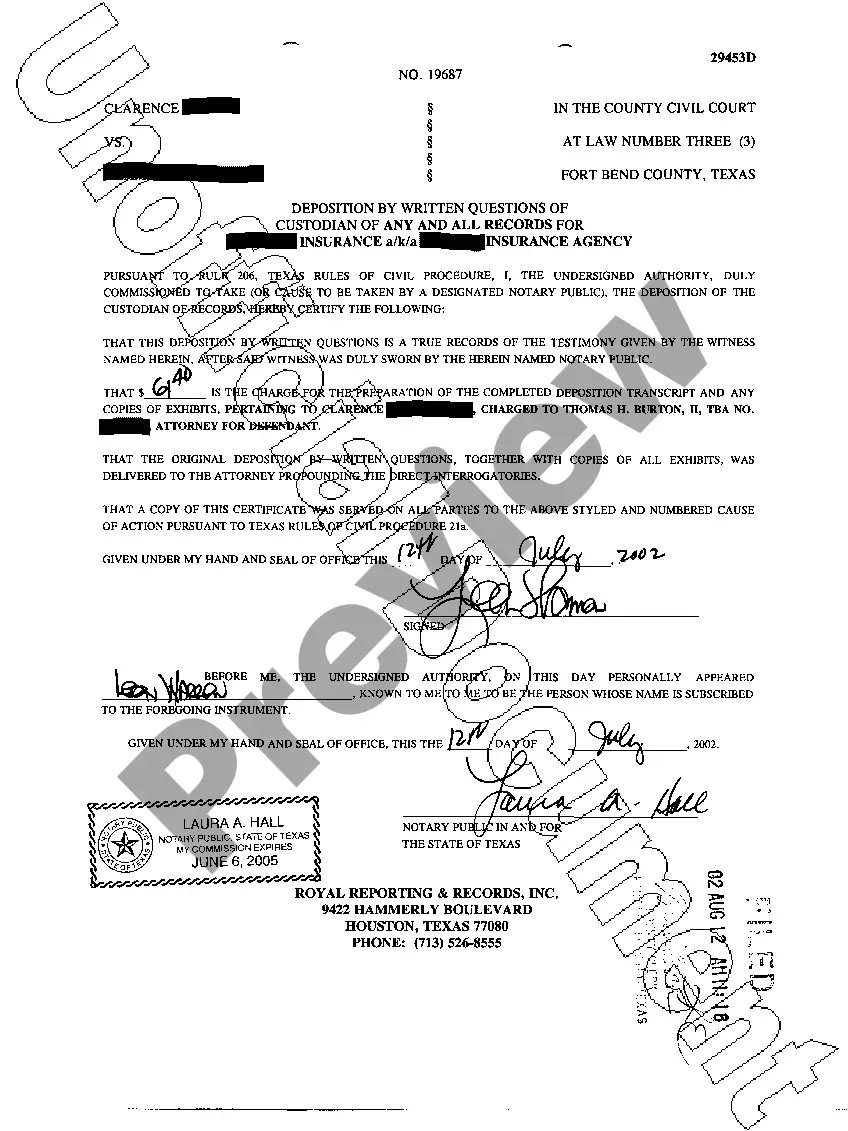

This form is a sample of an agreement to extend the time of a loan commitment in order to consummate a purchase of real property which will be security for the loan. In effect the loan applicant is asking for an extension of the date of closing set forth in the loan commitment or application.

New Jersey Extension of Loan Closing Date

Description

How to fill out Extension Of Loan Closing Date?

US Legal Forms - one of several largest libraries of legal varieties in America - gives a variety of legal file web templates it is possible to acquire or printing. Using the site, you can find a huge number of varieties for company and individual purposes, categorized by classes, suggests, or key phrases.You can get the most up-to-date types of varieties such as the New Jersey Extension of Loan Closing Date within minutes.

If you already have a membership, log in and acquire New Jersey Extension of Loan Closing Date through the US Legal Forms catalogue. The Acquire option can look on every form you see. You have accessibility to all earlier saved varieties within the My Forms tab of your bank account.

If you would like use US Legal Forms for the first time, allow me to share easy directions to obtain began:

- Make sure you have chosen the right form for your personal metropolis/county. Click the Preview option to review the form`s content. See the form information to ensure that you have chosen the appropriate form.

- If the form does not match your requirements, utilize the Search discipline at the top of the display screen to get the one who does.

- Should you be satisfied with the form, verify your decision by clicking the Buy now option. Then, pick the rates plan you favor and provide your accreditations to register on an bank account.

- Process the purchase. Utilize your Visa or Mastercard or PayPal bank account to complete the purchase.

- Pick the formatting and acquire the form on your own gadget.

- Make alterations. Load, modify and printing and indicator the saved New Jersey Extension of Loan Closing Date.

Every template you added to your money does not have an expiry day and is your own forever. So, if you would like acquire or printing an additional version, just proceed to the My Forms area and click on in the form you require.

Gain access to the New Jersey Extension of Loan Closing Date with US Legal Forms, the most extensive catalogue of legal file web templates. Use a huge number of expert and condition-certain web templates that satisfy your company or individual needs and requirements.

Form popularity

FAQ

Due Date - Individual Returns - April 15 or the same as the IRS. Extensions - A six month extension request must be filed on form NJ-630 no later than the original due date of the return. Any extension granted is for time to file and does NOT extend time to pay.

Personal. We give you an automatic 6-month extension to file your return. You must file by the deadline to avoid a late filing penalty.

Per Publication 4163, Modernized E-file (MeF) business returns have a ?perfection period? of 10 days from the date of rejection. Extensions (Forms 7004 and 8868) have five (5) days from the date of rejection, which isnot an extension of time to file; this is the period to correct errors in the e-file.

In New Jersey, the closing is often scheduled for 30 to 45 days after the agreement has been signed. But the timeline can vary due to a number of factors. Do the buyer and seller both attend? Closing procedures can vary slightly from state-to-state.

New Jersey S-Corporation Form CBT-200-T grants an automatic 6-month extension of time to file Form CBT-100. Corporations will automatically receive a six-month extension only if they have paid at least 90% of the tax liability and timely filed Form CBT-200-T.

The moratorium on home foreclosures ended on November 15, 2021. Mortgage assistance, free foreclosure mediation, and housing counselors are available. In addition, participating financial institutions are committed to providing mortgage relief.

Due Date - Individual Returns - April 15 or the same as the IRS. Extensions - A six month extension request must be filed on form NJ-630 no later than the original due date of the return. Any extension granted is for time to file and does NOT extend time to pay.

The businesses operating (as Corporation) in New Jersey need to file a separate Corporate tax extension Form CBT-200-T with the state to obtain a 6-month extension of time to file their business income tax return with the state.