New Jersey Loan Commitment Agreement

Description

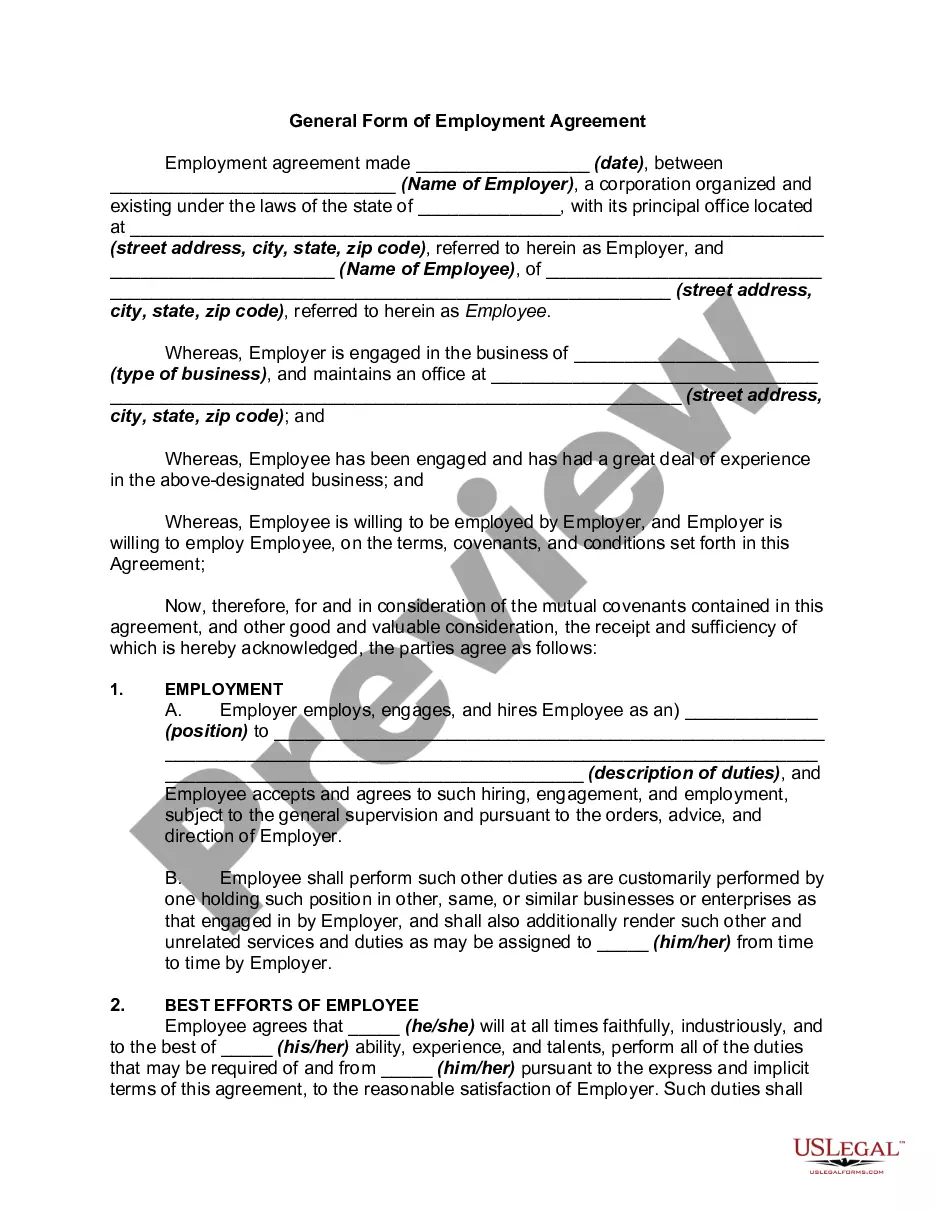

How to fill out Loan Commitment Agreement?

US Legal Forms - among the largest libraries of legitimate forms in the USA - provides a variety of legitimate file web templates you are able to acquire or produce. Making use of the web site, you may get thousands of forms for enterprise and personal functions, categorized by groups, claims, or keywords and phrases.You will find the most up-to-date variations of forms like the New Jersey Loan Commitment Agreement in seconds.

If you already possess a subscription, log in and acquire New Jersey Loan Commitment Agreement through the US Legal Forms library. The Down load switch can look on every single kind you look at. You gain access to all formerly acquired forms inside the My Forms tab of the accounts.

If you wish to use US Legal Forms initially, here are straightforward instructions to help you get began:

- Be sure to have picked the proper kind for the city/region. Select the Review switch to check the form`s content. Look at the kind description to actually have chosen the appropriate kind.

- In case the kind does not fit your demands, utilize the Lookup field towards the top of the screen to discover the one that does.

- In case you are happy with the form, confirm your selection by simply clicking the Get now switch. Then, pick the pricing program you favor and give your qualifications to register for an accounts.

- Method the purchase. Make use of bank card or PayPal accounts to complete the purchase.

- Find the structure and acquire the form on your own device.

- Make changes. Load, modify and produce and sign the acquired New Jersey Loan Commitment Agreement.

Each and every template you included with your bank account lacks an expiration particular date and is also the one you have permanently. So, if you want to acquire or produce yet another version, just proceed to the My Forms section and then click about the kind you want.

Obtain access to the New Jersey Loan Commitment Agreement with US Legal Forms, the most considerable library of legitimate file web templates. Use thousands of specialist and express-particular web templates that satisfy your organization or personal requirements and demands.

Form popularity

FAQ

It signifies that financing is officially approved for a real estate transaction. Getting a mortgage commitment letter can be an exciting step in the home buying process because it can show sellers that your loan application has been approved and you have the funds to purchase their home.

A loan commitment is an agreement by a commercial bank or other financial institution to lend a business or individual a specified sum of money. A loan commitment is useful for consumers looking to buy a home or a business planning to make a major purchase.

Before receiving the full mortgage contract, you will receive a letter of commitment (also known as an approval letter). It signifies that financing has been officially approved and represents a formal, binding contract between you and the lender once signed. This letter outlines the terms and conditions of the loan.

The lender may include a deadline or a specified date by which the appraisal must be completed and meet the lender's requirements. So, to clarify, the commitment letter can come before the appraisal, with the appraisal being a condition to be completed at a later or specified date.

Your mortgage commitment letter is comprised of all the terms that you and your lender have agreed upon. Included will be the approved loan amount and other conditions required by the lender. This is basically your golden ticket to home-ownership!

It's important to note that just because your mortgage company created the commitment letter, doesn't mean you shouldn't be able to still back out. Nothing is final for the borrower until the loan is funded and all the closing documents are signed.

Section -16.5 - Commitment process (a) At or before issuance of a commitment, the lender shall disclose in writing the following: 1. The expiration date of the commitment; 2. The amount financed, which shall have the same meaning as that term is defined in Federal Regulation Z; 3.