[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Date] [Client's Name] [Client's Address] [City, State, ZIP] Subject: Letter Regarding Fraudulent Charges on Your Account Dear [Client's Name], I hope this letter finds you well. I am writing to address a matter of utmost importance regarding your account with [Bank/Financial Institution Name]. It has come to our attention that there have been certain suspicious and fraudulent charges on your account. We understand that such incidents can be distressing, and we assure you that we are committed to resolving this matter swiftly and efficiently. Our investigation team has thoroughly reviewed your account activity and identified several transactions that warrant immediate attention. While we diligently monitor the security of your account, cyber fraudsters constantly adapt their techniques to circumvent security measures. Therefore, it is critical that we work together to resolve this matter promptly. To assist us in our investigation, we kindly request your cooperation in providing any additional information or documentation related to your account activity during the period in question. To ensure the security of your funds, we immediately suspended any further transactions on your account upon detecting the fraudulent charges. The amount of the disputed transactions totals [total amount in USD]. We understand the inconvenience caused and assure you that we are actively working towards a resolution. In accordance with the New Jersey Consumer Fraud Act and federal regulations enforced by regulatory authorities such as the Consumer Financial Protection Bureau (CFPB), we are committed to protecting your rights as our valued client. We will promptly initiate an investigation to identify the source of the fraudulent activity and take appropriate measures to minimize any financial losses you may have incurred. To expedite the resolution process, we kindly request you to complete and submit the attached Fraudulent Charges Declaration Form. This form will enable us to gather the necessary details and initiate a dispute with the relevant financial institutions involved in the unauthorized transactions. We recommend that you review all recent statements and inform us immediately if you come across any additional unauthorized charges. Prompt reporting will aid our investigation and enhance our ability to recover any lost funds. Our dedicated fraud resolution team will closely monitor your case and provide regular updates on the progress of our investigation. Our primary goal is to restore the security of your account and facilitate a swift resolution to this unfortunate incident. If you have any questions or need further assistance, please do not hesitate to contact our fraud resolution hotline at [phone number] or reach out to us via email at [email address]. Our team of experts is available [day(s) of the week] from [time] to [time] to address any concerns you may have. We sincerely apologize for any inconvenience caused by this incident and assure you that we are focused on resolving this matter expeditiously. We value your trust as our client and remain committed to providing you with the highest level of account security and customer service. Thank you for your cooperation and understanding in this matter. Yours sincerely, [Your Name] [Your Title/Position] [Bank/Financial Institution Name] Keywords: New Jersey, sample letter, fraudulent charges, client's account, cyber fraud, investigation, security, financial losses, unauthorized transactions, Consumer Fraud Act, regulatory authorities, prompt reporting, restore security, swift resolution, fraud resolution hotline, inconvenience, trust, account security, customer service.

New Jersey Sample Letter for Fraudulent Charges against Client's Account

Description

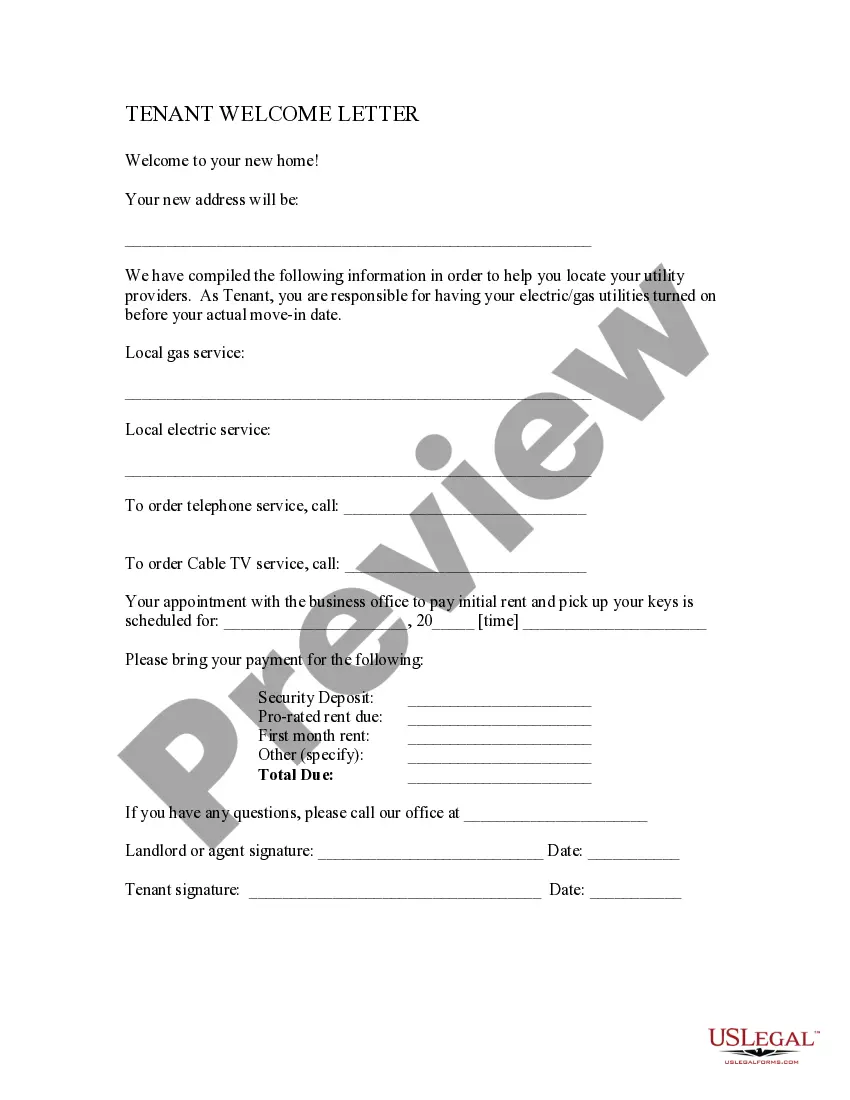

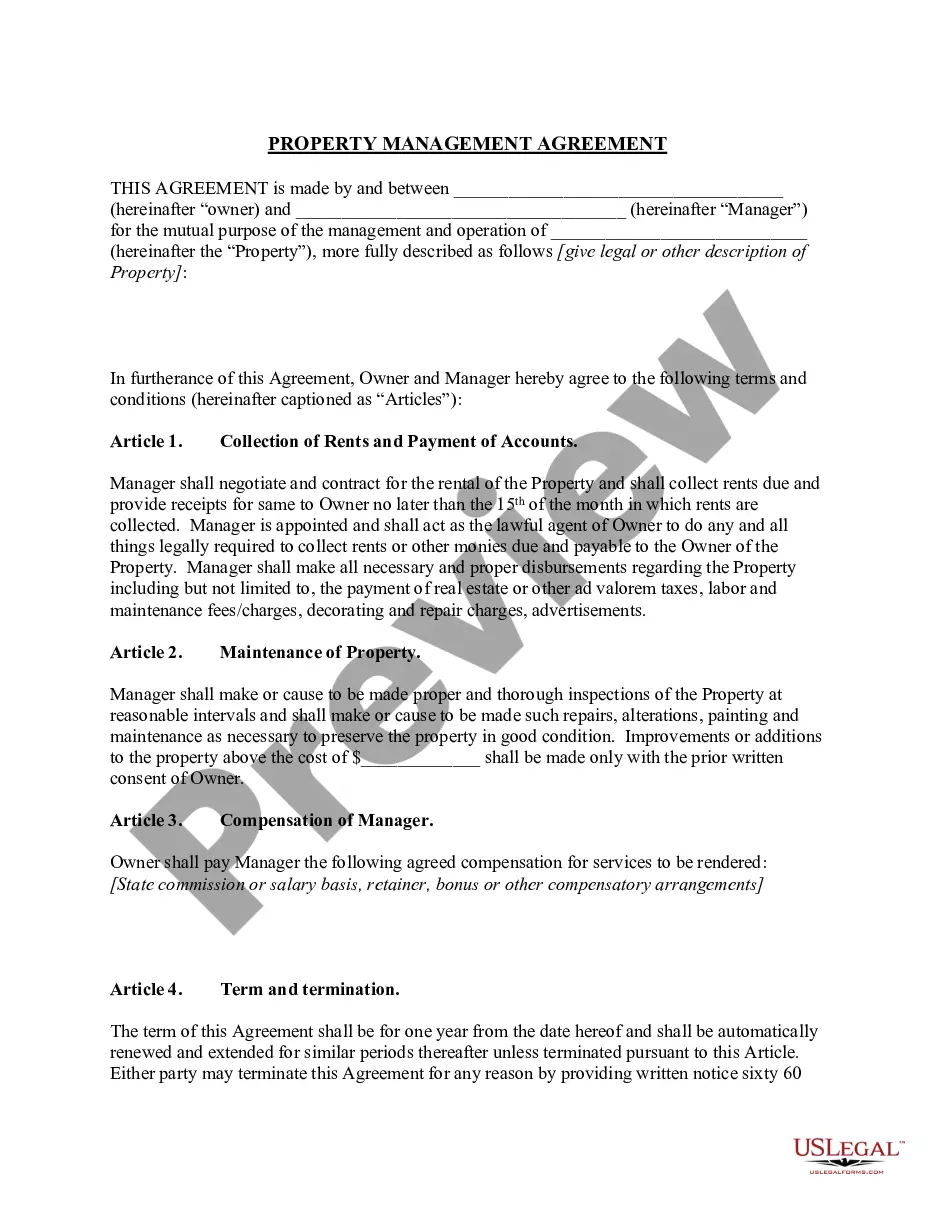

How to fill out New Jersey Sample Letter For Fraudulent Charges Against Client's Account?

If you have to full, down load, or print authorized file themes, use US Legal Forms, the biggest selection of authorized varieties, that can be found on the web. Take advantage of the site`s easy and hassle-free look for to discover the paperwork you need. Various themes for company and personal purposes are sorted by groups and claims, or keywords and phrases. Use US Legal Forms to discover the New Jersey Sample Letter for Fraudulent Charges against Client's Account with a handful of clicks.

If you are currently a US Legal Forms buyer, log in to the accounts and click the Download button to find the New Jersey Sample Letter for Fraudulent Charges against Client's Account. You may also entry varieties you in the past delivered electronically within the My Forms tab of your own accounts.

If you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape to the right town/region.

- Step 2. Make use of the Review method to look through the form`s information. Never forget about to read the explanation.

- Step 3. If you are not happy together with the develop, utilize the Search discipline at the top of the display screen to locate other models of the authorized develop web template.

- Step 4. After you have found the shape you need, select the Purchase now button. Opt for the prices prepare you choose and put your qualifications to sign up for the accounts.

- Step 5. Process the purchase. You can utilize your Мisa or Ьastercard or PayPal accounts to complete the purchase.

- Step 6. Find the structure of the authorized develop and down load it in your gadget.

- Step 7. Complete, change and print or indicator the New Jersey Sample Letter for Fraudulent Charges against Client's Account.

Each and every authorized file web template you purchase is your own property permanently. You may have acces to each and every develop you delivered electronically within your acccount. Click on the My Forms portion and pick a develop to print or down load yet again.

Be competitive and down load, and print the New Jersey Sample Letter for Fraudulent Charges against Client's Account with US Legal Forms. There are millions of expert and state-specific varieties you can use for your personal company or personal needs.

Form popularity

FAQ

The sooner you contact your bank, the more likely you are to get your money back ? and if the transaction is unauthorised, the sooner the bank can stop any further transactions. When you report a mistaken or unauthorised transaction, make sure the bank gives you a reference number.

Contact your bank right away. To limit your liability, it is important to notify the bank promptly upon discovering any unauthorized charge(s). You may notify the bank in person, by telephone, or in writing.

Contact the company or bank that issued the credit card or debit card. Tell them it was a fraudulent charge. Ask them to reverse the transaction and give you your money back. Did a scammer make an unauthorized transfer from your bank account?

The details of the transaction are as follows: ? Date of transaction: [INSERT DATE OF TRANSACTION] ? Amount of transaction:[INSERT AMOUNT OF TRANSACTION] ? Name of merchant: [INSERT NAME OF SELLER] ? Reasons for the request for chargeback: [FOR EXAMPLE you did not receive the goods, they were faulty etc] Please let me ...

The bank investigates fraud claims and suspicious activity and then determines if the suspicious activity amounts to fraud. From there, the bank will submit a Suspicious Activity Report (SAR), which will be escalated to the proper legal authority.

I am writing to dispute a charge of [$______] to my [credit or debit card] account on [date of the charge]. The charge is in error because [explain the problem briefly. For example, the items weren't delivered, I was overcharged, I returned the items, I did not buy the items, etc.].

Fortunately, most major card networks have a ?zero liability? policy that ensures you will not be held responsible for fraudulent charges. And federal law limits your losses for unauthorized credit card use to $50.

If you report a fraudulent charge within two days, you can't be held responsible for more than $50 in charges. Keep in mind that you have 60 days to dispute the transaction or else you could be stuck paying for it.