New Jersey Complaint for Impropriety Involving Loan Application

Description

How to fill out Complaint For Impropriety Involving Loan Application?

Are you presently in the placement the place you require documents for sometimes company or person purposes nearly every day time? There are plenty of legitimate document web templates accessible on the Internet, but locating versions you can rely is not simple. US Legal Forms gives 1000s of develop web templates, such as the New Jersey Complaint for Impropriety Involving Loan Application, which can be composed in order to meet state and federal specifications.

Should you be already familiar with US Legal Forms internet site and also have a merchant account, basically log in. Following that, you are able to download the New Jersey Complaint for Impropriety Involving Loan Application design.

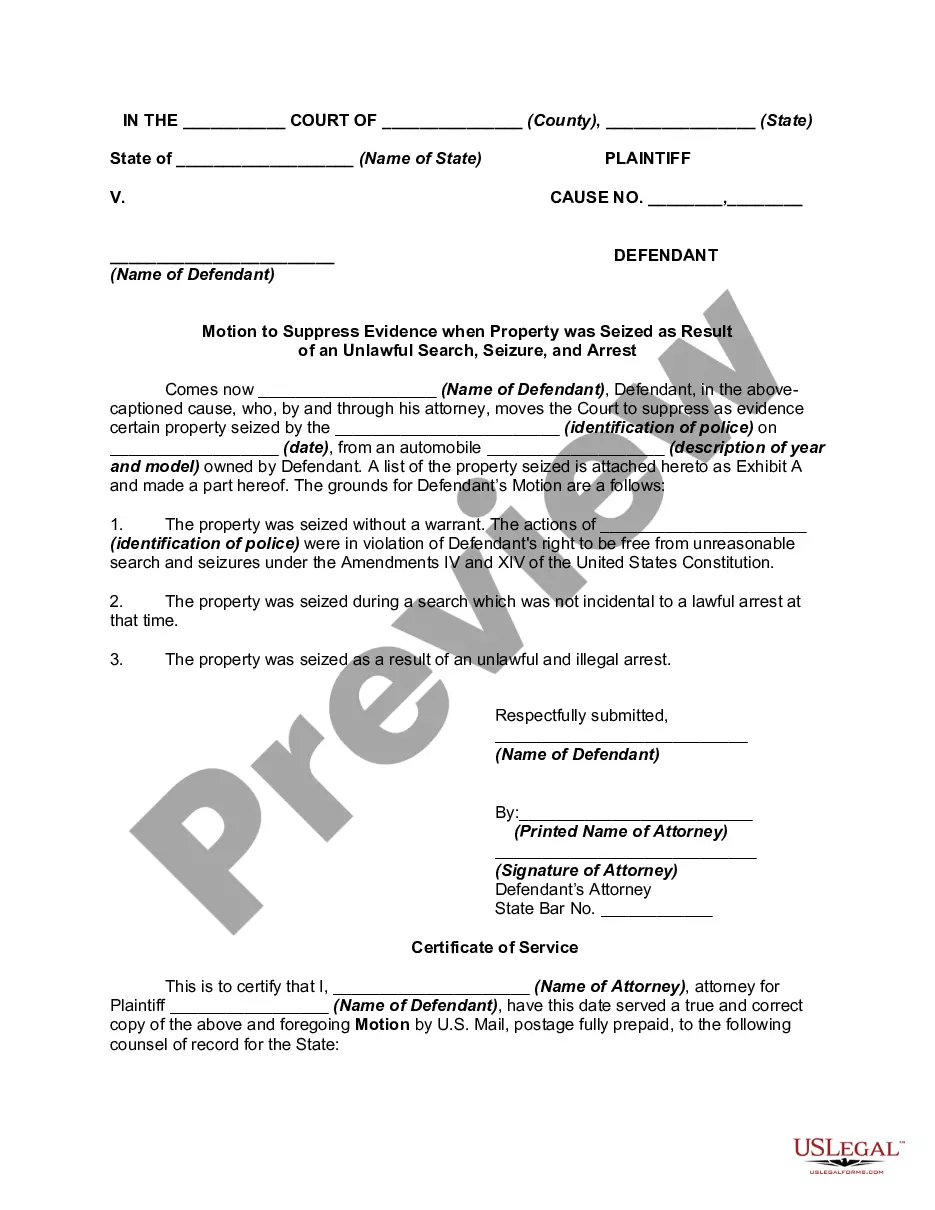

Unless you offer an account and need to start using US Legal Forms, abide by these steps:

- Get the develop you want and make sure it is for that correct city/area.

- Make use of the Review option to examine the shape.

- See the explanation to actually have chosen the correct develop.

- If the develop is not what you`re trying to find, use the Research discipline to find the develop that meets your needs and specifications.

- If you get the correct develop, click on Buy now.

- Opt for the rates plan you need, fill out the required information to generate your money, and buy the transaction making use of your PayPal or credit card.

- Decide on a practical document file format and download your version.

Locate each of the document web templates you have purchased in the My Forms food selection. You can aquire a further version of New Jersey Complaint for Impropriety Involving Loan Application whenever, if necessary. Just click the needed develop to download or print the document design.

Use US Legal Forms, by far the most substantial assortment of legitimate kinds, to save lots of time and avoid errors. The support gives skillfully produced legitimate document web templates that can be used for a selection of purposes. Produce a merchant account on US Legal Forms and initiate producing your daily life a little easier.

Form popularity

FAQ

We investigate complaints and answer hundreds of consumer questions every day. If we can't help, we will provide you with the contact information for a State or Federal agency that can help.

New Jersey Department of Banking and Insurance. Consumer Inquiry and Response Center (?CIRC?) P.O. Box 471 ? Trenton, New Jersey 08625-0471. Phone: (609) 292-7272. Fax: (609) 777-0508 or (609) 292-2431.

Division Initiatives. Angelie's Law. Board Related Information. Laws & Regulations. Email. General AskConsumerAffairs@dca.lps.state.nj.us. Call. Consumer Service Center Hotline (973) 504-6200. Toll free (NJ only) (800) 242-5846. Visit. 124 Halsey Street. At this time, all visitors to DCA offices require an appointment.

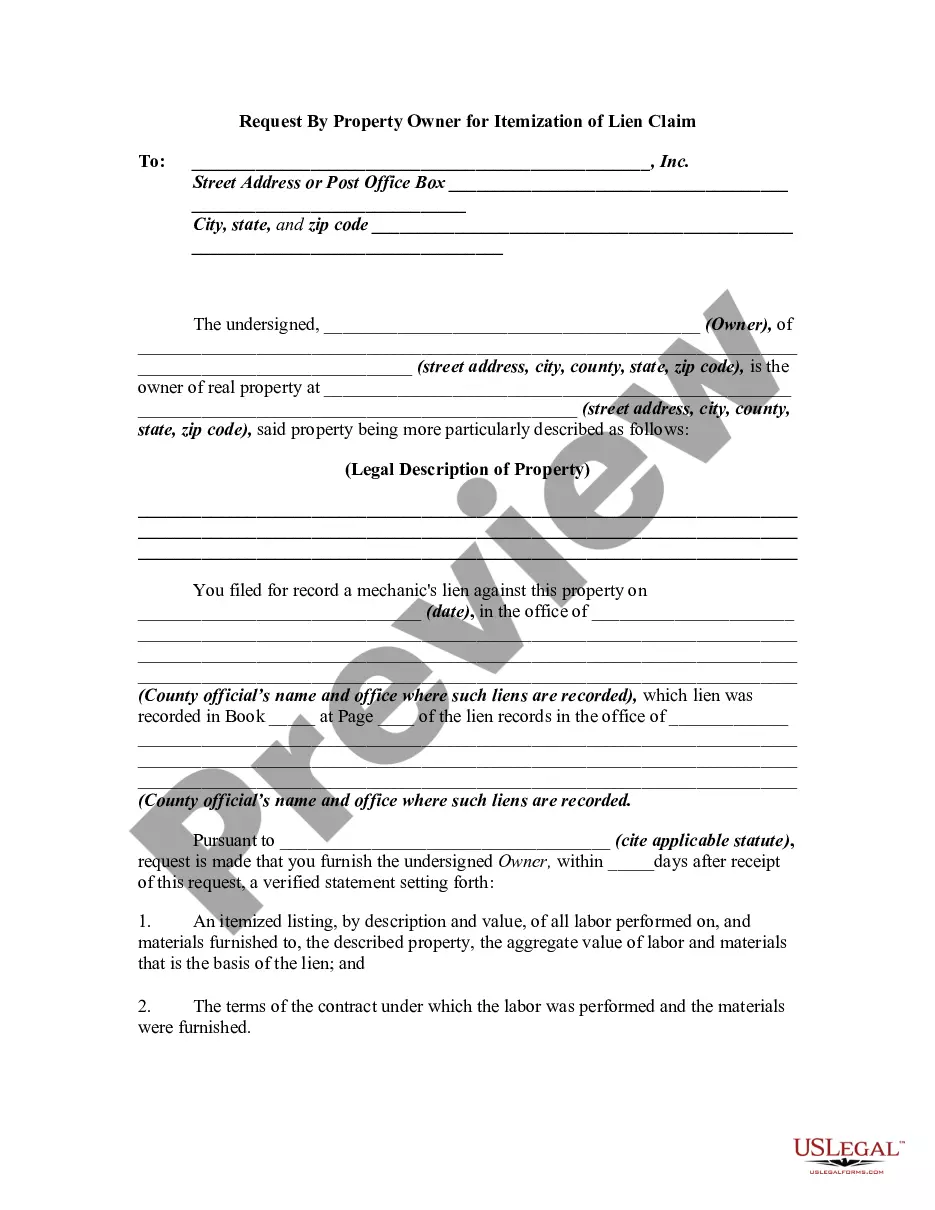

STEP 1: Fill out the Complaint (Form A) ... STEP 2: Fill out the Civil Case Information Statement (CIS) ... STEP 3: Make a check or money order payable to Treasurer, State of New Jersey in the. STEP 4: Check your completed forms and make copies. ... STEP 5: Mail or deliver the forms to the court.

Division Initiatives. Angelie's Law. Board Related Information. Laws & Regulations. Email. General AskConsumerAffairs@dca.lps.state.nj.us. Call. Consumer Service Center Hotline (973) 504-6200. Toll free (NJ only) (800) 242-5846. Visit. 124 Halsey Street. At this time, all visitors to DCA offices require an appointment.

A. If the complaint is regarding the defect of goods /Items, or about the deficiency of service then provide details of deficiency/ type of services and date/year of purchase of goods/ service received. B. Details of the items/goods (provide information about defect/supplying of less quantity of goods/items.)

Call Citizen Services at 609-984-5828 or. Email: Citizens Services via online form.

Defendant(s) must file an answer to the complaint along with the appropriate filing fee within 35 days after service of the complaint. After the complaint is served and an answer is filed, the discovery period begins.