A New Jersey Corporate Resolution for the Sale of Stock is a legal document specifically designed for companies in New Jersey that wish to authorize and formalize the sale of stock to shareholders. This resolution outlines the necessary steps and approvals required for the sale of stock to take place, ensuring that the process is conducted in accordance with both state and federal laws. The New Jersey Corporate Resolution for the Sale of Stock typically includes essential details such as the company's name, its address, the names of the directors and officers involved, and the specific purpose of the resolution. It also outlines the total number of shares to be sold, the class or type of stock being sold, and any restrictions or conditions associated with the sale. Moreover, the resolution typically addresses the specific terms of the sale, including the purchase price per share, any agreed-upon discounts or additional considerations, and the timeline for completing the transaction. It may also include provisions related to the allocation of proceeds, disbursement of funds, and the required documentation to be provided by the shareholders. It's important to note that there may be different types or variations of the New Jersey Corporate Resolution for the Sale of Stock, depending on the specific circumstances or requirements of the company. Some possible variations include: 1. General Sale of Common Stock Resolution: Specifically used when a company intends to sell its common stock to existing or new shareholders. This resolution defines the terms and conditions applicable to the sale, such as the number of shares, purchase price, and any shareholder agreements. 2. Preferred Stock Issuance Resolution: Pertains to the sale or issuance of preferred stock, which often comes with different rights and privileges compared to common stock. This resolution outlines the specific terms and conditions associated with the sale of preferred stock, including the dividend rate, liquidation preference, and voting rights. 3. Stock Option Plan Resolution: Companies that have implemented employee stock option plans may require a specific resolution to authorize the sale or issuance of stock options to employees or directors. This resolution outlines the terms, conditions, and restrictions associated with the options, including the exercise price, vesting schedule, and eligibility criteria. In conclusion, a New Jersey Corporate Resolution for the Sale of Stock is a vital legal document used to authorize and formalize the sale of stock in compliance with state and federal laws. Different types of resolutions may exist, each tailored to address specific circumstances such as the sale of common stock, preferred stock, or the issuance of stock options.

New Jersey Corporate Resolution For Sale of Stock

Description

How to fill out New Jersey Corporate Resolution For Sale Of Stock?

If you want to total, download, or print legitimate document themes, use US Legal Forms, the biggest variety of legitimate forms, that can be found on-line. Use the site`s basic and convenient search to get the files you want. Numerous themes for company and individual purposes are sorted by classes and says, or search phrases. Use US Legal Forms to get the New Jersey Corporate Resolution For Sale of Stock in a handful of click throughs.

When you are already a US Legal Forms customer, log in in your bank account and click the Acquire switch to get the New Jersey Corporate Resolution For Sale of Stock. Also you can access forms you previously downloaded within the My Forms tab of your own bank account.

If you use US Legal Forms for the first time, follow the instructions beneath:

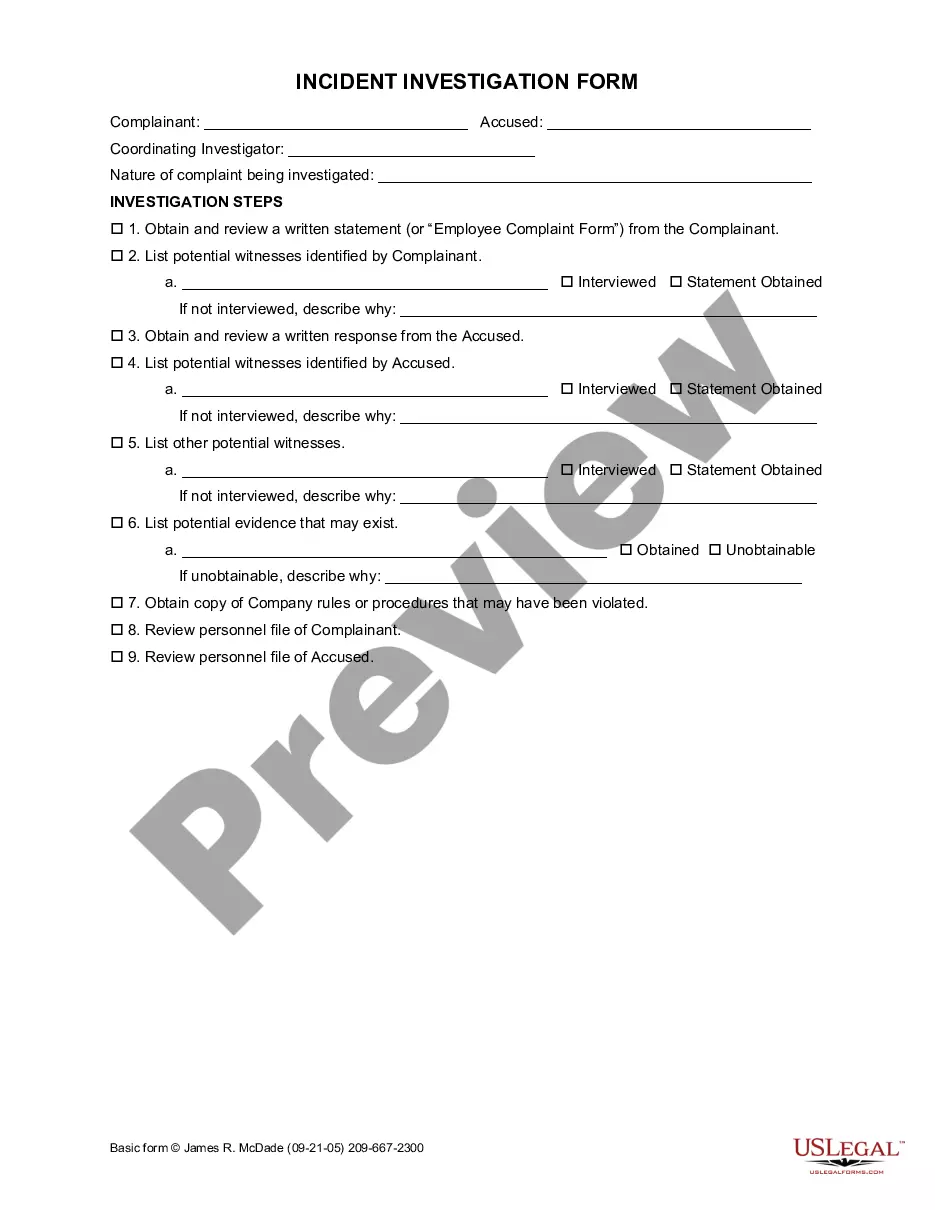

- Step 1. Be sure you have chosen the shape for your appropriate area/nation.

- Step 2. Take advantage of the Review option to examine the form`s content material. Never forget to learn the description.

- Step 3. When you are not satisfied with all the type, utilize the Look for field on top of the monitor to locate other variations from the legitimate type template.

- Step 4. Upon having identified the shape you want, click on the Buy now switch. Pick the pricing prepare you choose and put your references to register to have an bank account.

- Step 5. Method the financial transaction. You can use your credit card or PayPal bank account to complete the financial transaction.

- Step 6. Select the formatting from the legitimate type and download it on the gadget.

- Step 7. Full, change and print or sign the New Jersey Corporate Resolution For Sale of Stock.

Every legitimate document template you get is your own property permanently. You may have acces to every single type you downloaded in your acccount. Select the My Forms portion and pick a type to print or download again.

Contend and download, and print the New Jersey Corporate Resolution For Sale of Stock with US Legal Forms. There are many expert and express-specific forms you can utilize for your company or individual demands.