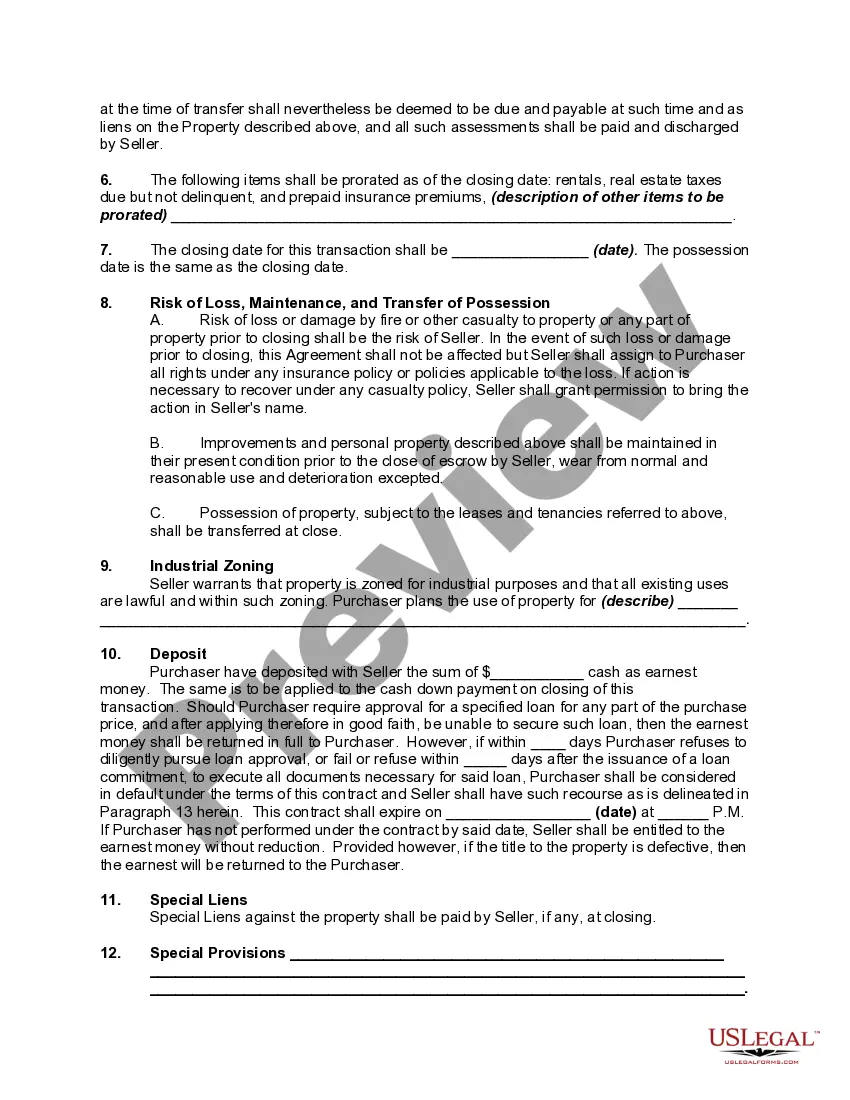

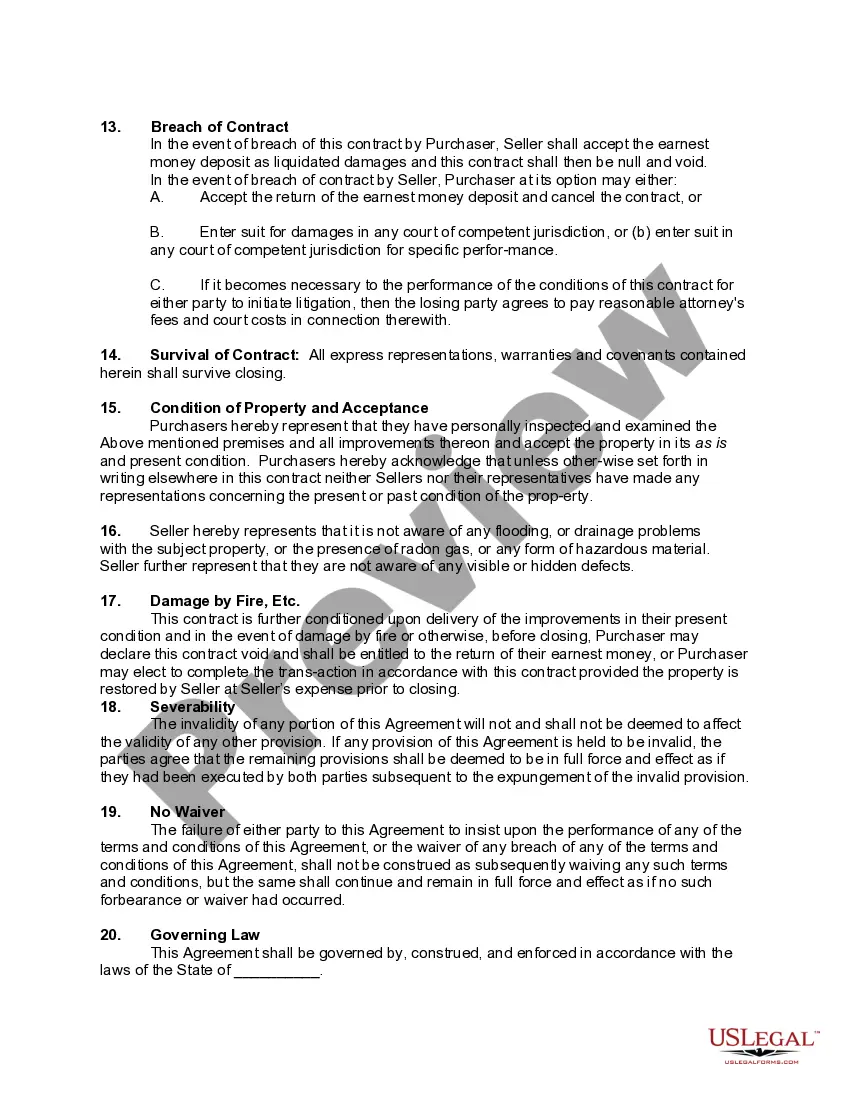

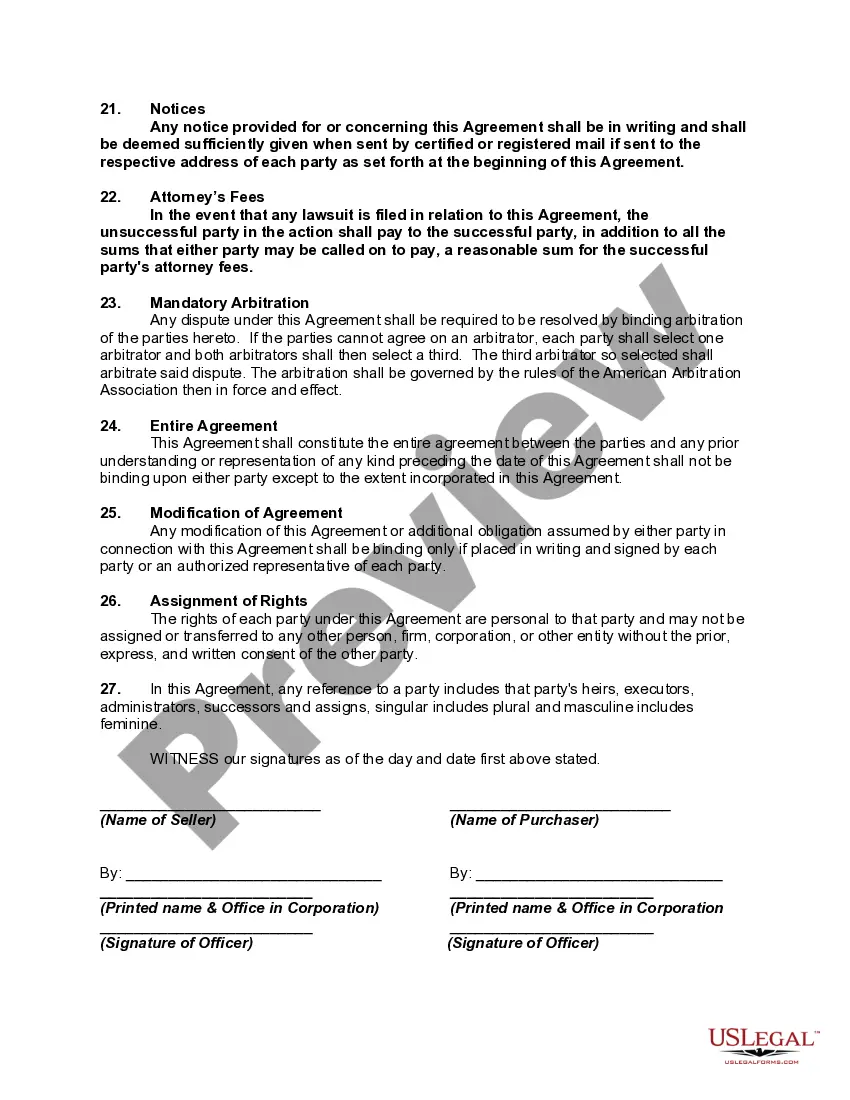

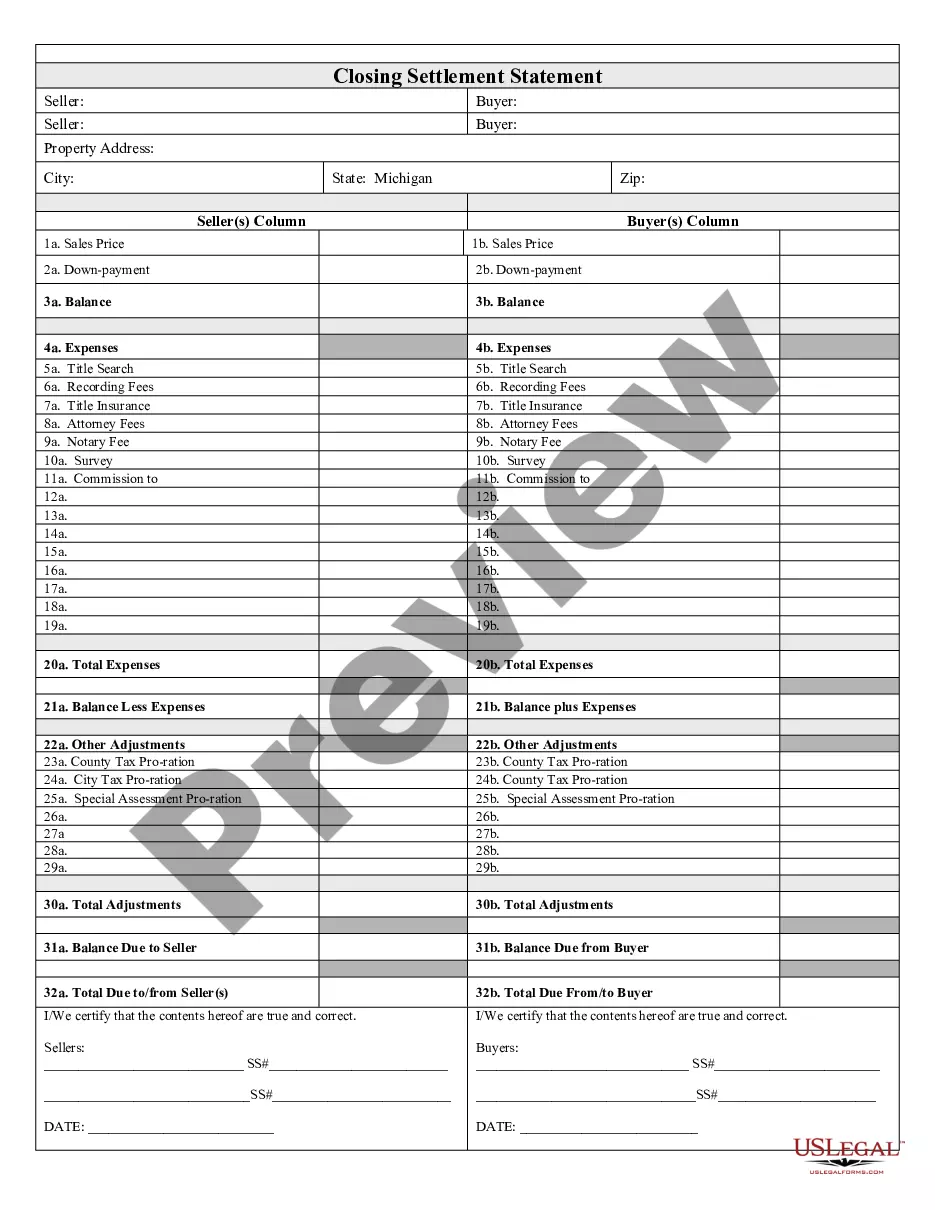

The New Jersey Contract for the Sale and Purchase of Commercial or Industrial Property is a legally binding agreement that outlines the terms and conditions for the sale or purchase of a commercial or industrial property in the state of New Jersey. It serves as a comprehensive document that protects the rights and interests of both the buyer and the seller. The contract is designed to cover various aspects of the transaction, including the identification of the property, purchase price, financing terms, contingencies, and closing procedures. It ensures that all parties involved are aware of their obligations and responsibilities throughout the process. There are different types of New Jersey Contracts for the Sale and Purchase of Commercial or Industrial Property, which are tailored to specific situations or preferences. Some common types or variations may include: 1. Standard Contract: This is a general contract that outlines the basic terms and conditions for the sale or purchase of a commercial or industrial property. It covers essential elements such as the purchase price, closing date, and inspections. 2. As-Is Contract: This type of contract specifies that the property is being sold in its current condition, without any guarantees or warranties from the seller. The buyer accepts the property "as is" and assumes all risks associated with any existing defects or issues. 3. Lease-Purchase Contract: This contract combines elements of a lease agreement and a purchase contract. It allows the buyer to occupy and lease the property for a specified period before completing the purchase. This option is beneficial for buyers who want to test the property or secure it for a future purchase. 4. Seller Financing Contract: In this type of contract, the seller agrees to provide financing to the buyer instead of relying solely on a traditional lender. The terms of seller financing, including interest rates, repayment schedules, and conditions, are outlined in the agreement. 5. Contingent Offer Contract: This contract includes specific contingencies that must be satisfied for the sale or purchase to proceed. These contingencies might involve inspections, financing approval, environmental assessments, or other conditions that protect the buyer's interests. In conclusion, the New Jersey Contract for the Sale and Purchase of Commercial or Industrial Property is a vital legal document that outlines the terms and conditions of a commercial or industrial property transaction. Various types or variations of the contract exist to accommodate different scenarios, including standard contracts, as-is contracts, lease-purchase contracts, seller financing contracts, and contingent offer contracts. Each type offers specific provisions and conditions to protect the interests of both the buyer and the seller during the real estate transaction process.

New Jersey Contract for the Sale and Purchase of Commercial or Industrial Property

Description

How to fill out New Jersey Contract For The Sale And Purchase Of Commercial Or Industrial Property?

Finding the right legitimate document web template might be a struggle. Of course, there are tons of web templates available on the net, but how do you discover the legitimate type you require? Take advantage of the US Legal Forms internet site. The service offers a large number of web templates, for example the New Jersey Contract for the Sale and Purchase of Commercial or Industrial Property , which you can use for enterprise and personal requires. Every one of the forms are checked out by specialists and meet up with state and federal specifications.

Should you be currently signed up, log in in your account and click the Acquire switch to obtain the New Jersey Contract for the Sale and Purchase of Commercial or Industrial Property . Make use of your account to appear with the legitimate forms you may have bought previously. Visit the My Forms tab of your own account and get another version of your document you require.

Should you be a whole new consumer of US Legal Forms, listed below are easy recommendations so that you can stick to:

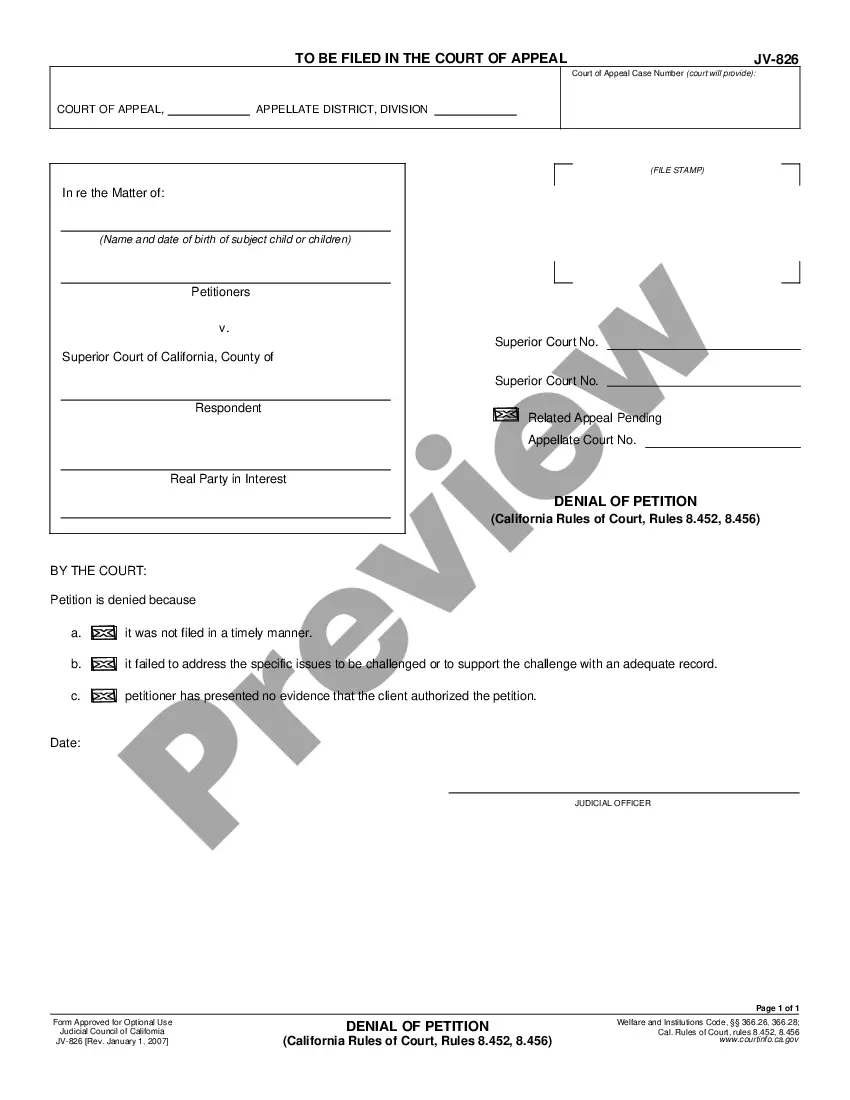

- Initially, make sure you have chosen the correct type to your area/area. You are able to look through the form while using Review switch and browse the form outline to make certain it will be the best for you.

- In the event the type is not going to meet up with your preferences, make use of the Seach field to get the proper type.

- Once you are sure that the form is suitable, select the Get now switch to obtain the type.

- Opt for the pricing plan you would like and enter in the needed info. Build your account and buy the transaction using your PayPal account or charge card.

- Opt for the document format and acquire the legitimate document web template in your product.

- Complete, change and print and indication the attained New Jersey Contract for the Sale and Purchase of Commercial or Industrial Property .

US Legal Forms may be the greatest library of legitimate forms in which you can discover different document web templates. Take advantage of the service to acquire professionally-produced papers that stick to state specifications.

Form popularity

FAQ

Purchase Agreement A purchase agreement (also called a sales contract) is a binding contract between two parties (property buyer and property seller) to transfer a particular property. This contract specifies the details regarding the sale of a property.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

Buyer contingencies addenda. Buyer contingencies are the most common addenda, according to Justin Ostow, a top real estate agent in Tampa, Florida, who completes 10% more sales than the average agent. Contingencies dictate certain conditions which must be met for the contract to go through.

To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.

The Five Elements of a ContractOffer.Acceptance.Consideration.Capacity.Lawful Purpose.

The basics: What is an option contract in real estate? In the simplest terms, a real-estate option contract is a uniquely designed agreement that's strictly between the seller and the buyer. In this agreement, a seller offers an option to the buyer to purchase property at a fixed price within a limited time frame.

Real Estate Terms GlossaryBorrower.Broker.Buyer's agent/listing agent.Buyer's market/seller's market.Co-borrower.Commission.Eminent domain.Exclusive listing.More items...?

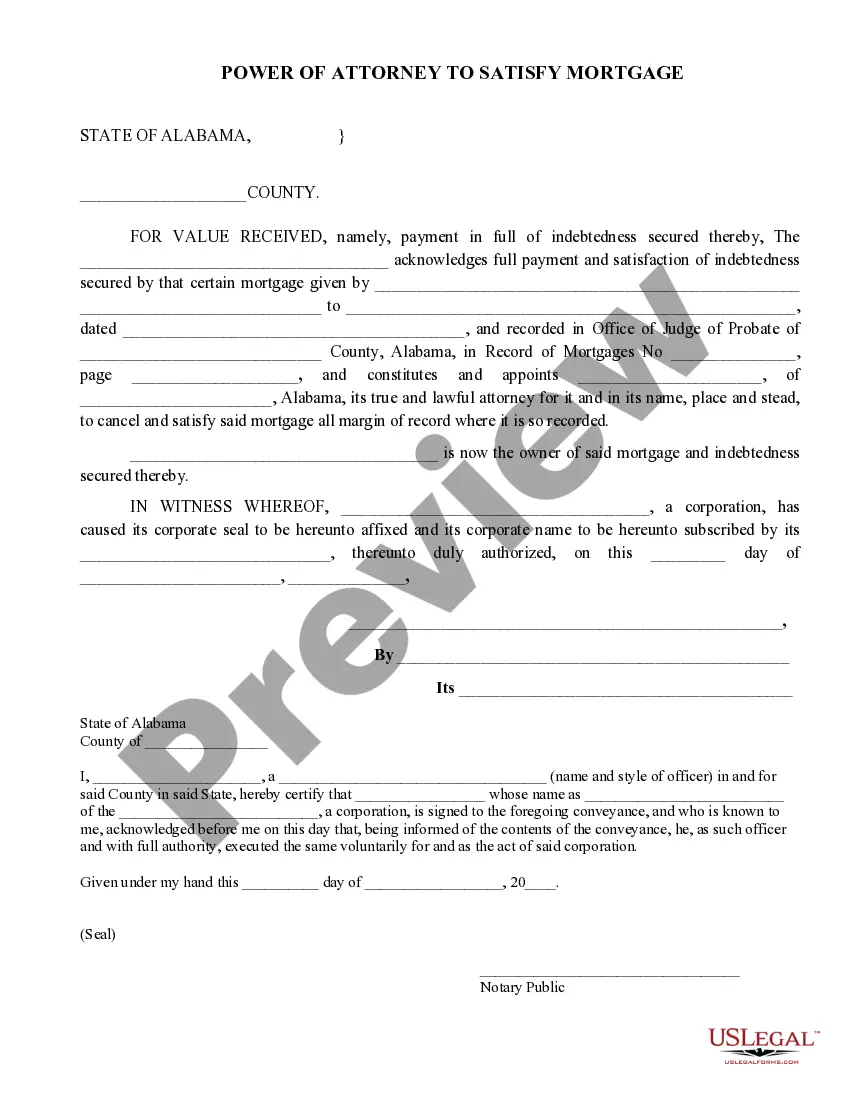

There are essentially four types of real estate contracts: purchase agreement contracts, contracts for deed, lease agreements, and power of attorney contracts.

What Should I Include in a Sales Contract?Identification of the Parties.Description of the Services and/or Goods.Payment Plan.Delivery.Inspection Period.Warranties.Miscellaneous Provisions.

More info

Bank America's small business counsel and compliance. Small Business Legal Advocacy Advisors Small Business Legal Counseling Small Business Insurance Bank Americas Small Business Services Small Business Legal. Personal Finance Banking Small Business Investment Bank Your investment portfolio's size, complexity, and future growth. Bank Americas is a member of The FDIC, the Federal Deposit Insurance Corporation. Bank Americas is the leader in commercial banking, serving customers across the U.S., Europe, and Asia. It offers a wide range of product options to suit an individual investor's needs. Bank Americas has more than 1 billion in assets and employs over 35,000 people across the U.S. in a headquarters in Los Angeles with employees based in more than 40 communities. Bank Americas is also the majority shareholder and Chairman of American Century RBS Bank Americas RBS is a fully integrated financial holding company.