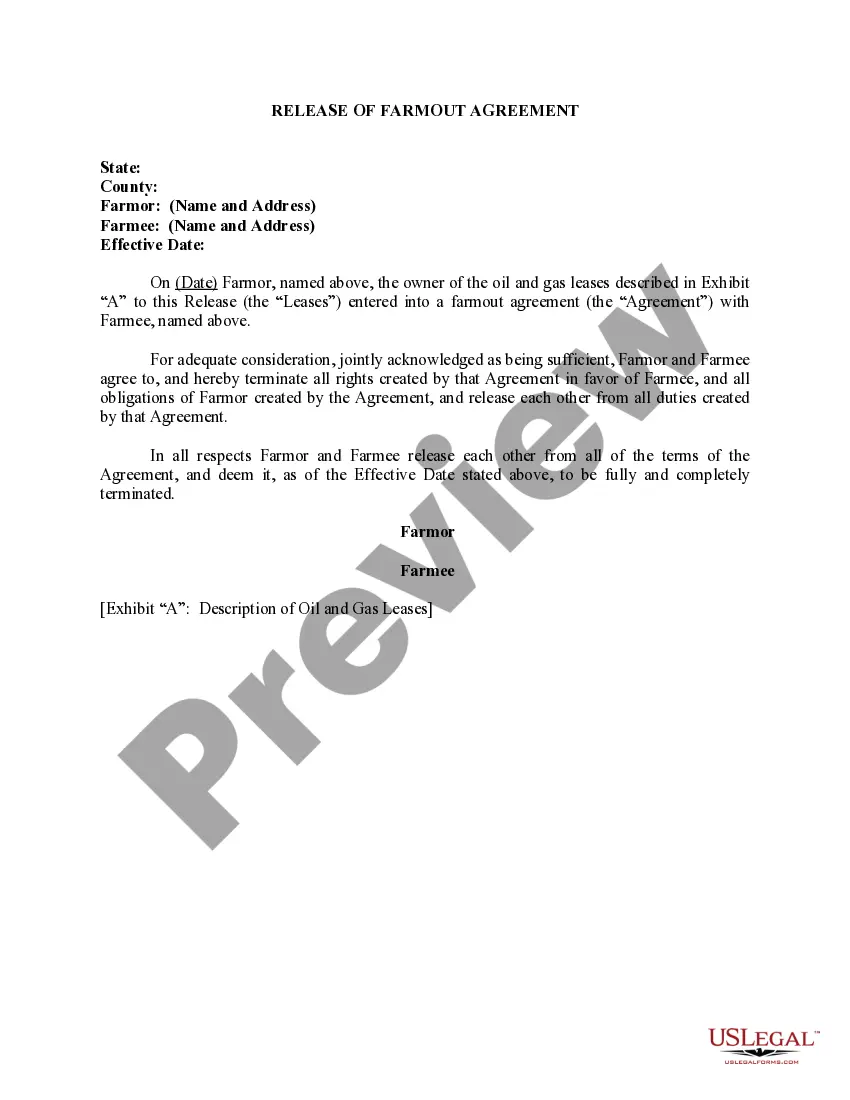

New Jersey Contract with Marketing Representative

Description

How to fill out Contract With Marketing Representative?

Are you presently in the situation where you need documents for either business or personal reasons almost every day.

There is a multitude of legal document templates accessible online, but discovering reliable ones can be challenging.

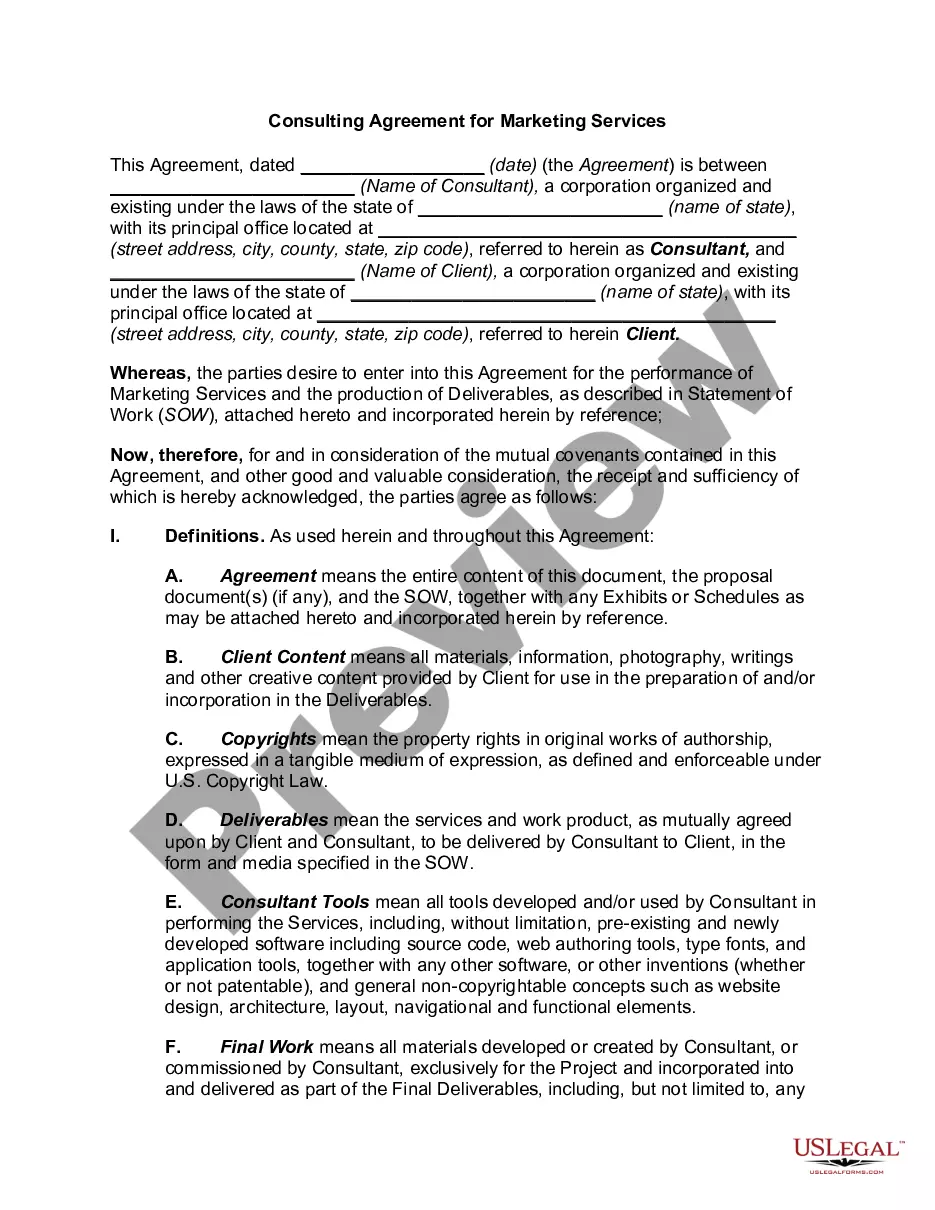

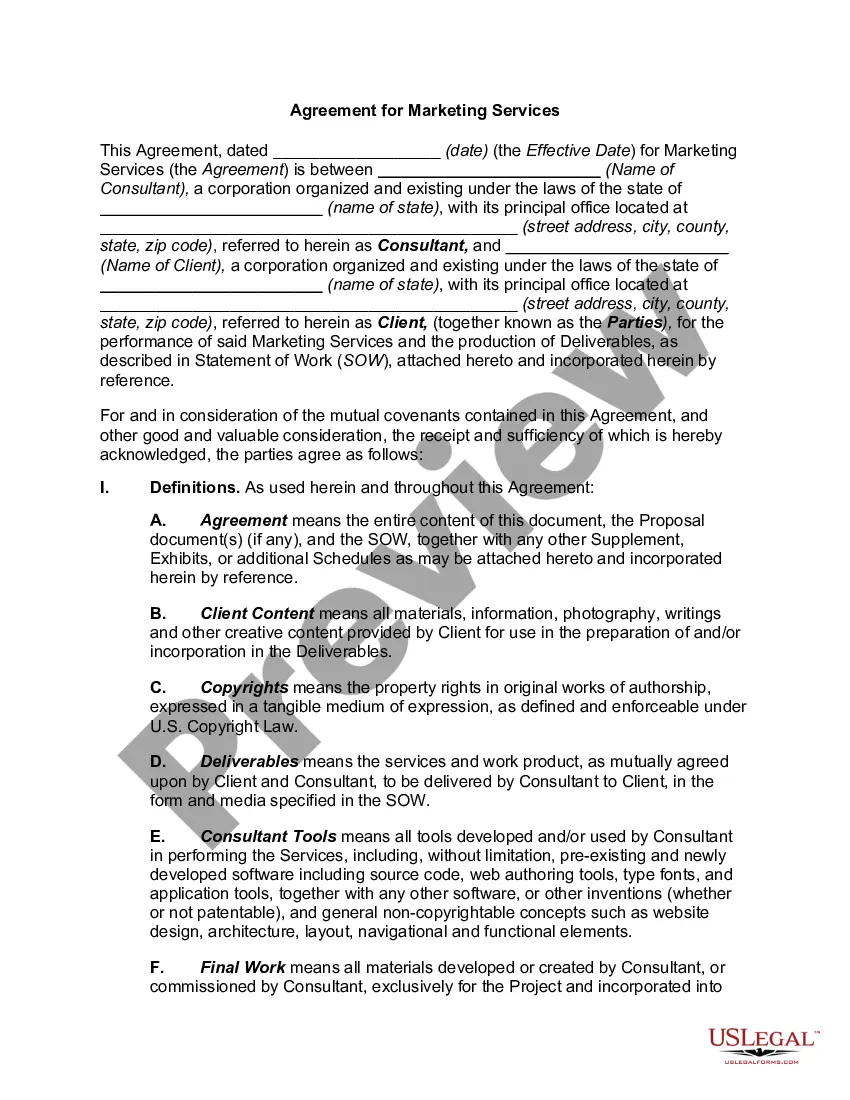

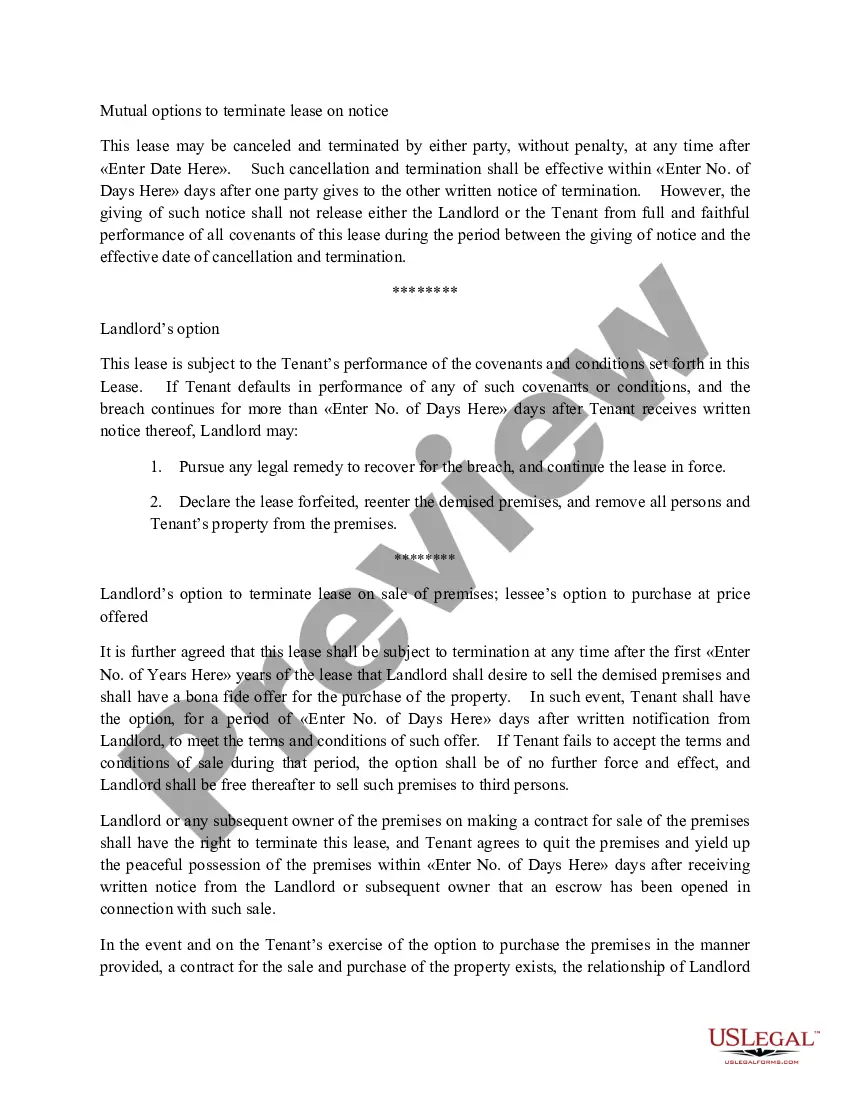

US Legal Forms offers a vast array of form templates, including the New Jersey Contract with Marketing Representative, specifically crafted to comply with state and federal regulations.

Once you identify the appropriate form, click Buy now.

Choose the pricing plan you desire, complete the required details to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the New Jersey Contract with Marketing Representative template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Use the Review button to evaluate the form.

- Check the information to confirm that you have selected the right form.

- If the form does not match what you are looking for, utilize the Research box to search for the form that meets your needs.

Form popularity

FAQ

No, a Certificate of Authority and an Employer Identification Number (EIN) serve different purposes. The Certificate of Authority allows you to collect sales tax in New Jersey, while the EIN is used for tax purposes and employee identification. When involved in a New Jersey Contract with Marketing Representative, having both may be necessary to operate effectively.

In New Jersey, many professional services are generally exempt from sales tax, but this can vary. Services tied to tangible goods might incur taxes, depending on the context. If you are relying on a New Jersey Contract with Marketing Representative for professional services, clarifying these tax implications is vital.

Yes, marketing services can be subject to sales tax in New Jersey. It's essential to determine if your specific services fall under taxable categories when you enter a New Jersey Contract with Marketing Representative. Consulting the New Jersey Division of Taxation can provide you with more detailed guidance on this topic.

A contractor's Certificate of Authority number in New Jersey is a unique identification number that allows businesses to collect sales tax. This number is crucial for compliance, especially when entering into contracts like a New Jersey Contract with Marketing Representative. Having this number ensures that your business operates within the legal framework set by state authorities.

Yes, marketing services can be taxable in New Jersey under certain conditions. When you engage in a New Jersey Contract with Marketing Representative, it's important to consider the nature of the services you provide or receive. Understanding these tax implications can help you manage costs and ensure compliance.

Digital marketing services can be subject to sales tax in New Jersey, depending on the nature of the services provided. If these services are included in a New Jersey Contract with Marketing Representative, it's crucial to understand the tax implications. Consulting with a tax professional can help clarify any uncertainties regarding taxation on digital marketing.

In New Jersey, the taxation of advertising varies based on the services provided. Generally, if advertising services are part of a contract with a New Jersey marketing representative, those services might be liable for sales tax. Always check current tax regulations to ensure compliance when entering into a New Jersey Contract with Marketing Representative.

To secure a Certificate of Authority in New Jersey, you must register your business with the New Jersey Division of Revenue and Enterprise Services. This certificate allows your business to legally operate and collect sales tax in New Jersey. If you're engaging in a New Jersey Contract with Marketing Representative, having this certificate is often a vital requirement.

To obtain an Employer Identification Number (EIN) in New Jersey, you can apply directly through the IRS. This number is crucial for businesses that hire employees or operate as a corporation or partnership. Having an EIN is an important step when entering a New Jersey Contract with Marketing Representative, as it helps streamline your business processes.

The New Jersey Sales Representatives Rights Act establishes the rights of sales representatives who work for companies in New Jersey. This law protects these professionals by ensuring they receive proper compensation for their services, especially under a New Jersey Contract with Marketing Representative. Understanding this act is essential for anyone looking to engage in marketing or sales practices under New Jersey law.