New Jersey Receipt for Payment of Account

Description

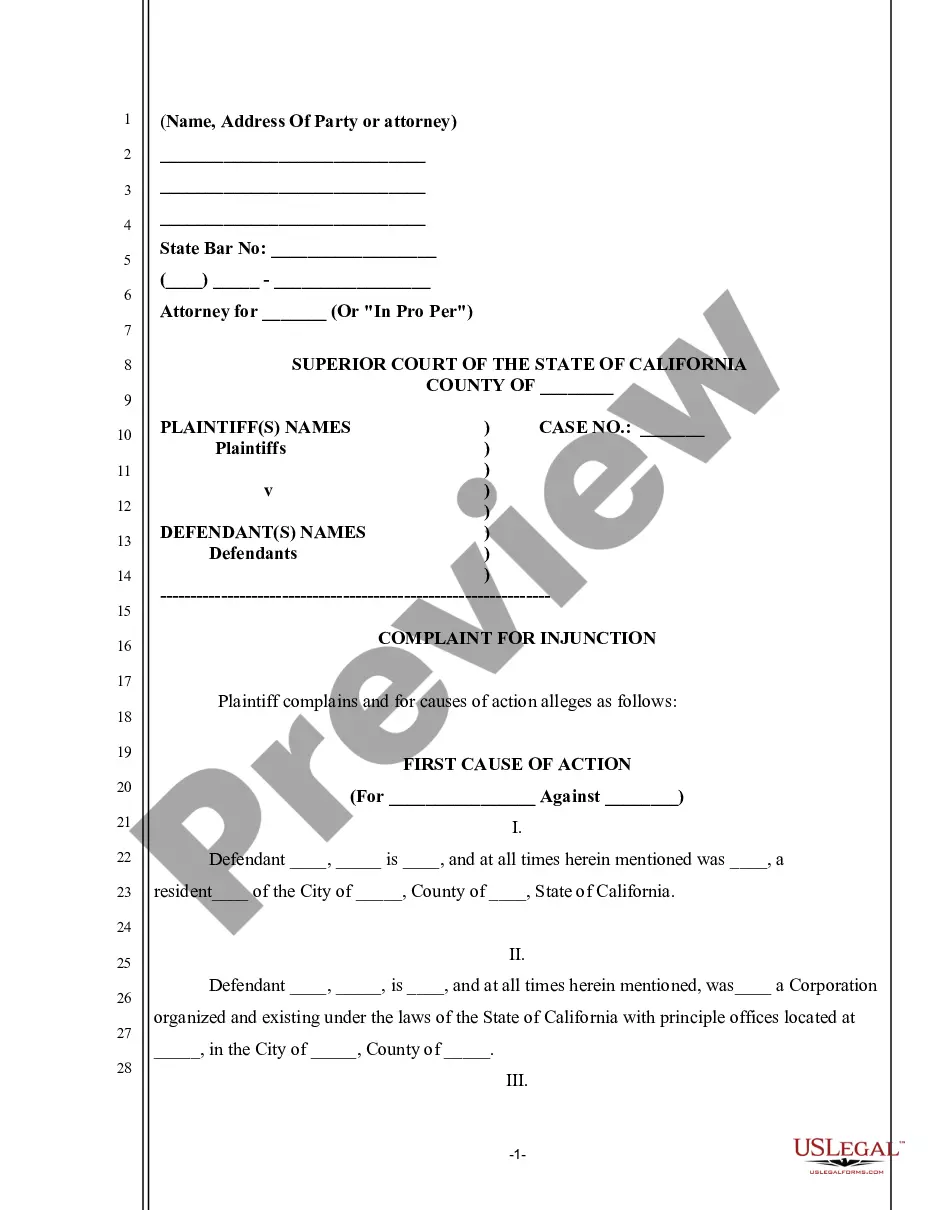

How to fill out Receipt For Payment Of Account?

Are you currently in the situation the place you need to have files for possibly business or individual functions just about every day? There are plenty of legal record themes available online, but finding versions you can rely on is not effortless. US Legal Forms gives 1000s of develop themes, much like the New Jersey Receipt for Payment of Account, that are published in order to meet federal and state needs.

Should you be currently informed about US Legal Forms internet site and have a merchant account, simply log in. Following that, it is possible to acquire the New Jersey Receipt for Payment of Account web template.

Unless you provide an accounts and want to begin to use US Legal Forms, adopt these measures:

- Find the develop you require and ensure it is to the right area/county.

- Utilize the Preview option to examine the form.

- Read the description to actually have chosen the appropriate develop.

- In case the develop is not what you are searching for, make use of the Search industry to obtain the develop that meets your needs and needs.

- Whenever you obtain the right develop, click Get now.

- Opt for the pricing strategy you need, fill out the necessary information and facts to generate your bank account, and pay for the transaction using your PayPal or charge card.

- Decide on a handy document format and acquire your copy.

Discover every one of the record themes you may have bought in the My Forms food list. You can aquire a more copy of New Jersey Receipt for Payment of Account anytime, if possible. Just click the required develop to acquire or print out the record web template.

Use US Legal Forms, one of the most considerable collection of legal types, to conserve some time and avoid blunders. The support gives professionally produced legal record themes which can be used for an array of functions. Produce a merchant account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

Source income means the money you earned in New Jersey. Domicile is the place and state you consider your permanent home ? the place where you intend to return after a period of absence (e.g., vacation, business assignment, educational leave). you establish a new permanent home elsewhere.

An EFT (Electronic Funds Transfer) payment is a type of electronic payment that allows money to be transferred directly from one bank account to another, including direct deposit of paychecks, automatic bill payments, and online money transfers.

NJ Revenue Businesses registered in the Electronic Funds Transfer (EFT) Program who are using the debit method may make payments online for all eligible taxes and fees including the hotel occupancy fee. To access the system, the 12-digit New Jersey identification number and the EFT PIN will be required.

There are two EFT methods: Automated Clearing House (ACH) Debit and ACH Credit. Fed Wires or other wire transfers are not acceptable methods of EFT payments. In order to register as an EFT payer, your business must be registered with the Division and you must have a PIN for your business.

An electronic funds transfer (EFT) is a broad term for a payer sending money and a payee receiving money through an online payment system. Electronic funds transfers include ACH, wire transfer, instant eWallet payments, and other digital payment methods.

Direct deposit, credit card transactions, ATM transactions, electronic checks and phone payments are all types of EFT payments.

New Jersey Form NJ-1040 ? Personal Income Tax Return for Residents. New Jersey Form NJ-1040NR ? Personal Income Tax Return for Nonresidents. New Jersey 100S K1 ? Shareholder's Share of Income/Loss.

Use Form 1040-ES to figure and pay your estimated tax for 2023. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).