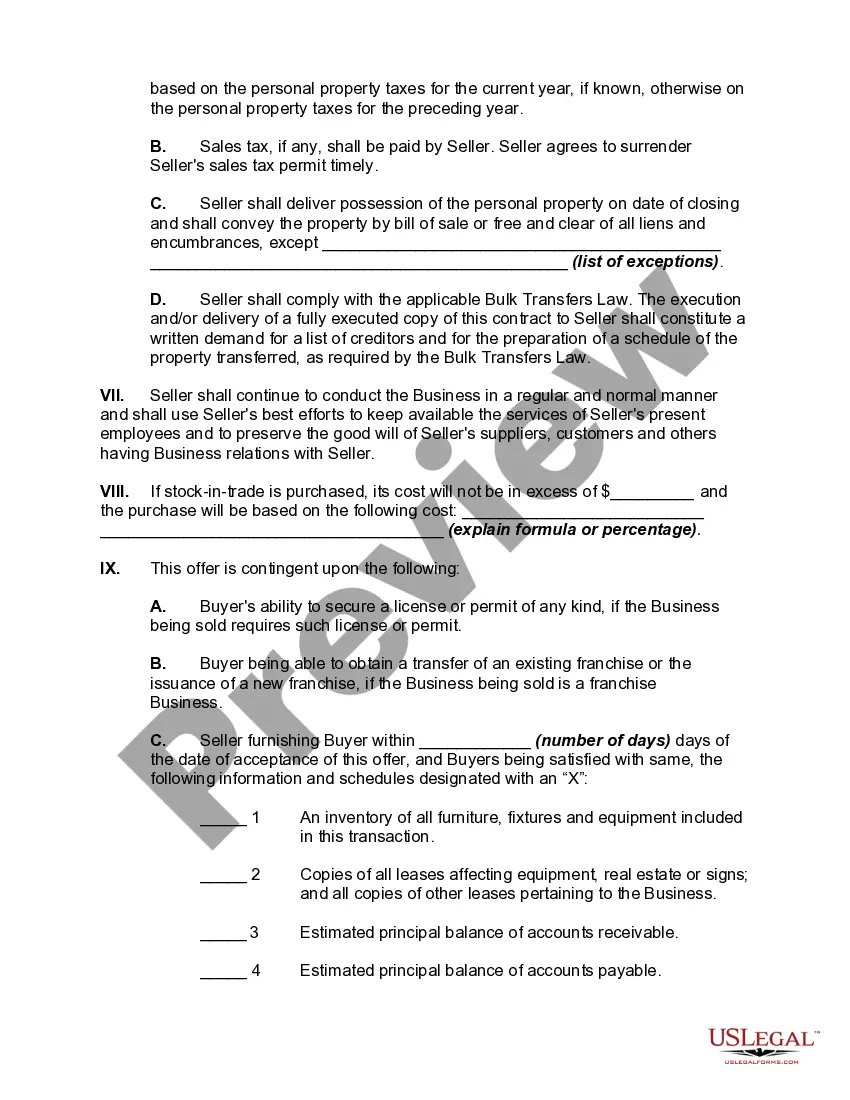

The sale of any ongoing business, even a sole proprietorship, can be a complicated transaction. Depending on the nature of the business sold, statutes and regulations concerning the issuance and transfer of permits, licenses, and/or franchises should be consulted. If a license or franchise is important to the business, the buyer generally would want to make the sales agreement contingent on such approval. Sometimes, the buyer will assume certain debts, liabilities, or obligations of the seller. In such a sale, it is vital that the buyer know exactly what debts he/she is assuming.

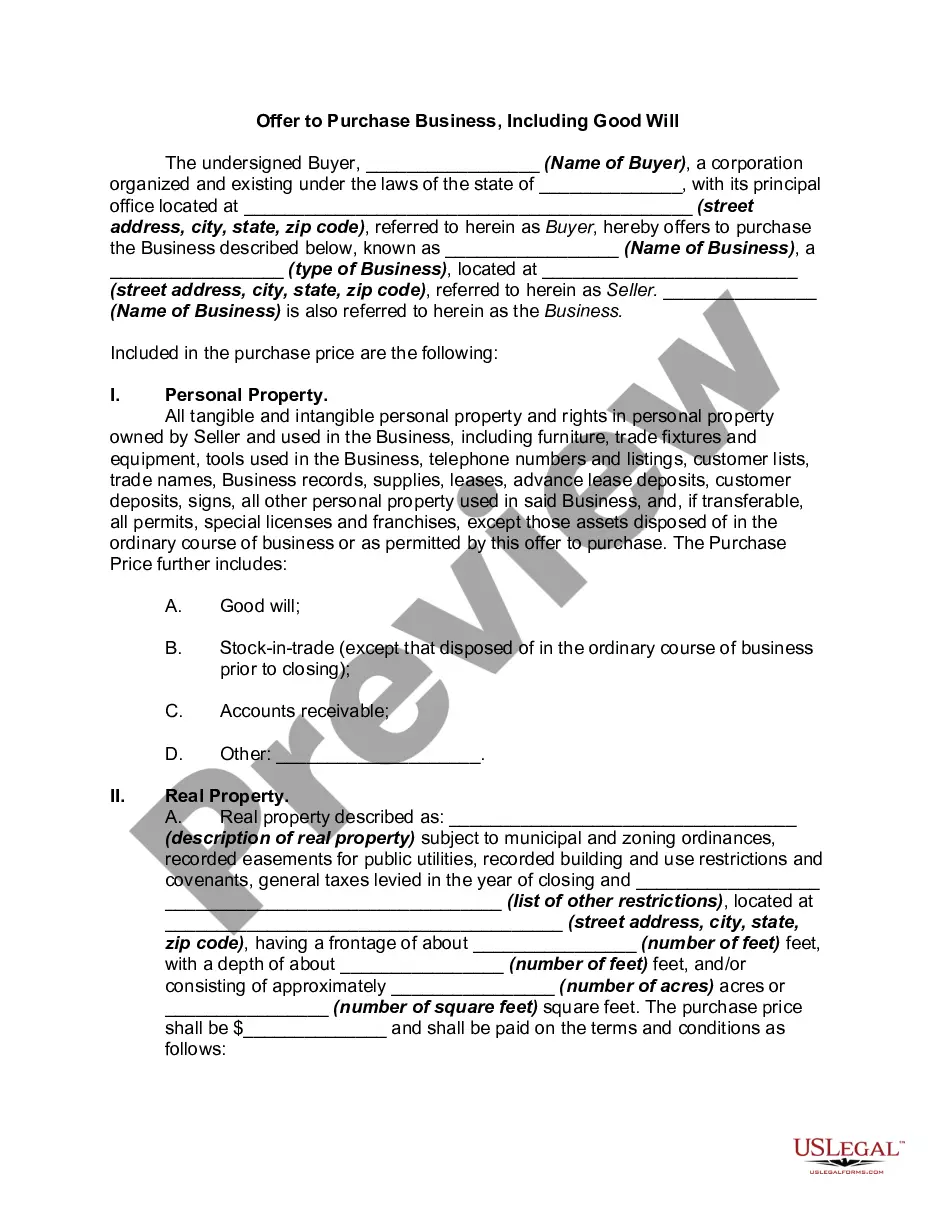

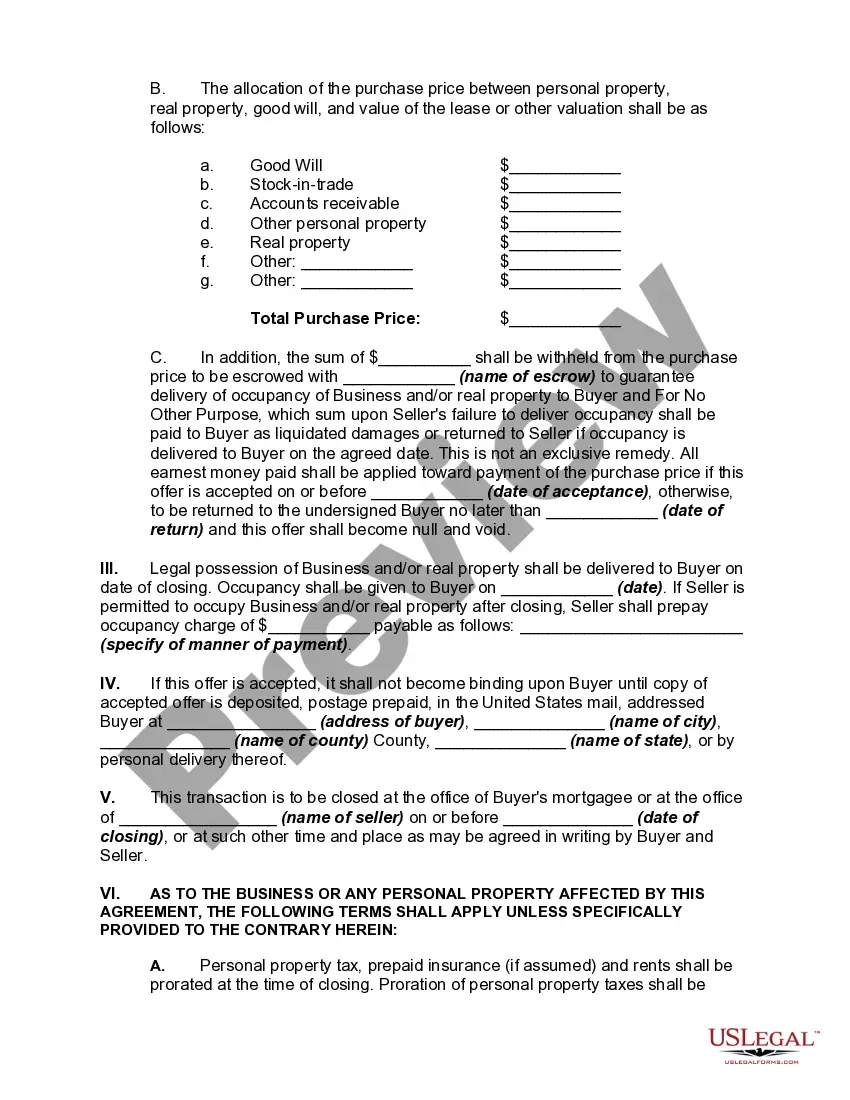

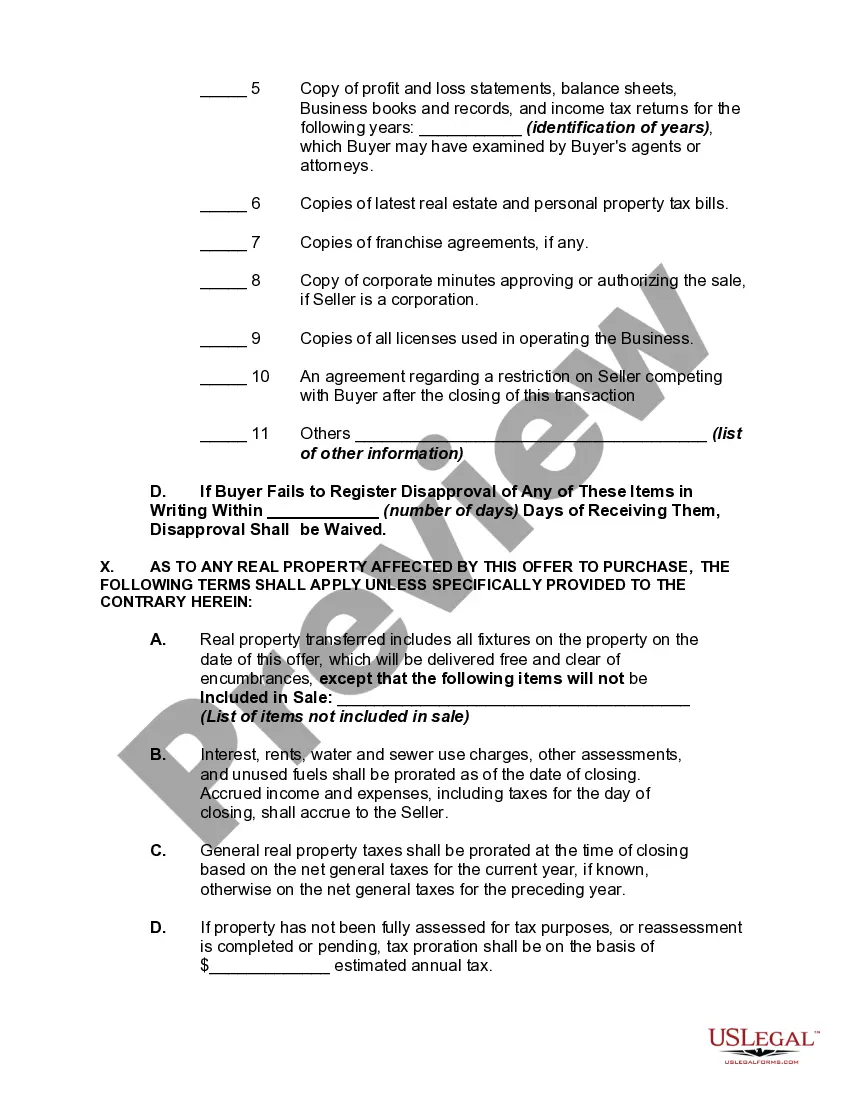

A sale of a business is considered for tax purposes to be a sale of the various assets involved. Therefore it is important that the contract allocate parts of the total payment among the items being sold. For example, the sale may require the transfer of the place of business, including the real property on which the building(s) of the business are located. The sale might involve the assignment of a lease, the transfer of good will, equipment, furniture, fixtures, merchandise, and inventory. The sale may also include the transfer of the business name, patents, trademarks, copyrights, licenses, permits, insurance policies, notes, accounts receivables, contracts, cash on hand and on deposit, and other tangible or intangible properties. It is best to include a broad transfer provision to insure that the entire business is being transferred to the buyer, with an itemization of at least the more important assets to be transferred.