New Jersey Security Agreement Regarding Aircraft and Equipment

Description

Until a conveyance, lease, or instrument executed for security purposes which may be recorded under ??? 44107(a)(1) or (2) has been filed with the FAA, it is valid only against the parties to the instrument and individuals and entities who have actual knowledge of the instrument. Therefore, the interests of the parties to a transaction, including purchasers, lessor, lessees and secured parties, are not perfected until the instruments creating those interests have been filed with the FAA.

How to fill out Security Agreement Regarding Aircraft And Equipment?

If you require extensive, download, or printing legal document templates, utilize US Legal Forms, the largest collection of legal forms, which are available online.

Take advantage of the site’s straightforward and convenient search to find the documents you need.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours forever. You have access to every form you downloaded with your account. Check the My documents section and select a form to print or download again.

Complete and download, then print the New Jersey Security Agreement Regarding Aircraft and Equipment with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to find the New Jersey Security Agreement Regarding Aircraft and Equipment in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and then click the Download button to locate the New Jersey Security Agreement Regarding Aircraft and Equipment.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

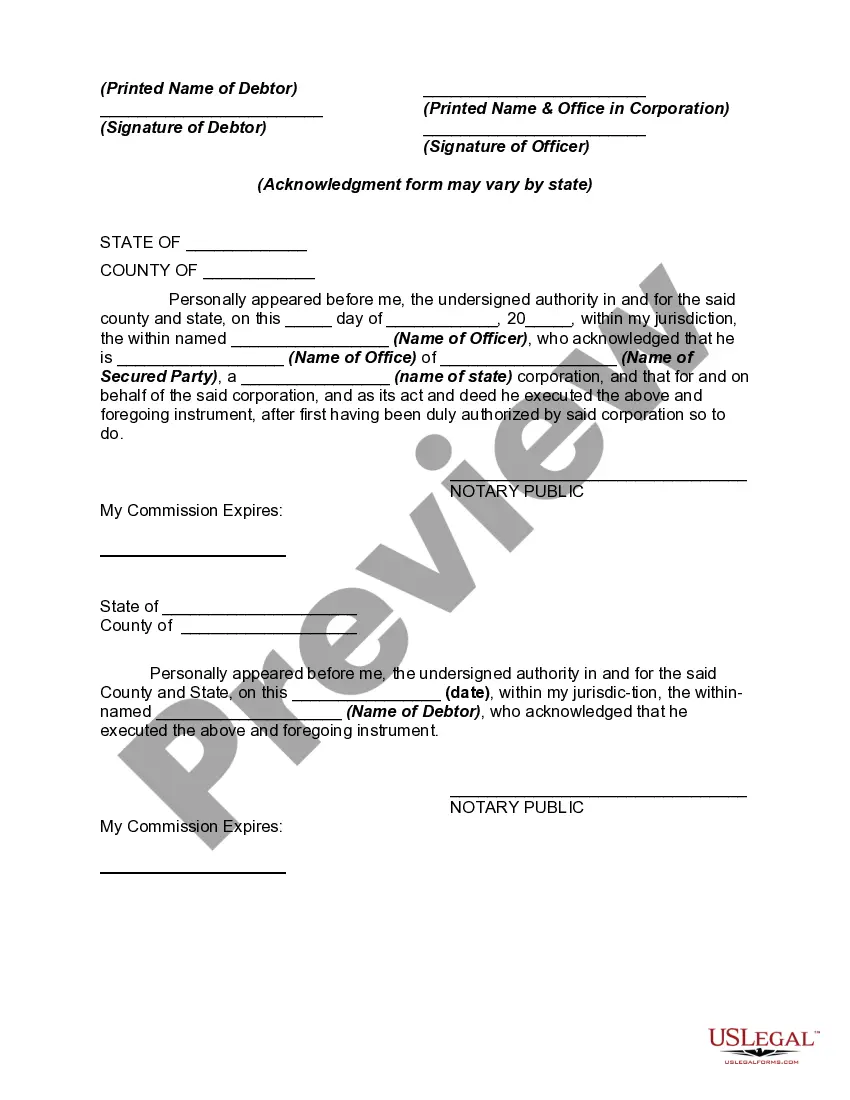

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the type, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have identified the form you need, click the Get now button. Choose the payment plan you prefer and enter your details to create an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the New Jersey Security Agreement Regarding Aircraft and Equipment.

Form popularity

FAQ

When operating a US registered aircraft, the airworthiness certificate is required to be available on board, as mandated by federal regulations. This document verifies that the aircraft meets safety requirements and can be safely operated. In the context of a New Jersey Security Agreement Regarding Aircraft and Equipment, having this document readily accessible reinforces your legal and operational compliance, which is crucial for both lenders and operators alike.

You can perfect a security interest in an airplane by filing a security agreement with the FAA and ensuring all documents meet federal requirements. This action secures your rights under the New Jersey Security Agreement Regarding Aircraft and Equipment, creating a public record of your interest in the aircraft. By doing so, you protect yourself from competitors for the claim on the aircraft, allowing you to maintain confidence in your investment.

To perfect a lien on an airplane, you must submit an appropriate notice to the FAA, typically through a security agreement that includes specifics about the airplane. This action finalizes your claim under the New Jersey Security Agreement Regarding Aircraft and Equipment, making your lien effective against third parties. Additionally, it’s essential to review local laws and requirements to ensure compliance and protect your interests.

An aircraft security agreement is a legal document that outlines the terms under which a lender secures an interest in an aircraft. This agreement protects the lender in the event of default by establishing a clear claim to the aircraft. When utilizing a New Jersey Security Agreement Regarding Aircraft and Equipment, both parties agree to the specific terms and conditions that govern the security interest, ensuring mutual understanding and compliance with relevant laws.

To perfect a security interest in aircraft, you should file a security agreement with the Federal Aviation Administration (FAA). This process involves submitting documentation that complies with FAA regulations, reinforcing your claim under a New Jersey Security Agreement Regarding Aircraft and Equipment. Proper filing ensures that your interest is legally recognized, safeguarding your rights against claims from other creditors.

Filing a UCC-1 form is the most common way to perfect a security interest, particularly for a New Jersey Security Agreement Regarding Aircraft and Equipment. This legal document is submitted to the state's Secretary of State, establishing a public record of the secured party’s interest. By doing so, you effectively notify potential creditors of the existing security interest, which protects your claim on the aircraft or equipment in question.

The three main ways of perfecting a security interest include possession, filing, and control. In the context of a New Jersey Security Agreement Regarding Aircraft and Equipment, filing a UCC-1 form with the appropriate state office is often the most effective method. Possession allows the secured party to take physical control of the asset, while control generally applies to deposit accounts. Each method serves to establish the secured party's claim to the asset secured by the agreement.

Yes, recording a New Jersey Security Agreement Regarding Aircraft and Equipment is essential for establishing legal rights to the assets involved. Recording helps protect the interests of the secured party by providing public notice of the agreement. Furthermore, it can aid in preventing disputes over ownership or priority in case of default. Utilizing a platform like uslegalforms can simplify the process of creating and recording these agreements, ensuring compliance with state regulations.

Registering a drone with the FAA costs $5 for a three-year period. This registration is crucial for compliance with regulations, especially in relation to the New Jersey Security Agreement Regarding Aircraft and Equipment. By ensuring your drone is registered, you can operate it safely and within the legal framework. US Legal Forms offers various forms and guides that can assist you during the registration process.

Section 7 of the Aviation Security Act addresses the security interests in aircraft and equipment, promoting clear guidelines for lenders and borrowers. It aims to protect the rights of secured parties while ensuring transparency in transactions involving aviation assets. Understanding this section is crucial for anyone dealing with a New Jersey Security Agreement Regarding Aircraft and Equipment, as compliance helps avoid legal pitfalls.