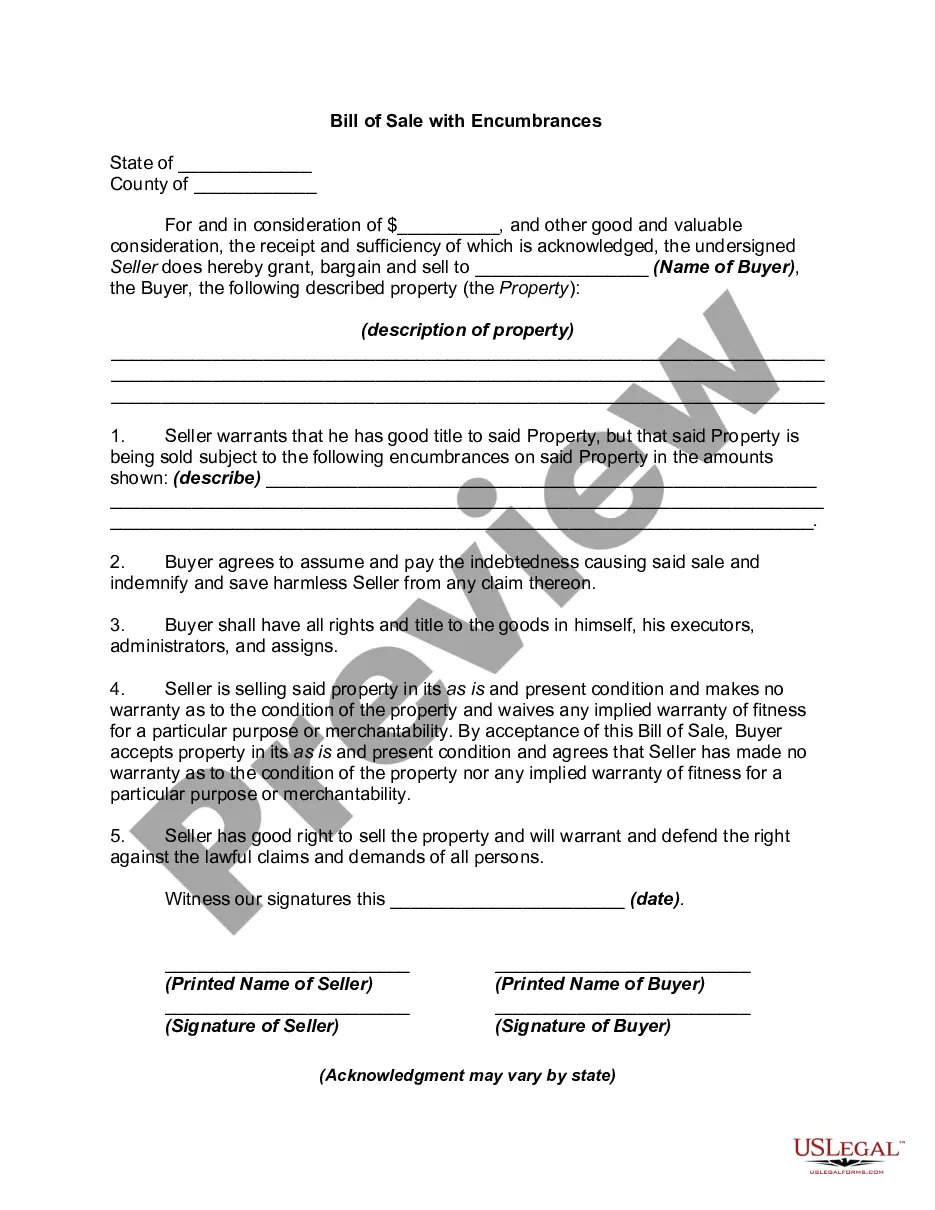

A Bill of Sale with encumbrances means that whatever product is being sold has some sort of lien, mortgage, or monies owing, and the Buyer is agreeing that they will take on these obligations upon purchase.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

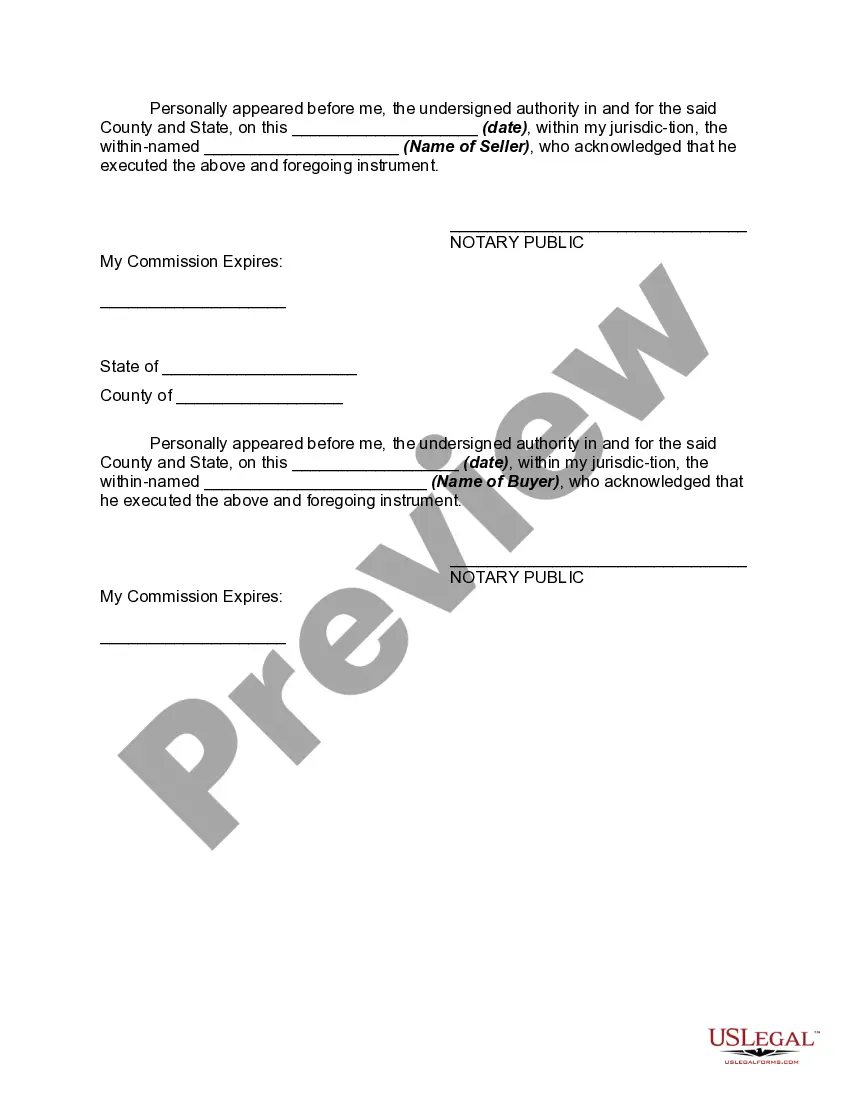

A New Jersey Bill of Sale with Encumbrances is a legal document used to record the transfer of ownership of a property or item that has existing encumbrances, such as liens, mortgages, or other financial claims. This type of bill of sale is essential in situations where the seller does not fully own the property or item and there are encumbrances that could affect the buyer's rights or future ownership. By using a New Jersey Bill of Sale with Encumbrances, both parties can ensure transparency, mitigate risks, and protect their interests. The contents of a New Jersey Bill of Sale with Encumbrances typically include: 1. Identification of parties: The bill of sale starts with the identification details of both the seller and the buyer involved in the transaction. This includes their names, addresses, and contact information. 2. Description of the property or item: A detailed description of the property or item being sold must be included. This could include its make, model, serial number, year of manufacture, and any other specific identifying information. 3. Statement of encumbrances: The bill of sale should clearly state the existing encumbrances on the property or item being sold. This could include any outstanding mortgages, liens, judgments, or other financial claims. The nature and amount of each encumbrance should be documented to provide a comprehensive understanding of the buyer's responsibilities and limitations. 4. Purchase price and payment terms: The bill of sale should outline the agreed-upon purchase price for the property or item and specify if any down payment or installment payments are involved. Additionally, the bill of sale may state the method of payment, such as cash, check, or wire transfer, along with any applicable due dates. 5. Seller's representations: It is common for the seller to make certain representations about the ownership and condition of the property or item being sold. This includes affirming that they have the legal right to transfer ownership and that the information provided is accurate to the best of their knowledge. 6. Warranty disclaimers: Depending on the circumstances, the bill of sale may also contain disclaimers regarding any warranties or guarantees, especially if the property or item is sold "as-is" or with no expressed warranties. Different types of New Jersey Bill of Sale with Encumbrances may include: 1. Real Estate Bill of Sale with Encumbrances: Specifically used for the transfer of ownership of real property, such as a house, land, or commercial building, that is subject to liens, mortgages, or other encumbrances. 2. Vehicle Bill of Sale with Encumbrances: Used for the sale of vehicles, such as cars, motorcycles, boats, or RVs, that have outstanding loans or liens against them. 3. Business Assets Bill of Sale with Encumbrances: Commonly used when selling a business, this type of bill of sale covers the transfer of ownership for assets like equipment, inventory, or intellectual property that may have existing encumbrances. In conclusion, a New Jersey Bill of Sale with Encumbrances is a vital legal document that protects the interests of both the buyer and seller during the transfer of ownership of a property or item. The inclusion of relevant keywords like "New Jersey," "Bill of Sale," "encumbrances," and specific types of bills of sale enables individuals to understand the concept and types associated with this topic in New Jersey.A New Jersey Bill of Sale with Encumbrances is a legal document used to record the transfer of ownership of a property or item that has existing encumbrances, such as liens, mortgages, or other financial claims. This type of bill of sale is essential in situations where the seller does not fully own the property or item and there are encumbrances that could affect the buyer's rights or future ownership. By using a New Jersey Bill of Sale with Encumbrances, both parties can ensure transparency, mitigate risks, and protect their interests. The contents of a New Jersey Bill of Sale with Encumbrances typically include: 1. Identification of parties: The bill of sale starts with the identification details of both the seller and the buyer involved in the transaction. This includes their names, addresses, and contact information. 2. Description of the property or item: A detailed description of the property or item being sold must be included. This could include its make, model, serial number, year of manufacture, and any other specific identifying information. 3. Statement of encumbrances: The bill of sale should clearly state the existing encumbrances on the property or item being sold. This could include any outstanding mortgages, liens, judgments, or other financial claims. The nature and amount of each encumbrance should be documented to provide a comprehensive understanding of the buyer's responsibilities and limitations. 4. Purchase price and payment terms: The bill of sale should outline the agreed-upon purchase price for the property or item and specify if any down payment or installment payments are involved. Additionally, the bill of sale may state the method of payment, such as cash, check, or wire transfer, along with any applicable due dates. 5. Seller's representations: It is common for the seller to make certain representations about the ownership and condition of the property or item being sold. This includes affirming that they have the legal right to transfer ownership and that the information provided is accurate to the best of their knowledge. 6. Warranty disclaimers: Depending on the circumstances, the bill of sale may also contain disclaimers regarding any warranties or guarantees, especially if the property or item is sold "as-is" or with no expressed warranties. Different types of New Jersey Bill of Sale with Encumbrances may include: 1. Real Estate Bill of Sale with Encumbrances: Specifically used for the transfer of ownership of real property, such as a house, land, or commercial building, that is subject to liens, mortgages, or other encumbrances. 2. Vehicle Bill of Sale with Encumbrances: Used for the sale of vehicles, such as cars, motorcycles, boats, or RVs, that have outstanding loans or liens against them. 3. Business Assets Bill of Sale with Encumbrances: Commonly used when selling a business, this type of bill of sale covers the transfer of ownership for assets like equipment, inventory, or intellectual property that may have existing encumbrances. In conclusion, a New Jersey Bill of Sale with Encumbrances is a vital legal document that protects the interests of both the buyer and seller during the transfer of ownership of a property or item. The inclusion of relevant keywords like "New Jersey," "Bill of Sale," "encumbrances," and specific types of bills of sale enables individuals to understand the concept and types associated with this topic in New Jersey.