channels, such as phone calls. e) Request for Verification: Politely request verification of the debt in question, including copies of any relevant documents, to ensure its validity. f) Notification of Violations: Conclude the letter by informing the debt collector that any violation of your stated contact preferences may be reported to relevant authorities, such as the New Jersey Attorney General's Office or the Federal Trade Commission (FTC). Remember, it is crucial to keep copies of any correspondence and send the letter via certified mail with a return receipt request. This provides evidence of the debt collector's receipt and your attempt to resolve the matter as per the FD CPA guidelines.In New Jersey, the Fair Debt Collection Practices Act (FD CPA) provides guidelines for debt collectors regarding the days and times they can contact debtors. As a debtor, it is essential to be aware of your rights and communicate your preferences to debt collectors through a formal letter. This letter, known as the "New Jersey Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor," allows you to express your desired contact schedule and ensures that the debt collector abides by your preferences. There are various types of New Jersey Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor, depending on the specific circumstances and preferences of the debtor. These can include: 1. Standard Letter: This type of letter is used when a debtor wants to restrict the time and days a debt collector can contact them. It will typically include a general limitation to weekdays or specific hours on weekdays when they prefer not to be contacted. 2. Night Shift Worker Letter: If you work night shifts and need to sleep during the day, a Night Shift Worker Letter is more suitable. This letter informs debt collectors that you can only be contacted during specific hours when you are available. 3. Emergency Only Letter: This type of letter sets strict limitations on the debt collector's contact, allowing them to reach out only in case of emergencies. Debtors who are going through difficult situations or personal crises may opt for this level of contact restriction. 4. Limited Contact Letter: A Limited Contact Letter specifies that the debt collector may only contact the debtor via mail or email, eliminating phone calls altogether. Debtors who prefer written communication or want to avoid phone conversations may choose this option. Regardless of the type, the New Jersey Letter Informing Debt Collector as to Days and Time Collector May Contact Debtor should include the following information: a) Personal Information: Begin the letter by providing your full name, address, and contact details. Make sure to use the same information associated with the debt in question. b) Account Information: State the account or reference number, the name of the original creditor, and the current outstanding balance to ensure accurate identification of the debt. c) Preferred Contact Schedule: Clearly specify the days of the week and the time frame during which you agree to be contacted by the debt collector. If you have different preferences for weekdays and weekends, be sure to include that information as well. d) Communicating Preferences: If you have a preferred method of contact, such as email or mail, indicate it in the letter. You can also choose to exclude certain channels, such as phone calls. e) Request for Verification: Politely request verification of the debt in question, including copies of any relevant documents, to ensure its validity. f) Notification of Violations: Conclude the letter by informing the debt collector that any violation of your stated contact preferences may be reported to relevant authorities, such as the New Jersey Attorney General's Office or the Federal Trade Commission (FTC). Remember, it is crucial to keep copies of any correspondence and send the letter via certified mail with a return receipt request. This provides evidence of the debt collector's receipt and your attempt to resolve the matter as per the FD CPA guidelines.