Subject: Your Inquiry — Mortgage Options in New Jersey Dear [Customer's Name], Thank you for reaching out to [Mortgage Company] regarding your inquiry about mortgage options in New Jersey. We appreciate your interest and would be delighted to assist you in finding the perfect mortgage solution that best fits your needs. New Jersey offers a diverse range of mortgage products, tailored to cater to different individuals and their unique financial circumstances, such as: 1. Conventional Mortgages: Conventional mortgages are the most common type of home loans, ideal for borrowers with good credit scores and stable incomes. They typically require a down payment of at least 3%, but can vary based on your specific situation and loan program. 2. Fixed-Rate Mortgages: Fixed-rate mortgages maintain the same interest rate throughout the loan term, providing stability and predictability. They are perfect for borrowers seeking consistency in monthly payments and protection against potential interest rate fluctuations. 3. Adjustable-Rate Mortgages (ARM's): ARM's offer an initial fixed interest rate for a specified period, typically 5, 7, or 10 years, and then adjust annually based on prevailing market rates. These mortgages are a great choice for individuals planning to move or refinance before the initial fixed rate period ends. 4. Government-Backed Mortgages: New Jersey residents may also qualify for government-insured mortgages such as FHA (Federal Housing Administration) loans, VA (Veterans Affairs) loans for eligible veterans, or USDA (United States Department of Agriculture) loans for rural areas. These programs often offer more flexible qualification requirements and lower down payment options. Our experienced mortgage professionals will work closely with you to determine the best mortgage solution for your unique situation. We take pride in offering competitive interest rates, flexible terms, and exceptional customer service. To get started, we kindly request additional information about your financial standing and homeownership goals. Please provide us with the following documents (if available): — Recent pay stubs or prooincomeom— - Tax returns (previous two years) — Bank statements (previous two to three months) — Identification documents (e.g., driver's license, passport) — Credit history or credit score report (if already obtained) Once we have received the required information, we will promptly review your application and provide you with a detailed analysis of the mortgage options available to you. At [Mortgage Company], ensuring your satisfaction and securing your dream home is our ultimate goal. We understand that obtaining a mortgage can be a complex process, so we are committed to guiding you through every step of the way. Please don't hesitate to contact our office at [Phone Number] or reply to this email if you have any further questions or require additional assistance. We look forward to serving you and making your homeownership dreams in New Jersey a reality. Thank you for considering [Mortgage Company] as your trusted mortgage partner. Warm regards, [Your Name] [Your Title/Position] [Mortgage Company Name] [Mortgage Company Contact Information]

New Jersey Sample Letter for Response to Inquiry - Mortgage Company

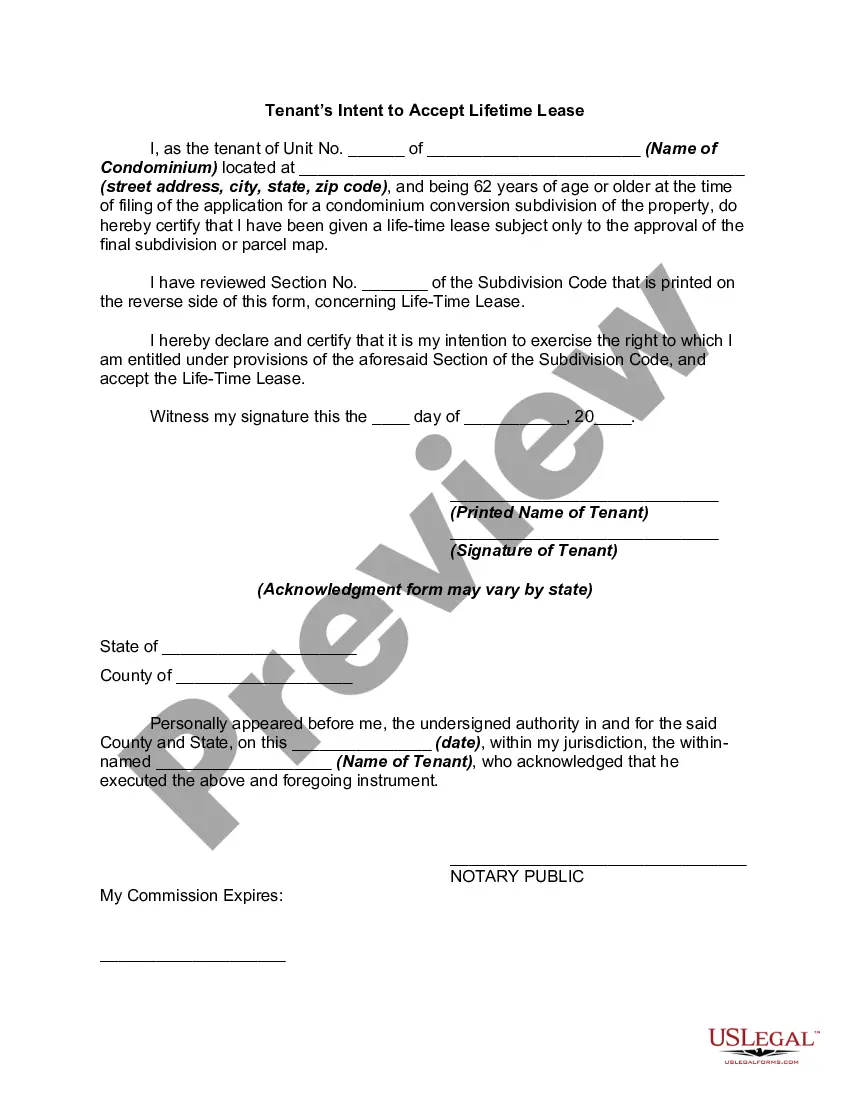

Description

How to fill out New Jersey Sample Letter For Response To Inquiry - Mortgage Company?

You may invest time on the Internet attempting to find the authorized document design that fits the state and federal needs you want. US Legal Forms offers thousands of authorized kinds which are reviewed by pros. It is possible to obtain or print the New Jersey Sample Letter for Response to Inquiry - Mortgage Company from the support.

If you have a US Legal Forms accounts, you can log in and then click the Download option. Afterward, you can complete, revise, print, or indicator the New Jersey Sample Letter for Response to Inquiry - Mortgage Company. Every single authorized document design you buy is yours eternally. To have one more duplicate of the acquired kind, visit the My Forms tab and then click the related option.

If you are using the US Legal Forms site the first time, stick to the straightforward instructions listed below:

- Initially, make certain you have chosen the correct document design for your area/area of your liking. Look at the kind description to make sure you have chosen the appropriate kind. If readily available, make use of the Preview option to look with the document design also.

- If you wish to discover one more model of your kind, make use of the Look for area to get the design that meets your needs and needs.

- Upon having located the design you would like, simply click Get now to proceed.

- Select the costs prepare you would like, enter your references, and sign up for a free account on US Legal Forms.

- Complete the deal. You should use your charge card or PayPal accounts to fund the authorized kind.

- Select the formatting of your document and obtain it to your system.

- Make adjustments to your document if needed. You may complete, revise and indicator and print New Jersey Sample Letter for Response to Inquiry - Mortgage Company.

Download and print thousands of document web templates while using US Legal Forms Internet site, which provides the most important variety of authorized kinds. Use professional and status-particular web templates to deal with your organization or personal requires.