New Jersey Sample Letter for Creditor Notification of Estate Opening

Description

How to fill out Sample Letter For Creditor Notification Of Estate Opening?

If you need to full, download, or print out lawful papers web templates, use US Legal Forms, the biggest variety of lawful varieties, that can be found on the web. Make use of the site`s simple and hassle-free research to get the documents you need. Various web templates for business and specific uses are sorted by classes and claims, or search phrases. Use US Legal Forms to get the New Jersey Sample Letter for Creditor Notification of Estate Opening in just a couple of mouse clicks.

If you are presently a US Legal Forms client, log in for your bank account and then click the Obtain button to have the New Jersey Sample Letter for Creditor Notification of Estate Opening. Also you can access varieties you in the past downloaded within the My Forms tab of the bank account.

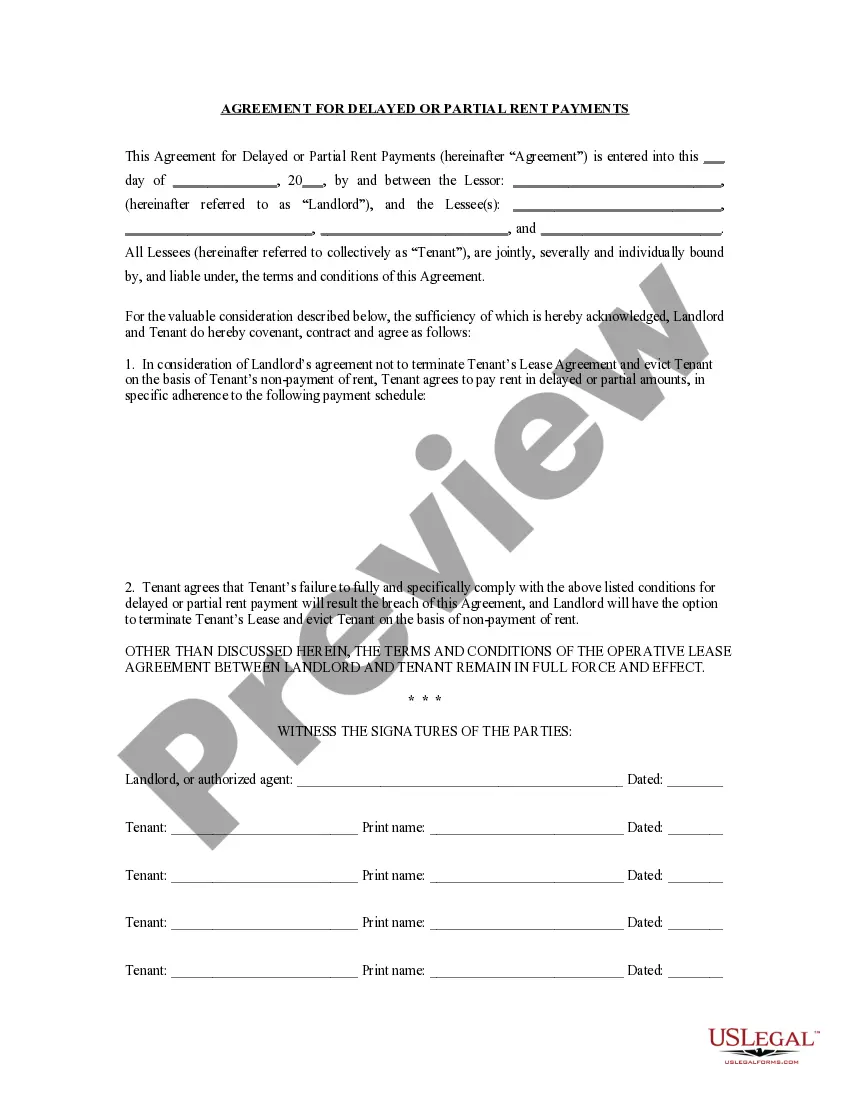

Should you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Ensure you have chosen the shape for that correct city/region.

- Step 2. Use the Review method to examine the form`s articles. Don`t forget to read the description.

- Step 3. If you are unhappy with all the kind, make use of the Search area at the top of the display to locate other types from the lawful kind design.

- Step 4. After you have discovered the shape you need, click on the Buy now button. Opt for the costs prepare you prefer and add your credentials to register on an bank account.

- Step 5. Procedure the transaction. You can use your Мisa or Ьastercard or PayPal bank account to complete the transaction.

- Step 6. Find the structure from the lawful kind and download it on the gadget.

- Step 7. Comprehensive, modify and print out or sign the New Jersey Sample Letter for Creditor Notification of Estate Opening.

Every lawful papers design you buy is the one you have eternally. You may have acces to every single kind you downloaded within your acccount. Click on the My Forms segment and decide on a kind to print out or download yet again.

Be competitive and download, and print out the New Jersey Sample Letter for Creditor Notification of Estate Opening with US Legal Forms. There are millions of expert and state-distinct varieties you may use for the business or specific demands.

Form popularity

FAQ

Beneficiaries have the right to be informed As a beneficiary, you are entitled to have an accounting from the executor, also known as a personal representative or fiduciary.

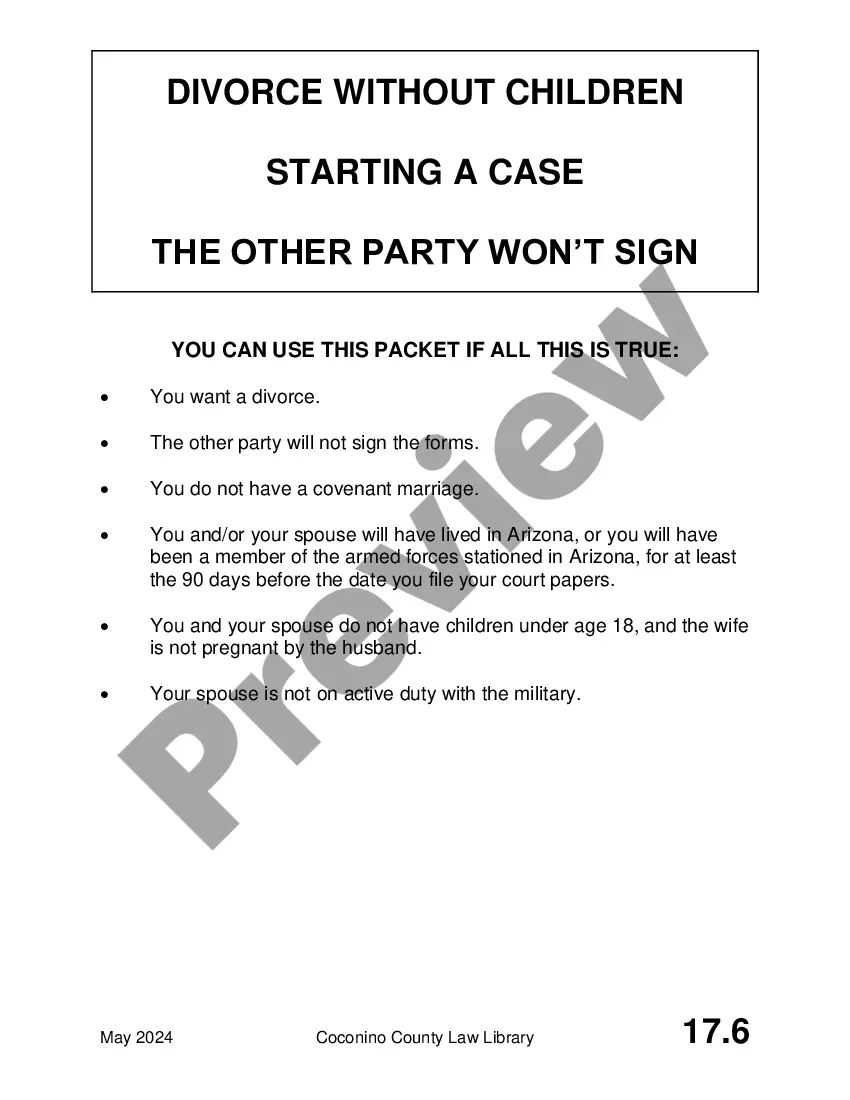

In New Jersey, creditors have nine months after death to stake a claim against an estate. If the claim is not made within those nine months, the courts may dismiss the claim and leave the creditor empty-handed. This is why notice of death from the executor to the creditors is so important.

A notice to creditors is a public notice filed by the appointed estate executor and is used to facilitate probate proceedings. The court appoints the executor named in the will, and the individual acts as the personal representative of the deceased's estate.

Basic Requirements for Serving as a New Jersey Executor The court must appoint that person unless there is clear evidence that he or she acquired the position through fraud or misconduct, is incapacitated, or otherwise unsuitable to serve. (See N.J. Stat. Ann. § 3B:14-21; 77 N.J. 316.)

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.

Seeking Legal Recourse If you believe that the executor is not living up to their duties, you have two legal options: petition the court or file a civil lawsuit.

After nine months, and if there are no unpaid or pending claims, the executor can distribute the assets and issue a declaration of discharge. Closing an estate can take just a little over nine months if there's no litigation, no problems determining beneficiaries, and no creditor issues.

The Estate Settlement Timeline: While there is no specific deadline for this in New Jersey law, it is generally best to do so within a month to prevent unnecessary delays in the probate process.