New Jersey Verification of Employment (VOTE) is a process that confirms an individual's current or previous employment status in the state of New Jersey. Does are often provided by employers, lending institutions, or government agencies to verify employment history and income for various purposes, such as loan applications, housing applications, background checks, and government benefits. The primary purpose of a New Jersey Verification of Employment is to authenticate an individual's income and employment status, ensuring the accuracy of information provided. This verification process helps lenders, employers, and other relevant parties make informed decisions based on the applicant's financial stability and employment history. There are different types of New Jersey Verification of Employment, depending on the entity requesting the verification and the specific requirements involved. Here are a few common types: 1. Standard Employment Verification: This type of verification is typically requested by lending institutions during mortgage or loan application processes. It confirms basic employment details such as job title, current employment status, dates of employment, and salary or hourly wage. 2. Income Verification: This type of verification focuses on an individual's income details, including base salary, overtime pay, commissions, and bonuses. Lenders and landlords often require income verification to assess an applicant's financial capability to repay loans or afford rent. 3. Government Assistance Verification: Government agencies and programs may require verification of employment and income to determine an individual's eligibility for certain benefits, such as unemployment benefits, Medicaid, food stamps, or housing assistance. This type of verification helps ensure that those in need receive appropriate support. 4. Background Check Employment Verification: Employers may request verification of employment as part of their hiring or screening process. This type of verification often includes information regarding an individual's job title, job responsibilities, dates of employment, and eligibility for rehire. To obtain New Jersey Verification of Employment, individuals typically need to complete a request form provided by the requesting entity. This form usually requires personal information, such as full name, social security number, current and previous employers, and contact details. Once the form is submitted, the entity may contact the employer or a designated verification service to authenticate the employment details provided. In conclusion, New Jersey Verification of Employment is a crucial process that validates an individual's employment history and income for various purposes. Through different types of verification, lenders, landlords, employers, and government agencies ensure the accuracy of information, making well-informed decisions regarding loans, rentals, employment, or benefits eligibility.

New Jersey Verification of Employment

Description

How to fill out New Jersey Verification Of Employment?

It is possible to invest hrs on the Internet trying to find the lawful papers template that suits the federal and state requirements you want. US Legal Forms gives thousands of lawful kinds that happen to be examined by specialists. It is simple to download or produce the New Jersey Verification of Employment from the services.

If you already possess a US Legal Forms accounts, you can log in and click on the Download button. Next, you can comprehensive, edit, produce, or signal the New Jersey Verification of Employment. Every lawful papers template you get is yours forever. To get yet another backup for any acquired type, proceed to the My Forms tab and click on the related button.

If you work with the US Legal Forms site for the first time, stick to the easy recommendations below:

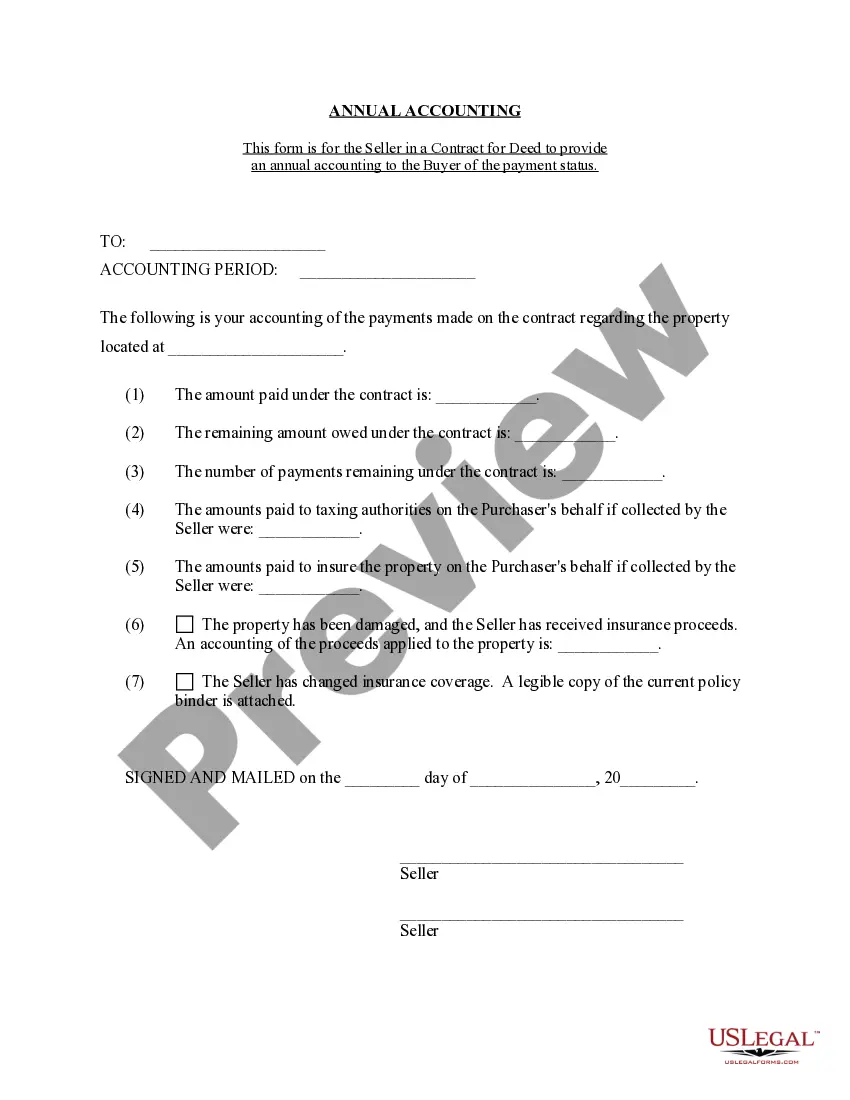

- Initially, ensure that you have chosen the proper papers template for your county/metropolis of your choosing. Read the type outline to ensure you have picked out the proper type. If offered, use the Review button to check through the papers template as well.

- If you wish to get yet another edition of the type, use the Research field to obtain the template that meets your needs and requirements.

- When you have located the template you need, click on Purchase now to move forward.

- Select the rates strategy you need, type in your credentials, and register for your account on US Legal Forms.

- Full the deal. You can use your credit card or PayPal accounts to pay for the lawful type.

- Select the file format of the papers and download it to the system.

- Make changes to the papers if needed. It is possible to comprehensive, edit and signal and produce New Jersey Verification of Employment.

Download and produce thousands of papers themes while using US Legal Forms web site, that offers the biggest assortment of lawful kinds. Use skilled and state-certain themes to tackle your business or person demands.