The right of an employee to compensation is based on either an express or implied contract. Whether the employment contract is express or implied, it need not be formalized in order for the terms of employment to begin. Once employment has begun, the employment contract represents the right of the employee to be paid the wages agreed upon for services he or she has performed and the right of an employer to receive the services for which the wages have been paid.

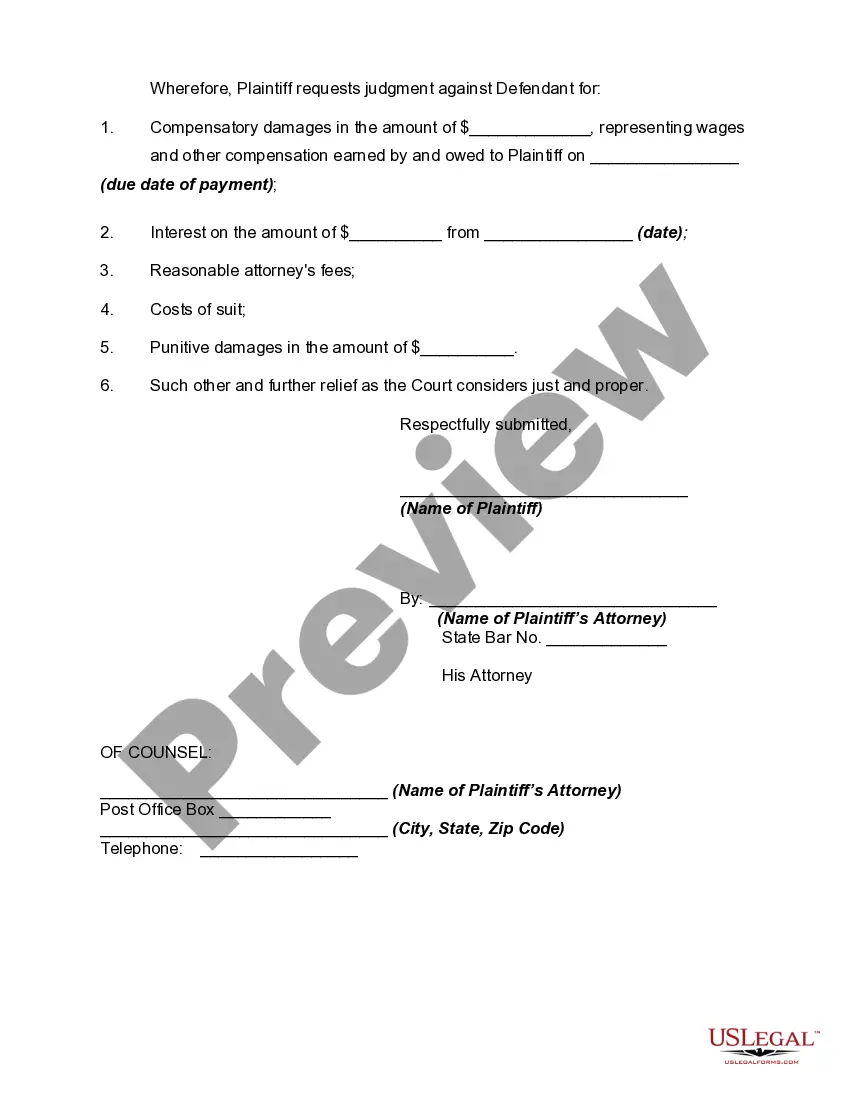

Title: New Jersey Complaint for Recovery of Unpaid Wages: A Comprehensive Overview Introduction: The New Jersey Complaint for Recovery of Unpaid Wages is a legal document that serves as a formal mechanism for employees who have not been paid proper wages or compensation for their work. This carefully crafted complaint allows aggrieved employees to seek restitution and pursue legal action against their employers for wage-related violations in the state of New Jersey. In this article, we will delve into the various types of complaints that can be filed for unpaid wages under New Jersey law. 1. Unpaid Regular Wages Complaint: This type of complaint is filed when an employee has not received their regular wages as agreed upon in their employment contract or according to the state's prevailing minimum wage laws. Key elements to include in this complaint are the specific wage amount owed, the duration of non-payment, and any supporting evidence such as timesheets or pay stubs. 2. Overtime Wages Complaint: New Jersey law stipulates that eligible employees must receive overtime compensation for hours worked beyond the standard 40-hour workweek. If an employer fails to pay the legally mandated overtime rates, the affected employee can file an overtime wages complaint. Pertinent information to include in this complaint would be the number of hours worked, the regular and overtime wages owed, and any relevant timesheet or payroll records. 3. Meal and Rest Breaks Complaint: Employers must provide their employees with suitable meal and rest breaks in accordance with state laws. If an employer denies or deducts wages for missed breaks, employees can file a complaint seeking reimbursement for these unpaid breaks. The complaint should outline the number of breaks missed, the hours during which they were denied, and any incident reports or witness statements supporting the claim. 4. Wage Discrimination Complaint: Under New Jersey law, it is illegal for employers to discriminate against employees in terms of wages on the basis of characteristics such as gender, race, age, disability, or other protected classes. Employees who suspect wage discrimination can file a complaint highlighting the wage disparity, providing evidence of comparable employees in the same role, and any relevant supporting documentation. 5. Deduction Complaint: Employers are generally not permitted to make unauthorized deductions from an employee's wages unless they are required by law or agreed upon in writing. If an employer has made unlawful wage deductions, employees can file a deduction complaint, outlining the specific deductions made and their unjust nature, along with any relevant written agreements or other proof of the employer's actions. Conclusion: The New Jersey Complaint for Recovery of Unpaid Wages gives employees an essential tool to address wage-related violations committed by their employers. By clearly delineating the various types of complaints one can file for different unpaid wage scenarios, employees can proceed confidently in seeking justice and recovering the compensation they rightfully deserve. Remember, consulting with an experienced employment attorney is crucial to fully understand the legal process and maximize chances of a successful resolution.