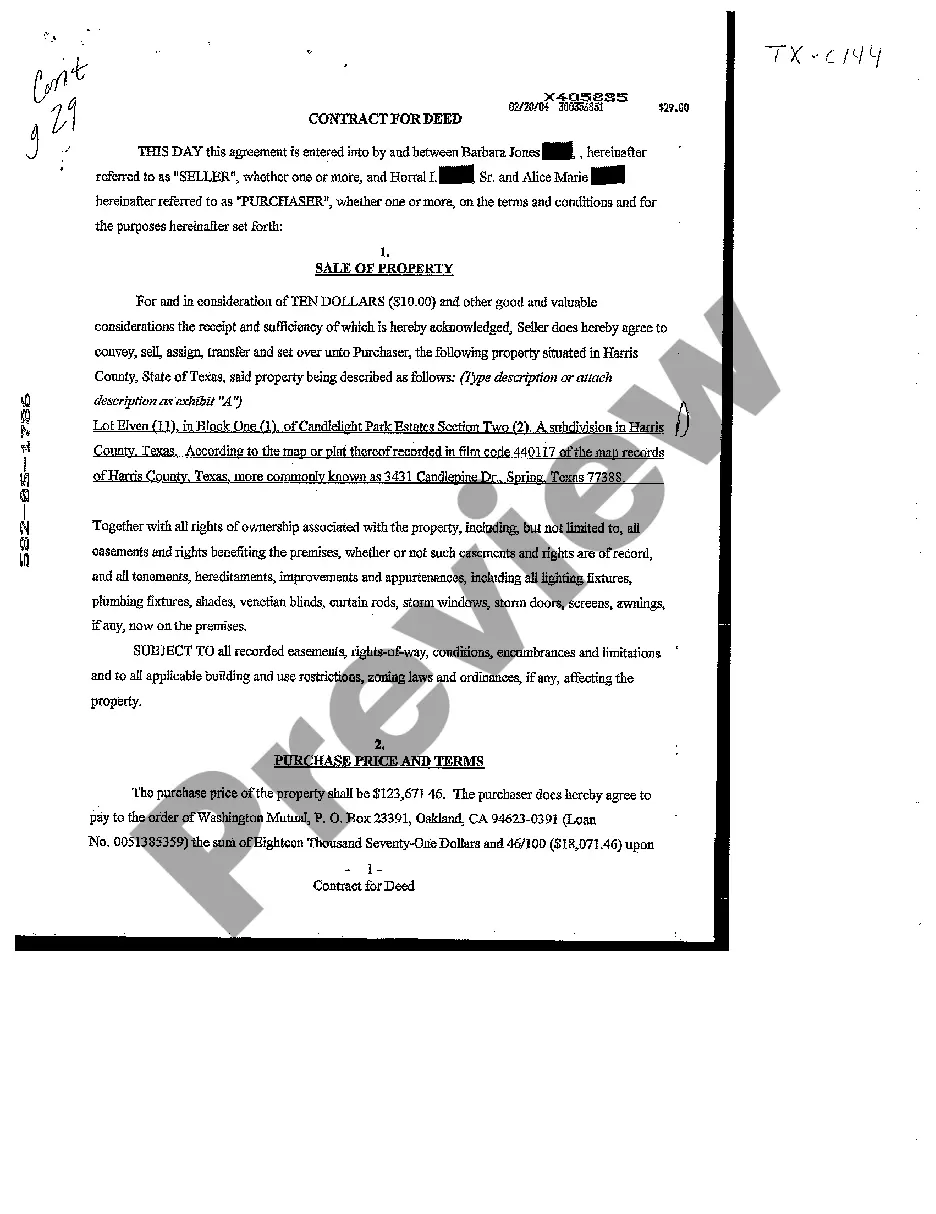

The New Jersey Small Business Administration Loan Application Form and Checklist is a crucial document and resource for small businesses in New Jersey seeking financial assistance. This comprehensive form and checklist serves as a guideline for applicants to organize and submit the necessary information and documents required to apply for various types of SBA loans. The New Jersey Small Business Administration offers several types of loans tailored to different business needs, each having its own unique application form and checklist. These include: 1. SBA 7(a) Loan Application Form and Checklist: This is one of the most popular SBA loan programs aiming to provide financial aid for small businesses looking to start, acquire, or expand their operations. The application form and checklist for SBA 7(a) loans outline the necessary paperwork, financial statements, personal background, credit history, and collateral details required from the applicants. 2. SBA Express Loan Application Form and Checklist: The SBA Express loan program is designed to expedite the loan approval process and provide small businesses with quick access to capital. The application form and checklist for SBA Express loans would highlight the specific documentation needed, such as financial statements, tax returns, business plan, and personal background information. 3. SBA 504 Loan Application Form and Checklist: SBA 504 loans are intended for small businesses seeking long-term financing for major fixed assets, including real estate or large equipment purchases. The application form and checklist for SBA 504 loans would emphasize the need for property appraisals, project feasibility studies, financial projections, personal financial statements, and legal documentation related to the assets. 4. SBA Microloan Program Application Form and Checklist: The Microloan program provides small businesses with small-scale financing, typically up to $50,000, for working capital or equipment purchases. The application form and checklist for this program would focus on the specific requirements such as business plans, financial statements, credit history, and personal guarantee documents. 5. SBA Disaster Loan Application Form and Checklist: In times of disasters or emergencies, small businesses may apply for SBA disaster loans to recover and rebuild. The application form and checklist for SBA disaster loans would include details related to the nature of damages, financial records, insurance information, and other supporting documentation as required. In summary, the New Jersey Small Business Administration Loan Application Form and Checklist provide a comprehensive overview of the specific requirements and documentation needed for obtaining various types of SBA loans, such as SBA 7(a) loans, SBA Express loans, SBA 504 loans, SBA Microloans, and SBA Disaster loans. These forms and checklists ensure that small business owners can effectively complete their loan applications and increase their chances of securing the financial support they need to thrive and grow.

New Jersey Small Business Administration Loan Application Form and Checklist

Description

How to fill out New Jersey Small Business Administration Loan Application Form And Checklist?

It is possible to spend time online attempting to find the authorized document format that suits the federal and state requirements you will need. US Legal Forms supplies thousands of authorized varieties which can be reviewed by experts. It is simple to download or produce the New Jersey Small Business Administration Loan Application Form and Checklist from the service.

If you already possess a US Legal Forms profile, you are able to log in and then click the Down load button. Following that, you are able to total, change, produce, or signal the New Jersey Small Business Administration Loan Application Form and Checklist. Every single authorized document format you get is the one you have for a long time. To have another version of any acquired develop, go to the My Forms tab and then click the corresponding button.

If you work with the US Legal Forms web site initially, keep to the straightforward directions listed below:

- Initial, make certain you have chosen the correct document format for the county/metropolis of your liking. Browse the develop outline to make sure you have selected the correct develop. If offered, utilize the Review button to search throughout the document format also.

- In order to discover another model from the develop, utilize the Research industry to obtain the format that meets your needs and requirements.

- After you have identified the format you would like, click Acquire now to proceed.

- Pick the costs plan you would like, type in your qualifications, and sign up for a free account on US Legal Forms.

- Full the transaction. You can utilize your Visa or Mastercard or PayPal profile to purchase the authorized develop.

- Pick the formatting from the document and download it for your system.

- Make alterations for your document if needed. It is possible to total, change and signal and produce New Jersey Small Business Administration Loan Application Form and Checklist.

Down load and produce thousands of document web templates using the US Legal Forms website, which provides the biggest assortment of authorized varieties. Use professional and express-particular web templates to tackle your company or individual requirements.

Form popularity

FAQ

The SBA Loan Process: Six Steps to Success Identify Your Small Business Project. ... Determine How Much Financing You Need. ... Find a Bank to Finance Your Loan. ... Complete Your Full Loan Application Package. ... Underwriting With the Bank. ... Closing.

The SBA Checklist Borrower Information Form. Personal Background and Financial Statement. Business Financial Statements. Business Certificate/License. Loan Application History. Income Tax Returns. Resumes. Business Overview and History.

Creditagreement_300ps. jpg Loan Application Form. Forms vary by program and lending institution, but they all ask for the same information. ... Resumes. ... Business Plan. ... Business Credit Report. ... Income Tax Returns. ... Financial Statements. ... Accounts Receivable and Accounts Payable. ... Collateral.

Although the SBA Form 912 is no longer required, if an individual owner answers ?yes? to question 18 or 19, the individual must provide the details to Page 3 PAGE 3 of 6 EXPIRES: 9-1-21 SBA Form 1353.3 (4-93) MS Word Edition; previous editions obsolete Must be accompanied by SBA Form 58 Federal Recycling Program ...

SBA only makes direct loans in the case of businesses and homeowners recovering from a declared disaster. SBA partners with lenders to help increase small business access to loans.