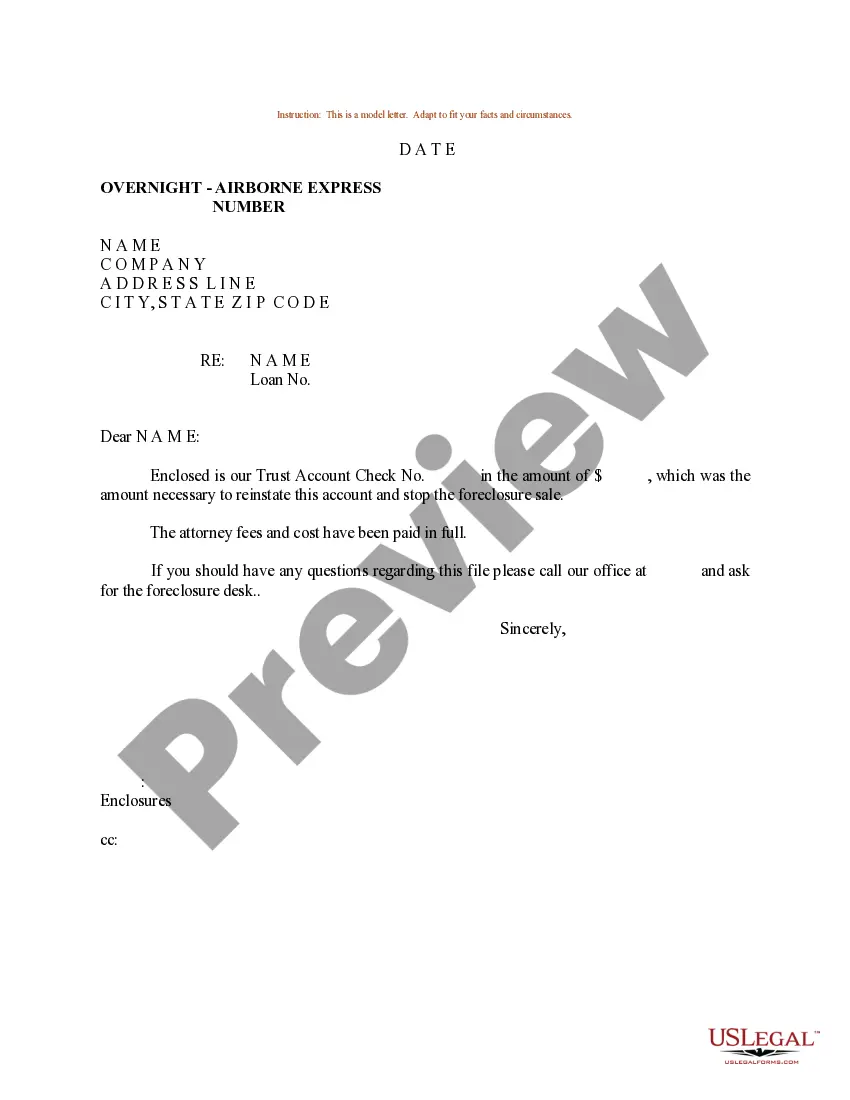

Subject: Urgent Notice — Stop of Foreclosure Sale in New Jersey! Dear [Borrower's Name], RE: Ceasing Foreclosure Sale Proceedings — Immediate Action Required We hope this letter finds you well. It has come to our attention that your property, located at [property address], is currently in the process of foreclosure. We understand the distressing situation you might be facing and want to provide you with valuable information that may help prevent further actions against your property. New Jersey State laws provide homeowners with certain options to halt foreclosure sales, offering a window of opportunity to explore alternative solutions. With prompt action and the right approach, it is possible to achieve a favorable outcome and bring foreclosure proceedings to a stop. Given the gravity of this matter, it is crucial that you act swiftly. Here are some potential New Jersey Sample Letters regarding Stop of Foreclosure Sale to consider, depending on your specific circumstances: 1. Letter of Financial Hardship: If you are experiencing financial difficulties that make it challenging to meet your mortgage obligations, a letter outlining your circumstances and inability to pay the mortgage due could be beneficial. This letter should be supported by relevant financial documents, such as bank statements, income statements, and tax returns. 2. Loan Modification Request: This type of letter seeks to modify the terms of the original loan agreement to make it more manageable for you to repay the mortgage. In the letter, you should address the reasons for the modification request, explain any changes in your financial situation, and propose alternative loan terms that could potentially allow you to resume regular payments. 3. Forbearance Agreement Proposal: A forbearance agreement letter is meant to request a temporary pause or reduction in mortgage payments for a specific period. It is suitable if you are facing a short-term financial hardship but expect to recover. In this letter, you will need to demonstrate the reasons for your request and offer a plan to repay any arrears that may accumulate during the forbearance period. 4. Short Sale Proposal: If you're unable to afford your mortgage payments and wish to sell your property promptly to avoid foreclosure, a short sale could be an option. The short sale letter should provide a compelling case for the sale, demonstrating financial distress, highlighting any potential loss for the lender, and proposing a fair price for your property. It is important to note that these samples serve as a reference but should be customized to reflect your unique circumstances accurately. Additionally, seeking professional legal advice is strongly recommended ensuring compliance with New Jersey State laws and increase your chances of success. To prevent the imminent foreclosure sale, we encourage you to take immediate action and send the applicable letter to your lender, mortgage service, or foreclosure attorney. Remember to retain copies of all correspondence for your records. Please understand that time is of the essence, and we urge you to act decisively to explore these potential solutions. Contacting a foreclosure expert or foreclosure defense attorney in your area can also be immensely beneficial in navigating the complexities of this process. Wishing you the best of luck in your efforts to stop the foreclosure sale and regain control of your property. If you require any further assistance or have questions, please do not hesitate to reach out to us. Sincerely, [Your Name] [Your Contact Information]

New Jersey Sample Letter regarding Stop of Foreclosure Sale

Description

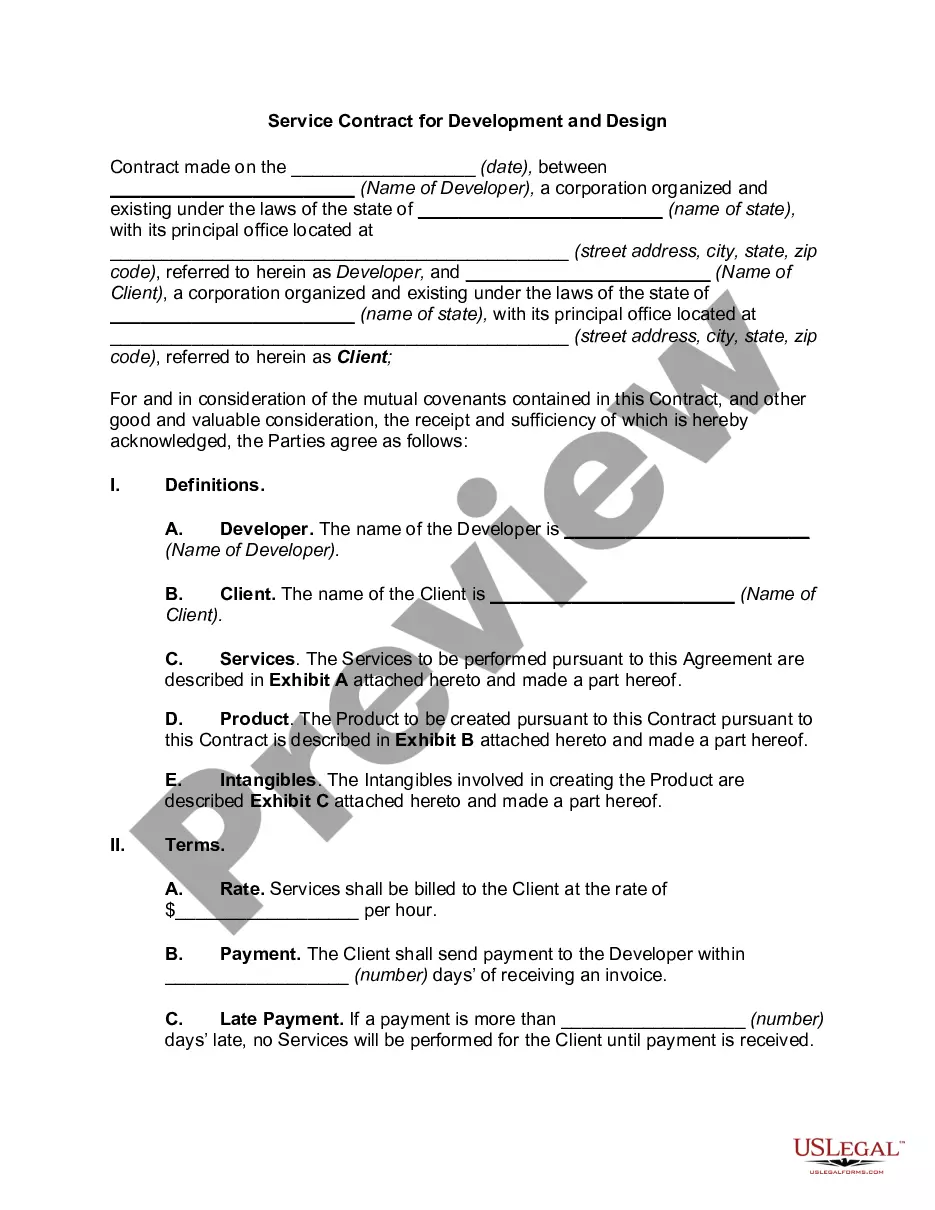

How to fill out Sample Letter Regarding Stop Of Foreclosure Sale?

US Legal Forms - among the largest libraries of legal forms in America - provides a wide array of legal file web templates you may down load or print out. While using web site, you will get a large number of forms for organization and person functions, categorized by classes, says, or search phrases.You can get the newest versions of forms such as the New Jersey Sample Letter regarding Stop of Foreclosure Sale within minutes.

If you currently have a registration, log in and down load New Jersey Sample Letter regarding Stop of Foreclosure Sale from your US Legal Forms collection. The Down load key will appear on each and every develop you see. You have access to all earlier saved forms within the My Forms tab of your own account.

If you want to use US Legal Forms the very first time, listed below are simple instructions to help you get began:

- Be sure to have selected the proper develop for your personal area/state. Go through the Preview key to check the form`s content. Read the develop explanation to ensure that you have chosen the appropriate develop.

- If the develop doesn`t satisfy your specifications, make use of the Search area near the top of the display to get the one that does.

- If you are satisfied with the form, verify your decision by simply clicking the Buy now key. Then, opt for the costs prepare you favor and offer your credentials to register on an account.

- Approach the deal. Make use of your bank card or PayPal account to perform the deal.

- Find the file format and down load the form in your device.

- Make adjustments. Fill out, edit and print out and indication the saved New Jersey Sample Letter regarding Stop of Foreclosure Sale.

Every template you included with your account does not have an expiration time and is the one you have eternally. So, if you want to down load or print out another backup, just proceed to the My Forms segment and then click about the develop you require.

Gain access to the New Jersey Sample Letter regarding Stop of Foreclosure Sale with US Legal Forms, by far the most substantial collection of legal file web templates. Use a large number of specialist and state-certain web templates that meet up with your business or person needs and specifications.

Form popularity

FAQ

You can potentially file for bankruptcy or file a lawsuit against the foreclosing party (the "bank") to possibly stop the foreclosure entirely or at least delay it. If you have a bit more time on your hands, you can apply for a loan modification or another workout option.

Cure Your Default Under New Jersey law, however, all foreclosures must be judicial, which means they go through the court system (and you can't file a separate lawsuit to challenge foreclosure). You can stop foreclosure by curing a default on your mortgage payments at any time up until the entry of a final judgment.

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.

After the 30-day period, the lender files a foreclosure complaint with the Office of Foreclosure. Once the complaint is filed, it enters a Lis pendens, meaning a suit is pending. The lender becomes the plaintiff, and the debtor becomes the defendant in the court record. The case receives a docket number.

You may file a written answer in which you present your defenses and explain the reasons why the lender is not entitled to a foreclosure judgment. property or for another reason, you may file a written answer to assert any rights you may have.

If you want to try to fight the foreclosure, you have the right to file a motion with the Court and ask that the judgment be set aside and that you be permitted to file an Answer and defend the foreclosure. However, the NJ Court Rules provide that these motions should be filed within one (1) year of the Final Judgment.

You must respond to each numbered paragraph in the complaint and either admit the allegation, deny the allegation, or state that you do not have enough information to know whether the statement is true. In the area for Affirmative Defenses, you can list the facts which defend your action or inaction.

The Fair Foreclosure Act (FFA), N.J.S.A §§ 2A:50-53 to 2A:50-73, is a state law that protects residential mortgage debtors and establishes a uniform statutory framework under which courts can more clearly identify the rights and remedies of the parties involved in foreclosure proceedings throughout New Jersey.