New Jersey Surety Agreement

Description

How to fill out Surety Agreement?

You can spend hours online seeking the authentic document template that meets the federal and state requirements you need.

US Legal Forms offers countless legitimate forms that have been reviewed by professionals.

You can easily obtain or print the New Jersey Surety Agreement from my service.

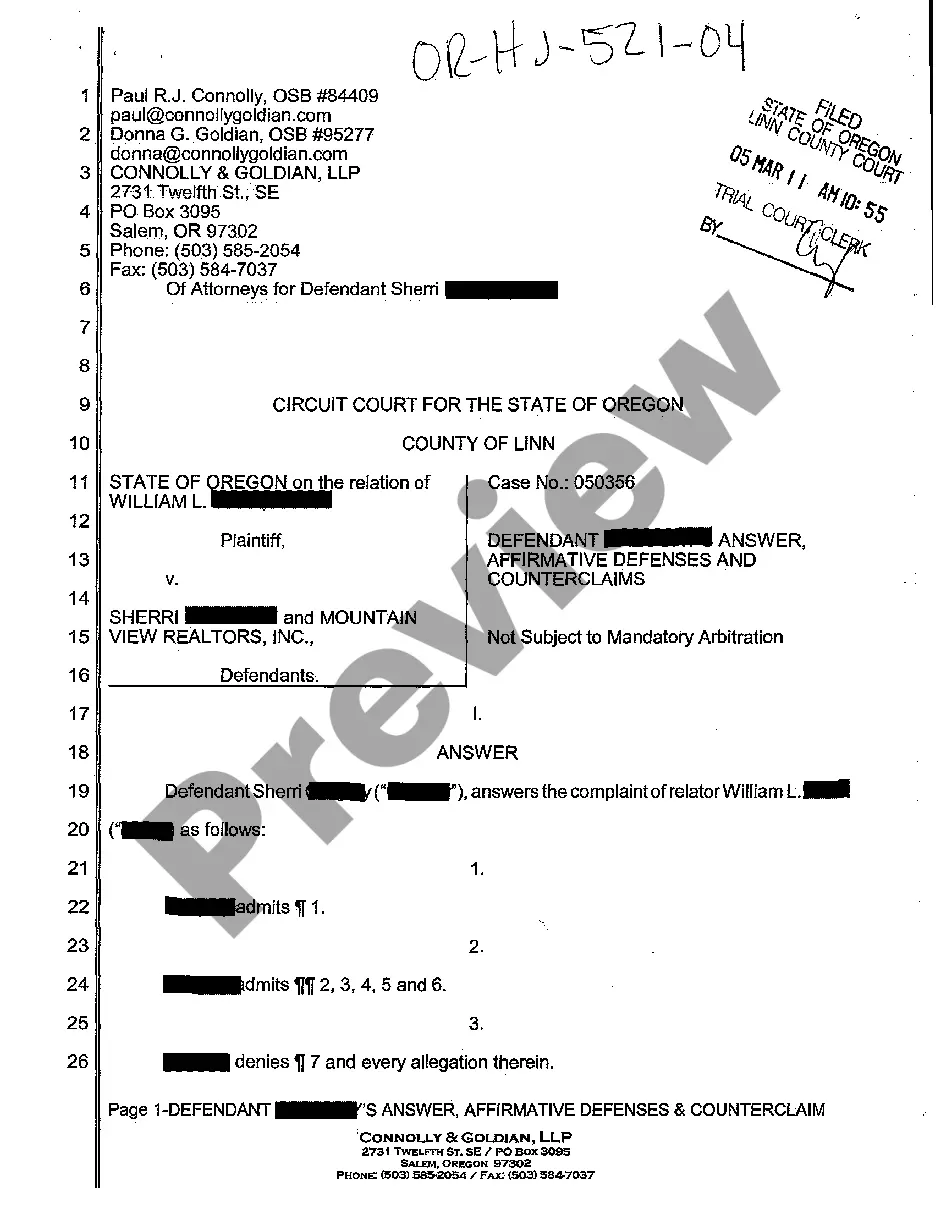

If available, utilize the Review button to go over the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Download button.

- Subsequently, you can complete, modify, print, or sign the New Jersey Surety Agreement.

- Every legitimate document template you acquire is yours forever.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the easy instructions below.

- First, ensure that you have chosen the correct document template for the area/city of your choice.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

The three most common types of contract surety bonds are bid bonds, performance bonds, and payment bonds. Bid bonds require that contractors enter into a contract if their bid for a project has been accepted by the obligee.

Surety bonds are typically required for contractors who seek to work on high-cost government contracts. Even when not compulsory, surety bonds make sense when a contract requires performance, because they help compensate obligees when principals fail to meet their contractual obligations.

NJ collection agencies are required to obtain a $5,000 surety bond and file it with the New Jersey Secretary of State. This is to protect the public against mishandling of collected funds.

These bond types are also referred to as commercial bonds" or business bonds." Examples of license and permit surety bonds include auto dealer bonds, mortgage broker bonds, and collection agency bonds.

These bond types are also referred to as commercial bonds" or business bonds." Examples of license and permit surety bonds include auto dealer bonds, mortgage broker bonds, and collection agency bonds.

Surety Bond Requirements in NJStarting January 1, 2021, student loan servicing businesses in New Jersey must have a surety bond to be licensed. To receive your license in the new year, you must file the bond with your application to the Nationwide Multistate Licensing System by December 31, 2020.

To get any type of surety bond in NJ you'll need to start the process by submitting an application form and the required supporting documentation to a bonding company licensed to operate in the state. Viking Bond Service offers an easy application process for all bonds.

To get any type of surety bond in NJ you'll need to start the process by submitting an application form and the required supporting documentation to a bonding company licensed to operate in the state. Viking Bond Service offers an easy application process for all bonds.

Someone who assumes direct liability for another's obligation. Financial creditors may require the debtor to find a surety, who then signs the loan agreement along with the debtor.

Surety Explained in Detail A surety bond is a legal binding agreement signed between three partiesthe lender, the trustee, and the guarantor. The obligee, generally a government agency, allows the principal to receive a security bond as a protection against future work output, normally a business owner or contractor.