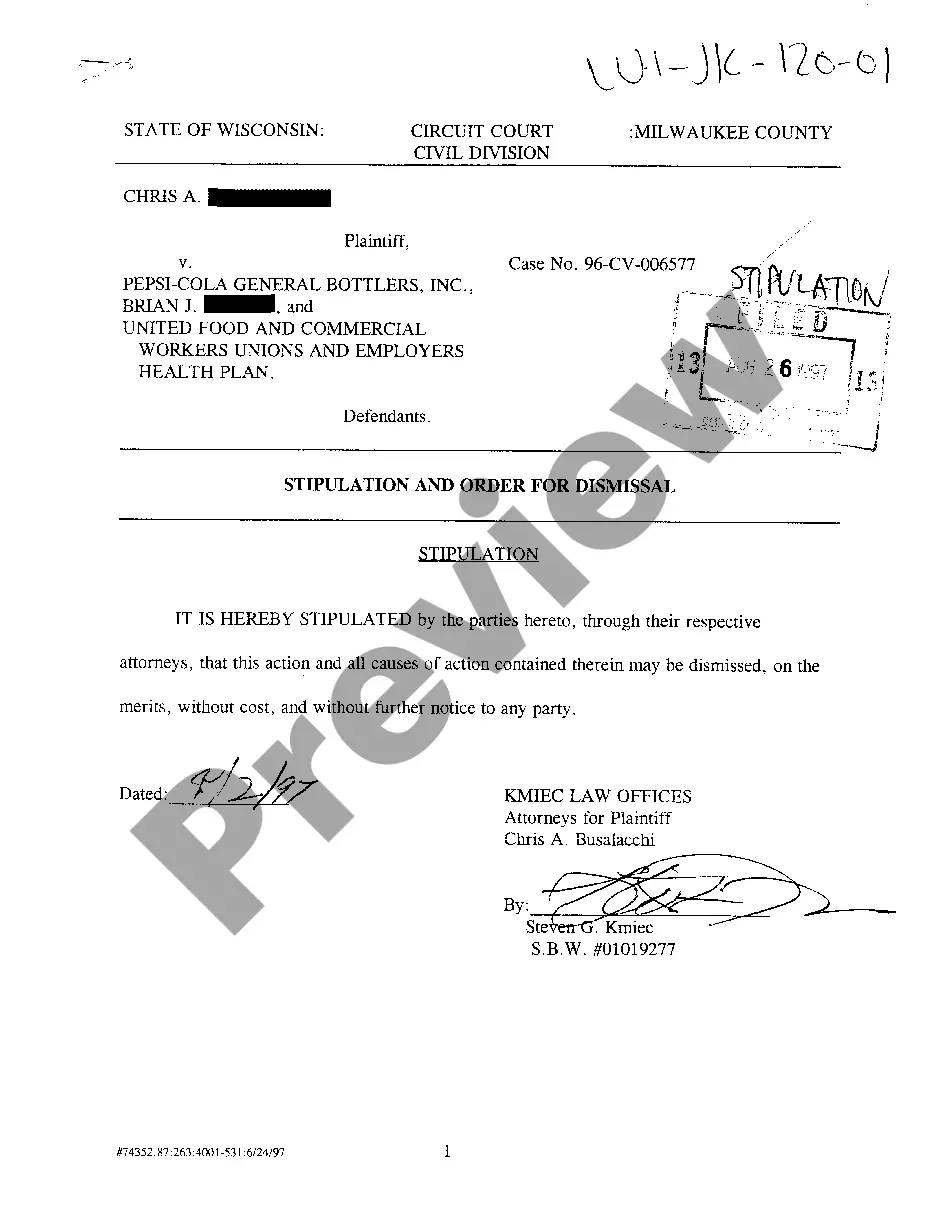

New Jersey Change of Beneficiary

Description

How to fill out Change Of Beneficiary?

US Legal Forms - one of the largest collections of legal documents in the U.S. - offers a broad selection of legal document templates that you can download or print. By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of documents like the New Jersey Change of Beneficiary in a matter of minutes.

If you already have a membership, Log In and obtain the New Jersey Change of Beneficiary from the US Legal Forms library. The Download option will be visible on every form you examine. You have access to all previously downloaded forms within the My documents section of your account.

If you are looking to use US Legal Forms for the first time, here are simple steps to help you get started: Ensure you have selected the correct form for your city/county. Click on the Preview option to check the form's details. Review the form information to confirm that you have chosen the right document. If the form does not meet your needs, use the Search box at the top of the page to find one that does. If you are satisfied with the document, confirm your selection by clicking on the Download now button. Then, choose the payment plan you prefer and provide your details to register for an account.

Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements and demands.

- Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

- Choose the format and download the document to your device.

- Make modifications. Fill out, edit, print, and sign the downloaded New Jersey Change of Beneficiary.

- Every template you add to your account has no expiration date and belongs to you indefinitely.

- So, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

- Access the New Jersey Change of Beneficiary with US Legal Forms, one of the most extensive libraries of legal document templates.

Form popularity

FAQ

The policyholderPolicyholderThe person who owns an insurance policy is the only person allowed to make changes to your life insurance beneficiaries. The only exception is if you've granted someone power of attorney, a legal document that lets someone make financial, legal, or medical decisions on your behalf.

As the policyholder, only you ? or someone who holds durable power of attorney for you ? can change your life insurance beneficiaries. However, if your policy names an irrevocable beneficiary, you will also need to get that beneficiary's consent before making changes.

The policy owner is the only person who can change the beneficiary designation in most cases. If you have an irrevocable beneficiary or live in a community property state you need approval to make policy changes. A power of attorney can give someone else the ability to change your beneficiaries.

A revocable beneficiary designation gives the policyholder the right to change the beneficiary without the consent of the named beneficiary.

How to Complete the Beneficiary Change Form - YouTube YouTube Start of suggested clip End of suggested clip But you should contact the pensions and benefits office for the correct. Form. After you haveMoreBut you should contact the pensions and benefits office for the correct. Form. After you have completed this section all that's left is to sign your name and date. The form in the designated. Space.

The policyowner can change the beneficiary. A policyowner may change a beneficiary at any time. However, consent may be needed by the current beneficiary if designated as irrevocable.

Irrevocable beneficiaries cannot be removed once designated unless they agree to it?even if they are divorced spouses. Children are often named irrevocable beneficiaries to ensure their inheritance or secure child support payments.

Generally, you will need to fill out a change of beneficiary form which includes information such as the policyholder's name, the new beneficiary's name, and the reason for the change. You may also need to provide a copy of the policyholder's death certificate if the beneficiary is being changed due to their death.