Title: New Jersey Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock Description: The New Jersey Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock is a legal document that outlines the process and requirements for incorporating a small business in New Jersey as an S Corporation (S Corp) while also qualifying for Section 1244 stock designation. This comprehensive agreement is crucial for entrepreneurs and small business owners seeking to establish their companies with the significant tax benefits and liability protection offered by S Corporation status. The incorporation process in New Jersey offers various advantages for small businesses, including flexibility in taxation, limited liability for owners, and attractive fringe benefits. By opting to incorporate as an S Corp, businesses can enjoy pass-through taxation, minimizing the overall tax burden on owners. Additionally, the Section 1244 stock qualification provides potential tax advantages for shareholders should the business suffer financial losses. Some different types or categories of New Jersey Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock may include: 1. New Jersey S Corporation Formation Agreement: This type of agreement focuses on the specific legal requirements and provisions needed to establish a small business as an S Corporation in New Jersey. It outlines details such as the company's name, purpose, registered agent, director and shareholder information, and the rights and responsibilities of all parties involved. 2. New Jersey Small Business Corporation Agreement: Such an agreement concentrates on the provisions related to forming a small business corporation in New Jersey. It covers crucial aspects such as the formation's intent, capital structure, shareholders' rights and obligations, decision-making procedures, and dissolution provisions. 3. New Jersey Section 1244 Stock Qualification Agreement: This type of agreement puts emphasis on the requirements and conditions to qualify for Section 1244 stock designation in New Jersey. It addresses matters such as the nature of the business, shareholder qualifications, capital structure specifications, and the potential tax benefits available for shareholders in case of financial losses. Establishing an S Corp with Section 1244 stock qualification in New Jersey can potentially provide significant tax advantages to business owners and shareholders, making it an attractive option for small enterprises. However, it is crucial to consult legal and financial professionals to ensure compliance with all regulations and to maximize the benefits afforded by these designations. Keywords: New Jersey, Agreement, Incorporate, S Corp, Small Business Corporation, Section 1244 Stock, legal document, tax benefits, liability protection, incorporation process, pass-through taxation, shareholder qualifications, tax advantages, financial losses.

New Jersey Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

How to fill out New Jersey Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

US Legal Forms - one of the greatest libraries of authorized varieties in the United States - gives an array of authorized file templates it is possible to acquire or print. Using the website, you will get 1000s of varieties for company and person reasons, sorted by classes, claims, or keywords.You can find the latest types of varieties just like the New Jersey Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock in seconds.

If you already have a registration, log in and acquire New Jersey Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock from your US Legal Forms library. The Obtain button can look on every form you perspective. You have accessibility to all formerly delivered electronically varieties from the My Forms tab of your own account.

In order to use US Legal Forms the first time, listed here are simple directions to help you began:

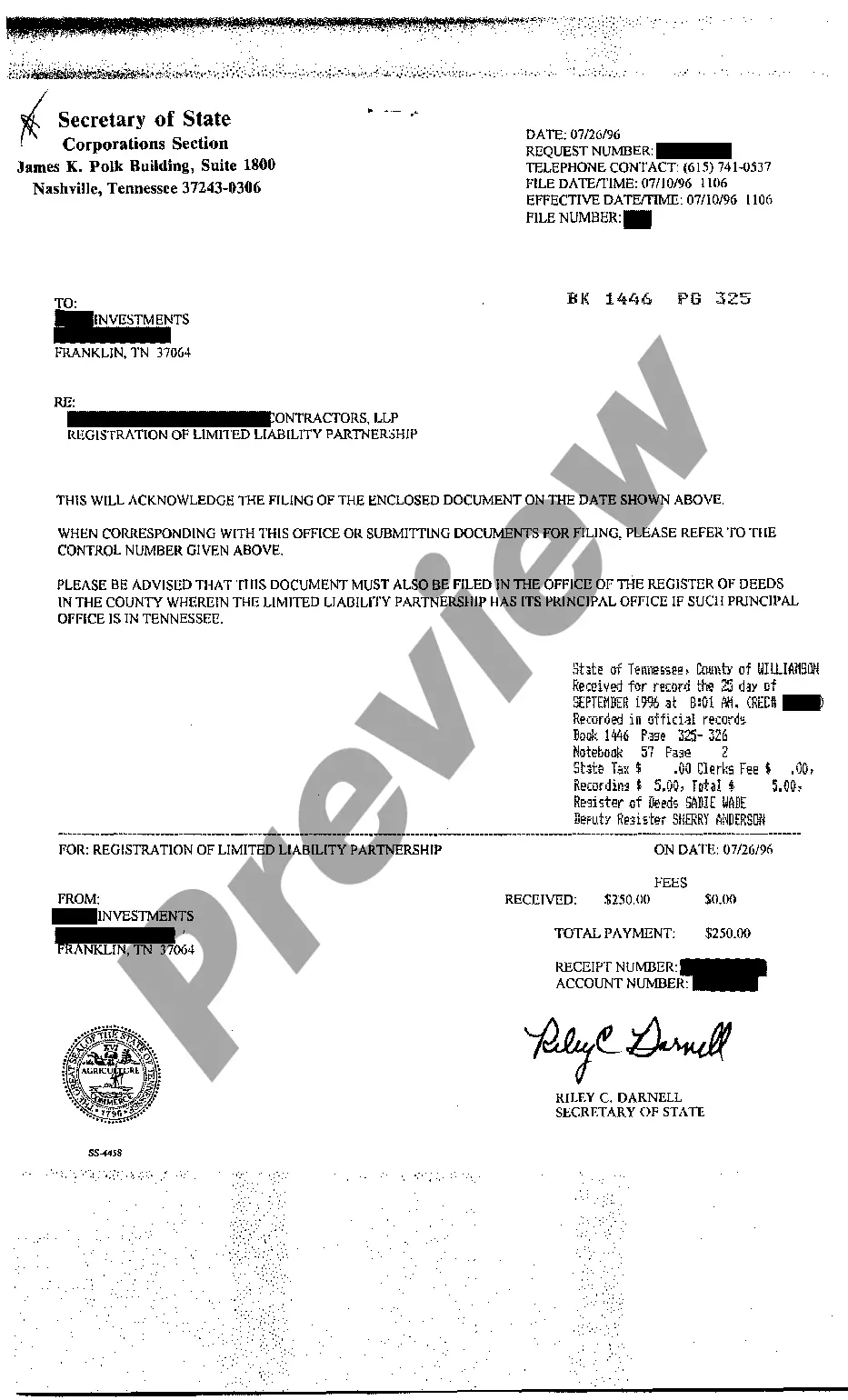

- Be sure to have picked the best form for the metropolis/state. Click the Preview button to check the form`s content material. Browse the form information to ensure that you have chosen the appropriate form.

- In the event the form doesn`t suit your specifications, take advantage of the Search field on top of the monitor to find the one that does.

- When you are content with the form, validate your selection by visiting the Get now button. Then, select the pricing program you prefer and provide your credentials to register on an account.

- Procedure the deal. Use your bank card or PayPal account to complete the deal.

- Choose the structure and acquire the form on your gadget.

- Make changes. Complete, change and print and signal the delivered electronically New Jersey Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock.

Every single web template you put into your account lacks an expiry particular date which is yours forever. So, if you wish to acquire or print one more duplicate, just check out the My Forms portion and click on around the form you require.

Get access to the New Jersey Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock with US Legal Forms, by far the most considerable library of authorized file templates. Use 1000s of expert and express-specific templates that meet up with your small business or person requires and specifications.

Form popularity

FAQ

Section 1244 of the Internal Revenue Code allows eligible shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than a capital loss. Eligible investors include individuals, partnerships and LLCs taxed as partnerships.

In order to qualify as §1244 stock, the stock must be issued, and the consideration paid by the shareholder must consist of money or other property, not services. Stock and other securities are not "other property" for this purpose.

S corporations as small business corporations. S corporations can issue Section 1244 stock.

To qualify under Section 1244, these five requirements must be adhered to:The stock must be acquired in exchange for cash or property contributed to the corporation.The corporation must issue the stock directly to the investors.The corporation must be an actual, operating company.More items...?

1244 stock is issued to S corporations, such corporations and their shareholders may not treat losses on such stock as ordinary losses. This is so notwithstanding IRC Sec. 1363, which provides that the taxable income of an S corporation must be computed in the same manner as that of an individual.

The maximum aggregate loss that may be treated by a taxpayer as ordinary loss for a taxable year with respect to an issuing corporation's Section 1244 stock is $50,000, or $100,000 for a husband and wife filing a joint return. Any loss in excess of the maximum allowable loss must be treated as a capital loss.

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of