New Jersey Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years

Description

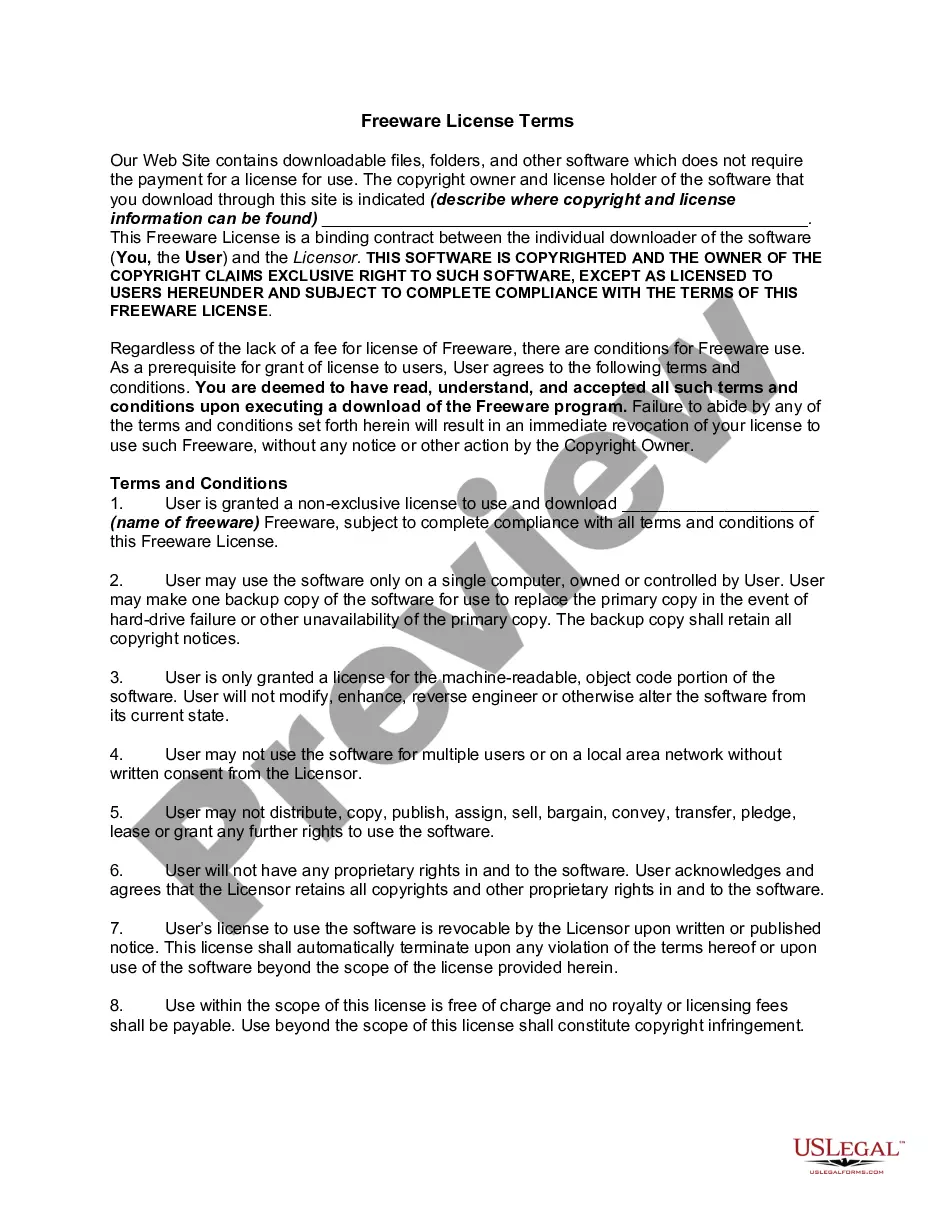

How to fill out Testamentary Provisions For Charitable Remainder Annuity Trust For Term Of Years?

Are you currently in the situation in which you require documents for both enterprise or personal purposes just about every day? There are plenty of legitimate file layouts accessible on the Internet, but locating types you can rely isn`t simple. US Legal Forms offers 1000s of type layouts, just like the New Jersey Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years, which can be created in order to meet federal and state needs.

In case you are currently informed about US Legal Forms site and have a merchant account, basically log in. Next, you can obtain the New Jersey Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years web template.

Should you not have an account and need to begin to use US Legal Forms, follow these steps:

- Obtain the type you need and ensure it is for your right town/region.

- Take advantage of the Review key to check the form.

- See the explanation to actually have chosen the right type.

- When the type isn`t what you are looking for, use the Lookup area to discover the type that fits your needs and needs.

- Whenever you get the right type, just click Acquire now.

- Opt for the rates strategy you would like, submit the required info to generate your account, and pay for your order using your PayPal or charge card.

- Pick a hassle-free file formatting and obtain your version.

Find all of the file layouts you have purchased in the My Forms food list. You may get a more version of New Jersey Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years whenever, if necessary. Just click the necessary type to obtain or produce the file web template.

Use US Legal Forms, the most considerable variety of legitimate forms, to conserve time as well as avoid blunders. The service offers expertly created legitimate file layouts that can be used for an array of purposes. Produce a merchant account on US Legal Forms and initiate creating your life easier.

Form popularity

FAQ

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

Charitable remainder unit trust (CRUT) pays the beneficiary a fixed percentage of the trust at least annually, often for life or a period up to 20 years. 2. Charitable remainder annuity trust (CRAT) pays the beneficiary a fixed amount, or annuity, for the term of the trust.

Charitable trusts are created in the same manner as private express trusts, with several key exceptions: the trust must be created for a charitable purpose, the beneficiaries to the trust must be indefinite, and the trust may be perpetual.

How Long Can a Charitable Trust Last? Charitable Remainder Trusts can either last the lifetime of another beneficiary, or for a specified term (usually 20 years). At that point, any remaining value would go to your designated charitable organization. Learn more about Charitable Trust tax rules.

A CRT lets you convert a highly appreciated asset like stock or real estate into lifetime income. It reduces your income taxes now and estate taxes when you die. You pay no capital gains tax when the asset is sold. It also lets you help one or more charities that have special meaning to you.

A CRT may last for the Lead Beneficiaries' joint lives or for a term of years (the term may not exceed 20 years).

How Long Can a Charitable Trust Last? Charitable Remainder Trusts can either last the lifetime of another beneficiary, or for a specified term (usually 20 years). At that point, any remaining value would go to your designated charitable organization. Learn more about Charitable Trust tax rules.

As a charitable entity, a CRUT does not pay income tax on any income it receives. In the case of a CRUT named as the beneficiary of an IRA, such income would include distributions from the IRA to the CRUT, as well as any interest, dividends, and capital gains earned within the trust.

A testamentary charitable remainder trust is created with assets upon your death. The trust then makes regular income payments to your named heirs for life or a term of up to 20 years.