A New Jersey revocable trust for real estate is a legal entity set up to hold and manage real estate assets in the state of New Jersey. It is created during the settler's lifetime and can be modified or revoked by the settler at any time. The trust is commonly used as an estate planning tool to ensure the seamless transfer of real estate assets to beneficiaries upon the settler's death, avoiding the need for probate. There are two main types of revocable trusts for real estate in New Jersey: 1. Living Revocable Trust: This trust is established during the settler's lifetime and allows them to retain control and ownership of the real estate assets placed in the trust. The settler can oversee the management of the trust's assets, collect rental income, and make decisions regarding the property. Additionally, this type of trust provides flexibility as it can be easily modified or revoked. 2. Testamentary Revocable Trust: Unlike the living revocable trust, this type of trust is created through a will and comes into effect after the settler's death, making it irrevocable. It allows the settler to name beneficiaries who will receive the real estate assets upon their passing. This trust provides the advantage of avoiding probate, ensuring a smooth transfer of assets while minimizing costs and delays. When considering a New Jersey revocable trust for real estate, it is crucial to consult with an experienced estate planning attorney familiar with state laws, as they may vary. This ensures that the trust is properly established, complies with legal requirements, and meets the specific needs and goals of the settler. Some relevant keywords for a New Jersey revocable trust for real estate may include: estate planning, revocable living trust, real estate asset protection, probate avoidance, beneficiaries, settler, irrevocable trust, property management, estate transfer, legal entity, estate taxes, estate administration, and asset distribution.

New Jersey Revocable Trust for Real Estate

Description

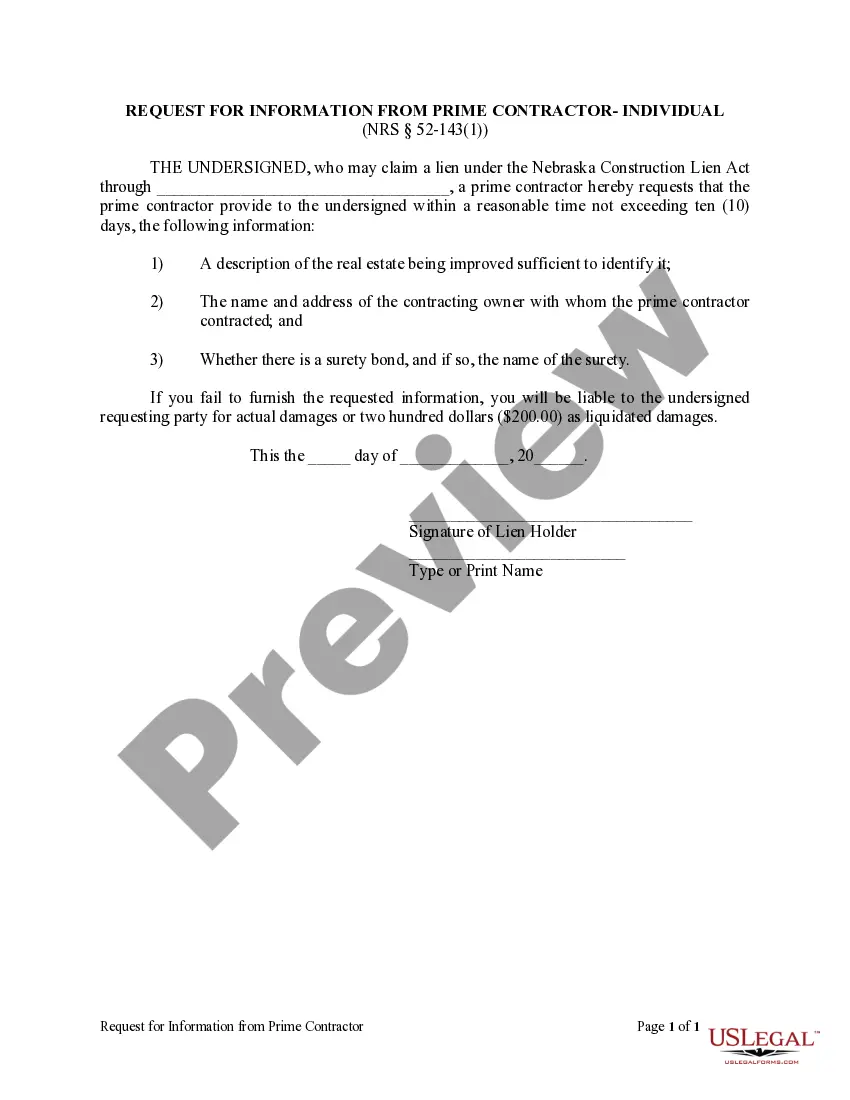

How to fill out New Jersey Revocable Trust For Real Estate?

It is feasible to spend hours online attempting to locate the legal document template that fulfills the state and federal criteria you require.

US Legal Forms offers thousands of legal forms that have been reviewed by experts.

You can easily obtain or print the New Jersey Revocable Trust for Real Estate from your service.

If available, use the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the New Jersey Revocable Trust for Real Estate.

- Each legal document template you receive is your property indefinitely.

- To acquire another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, confirm that you have selected the correct document template for the state/city of your choice.

- Review the form outline to ensure you have chosen the right form.

Form popularity

FAQ

You might consider placing your house in a New Jersey Revocable Trust for Real Estate for several reasons. This strategy can help your beneficiaries avoid the time-consuming probate process, which can delay property transfers. It also allows you to easily update or change your trust as your needs evolve. Moreover, a revocable trust ensures that your wishes are followed regarding the distribution of your property.

One downside of a New Jersey Revocable Trust for Real Estate is that it does not offer asset protection from creditors. While you retain control and can make changes, this means your assets could be susceptible to claims. Furthermore, managing a trust can involve administrative duties and potential costs. It’s crucial to weigh these factors against the benefits when considering a revocable trust.

The New Jersey Revocable Trust for Real Estate is often considered one of the best options for holding real estate. It allows you to maintain control over your property while providing flexibility for future changes. Plus, it simplifies the transfer process upon your passing, avoiding probate. However, consulting with a legal expert can help determine the best fit for your specific situation.

While using a New Jersey Revocable Trust for Real Estate can provide benefits, there are some disadvantages to consider. One major concern is the potential for added complexity in your estate planning. Additionally, transferring your property into a trust may trigger certain fees and costs. Finally, it's important to remember that revocable trusts do not protect your assets from creditors.

To put your house in a New Jersey Revocable Trust for Real Estate, start by creating the trust document that specifies the details of the asset and the beneficiaries. Next, execute a deed transferring the ownership of the house to the trust. Finally, file this deed with the appropriate county office to make the transfer official. If you need assistance, uslegalforms offers valuable resources to help guide you through this process smoothly.

Transferring your property to a New Jersey Revocable Trust for Real Estate is a straightforward process. You will need to execute a new deed that lists the trust as the property owner. Ensure that the deed is properly signed, notarized, and recorded with your county clerk's office. This transfer not only protects your assets but also aligns with your estate planning objectives.

Registering a New Jersey Revocable Trust for Real Estate involves certain steps that you need to follow. First, draft the trust document that outlines the terms and conditions of your trust. After creating the trust, you typically do not need to register it with the state but may need to file certain documents depending on how your assets are managed. Utilizing platforms like uslegalforms can simplify this process and ensure that you meet all necessary legal requirements.

A New Jersey Revocable Trust for Real Estate can offer several benefits that may be suitable for your situation. This type of trust allows for easy management of your assets while you are alive and ensures a smooth transfer to your beneficiaries after your passing. It can also provide privacy and help you avoid the probate process. Ultimately, the decision to create a trust depends on your personal circumstances and estate planning goals.

Yes, you can place your house in a trust in New Jersey, and doing so with a New Jersey Revocable Trust for Real Estate can simplify matters for your beneficiaries. This arrangement allows you to retain control of your property while providing clear instructions for its management after your death. It's crucial to follow the correct procedures to ensure that the property title transfers to the trust properly. Consider consulting a legal professional or using tools from US Legal Forms to facilitate this process.

To set up a revocable living trust in New Jersey, start by documenting your assets and deciding how you want them managed. You will need to create a trust document, designating a trustee, and specify how the trust should operate. When preparing this document, a New Jersey Revocable Trust for Real Estate can be tailored to meet your specific needs, including detailed instructions for real estate handling. You may also consider using a platform like US Legal Forms for straightforward access to templates and guidance.

Interesting Questions

More info

In the case of an estate that passes to a person who is not a “beneficiary” or “beneficiary's spouse, the trustee can take ownership of the living trust assets. If a living trust holds a balance owing the deceased person (sometimes referred to as a “debtor”), the trustee would have the right to claim its fair value as tax-deductible against the deceased person's estate. To read more about what is considered a debt, click here. What is considered a debtor's estate is often left undefined. For example, it may not be obvious whether assets are considered to have been left at the deceased person's (or spouse's) direction. Generally the estate of a debtor to be disbursed to the debtor's spouse may not make up more than 25% of the deceased person's estate. Some courts consider less than 25% to be a “fair balance” between the estate of the debtor and that of the deceased person.