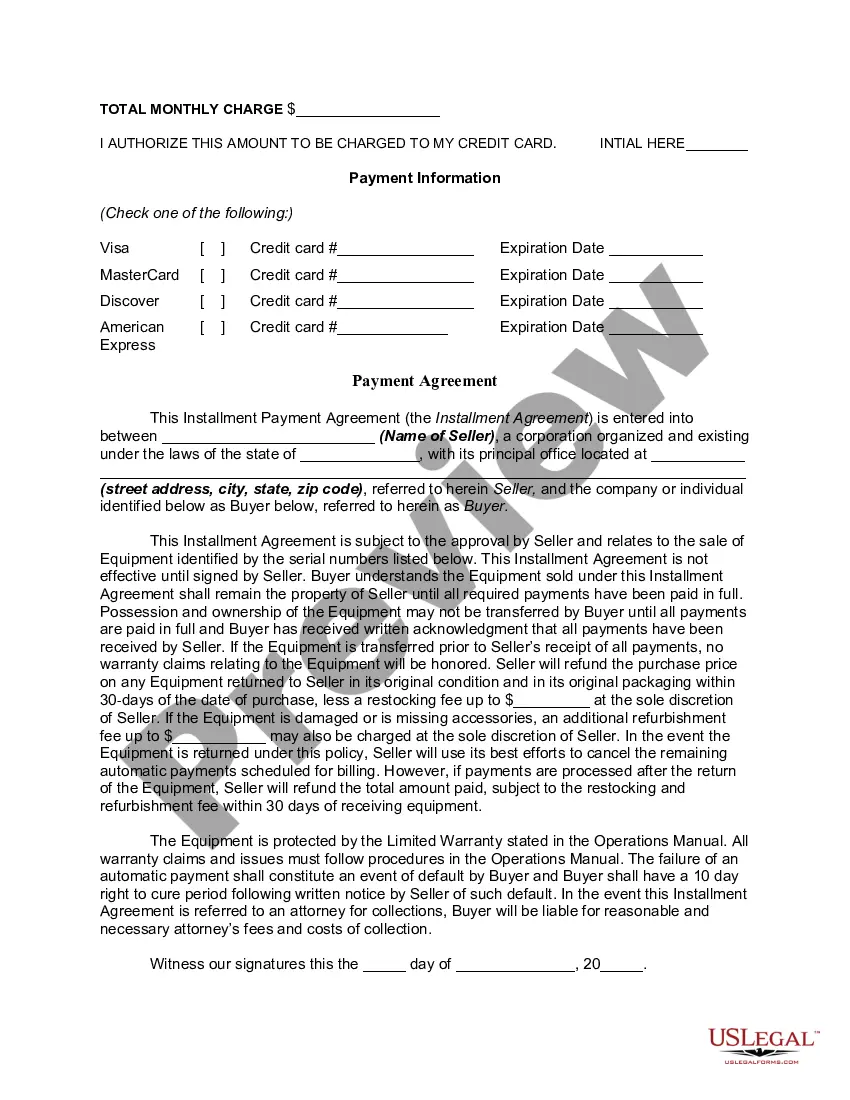

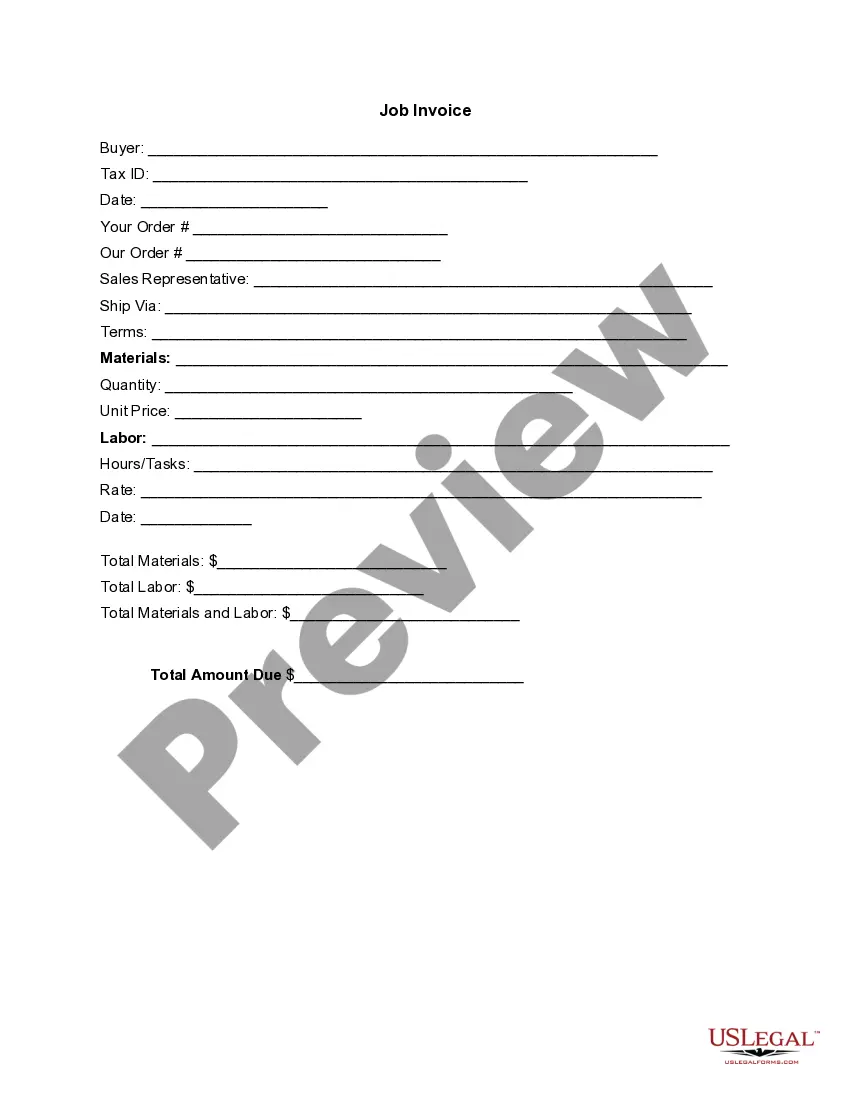

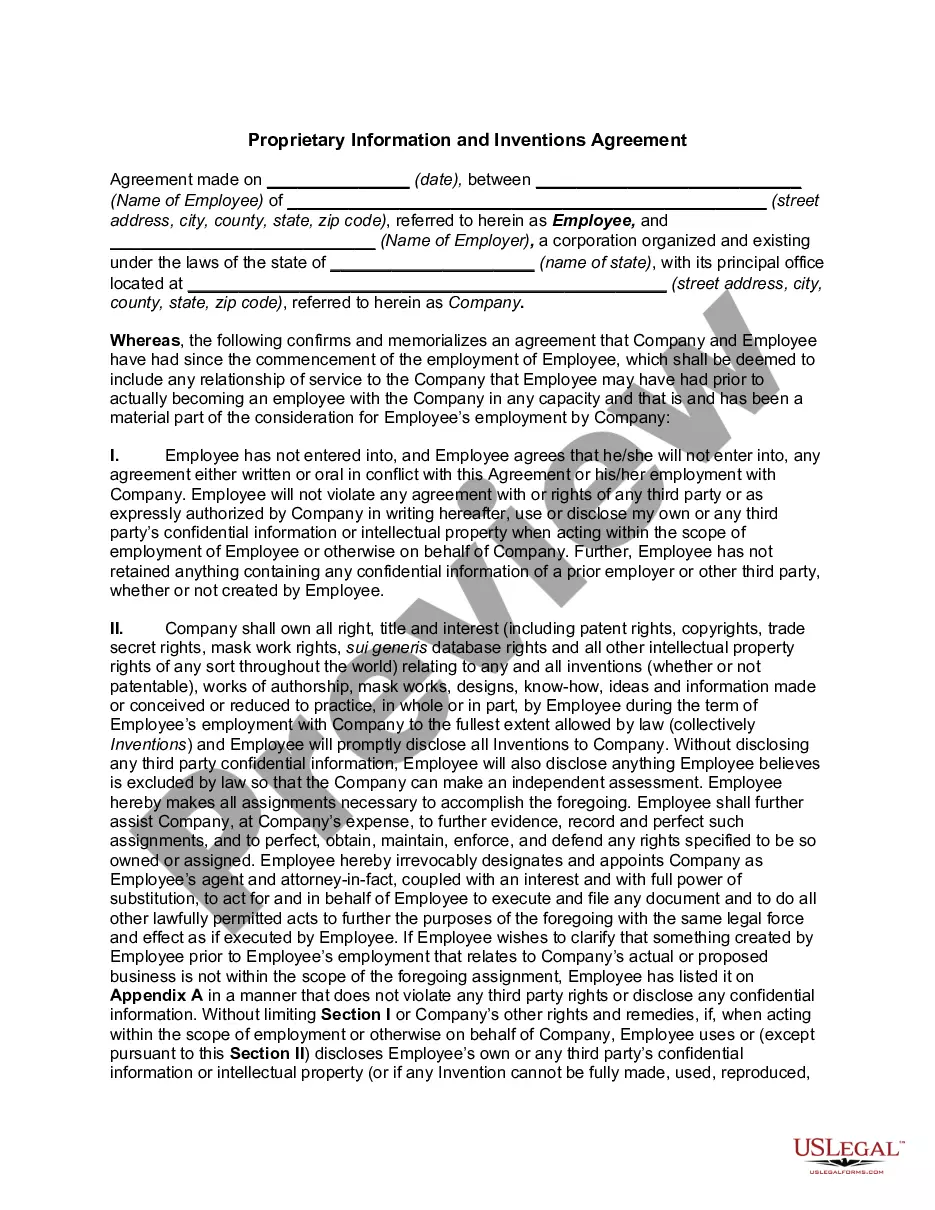

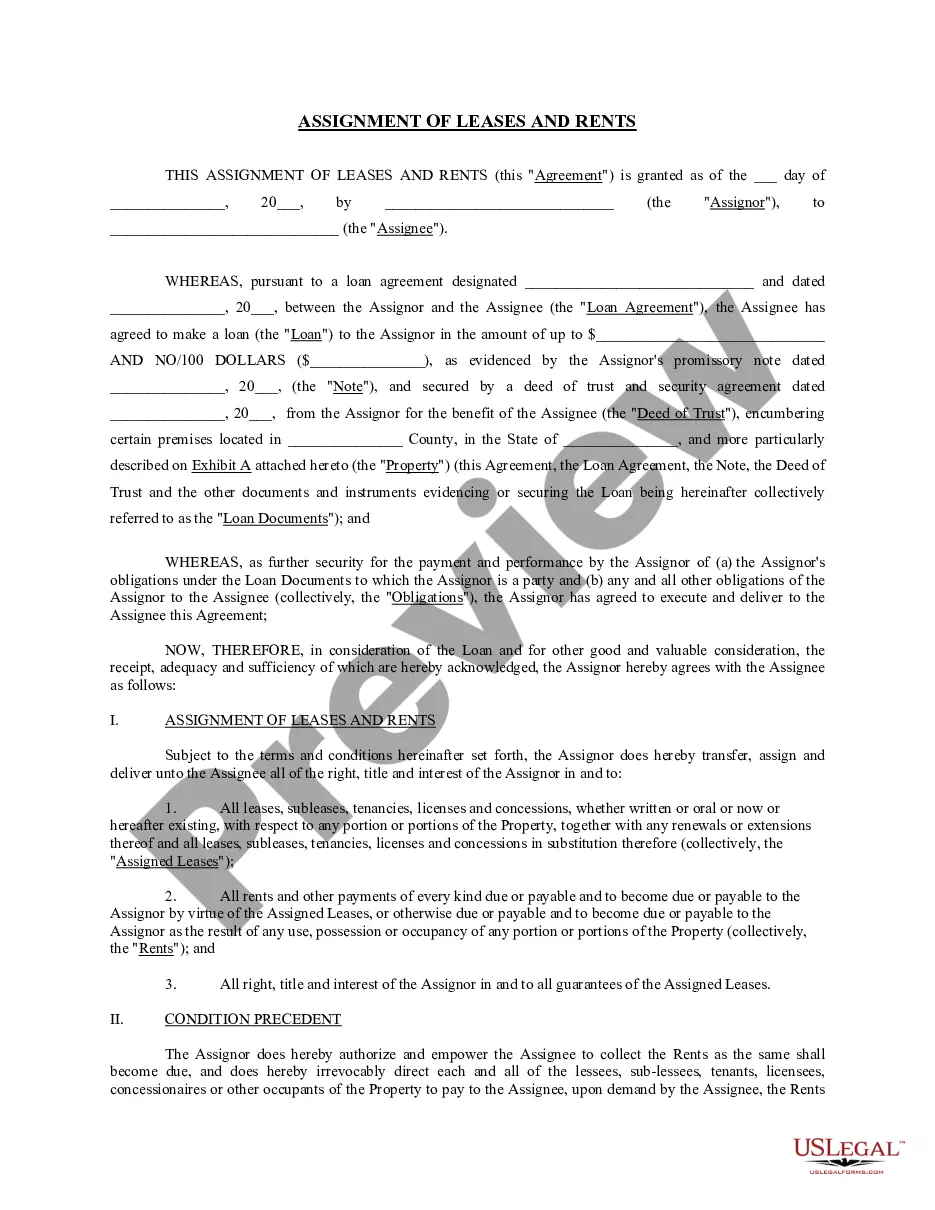

New Jersey Installment Payment and Purchase Agreement

Description

How to fill out Installment Payment And Purchase Agreement?

You can dedicate effort online striving to locate the official document template that meets the federal and state requirements you require.

US Legal Forms offers numerous legal forms that are verified by experts.

You have the option to download or print the New Jersey Installment Payment and Purchase Agreement from this service.

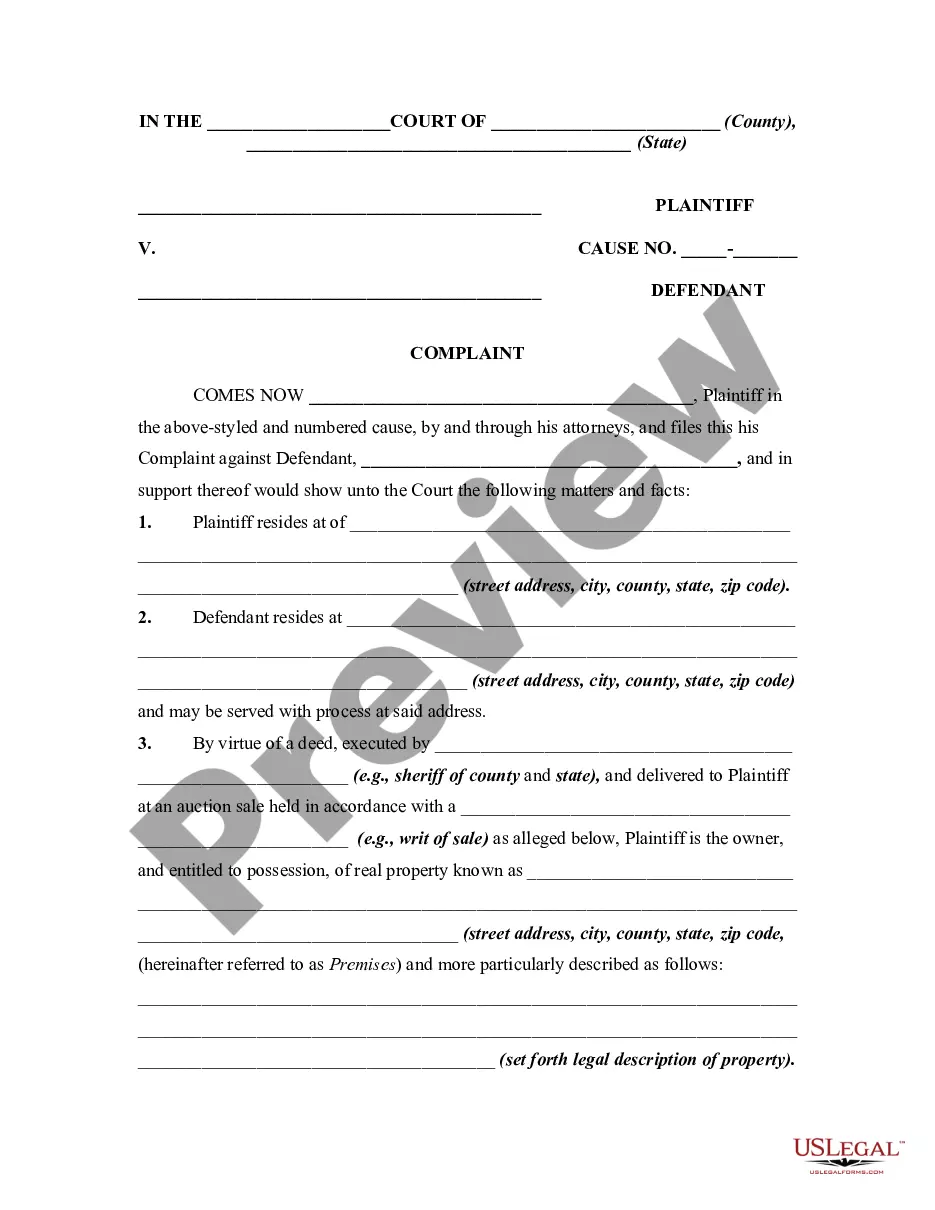

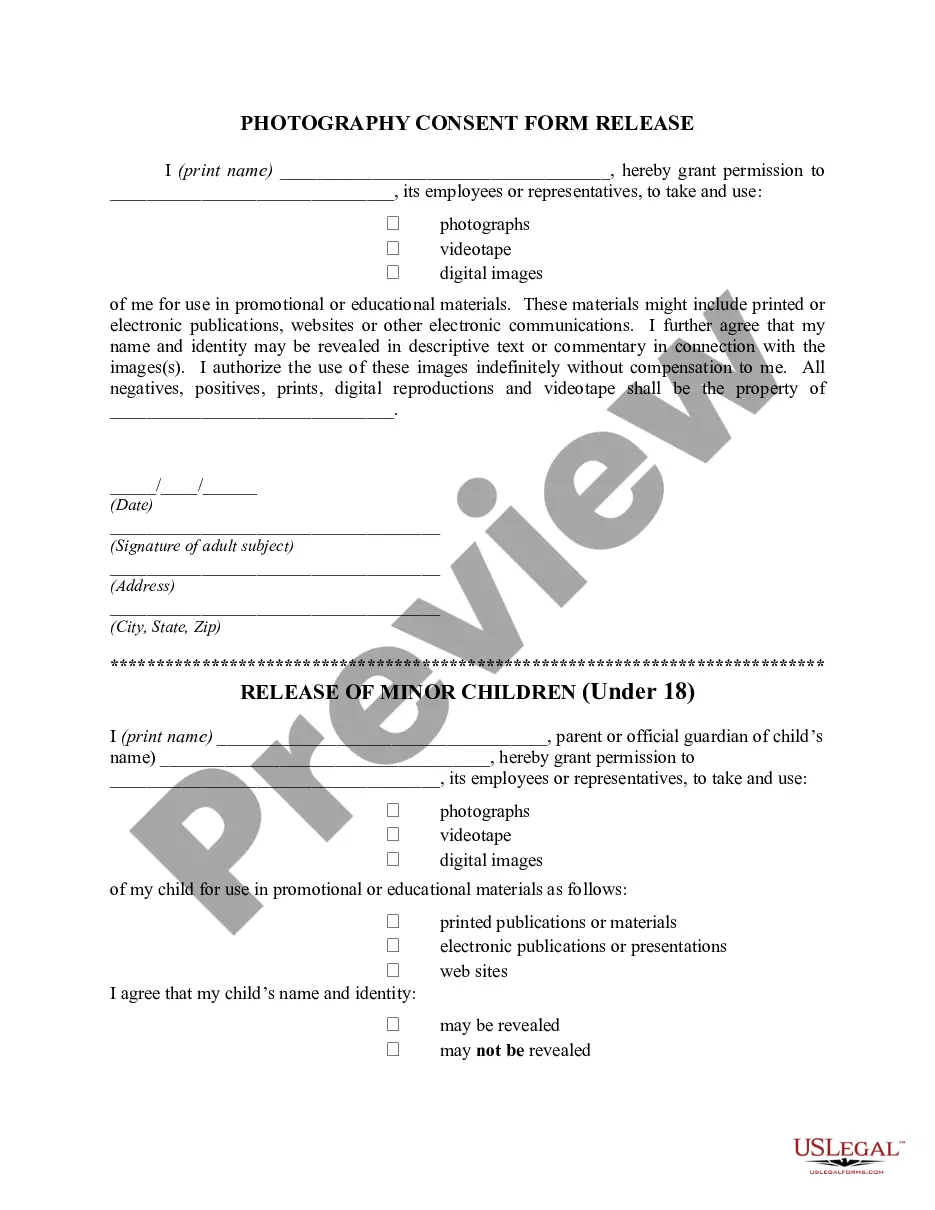

If available, utilize the Preview button to look at the document template as well.

- If you possess a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, modify, print, or sign the New Jersey Installment Payment and Purchase Agreement.

- Every legal document template you acquire is yours indefinitely.

- To get another copy of the purchased form, navigate to the My documents section and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the form description to ensure you have chosen the right form.

Form popularity

FAQ

Long-term Payment Plan (Installment Agreement) Pay amount owed in monthly payments. Payment Options. Costs. Option 1: Pay through Direct Debit (automatic monthly payments from your checking account), also known as a Direct Debit Installment Agreement (DDIA).

The State of New Jersey imposes a Realty Transfer Fee (RTF) on the seller whenever there is a transfer of title by deed. The fee is based on the sales price of the property, and the seller is required to pay the fee at the time of closing.

A qualified investment fund must: 2022 Be a regulated investment company; 2022 Invest 80% or more of its funds (other than cash or receivables) in securities that are exempt from New. Jersey Income Tax; and.

New Jersey depreciation adjustments will affect an individual's, estate's, or trust's determination of income reportable in the categories of net profits from business; net gains or income from disposition of property; net gains or net income from rents, royalties, patents, and copyrights; net gains or income derived

An Installment Agreement in the United States is an Internal Revenue Service (IRS) program which allows individuals to pay tax debt in monthly payments. The total amount paid can be the full amount of what is owed, or it can be a partial amount.

An Installment Payment Agreement permits payment over time. Interest and penalties continue to accrue and it is often in the best interest of the taxpayer to consider loans from other sources before pursuing an Installment Payment Agreement.

You can request a payment plan for any unpaid amount, including Cigarette Taxes, Homestead Benefit, and Senior Freeze (Property Tax Reimbursement) repayments. Your plan must include all unpaid balances. The monthly payment must be at least $25. Plans may be approved for up to a maximum of 72 months.

This graduated tax is levied on gross income earned or received after June 30, 1976, by New Jersey resident and nonresident individuals, estates, and trusts. Beginning January 1, 2019, the withholding rate on income over five million dollars is 11.8 percent.

A copy of your federal Form 7004 must be filed with your New Jersey return.

A GIT/REP form is a Gross Income Tax form required to be recorded with a deed when real property is transferred or sold in New Jersey. Several types of forms are in use.