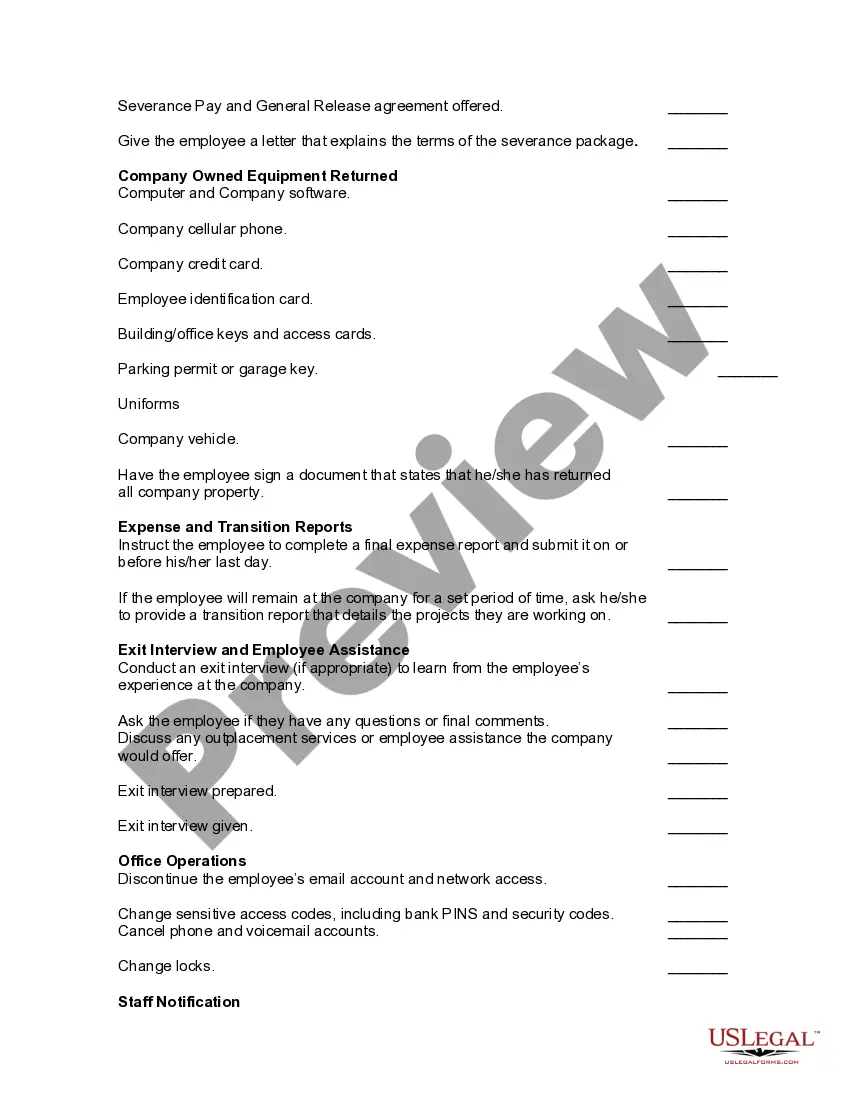

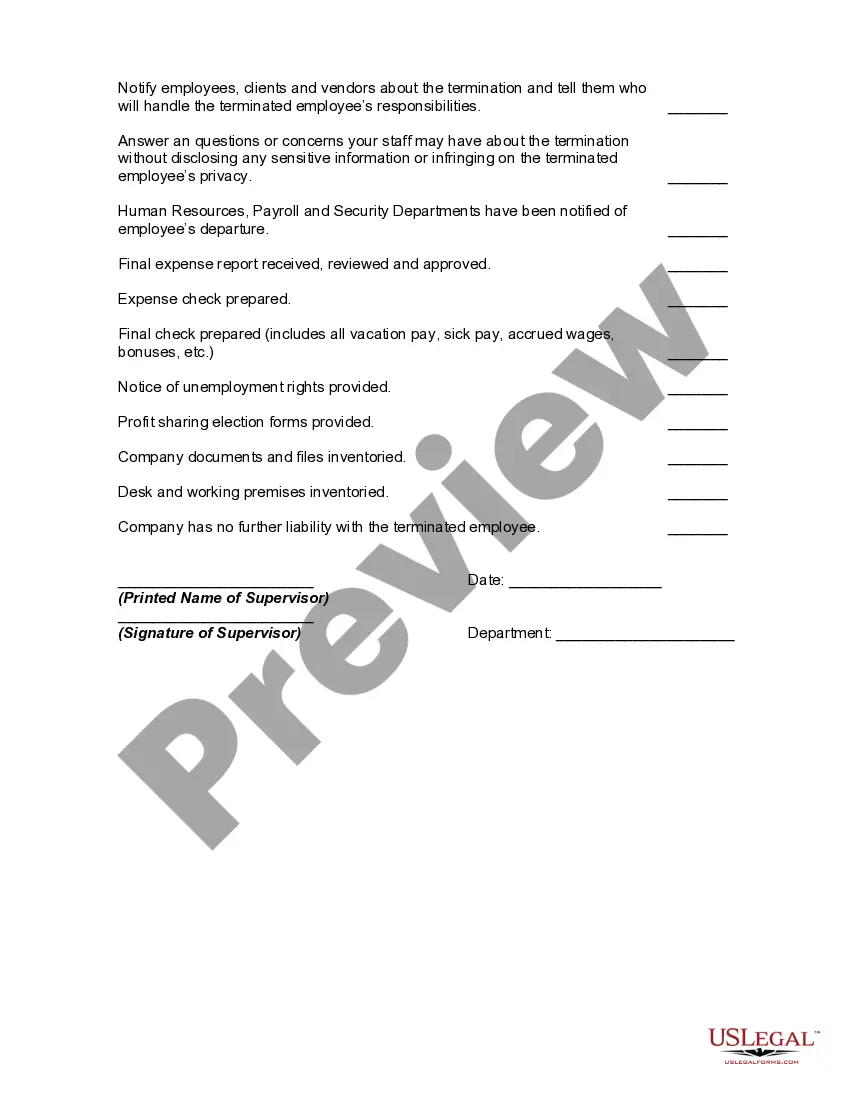

The following items should be checked off prior to an employee's final date of employment. Not all items will apply to all employees or to all circumstances.

New Jersey Worksheet — Termination of Employment is a comprehensive document designed to assist employers in properly terminating employees in compliance with the labor laws and regulations of the state. Whether you are an employer, HR professional, or business owner based in New Jersey, this worksheet acts as a valuable tool to ensure a smooth and legally compliant termination process. Key components of the New Jersey Worksheet — Termination of Employment: 1. Notice and Documentation: The worksheet guides employers on providing adequate notice to employees about termination and collecting necessary documentation, such as resignation letters, termination notices, and separation agreements. 2. Final Pay and Benefits: This section outlines the employer's obligations regarding the final paycheck, outstanding wages, unused vacation or sick leave, and benefits continuation or termination according to New Jersey labor laws. 3. Severance Agreements: In situations where an employer intends to offer a severance package, the worksheet provides information on drafting, negotiating, and executing appropriate severance agreements, ensuring compliance with state-specific requirements. 4. Unemployment Insurance (UI): Details regarding the employer's responsibility of providing necessary information to employees regarding unemployment benefits and the process for obtaining UI benefits in New Jersey are covered in this section. 5. Compliance with Anti-Discrimination Laws: The document highlights the importance of adhering to New Jersey's anti-discrimination laws during the termination process to prevent potential discrimination claims. It provides guidance on avoiding discriminatory practices based on race, gender, age, disability, and other protected characteristics. 6. Retention of Records: The worksheet outlines the required retention period for termination-related documentation, including records such as personnel files, termination notices, and separation agreements, as specified by New Jersey record keeping laws. Different types of New Jersey Worksheet — Termination of Employment: 1. Basic Termination Worksheet: A fundamental worksheet that covers the essential steps and considerations for terminating an employee in compliance with New Jersey labor laws. 2. Termination Due to Poor Performance Worksheet: This worksheet focuses on addressing terminations resulting from poor employee performance, including guidance on performance improvement plans, documentation, and legal risks associated with such terminations. 3. Termination for Misconduct Worksheet: Specifically designed for termination cases involving employee misconduct, this worksheet helps employers navigate the unique challenges associated with firing employees for reasons such as violation of company policies, theft, harassment, or insubordination while ensuring legal compliance throughout the process. 4. Reduction in Force (RIF) Worksheet: In situations where downsizing or business restructuring necessitates employee terminations, this worksheet provides a framework for conducting a lawful and fair reduction in force process, including considerations such as WARN Act compliance and severance options. 5. Termination Checklist for Employers: A comprehensive checklist that can be used as a quick reference guide for employers to ensure they have fulfilled all necessary legal obligations during the termination process, covering aspects like notification, final pay, return of company property, and benefits administration. By utilizing the New Jersey Worksheet — Termination of Employment, employers can streamline their termination procedures, minimize legal risks, and maintain compliance with the labor laws of the state, ultimately promoting a fair and professional work environment for all parties involved.