New Jersey Revocable Trust for Asset Protection

Description

How to fill out Revocable Trust For Asset Protection?

Are you now in a position where you need documentation for both corporate or personal purposes almost every workday.

There are numerous official document templates available online, but finding ones you can trust is not easy.

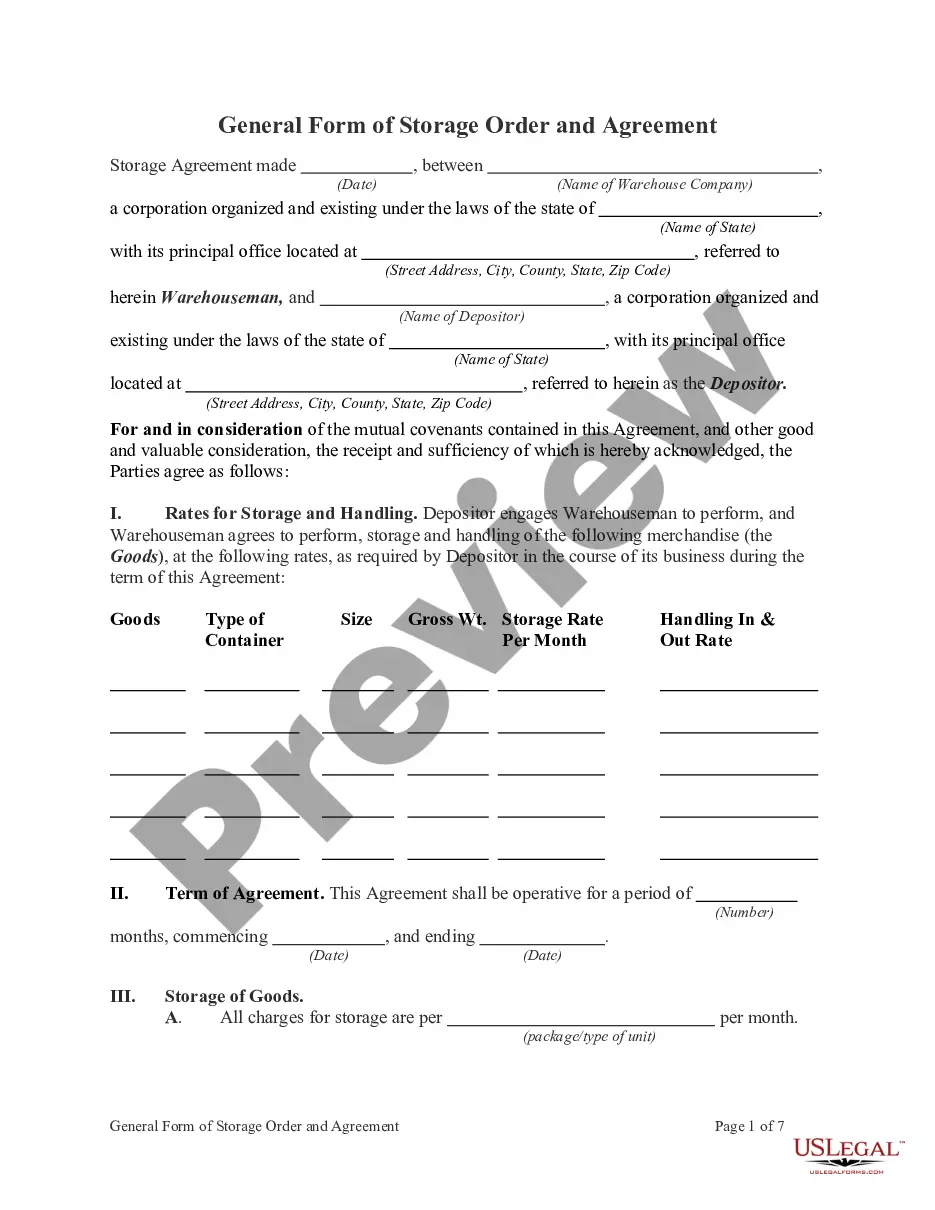

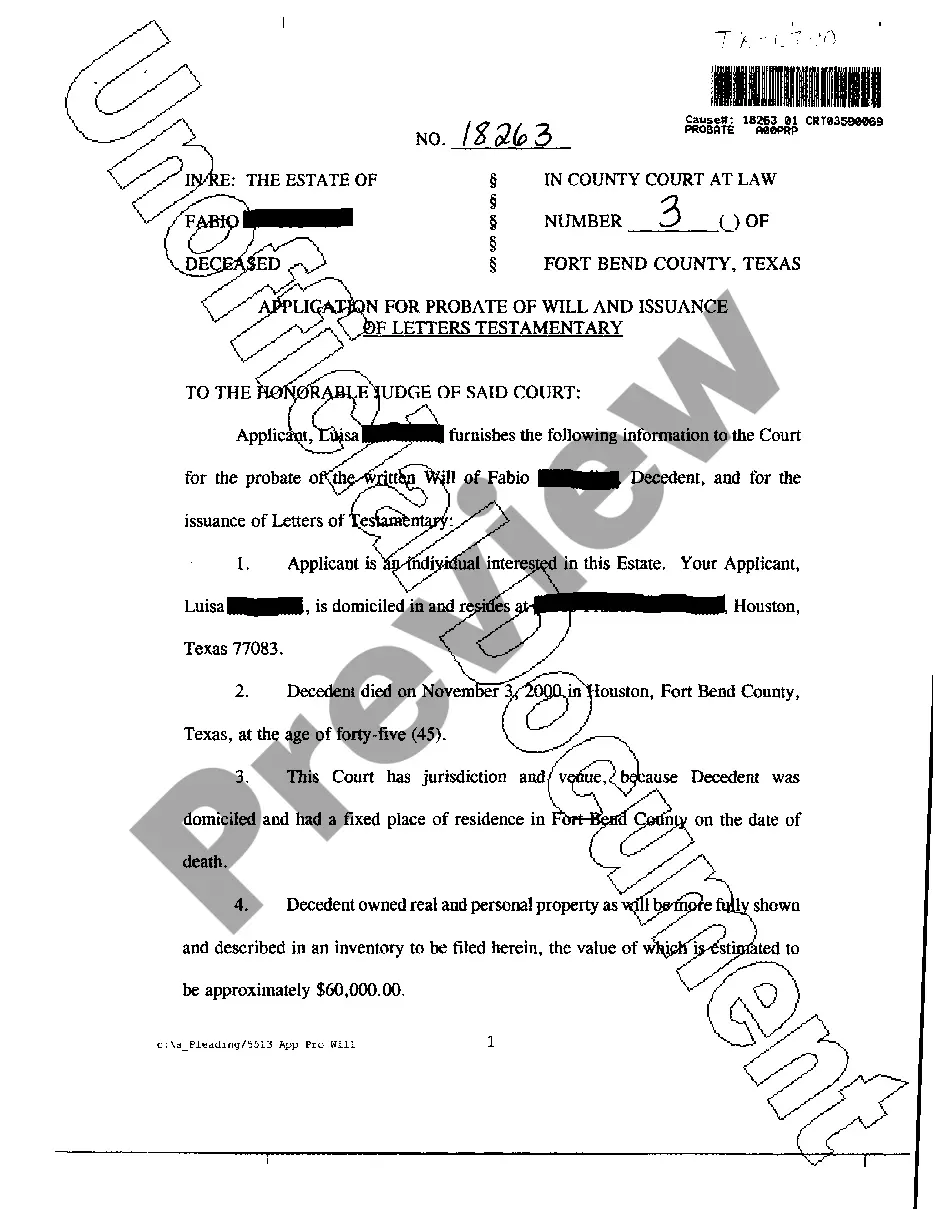

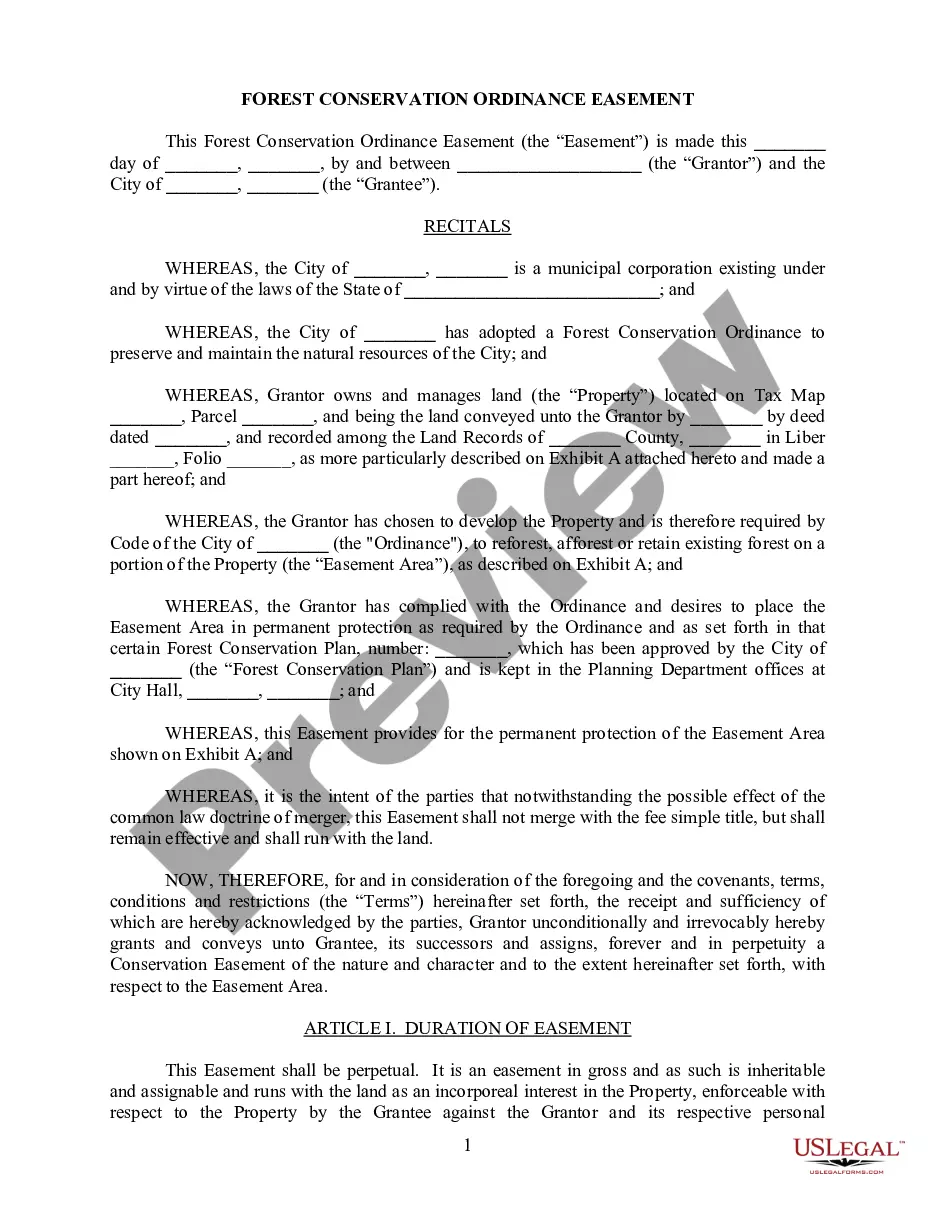

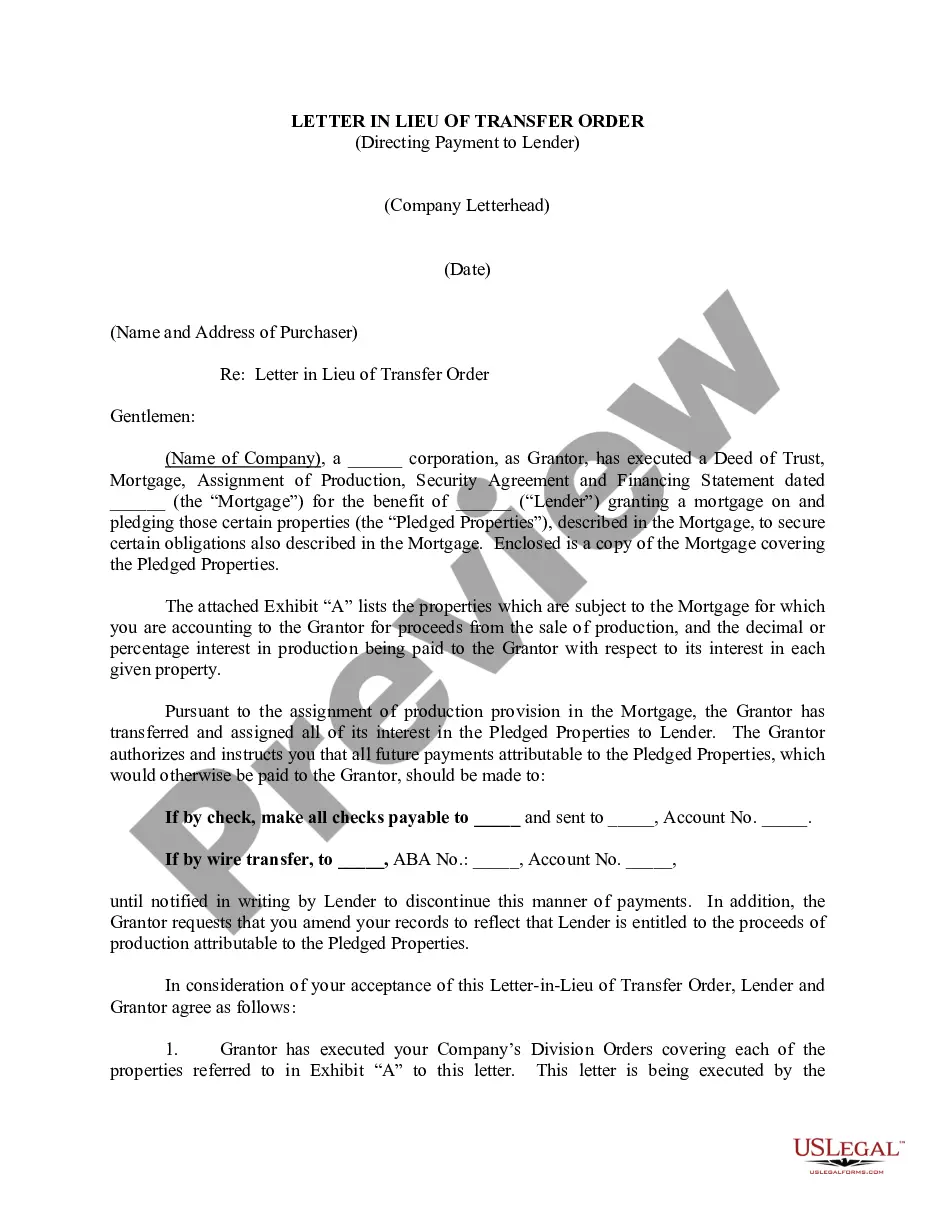

US Legal Forms provides thousands of template options, such as the New Jersey Revocable Trust for Asset Protection, designed to comply with federal and state requirements.

If you find the appropriate template, click on Get now.

Select the pricing plan you want, fill in the required information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the New Jersey Revocable Trust for Asset Protection template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the template you need and ensure it is for the correct city/region.

- Utilize the Preview option to review the form.

- Check the summary to confirm you have selected the correct template.

- If the template is not what you are looking for, use the Search section to find a template that meets your needs and requirements.

Form popularity

FAQ

For those seeking strong asset protection, an irrevocable trust is generally more effective than a New Jersey Revocable Trust for Asset Protection. With an irrevocable trust, you give up control over the assets, minimizing exposure to creditors and allowing for greater protection. Utilizing a service like US Legal Forms can simplify the process of establishing the most appropriate trust structure for your needs.

While a New Jersey Revocable Trust for Asset Protection can facilitate easier management and transfer of assets, it does not provide strong asset protection. Creditors can still access assets owned by the trust, so it is not a shield against legal claims. Consider alternative structures, such as irrevocable trusts, if protection from creditors is a primary goal.

One downside of a New Jersey Revocable Trust for Asset Protection is that it does not shield assets from creditors, lawsuits, or divorce settlements. Additionally, revocable trusts do not offer any tax benefits while you are alive. Since you can modify or revoke the trust at any time, this flexibility may lead to potential misuse or misunderstanding of the trust’s purpose.

A New Jersey Revocable Trust for Asset Protection can offer some level of asset management, but it does not provide absolute protection. Because the trust remains revocable, you still maintain control and ownership of the assets, meaning they may be vulnerable to creditors. However, for effective estate planning, this trust allows for smoother transfers and management of your assets upon death.

When considering a New Jersey Revocable Trust for Asset Protection, it is important to avoid placing certain assets within the trust. For example, retirement accounts like 401(k)s and IRAs typically do not belong in a revocable trust. Additionally, personal property, such as cars and clothing, may not benefit from being included. Keeping these assets outside the trust allows for greater liquidity and potential tax advantages.

One downfall of establishing a trust can be the complexity of management and ongoing maintenance. A New Jersey Revocable Trust for Asset Protection requires regular updates to reflect changes in family status, assets, or laws. Staying proactive is essential to fully leverage the benefits of a trust.

Yes, New Jersey does allow for asset protection trusts, but they must meet specific legal requirements. A New Jersey Revocable Trust for Asset Protection can help shield assets from creditors and legal claims while allowing family members to benefit during their lifetime. Understanding these regulations is vital to ensuring compliance.

The primary disadvantage of a family trust is the potential for disputes among family members after a loved one's passing. If not properly managed, a New Jersey Revocable Trust for Asset Protection may lead to misunderstandings regarding asset distribution. Clear communication and detailed documentation are crucial to preventing conflicts.

Creating an asset protection trust involves drafting a legal document that outlines the trust's terms and conditions. It’s essential to include details about beneficiaries, asset management, and distribution. Consulting with an attorney familiar with a New Jersey Revocable Trust for Asset Protection can ensure your trust aligns with your goals and complies with state laws.

Yes, placing assets in a trust can provide numerous benefits, including streamlined asset management and enhanced protection. A New Jersey Revocable Trust for Asset Protection allows your parents to safeguard their assets while enjoying flexibility in managing their wealth. It is wise to evaluate their specific situation to determine the best strategy.