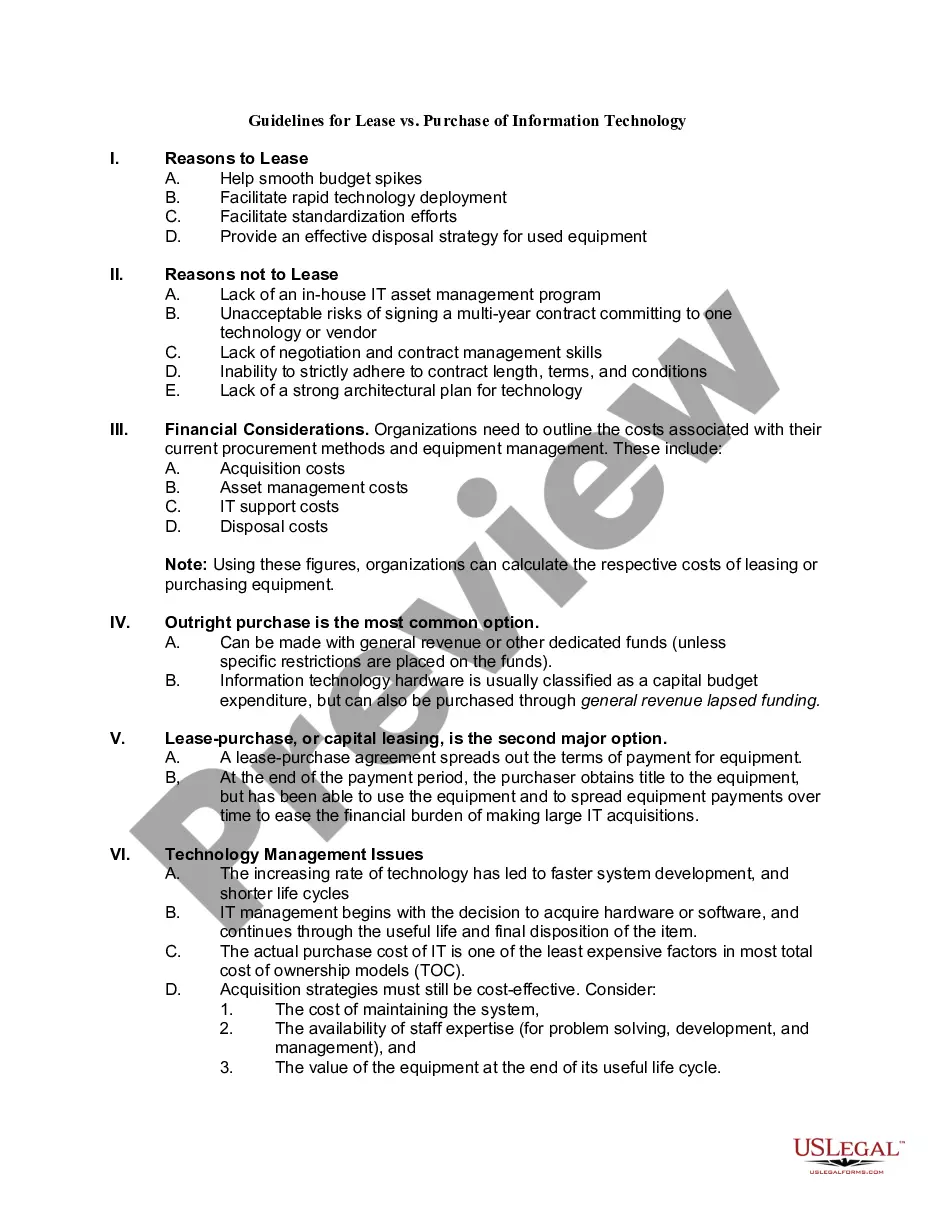

New Jersey Guidelines for Lease vs. Purchase of Information Technology

Instant download

Description

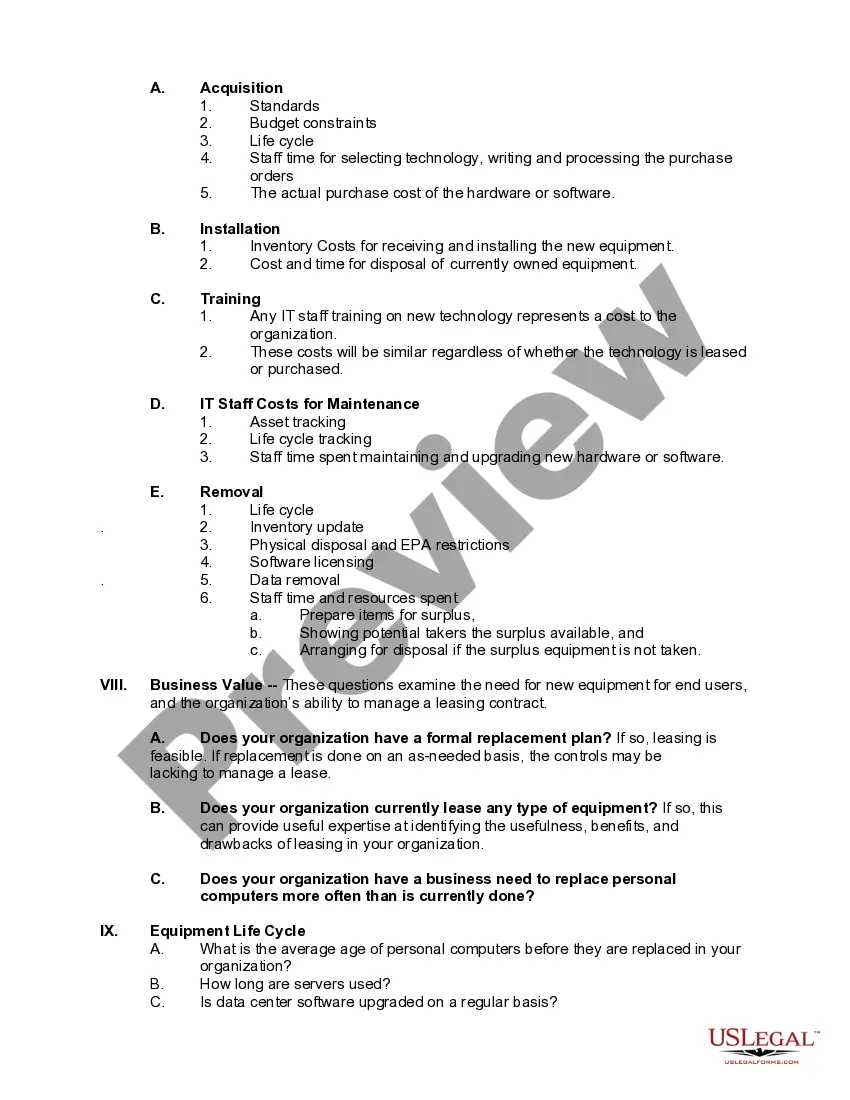

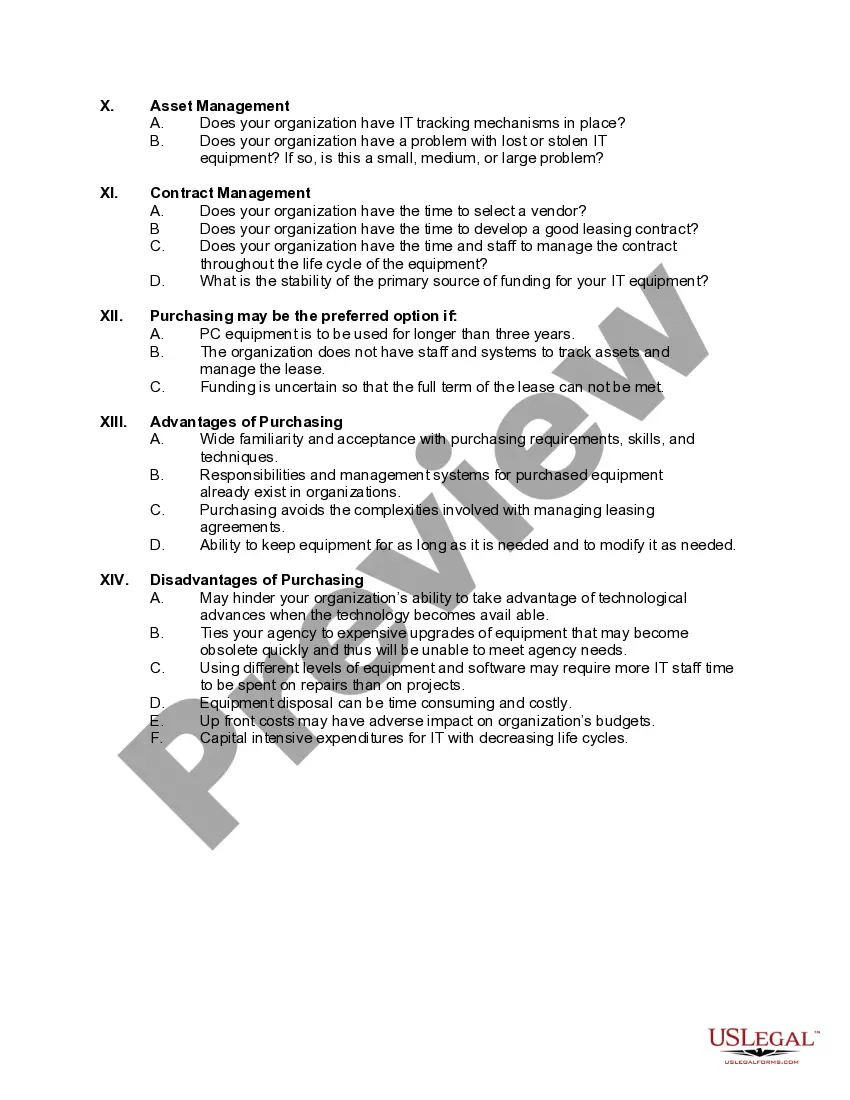

The rate of technology change is increasing, with an emphasis on client/server

technology, faster system development, and shorter life cycles. This has led to spiraling information technology (IT) budgets, driving the need for a re-evaluation of IT management issues. Organizations must find new ways to accommodate technological change. Leasing has recently emerged as a feasible, cost-effective alternative to purchasing equipment, particularly in the desktop and laptop areas.

technology, faster system development, and shorter life cycles. This has led to spiraling information technology (IT) budgets, driving the need for a re-evaluation of IT management issues. Organizations must find new ways to accommodate technological change. Leasing has recently emerged as a feasible, cost-effective alternative to purchasing equipment, particularly in the desktop and laptop areas.

Free preview

How to fill out Guidelines For Lease Vs. Purchase Of Information Technology?

Have you ever found yourself in a situation where you need documents for various business or personal purposes nearly every day.

There are numerous legal document templates available online, but locating reliable versions can be challenging.

US Legal Forms offers thousands of document templates, such as the New Jersey Guidelines for Lease vs. Purchase of Information Technology, which are designed to comply with state and federal regulations.

Once you find the appropriate form, click Get now.

Choose the payment plan you want, fill out the necessary information to create your account, and complete your purchase using PayPal or a credit card. Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- After that, you can download the New Jersey Guidelines for Lease vs. Purchase of Information Technology template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- 1. Locate the form you need and ensure it’s for your specific city or county.

- 2. Use the Preview button to review the document.

- 3. Read the description to ensure you’ve selected the correct form.

- 4. If the document isn't what you need, utilize the Search area to find the form that meets your requirements.