A New Jersey Revocable Trust for Lifetime Benefit of Trust or, Lifetime Benefit of Surviving Spouse after Trust or's Death with Trusts for Children is a comprehensive estate planning tool that provides individuals with control over their assets during their lifetime, while also ensuring the financial security of their surviving spouse and children after their passing. This type of trust is known for its flexibility, privacy, and ability to avoid probate. The primary purpose of a New Jersey Revocable Trust for Lifetime Benefit of Trust or is to allow the trust or (the person creating the trust) to maintain control and use of their assets throughout their lifetime. The trust or can transfer various types of assets, such as real estate, investments, and personal property, into the trust and manage them as they see fit. This includes the ability to add or remove assets, make investment decisions, and even revoke or amend the trust if necessary. Upon the trust or's death, the trust seamlessly transitions to provide lifetime benefits to the surviving spouse. The surviving spouse can rely on the trust's assets to maintain their standard of living, pay for medical expenses, and cover other financial needs. The trust's terms generally dictate how the assets are to be distributed to the surviving spouse, taking into consideration factors like age, health, and level of financial support required. In addition to benefiting the surviving spouse, this type of New Jersey Revocable Trust can create separate trusts for the benefit of the children or other designated beneficiaries. These trusts can be customized to meet the specific needs of each individual child, such as providing for education expenses, asset protection, or ensuring a responsible distribution of wealth over time. By utilizing separate trusts, the trust or can maintain control over how the assets are distributed to their children and specify any conditions or requirements that must be met. There are various types of New Jersey Revocable Trusts available for lifetime benefit planning, each designed to meet different needs and objectives. Some popular types include: 1. Family Revocable Trust: This trust is designed to benefit both the trust or and the surviving spouse, with further distributions to children or other beneficiaries after both spouses' deaths. 2. AB Trust (also known as Marital and Bypass Trust): This trust structure allows couples to maximize their estate tax exemptions, ensuring the preservation and transfer of wealth to future generations. 3. Charitable Remainder Trust: This trust allows the trust or to name a charitable organization as a beneficiary, providing income to the trust or their surviving spouse during their lifetime, with the remaining assets going to the designated charity upon their deaths. Overall, a New Jersey Revocable Trust for Lifetime Benefit of Trust or, Lifetime Benefit of Surviving Spouse after Trust or's Death with Trusts for Children offers the trust or significant control, flexibility, and peace of mind by ensuring their assets are managed and distributed according to their wishes, while also providing for the financial security of their loved ones.

New Jersey Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children

Description

How to fill out New Jersey Revocable Trust For Lifetime Benefit Of Trustor, Lifetime Benefit Of Surviving Spouse After Trustor's Death With Trusts For Children?

Choosing the right legitimate file web template can be a have a problem. Naturally, there are a lot of web templates available online, but how will you obtain the legitimate kind you will need? Make use of the US Legal Forms web site. The service gives a huge number of web templates, for example the New Jersey Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children, which you can use for enterprise and private requires. Each of the types are examined by specialists and satisfy state and federal specifications.

If you are already listed, log in to your accounts and click on the Down load button to get the New Jersey Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children. Make use of your accounts to look through the legitimate types you may have purchased previously. Proceed to the My Forms tab of the accounts and have yet another copy in the file you will need.

If you are a new customer of US Legal Forms, listed here are basic recommendations that you can adhere to:

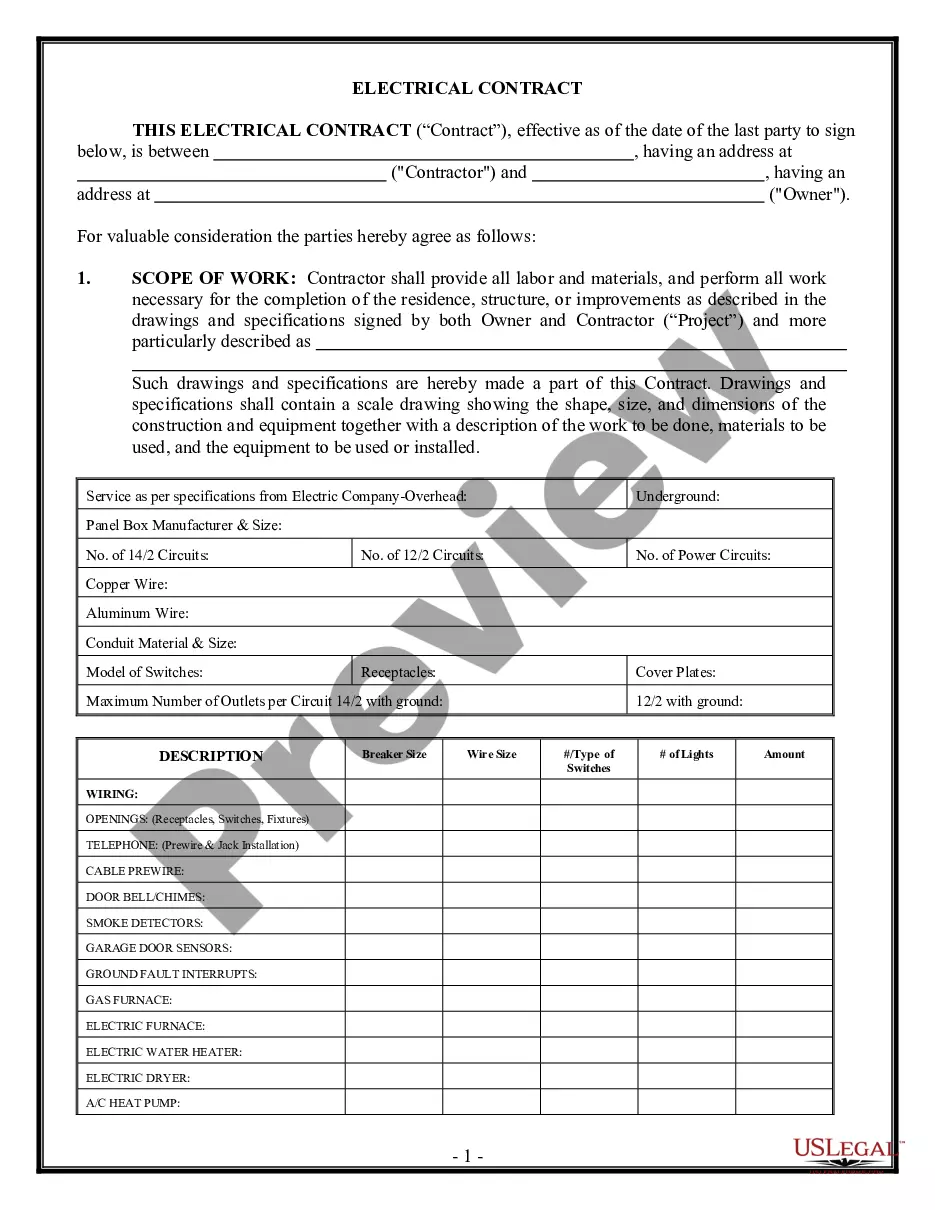

- Initial, make sure you have selected the correct kind for the area/area. You are able to look over the form making use of the Review button and browse the form explanation to ensure it is the right one for you.

- In the event the kind is not going to satisfy your requirements, use the Seach field to obtain the correct kind.

- Once you are positive that the form is suitable, select the Acquire now button to get the kind.

- Choose the pricing program you need and enter the necessary info. Create your accounts and pay for the order making use of your PayPal accounts or credit card.

- Pick the submit format and acquire the legitimate file web template to your device.

- Complete, edit and printing and signal the attained New Jersey Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children.

US Legal Forms is the greatest library of legitimate types for which you can see numerous file web templates. Make use of the service to acquire appropriately-made documents that adhere to condition specifications.