New Jersey Escrow Instructions for Residential Sale: A Comprehensive Guide In New Jersey, the process of buying or selling a residential property involves several crucial steps to ensure a smooth transaction. One imperative element of this process is the use of escrow instructions. This article aims to provide a detailed description of what New Jersey escrow instructions for residential sale entails, including its purpose, parties involved, and the different types available. Escrow Instructions Explained: Escrow instructions refer to a legally binding agreement established between the buyer, seller, and an escrow agent. The purpose of these instructions is to outline the terms and conditions under which the escrow agent holds and distributes the funds during a residential sale transaction. By using escrow instructions, both parties involved can have a sense of security, as an impartial third party oversees the transaction and ensures compliance with the agreed-upon terms. Parties Involved in New Jersey Escrow Instructions: 1. Buyer: The individual seeking to purchase the residential property. 2. Seller: The party selling the residential property to the buyer. 3. Escrow Agent: An impartial third party, such as an attorney, title agency, or escrow company, responsible for holding and distributing funds according to the agreed-upon instructions. Key Elements of New Jersey Escrow Instructions: 1. Purchase Price: The agreed-upon price for the residential property. 2. Closing Date: The date when the transaction is expected to be finalized. 3. Inspection Period: The timeframe during which the buyer can conduct inspections and negotiate repairs or price adjustments based on the results. 4. Deposit Amount: The initial deposit made by the buyer as a sign of their serious intent to purchase the property. 5. Contingencies: Various conditions that need to be satisfied for the transaction to proceed, such as a satisfactory home inspection, obtaining financing, or the sale of the buyer's current property. Different Types of New Jersey Escrow Instructions for Residential Sale: 1. Standard Escrow Instructions: These are the most common type of escrow instructions utilized for residential sales. They include the standard terms and conditions required for a typical transaction, such as the purchase price, closing date, and inspection period. 2. Contingency-Based Escrow Instructions: In some cases, buyers may include specific contingencies in the escrow instructions, allowing them to back out of the deal if certain conditions are not met. 3. Joint Escrow Instructions: When multiple buyers or sellers are involved in a residential sale, joint escrow instructions outline how the funds will be distributed among the parties upon completion of the transaction. 4. Escrow Instructions for Short Sales: In situations where the property is being sold for an amount lower than the outstanding mortgage balance, these instructions outline the lender's approval requirements and the distribution of the proceeds. In conclusion, New Jersey escrow instructions for residential sale are a crucial aspect of the property buying or selling process. They provide a clear framework and set of obligations for all parties involved, ensuring a secure and fair transaction. Understanding the different types available can assist both buyers and sellers in choosing the most suitable instructions for their specific circumstances.

New Jersey Escrow Instructions for Residential Sale

Description

How to fill out New Jersey Escrow Instructions For Residential Sale?

You could spend countless hours online trying to find the correct legal format that complies with both state and federal requirements.

US Legal Forms provides an extensive collection of legal documents that are verified by experts.

You can download or print the New Jersey Escrow Instructions for Residential Sale from our services.

If you want to find an alternative version of the form, use the Search box to locate the format that fits your requirements.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the New Jersey Escrow Instructions for Residential Sale.

- Every legal document you acquire is yours indefinitely.

- To get another copy of a purchased form, go to the My documents section and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have chosen the correct format for the area of your choice.

- Review the form details to confirm that you have selected the appropriate document.

Form popularity

FAQ

To avoid capital gains tax on your home sale in New Jersey, consider using the primary residence exclusion. If you have lived in your home for at least two of the five years prior to selling it, you may qualify for the exclusion, allowing you to exclude up to $250,000 of gain, or $500,000 if you are married. Additionally, when following the New Jersey Escrow Instructions for Residential Sale, ensure that all documentation is clear and compliant, which can help protect your financial interests. Utilizing resources like USLegalForms can provide the necessary guidance and templates to navigate this process smoothly.

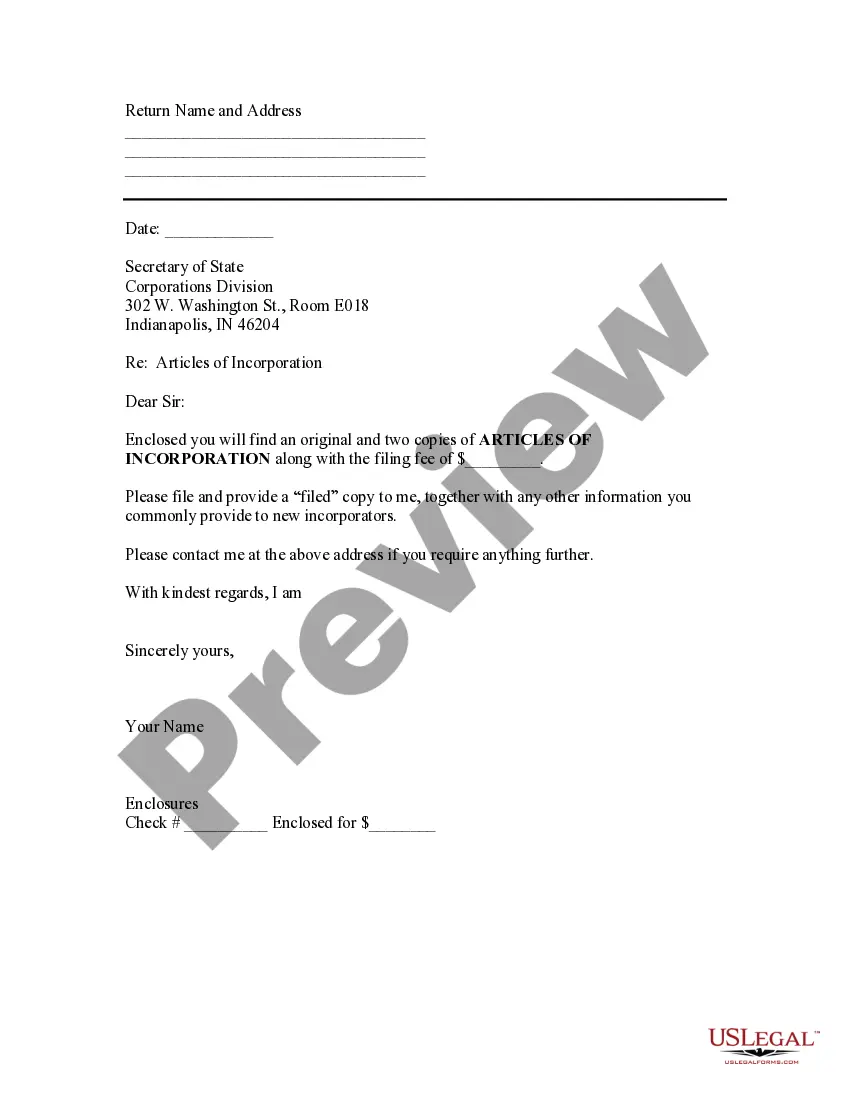

The execution of escrow instructions can be performed by the escrow agent or a licensed attorney. They ensure adherence to the New Jersey Escrow Instructions for Residential Sale that both parties have agreed upon. It’s crucial for these individuals to have a clear understanding of the transaction to execute effectively. Using services like US Legal Forms can provide the necessary templates to ensure everything is in order.

Escrow instructions are typically provided by the real estate attorney, real estate agents, or the parties involved in the transaction. They ensure all necessary details are included in the New Jersey Escrow Instructions for Residential Sale. At US Legal Forms, you can find templates that guide you in drafting accurate instructions. Providing clear directions helps prevent misunderstandings.

The individuals who signed the escrow instructions are usually the buyer and the seller, or their designated representatives. This signature confirms that they understand and accept the terms set forth in the New Jersey Escrow Instructions for Residential Sale. It’s important to maintain a copy of this signed document for future reference. Each party plays a crucial role in ensuring a successful transaction.

Typically, the escrow instructions must be signed by both the buyer and the seller. Their signatures indicate mutual agreement on how the transaction will proceed under the New Jersey Escrow Instructions for Residential Sale. This step is essential, as it helps protect both parties' interests. Always ensure that the signed document is kept with your transaction records.

The escrow instructions are specifically outlined in the escrow agreement. This document serves as the blueprint for the transaction, detailing how the escrow agent will manage the funds until closing. You can obtain a sample of these New Jersey Escrow Instructions for Residential Sale through US Legal Forms to ensure compliance and clarity. It's vital that all parties are aware of these instructions.

The closing instructions form must be signed by both the buyer and the seller or their respective attorneys. This ensures that all parties agree on the terms outlined in the New Jersey Escrow Instructions for Residential Sale. Having this document signed is crucial for a smooth transaction. Without signatures, the closing process cannot proceed.

In New Jersey, escrow instructions are typically prepared by the real estate attorney representing the buyer or seller. This document outlines how the funds should be handled during the residential sale. Using a qualified platform like US Legal Forms can streamline this process. With clear instructions, all parties understand their roles and responsibilities.

In New Jersey, the deed is usually prepared by the seller's attorney or a designated title company representative. They follow the established New Jersey escrow instructions for residential sale to ensure that all legal requirements are met for the transaction. It's essential to have accurate and complete documentation to facilitate a smooth transfer of ownership at closing.

Typically, the house closing process in New Jersey can take anywhere from 30 to 60 days, depending on various factors. Timing may fluctuate due to the complexities outlined in the New Jersey escrow instructions for residential sale, including financing approval and other contingencies. It's wise to communicate with your real estate agent and attorney to ensure a timely closing without unnecessary delays.

Interesting Questions

More info

For this we need the PayPal email address you gave to PayPal when you donated to The Jersey Project. This Email Address is already registered. Please log in below. You will be automatically redirected to PayPal. To manage your donation in our office, please create an account. Please provide a valid email address and password. Remember: you can donate to The Jersey Project by check, credit card, or PayPal You will need to create an account with PayPal. If you are not able to log in, please contact us for assistance. We have emailed you a link to create an account. Please follow this link to complete the registration for your account.