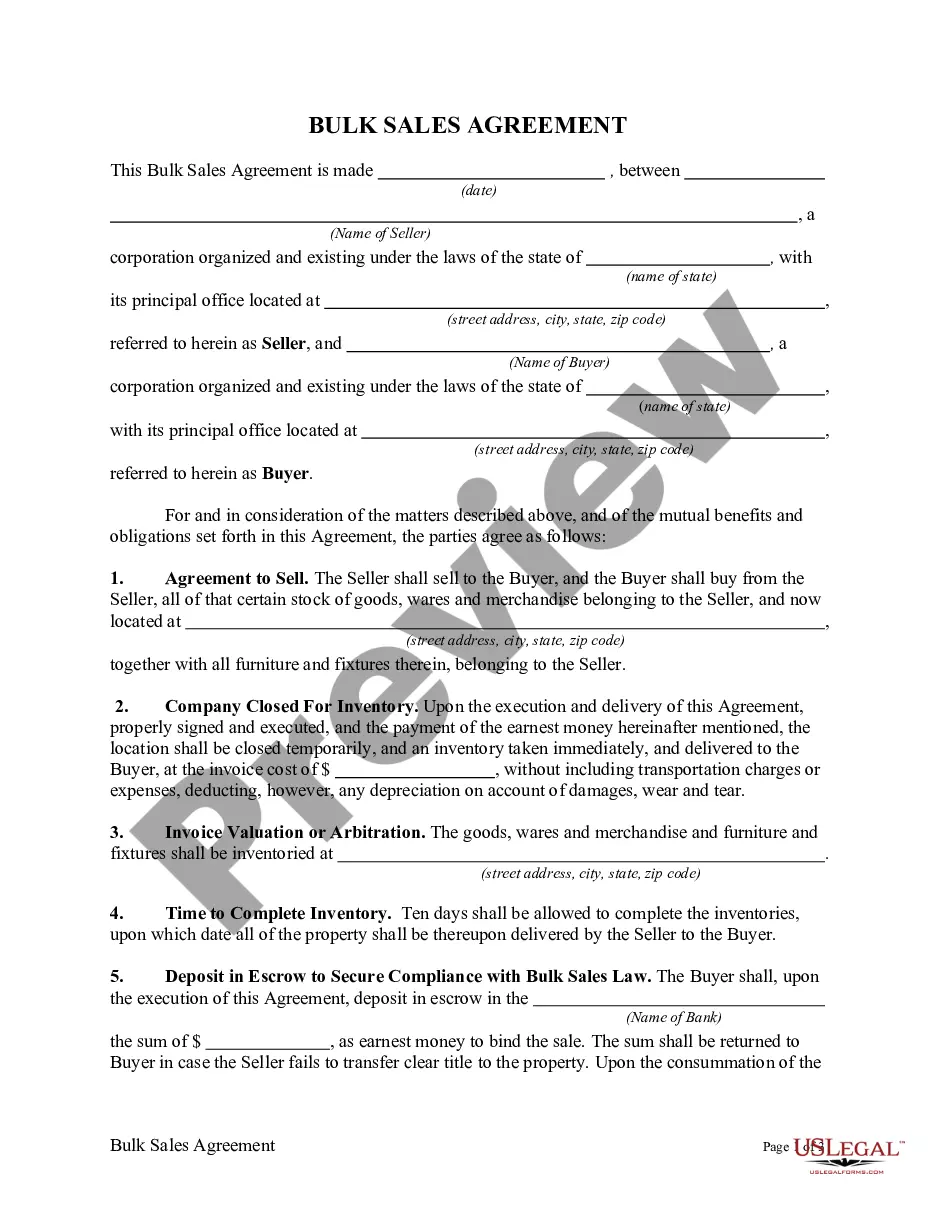

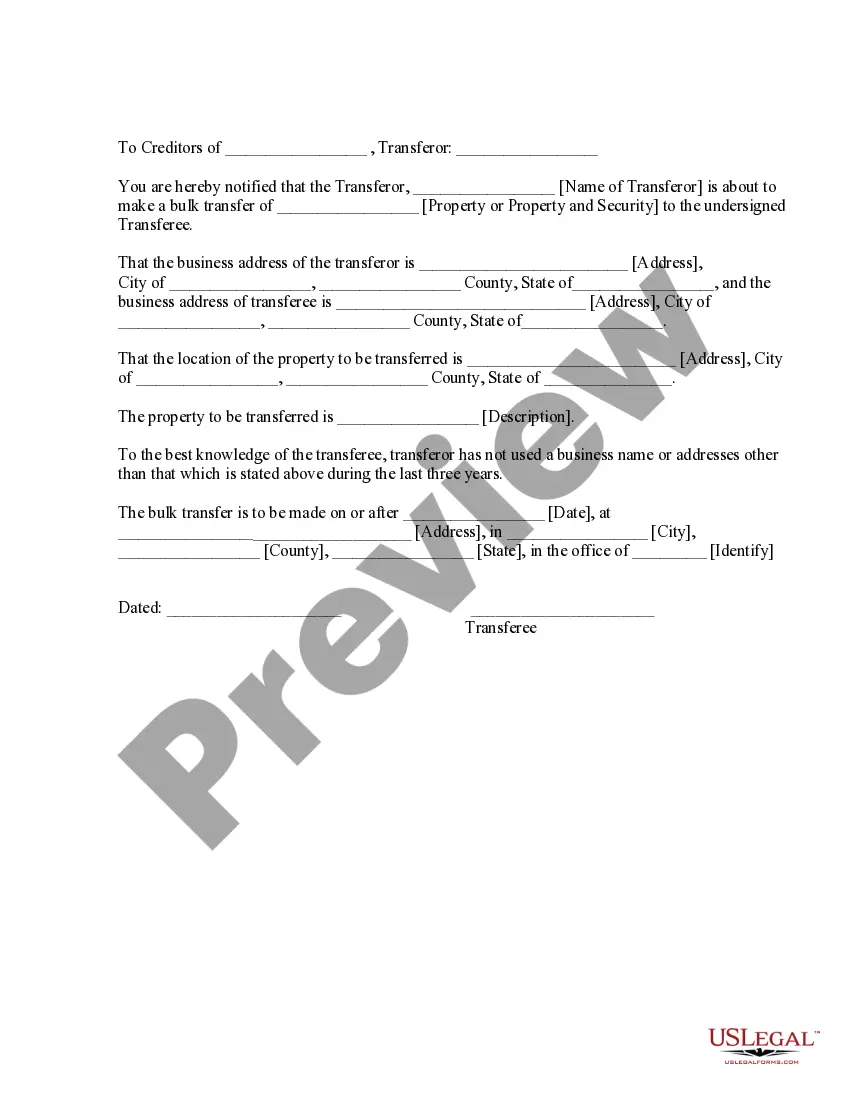

A bulk sale is a sale of goods by a business which engages in selling items out of inventory (as opposed to manufacturing or service industries), often in liquidating or selling a business, and is governed by the bulk sales law. Article 6 of the Uniform Commercial Code (UCC), which has been adopted at least in part all states, governs bulk sales. The heart of the bulk sales law is the requirement that the transferee provide the transferor's creditors with notice of the pending bulk transfer. This notice is the essential protection provided to creditors; once notified, the creditor must take the necessary steps to adequately protect his or her interest.

New Jersey Bulk Sale Notice

Description

How to fill out Bulk Sale Notice?

It is feasible to dedicate numerous hours online searching for the legal document template that meets the federal and state requirements you have.

US Legal Forms provides an extensive collection of legal forms that are verified by experts.

You can easily download or print the New Jersey Bulk Sale Notice from the service.

If available, utilize the Preview button to review the document format as well.

- If you possess a US Legal Forms account, you can Log In and click the Acquire button.

- Subsequently, you can complete, modify, print, or sign the New Jersey Bulk Sale Notice.

- Every legal document template you obtain is yours indefinitely.

- To download another copy of any purchased form, navigate to the My documents section and click on the relevant button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the right document format for the county/city of your choice.

- Review the form description to guarantee that you have picked the correct form.

Form popularity

FAQ

Bulk sales are a unique way to sell your property. Instead of selling one by unit, you can package many properties in bulk and get them off the market at once. Bulk sales escrow is an arrangement where the proceeds from a company's sale are placed into an account that can only be accessed by unsecured creditors.

Buyers of businesses should be aware that California, like some other states, has a bulk sales law. Its official name is Uniform Commercial CodeBulk Sales. The bulk sales act is designed to protect the creditors of a business by giving them notice of a bulk sale (sometimes called a bulk transfer).

A bulk sale is the sale (or transfer or assignment) of an individual's or company's business asset/s, in whole or in part, outside of the ordinary course of business.

The State of New Jersey imposes a Realty Transfer Fee (RTF) on the seller whenever there is a transfer of title by deed. The fee is based on the sales price of the property, and the seller is required to pay the fee at the time of closing.

A bulk sale, sometimes called a bulk transfer, is when a business sells all or nearly all of its inventory to a single buyer and such a sale is not part of the ordinary course of business.

DEFINITIONS1. bought or sold in large quantities. large companies that buy and sell in bulk.

New Jersey Bulk Sale Act Introduction The New Jersey Bulk Sale Act (N.J.S. -38) (the Bulk Sale Act) applies to many types of transactions and can expose purchasers, transferees and assignees (each a Purchaser) to all of a seller's State tax liabilities.

Under California law, a bulk sale is defined as a sale of more than half of a business' inventory and equipment, as measured by fair market value, that is not part of the seller's ordinary course of business. In order for the law to apply, the seller has to be physically located in California.

In general, a bulk sale is a sale to a buyer of all or most of the assets of the business outside the ordinary course of business.