New Jersey Articles of Incorporation for Not-for-Profit Organizations with Tax Provisions: A Detailed Description In New Jersey, nonprofit organizations are required to file Articles of Incorporation with the State to establish their legal existence. These Articles of Incorporation serve as a key document to formally establish a not-for-profit organization in the state. When filing, special provisions related to tax-exempt status and tax compliance should also be included to ensure the organization's eligibility for various tax benefits. Let's delve into the detailed description of these New Jersey Articles of Incorporation for Not-for-profit Organizations with Tax Provisions. 1. Basic Information: The Articles of Incorporation require specific details about the organization. This includes the organization's name, which must comply with the state's naming requirements, such as including a corporate indicator such as "Association," "Foundation," or "Institute." The registered office address and the name and address of the registered agent, who can accept legal documents on behalf of the organization, must also be provided. 2. Purpose: The Articles of Incorporation should clearly outline the organization's purpose. For a nonprofit, the purpose is typically charitable, educational, scientific, religious, or a combination thereof. It is crucial to explicitly specify the organization's intended activities, as this will determine its eligibility for tax-exempt status. 3. Non-Profit Nature: The Articles of Incorporation must state that the organization is not-for-profit and will not engage in any activities that conflict with its tax-exempt status. Additionally, it should include dissolution provisions that ensure the organization's assets will be distributed for exempt purposes upon dissolution. 4. Tax Provisions: To qualify for tax-exempt status, the Articles of Incorporation must include specific provisions required by the Internal Revenue Service (IRS) and the New Jersey Division of Taxation. These provisions demonstrate the organization's compliance with the tax regulations and its authorization to receive tax-deductible contributions. Some key tax provisions typically included are: a. 501(c)(3) Provision: This provision indicates that the organization will operate exclusively for exempt purposes, such as charitable, educational, or scientific, as defined by the IRS under Section 501(c)(3) of the Internal Revenue Code. b. Dissolution Clause: This clause outlines that all assets will be distributed to other nonprofit organizations or for public purposes upon dissolution, ensuring compliance with the IRS requirements. c. Conflict of Interest Policy: The provision specifies that the organization will establish and implement a conflict of interest policy to ensure that transactions involving board members, officers, or key employees are conducted ethically and in the best interest of the organization. 5. Additional New Jersey Articles of Incorporation: New Jersey offers various types of nonprofit organizations, and the specific Articles of Incorporation required may vary depending on the organization's purpose. These may include: a. Charitable Organization: If the nonprofit primarily focuses on charitable activities, specific provisions related to charitable purposes, programs, or services should be included. b. Religious Organization: For religious organizations, provisions outlining religious practices, sacraments, rituals, or ceremonies may be required alongside the general tax provisions. c. Educational Organization: Nonprofits operating within the educational sector should include provisions that highlight their educational programs, services, and methods employed. d. Scientific Organization: If the organization's focus is scientific research, development, or innovation, specific provisions emphasizing scientific research methodologies, collaborations, or grants may be necessary. In conclusion, New Jersey Articles of Incorporation for Not-for-Profit Organizations with Tax Provisions are essential documents that outline the legal framework, purpose, and tax-exempt status of an organization. By including the required tax provisions and any relevant specific provisions pertaining to the organization's purpose, not-for-profit organizations in New Jersey can establish themselves in accordance with state regulations and become eligible for various tax benefits.

New Jersey Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

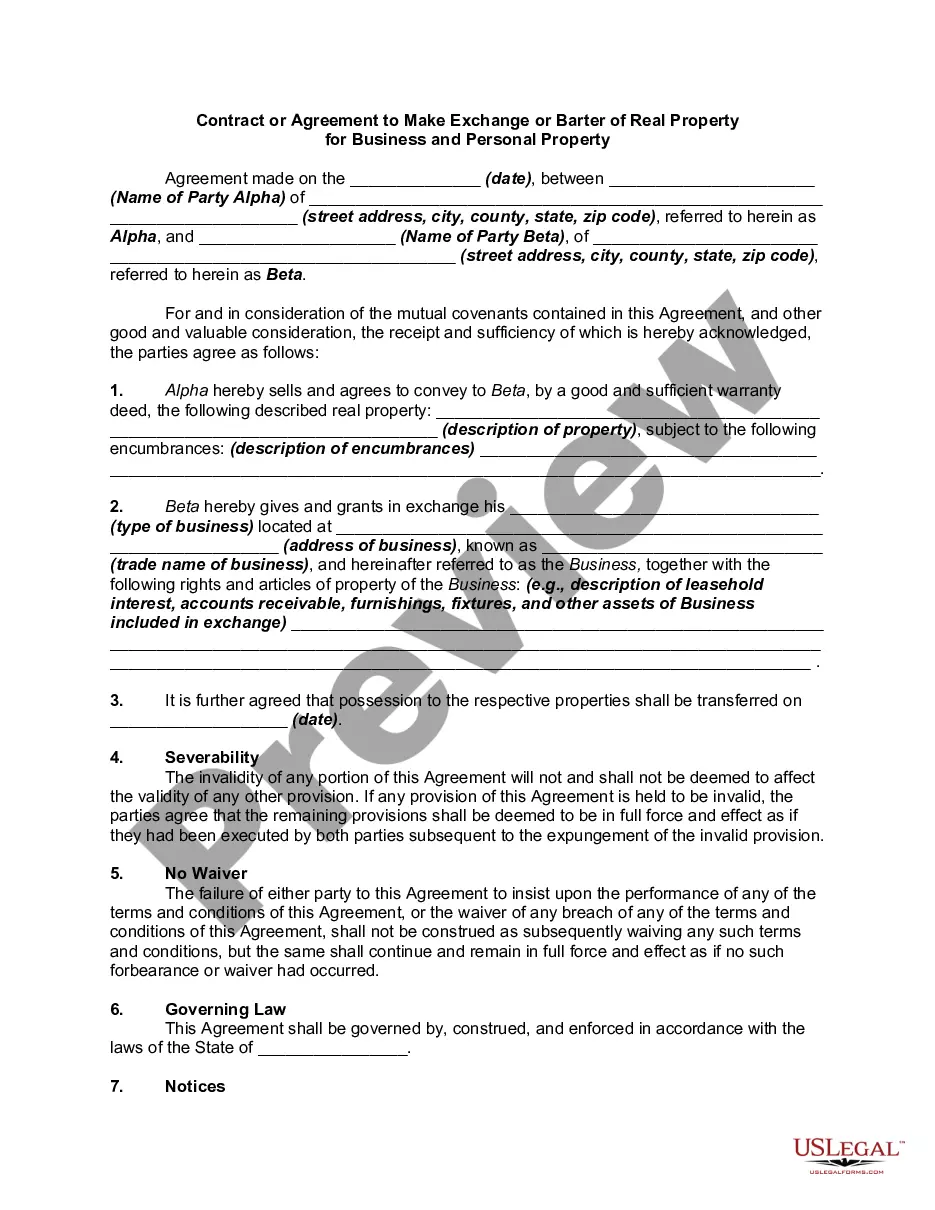

How to fill out New Jersey Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

Have you been inside a place the place you will need paperwork for both business or individual uses almost every time? There are tons of authorized file themes available on the Internet, but locating ones you can depend on isn`t effortless. US Legal Forms offers a huge number of form themes, like the New Jersey Articles of Incorporation, Not for Profit Organization, with Tax Provisions, which are composed to satisfy federal and state specifications.

If you are previously familiar with US Legal Forms website and get an account, just log in. Afterward, it is possible to acquire the New Jersey Articles of Incorporation, Not for Profit Organization, with Tax Provisions web template.

Unless you have an account and want to begin to use US Legal Forms, abide by these steps:

- Obtain the form you require and make sure it is to the proper area/state.

- Utilize the Review key to examine the form.

- Read the description to actually have chosen the appropriate form.

- In case the form isn`t what you`re looking for, utilize the Look for area to obtain the form that suits you and specifications.

- Whenever you find the proper form, click Get now.

- Opt for the prices prepare you desire, fill in the specified info to create your money, and pay money for an order using your PayPal or bank card.

- Choose a convenient file file format and acquire your version.

Locate each of the file themes you might have bought in the My Forms food selection. You can get a extra version of New Jersey Articles of Incorporation, Not for Profit Organization, with Tax Provisions whenever, if possible. Just click on the essential form to acquire or print the file web template.

Use US Legal Forms, one of the most comprehensive selection of authorized kinds, to save time and prevent mistakes. The assistance offers skillfully produced authorized file themes which can be used for an array of uses. Create an account on US Legal Forms and initiate making your lifestyle easier.