Title: Exploring the Different Types of New Jersey Letter to Lender for Produce the Note Request Introduction: The New Jersey Letter to Lender for Produce the Note Request acts as a crucial legal document used by borrowers in New Jersey when questioning the validity of the foreclosure process. It enables borrowers to request the lender to produce the original promissory note, demonstrating their legal right to foreclose. This article provides a detailed description of what a New Jersey Letter to Lender for Produce the Note Request entails, including its purpose, significance, and various types available. 1. Importance of a New Jersey Letter to Lender for Produce the Note Request: The New Jersey Letter to Lender for Produce the Note Request holds significant value for borrowers as it seeks to ensure that the lender has legal standing to pursue a foreclosure action. By requesting the production of the original promissory note, borrowers can ascertain whether the lender possesses the requisite rights to foreclose on their property, presenting a potential challenge to the foreclosure process. 2. Elements of a Typical New Jersey Letter to Lender for Produce the Note Request: The content of a New Jersey Letter to Lender for Produce the Note Request may include the following essential information: a) Borrower's contact details, including name, address, and contact number. b) Lender's contact information, such as the name of the loan service and contact details. c) The loan number, mortgage/deed of trust, and property address. d) A formal request for the "original wet ink" promissory note. e) A statement asserting the borrower's right to validate the lender's standing in the foreclosure process. f) A timeframe for the lender's compliance with the request, typically 30 days from the receipt of the letter. g) A warning of potential legal action if the lender fails to comply. 3. Different Types of New Jersey Letter to Lender for Produce the Note Request: Although the fundamental purpose remains consistent, borrowers may choose from several specialized variations of the New Jersey Letter to Lender for Produce the Note Request, depending on their specific situation or objectives. Some common types include: a) Standard Letter: A general template that encompasses the essential elements of a New Jersey Letter to Lender for Produce the Note Request. b) Attorney-Drafted Letter: Prepared by legal professionals, this type of letter includes additional legal language and technicalities to bolster the borrower's position. c) Suspected Mortgage Fraud Letter: Utilized when borrowers suspect fraudulent activities surrounding their mortgage, this letter requests comprehensive documentation beyond the promissory note. d) Non-Compliance Reminder Letter: Sent when the lender fails to comply with the initial request within the specified timeframe, this letter serves as a stern reminder to fulfill their obligations or face potential consequences. Conclusion: The New Jersey Letter to Lender for Produce the Note Request holds significant importance in safeguarding the rights of borrowers during the foreclosure process. By understanding the purpose and various types of letters available, borrowers can craft an effective request, ensuring that lenders comply with their legal obligations and protecting their interests. It is advisable for borrowers to consult legal professionals when initiating this process to improve their chances of success.

New Jersey Letter to Lender for Produce the Note Request

Description

How to fill out New Jersey Letter To Lender For Produce The Note Request?

Are you presently in a situation where you regularly require documents for potential business or personal purposes.

There are numerous legal document templates available online, but it isn't easy to find trustworthy versions.

US Legal Forms provides thousands of template forms, including the New Jersey Letter to Lender for Produce the Note Request, designed to meet federal and state regulations.

Once you find the appropriate form, click Get now.

Choose the pricing plan you want, fill in the necessary information to create your account, and purchase your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Jersey Letter to Lender for Produce the Note Request template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

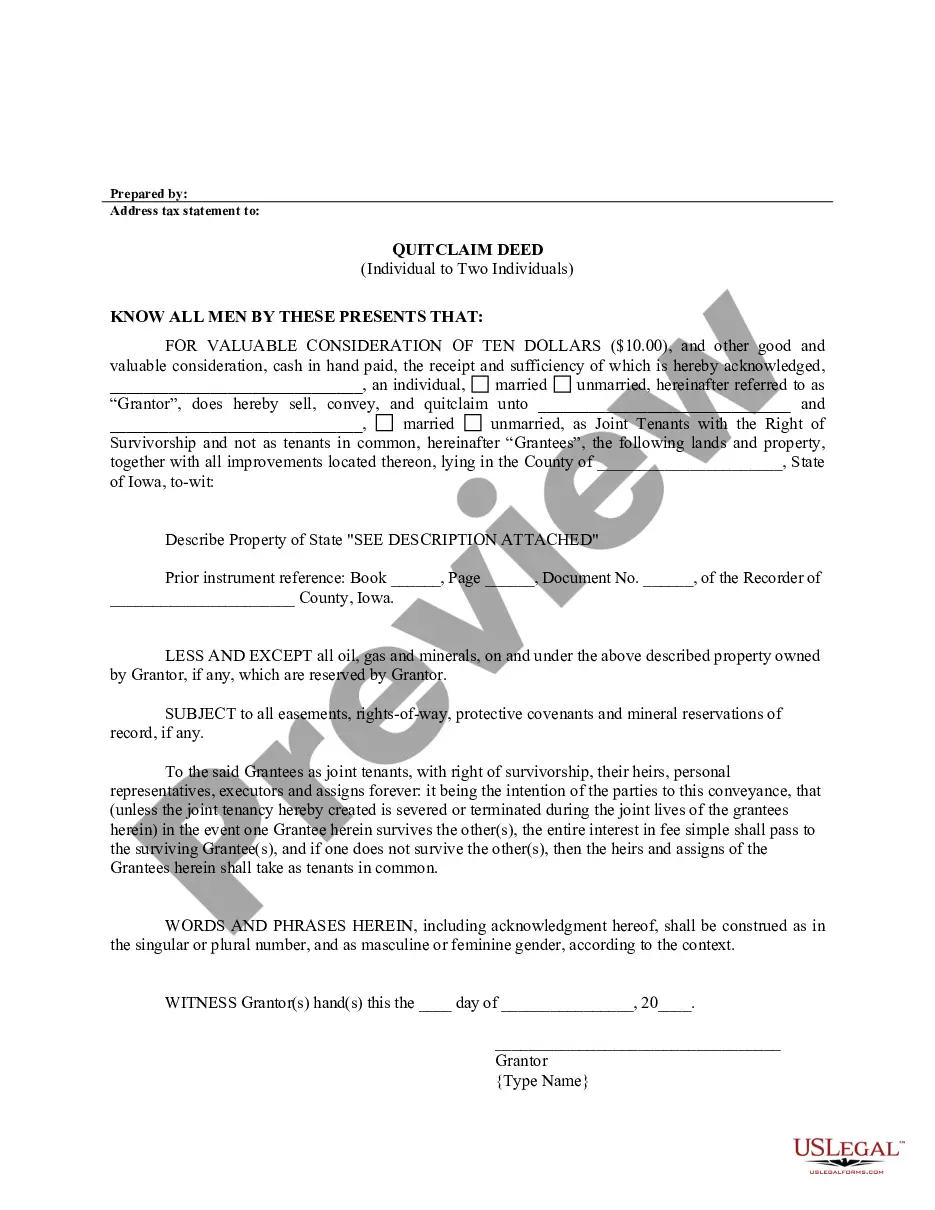

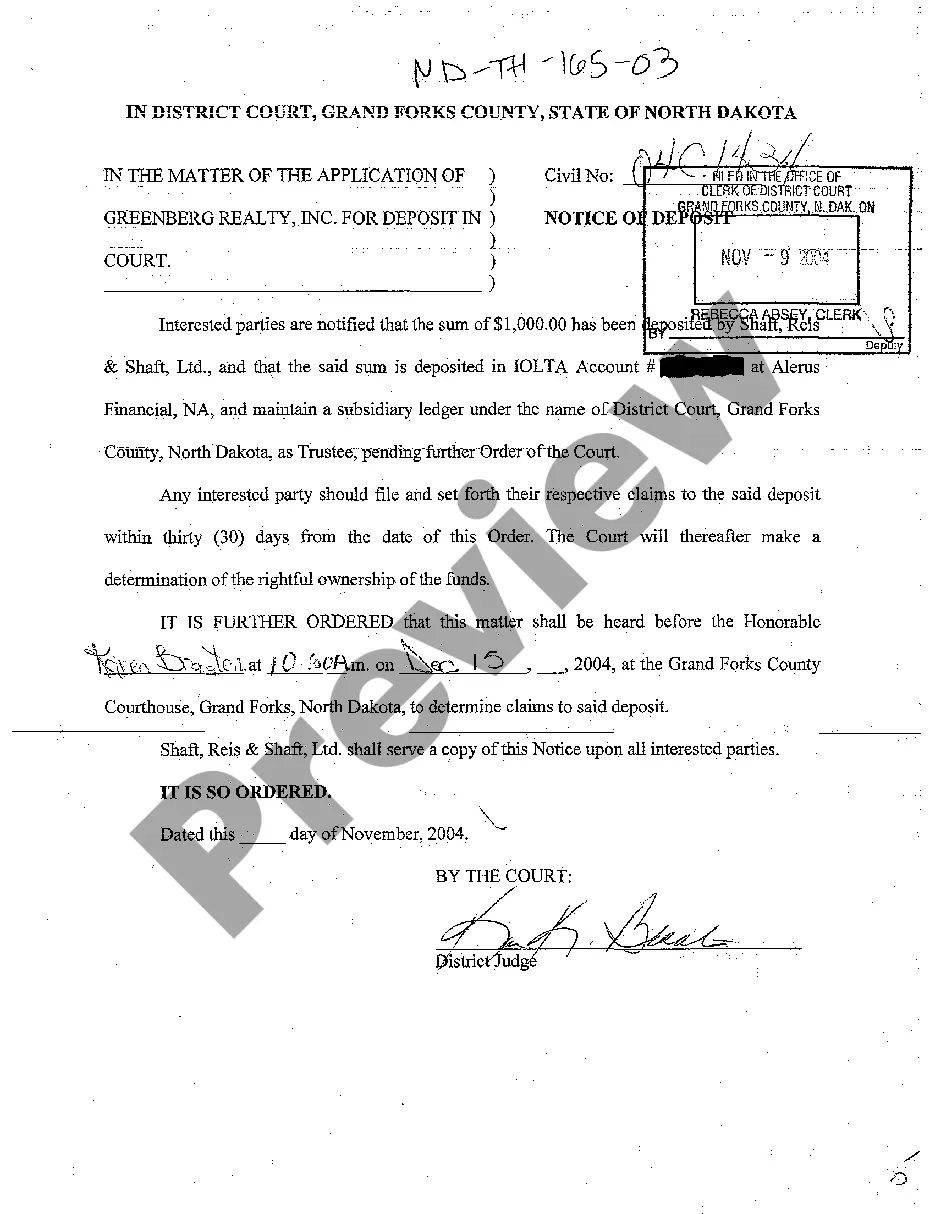

- Utilize the Review option to evaluate the form.

- Check the description to confirm that you have selected the correct form.

- If the form isn’t what you’re looking for, use the Lookup section to find the form that meets your needs.

Form popularity

FAQ

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

When a lender cannot produce a note, then they are not able to prove when they took ownership or assignment of the note. A court may dismiss the case as a result.

Anyone lending money can issue a promissory note (like home sellers, credit unions, FinTech solutions, and nonmortgage-related banks, for instance) but specific to real estate and the mortgage process, promissory notes serve as an agreement that the borrower will repay their mortgage loan by the maturity date.

A Promissory Note will only be enforceable if it includes all the elements which are necessary to make it a legal document.

How to write a letter of explanationThe lender's name and address.Your name and your application number.The date you're submitting the letter and expected closing date (if you know it)A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.More items...?15-Apr-2021

The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

To collect on a demand promissory note, you will need to send a demand for payment letter to the lender. This lets the lender know that you want the loan paid back now and that the repayment period is ending. This demand letter should include the following: The date of the letter.

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

Once the lender submits your information to the SBA, a decision from SBA will typically take 2-3 business days. If SBA approves your application then your lender will take 2-3 business days to send your Promissory Note via another email.