New Jersey Withdrawal of Partner

Description

How to fill out Withdrawal Of Partner?

If you need to compile, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site's simple and user-friendly search feature to locate the documents you require.

Various templates for business and personal purposes are categorized by groups and jurisdictions, or keywords.

Step 4. Once you have found the desired form, click the Buy now button. Choose your preferred pricing plan and provide your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to access the New Jersey Withdrawal of Partner in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the New Jersey Withdrawal of Partner.

- You can also view forms you have previously downloaded in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for your specific city/state.

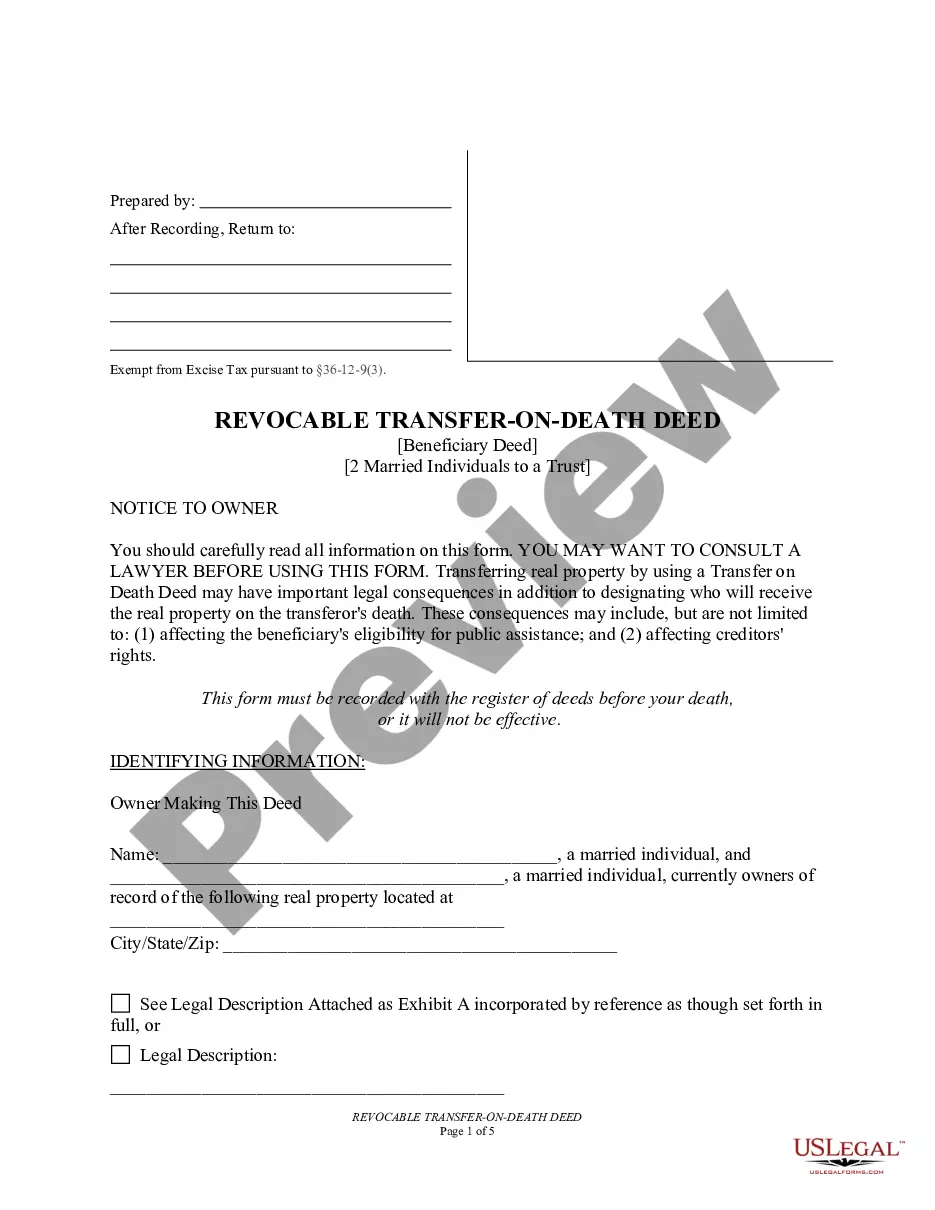

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If the form does not meet your expectations, utilize the Search field at the top of the screen to discover alternative legal document templates.

Form popularity

FAQ

A domestic partnership in New Jersey is a legally binding arrangement that grants many of the same rights as marriage. However, this status can be revoked through a formal dissolution process. Understanding the binding nature of domestic partnerships is crucial, and US Legal Forms offers resources to help clarify your rights and responsibilities.

Dissolution of a domestic partnership means legally ending the relationship recognized by New Jersey law. This process involves finalizing financial matters and resolving any joint responsibilities. It is essential to approach this with clarity and to understand the implications, which is where US Legal Forms can guide you with relevant information and documents.

Dissolving a partnership in New Jersey requires formal action from all partners involved. You must create a written agreement detailing the dissolution terms, which includes settling any outstanding debts and distributing assets. For assistance, US Legal Forms provides resources to help you navigate this process efficiently.

Terminating a domestic partnership in New Jersey involves filing a termination notice with the New Jersey Division of Revenue and completing specific forms. Both partners must consent to the termination, and any joint property and debts should be addressed. Using US Legal Forms can simplify this process, as it offers essential documents and support tailored to your needs.

To dissolve a partnership in New Jersey, all partners must agree to the decision. You will need to prepare a dissolution agreement that outlines the terms of the withdrawal. After the agreement is signed, file the necessary documents with the New Jersey Division of Revenue. Consulting resources like US Legal Forms can provide templates and guidance for this process.

To dissolve a partnership, begin by reviewing the partnership agreement, then notify all partners, and settle outstanding debts. Following that, you’ll need to file the required forms with state authorities to complete the dissolution process. Ensuring these steps are followed can ease the New Jersey Withdrawal of Partner journey.

Dissolution and termination are closely related but not interchangeable. Dissolution refers to the legal cessation of the partnership, while termination involves ceasing all business activities. Thus, recognizing each term’s role is essential during the New Jersey Withdrawal of Partner.

Dissolving a partnership in NJ entails officially notifying all partners, settling any existing debts, and filing a certificate of dissolution with the state. It’s important to carefully consider each step, especially during the New Jersey Withdrawal of Partner process. Legal assistance may streamline this procedure.

Removing a partner from an LLC requires following the procedures outlined in the operating agreement. This often involves a buyout agreement and proper documentation to ensure legal compliance. For specific guidance on your New Jersey Withdrawal of Partner situation, consulting platforms like US Legal Forms can be very helpful.

To dissolve a partnership in New Jersey, partners should follow the guidelines set in the partnership agreement. Generally, this process includes notifying partners, settling debts, and filing necessary forms with state authorities. For an efficient New Jersey Withdrawal of Partner, using resources like US Legal Forms can simplify these steps.