The sale of any ongoing business, even a sole proprietorship, can be a complicated transaction. The buyer and seller (and their attorneys) must consider the law of contracts, taxation, real estate, corporations, securities, and antitrust in many situations. Depending on the nature of the business sold, statutes and regulations concerning the issuance and transfer of permits, licenses, and/or franchises should be consulted.

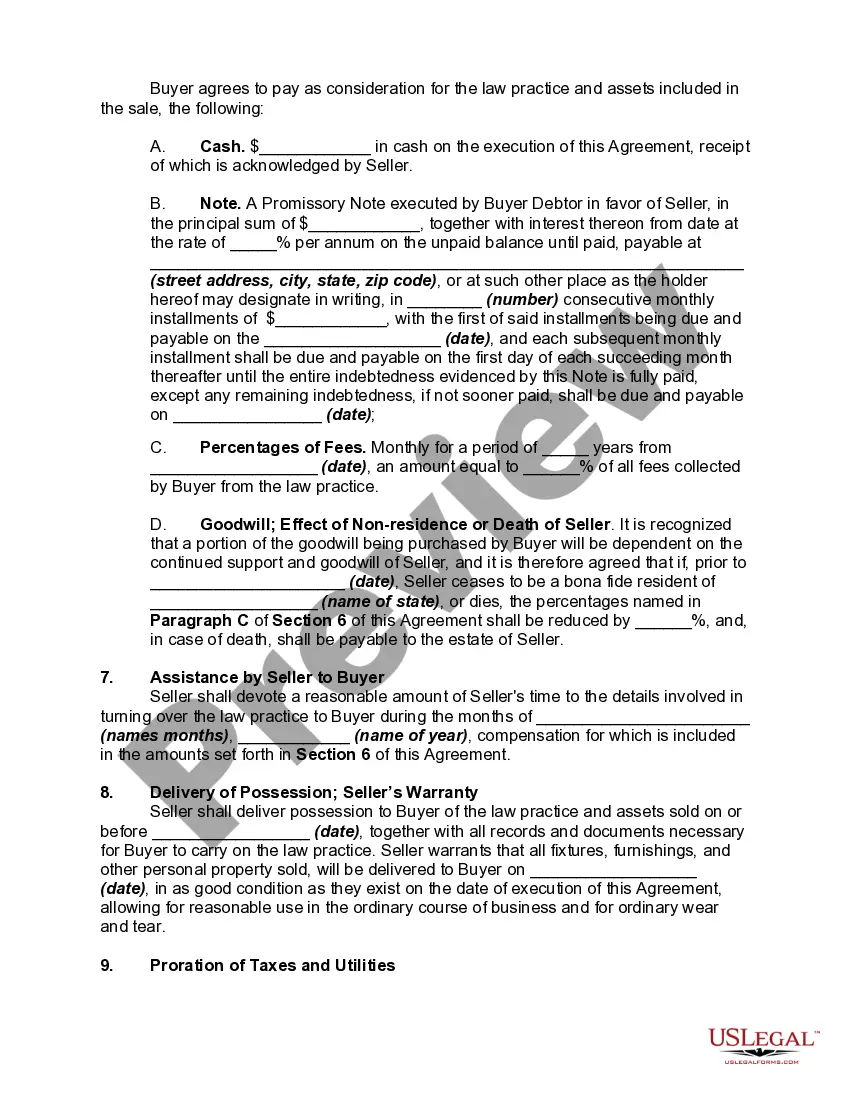

A sale of a business is considered for tax purposes to be a sale of the various assets involved. Therefore it is important that the contract allocate parts of the total payment among the items being sold. For example, the sale may require the transfer of the place of business, including the real property on which the building(s) of the business are located. The sale might involve the assignment of a lease, the transfer of good will, equipment, furniture, fixtures, merchandise, and inventory. The sale may also include the transfer of the business name, patents, trademarks, copyrights, licenses, permits, insurance policies, notes, accounts receivables, contracts, cash on hand and on deposit, and other tangible or intangible properties. It is best to include a broad transfer provision to insure that the entire business is being transferred to the buyer, with an itemization of at least the more important assets to be transferred.

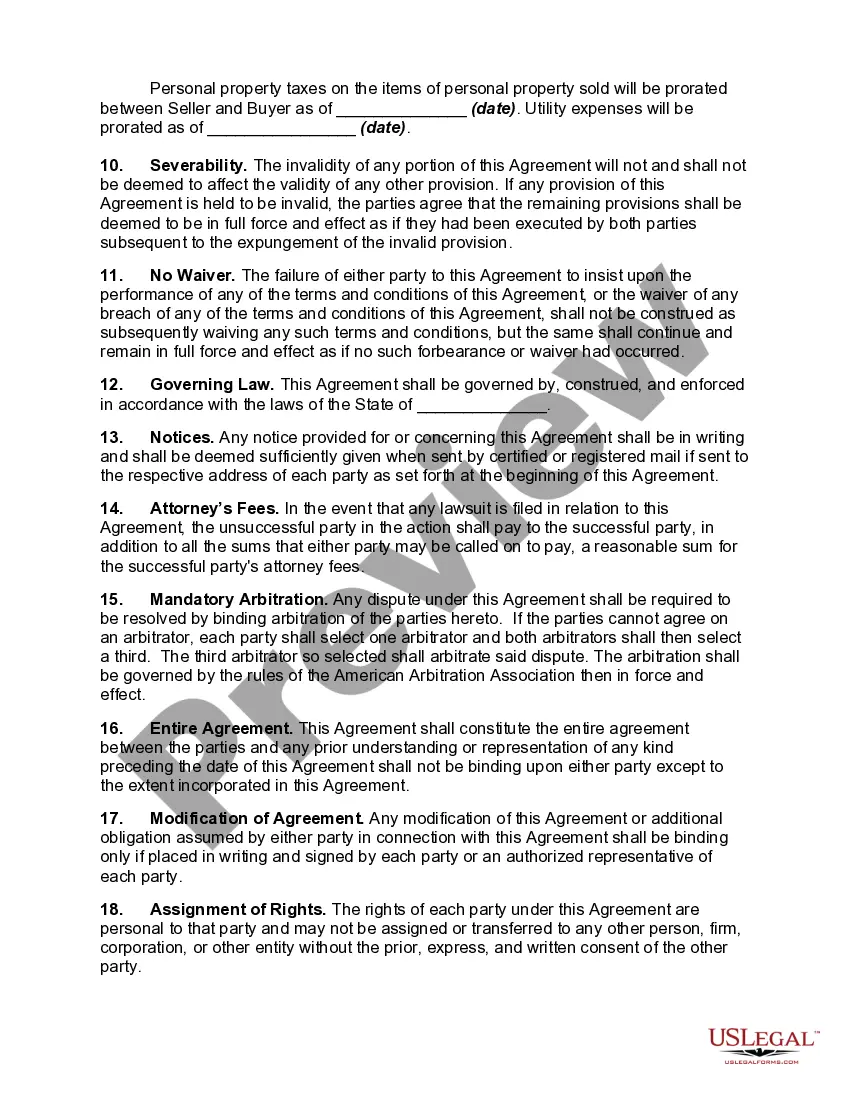

Title: Understanding the New Jersey Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant Keywords: New Jersey, Agreement for Sale, Sole Proprietorship, Law Practice, Restrictive Covenant, Types Introduction: The New Jersey Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant is a legal document that outlines the terms and conditions governing the sale and transfer of a sole proprietorship law practice in the state of New Jersey. This comprehensive agreement establishes a contractual framework that protects the interests of both the seller and the buyer, while also including a restrictive covenant to prevent unfair competition. Types of New Jersey Agreements for Sale of Sole Proprietorship Law Practice with Restrictive Covenant: 1. Standard New Jersey Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant: This type of agreement forms the basis for the sale and purchase of a sole proprietorship law practice. It includes specific clauses related to the transfer of assets, client relationships, liabilities, and the terms of employment for associated attorneys and staff. 2. Tailored New Jersey Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant: This type of agreement is customized to address the specific needs and considerations of the involved parties. It may include additional provisions or modifications to accommodate unique aspects of the sole proprietorship law practice being sold. Key Elements of the Agreement: 1. Parties Involved: Identify the parties involved in the agreement — the seller, buyer, and any other relevant stakeholders. 2. Business Assets: Detail the assets being sold, such as office space, furniture, equipment, case files, software licenses, and any intellectual property rights. 3. Client Transfers: Specify how the transfer of client files and relationships will be handled, including notification procedures, obtaining consent, and confidentiality obligations. 4. Liabilities and Indemnification: Address the allocation of existing liabilities, outstanding debts, claims, or litigation, ensuring adequate provisions for indemnification. 5. Purchase Price and Payment Terms: State the agreed-upon purchase price, including any proposed installment payments or alternative payment structures, along with a schedule for payment. 6. Restrictive Covenant: Establish a restrictive covenant that prevents the seller from competing in the same area or within a specific radius for a defined period, thus protecting the buyer's business interests and goodwill. 7. Transition Period and Employment Terms: Define the period during which the seller may provide assistance to ensure a smooth transition of clients, and address the terms of employment for associated attorneys and staff. 8. Governing Law and Jurisdiction: Specify that New Jersey law governs the agreement, along with the jurisdiction and venue for any disputes that may arise. Conclusion: A New Jersey Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant is a vital legal document protecting the interests of both parties involved in the transfer of a sole proprietorship law practice. Its provisions ensure a smooth and fair transaction, addressing matters such as the sale price, client transfers, restrictive covenants, and more. It is essential to consult with legal professionals when drafting or engaging in such agreements to ensure compliance with applicable laws and regulations.