New Jersey Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust

Description

How to fill out Termination Of Grantor Retained Annuity Trust In Favor Of Existing Life Insurance Trust?

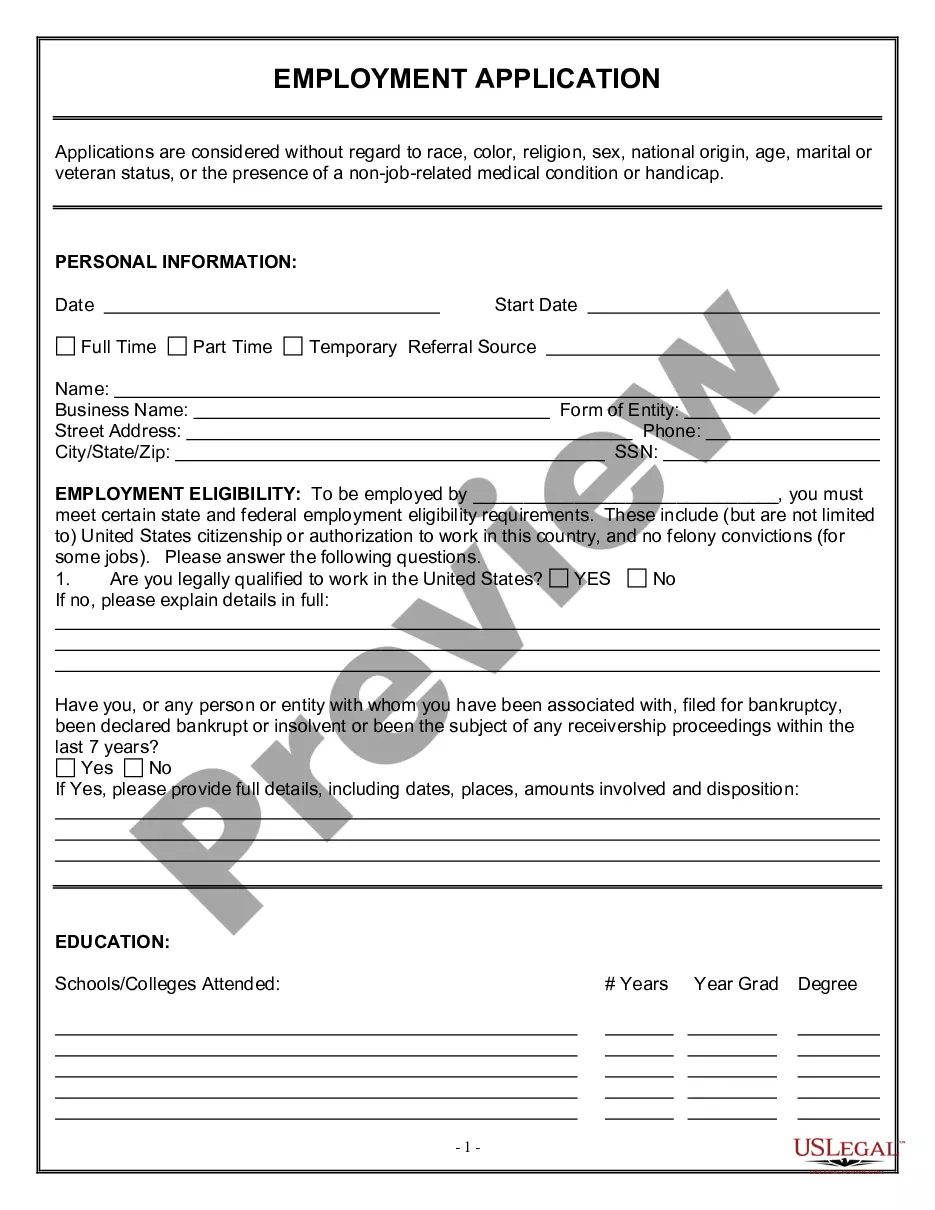

Are you currently in the location where you require documents for both professional or personal purposes nearly every day.

There are many legal document templates available online, but finding trustworthy ones is not simple.

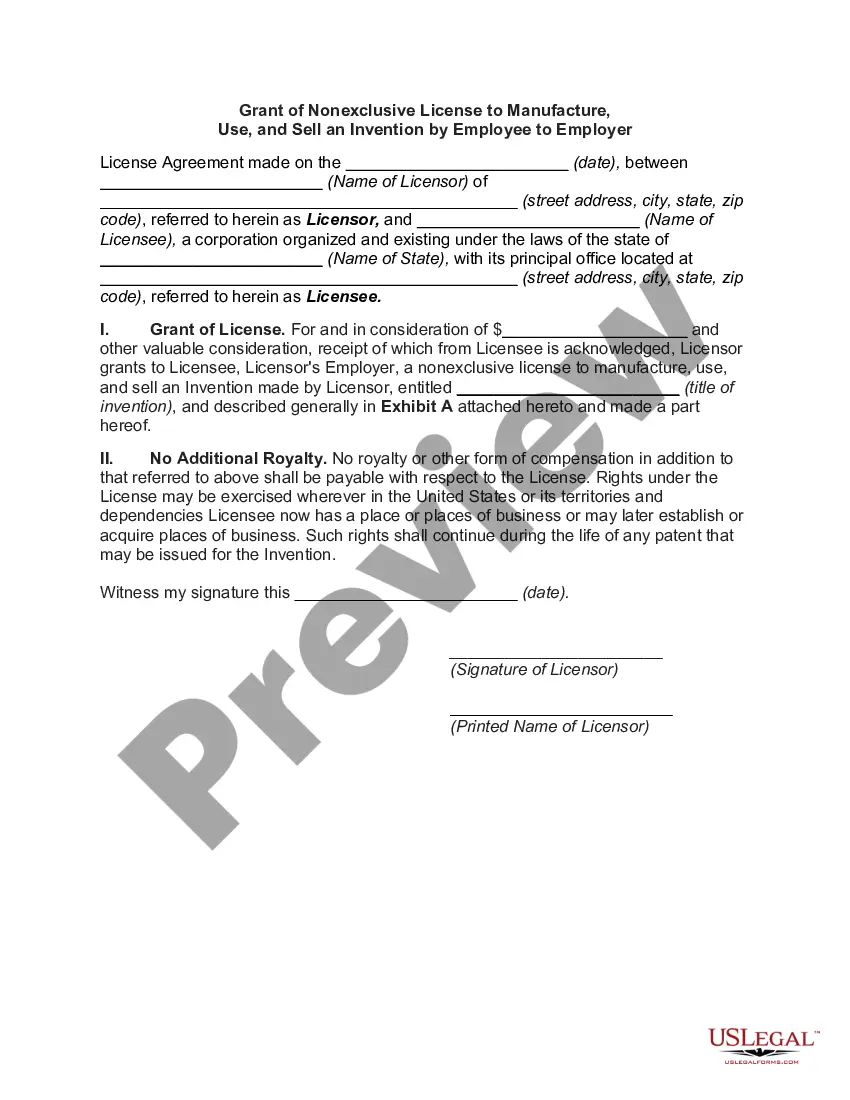

US Legal Forms offers thousands of template options, such as the New Jersey Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust, which is designed to meet federal and state regulations.

When you find the right template, click Get now.

Choose the payment plan you prefer, fill in the required details to create your account, and pay for your order using PayPal or credit card.

- If you are familiar with the US Legal Forms website and possess an account, simply Log In.

- Once logged in, you can download the New Jersey Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the template you need and ensure it is for the correct city/county.

- Use the Review button to examine the document.

- Read the description to confirm that you have selected the right template.

- If the template isn’t what you seek, use the Research field to find the document that fulfills your needs.

Form popularity

FAQ

IRC Sections 671-678 outline the rules governing grantor trusts and the taxation of their income. These sections clarify how the income generated by the trust is reported and taxed, retaining tax liability with the grantor. Knowing these sections is important when considering the New Jersey termination of grantor retained annuity trust in favor of existing life insurance trust, hence ensuring compliance with IRS regulations.

In other words, if the grantor (or a non-adverse party) has the power to revoke any part of a trust and reclaim the trust assets, then the grantor will be taxed on the trust income.

The annuity amount is paid to the grantor during the term of the GRAT, and any property remaining in the trust at the end of the GRAT term passes to the beneficiaries with no further gift tax consequences.

Thus, the trustee cannot terminate the GRAT before expiration of the term of the grantor's qualified interest by distributing to the grantor and the remainder beneficiaries the actuarial value of their term and remainder interests, respectively.

A grantor trust is considered a disregarded entity for income tax purposes. Therefore, any taxable income or deduction earned by the trust will be taxed on the grantor's tax return.

For all practical purposes, the trust is invisible to the Internal Revenue Service (IRS). As long as the assets are sold at fair market value, there will be no reportable gain, loss or gift tax assessed on the sale. There will also be no income tax on any payments paid to the grantor from a sale.

A grantor retained annuity trust is a type of irrevocable gifting trust that allows a grantor or trustmaker to potentially pass a significant amount of wealth to the next generation with little or no gift tax cost. GRATs are established for a specific number of years.

To implement this strategy, you zero out the grantor retained annuity trust by accepting combined payments that are equal to the entire value of the trust, including the anticipated appreciation. In theory, there would be nothing left for the beneficiary if the trust is really zeroed out.

One easy way to terminate a life insurance trust, the grantor to stops making the premium payments, known as gifts, to the trust. If the grantor stops making payments to the trust, then the policy will lapse. This causes the purpose of the trust to be eliminated.

If an irrevocable trust has its own tax ID number, then the IRS requires the trust to file its own income tax return, which is IRS form 1041. During the lifetime of the grantor, any interest, dividends, or realized gains on the assets of the trust are taxable on the grantor's 1040 individual income tax return.