New Jersey Bond to Secure against Defects in Construction: A Detailed Description Keywords: New Jersey bond, construction defects, secure, performance bond, payment bond, surety company, contractor, project owner In the construction industry, New Jersey Bond to Secure against Defects plays a crucial role in protecting project owners and ensuring the completion of construction projects free from defects. It is a form of financial guarantee that ensures the contractor's compliance with the terms and conditions of the construction contract and addresses any potential defects that may arise during or after the construction process. There are mainly two types of New Jersey Bonds to Secure against Defects in Construction: 1. Performance Bond: A performance bond is a type of surety bond that guarantees the contractor's performance and completion of the project as per the agreed-upon specifications, plans, and timeline. In the event of the contractor's failure to meet these obligations due to insolvency, default, or any other breach of contract, the performance bond provides financial compensation to the project owner. It reassures project owners that their investments are protected, and the project will be completed even if the contractor fails to do so. 2. Payment Bond: A payment bond, also known as a labor and material bond, ensures that subcontractors, suppliers, and laborers involved in the construction project are paid for their work and materials. It guarantees that the contractor will fulfill its payment obligations to all parties involved. If the contractor fails to make payments, the payment bond covers the unpaid amounts, protecting the subcontractors, suppliers, and laborers. This bond adds an extra layer of security and trust among the parties involved in the construction project. Both performance and payment bonds are usually issued by a surety company on behalf of the contractor, providing reassurance to the project owner that they will be compensated in case of any defects, delays, or financial issues during or after the construction process. The surety company acts as a reliable third party, ensuring that the contractor fulfills their contractual obligations, minimizing the risk for the project owner. To obtain a New Jersey Bond to Secure against Defects in Construction, contractors typically go through a rigorous process, including thorough evaluation of their financial status, creditworthiness, and experience in the construction industry. The surety company assesses the contractor's ability to complete the project successfully and fulfill their contractual obligations. In essence, a New Jersey Bond to Secure against Defects in Construction provides protection for project owners by mitigating the financial risks associated with construction projects. It ensures that the contractor will perform the work as agreed and pay all parties involved promptly, safeguarding against potential defects and project disruptions. By obtaining these bonds, project owners can have peace of mind and confidence in the successful completion of their construction projects.

New Jersey Bond to Secure against Defects in Construction

Description

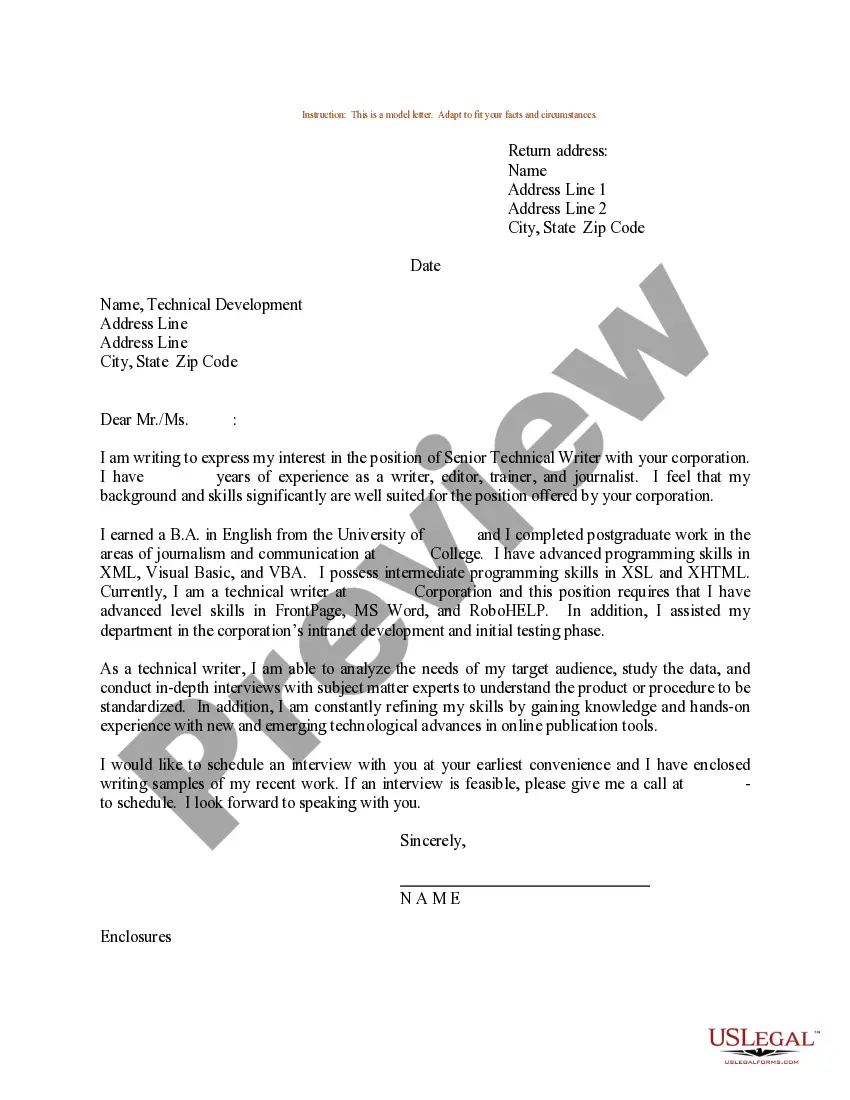

How to fill out New Jersey Bond To Secure Against Defects In Construction?

US Legal Forms - one of the greatest libraries of authorized varieties in the United States - gives a wide array of authorized record templates you may acquire or printing. Using the website, you can find thousands of varieties for enterprise and specific purposes, sorted by categories, says, or keywords.You can get the most recent versions of varieties just like the New Jersey Bond to Secure against Defects in Construction in seconds.

If you already possess a subscription, log in and acquire New Jersey Bond to Secure against Defects in Construction from the US Legal Forms local library. The Download switch can look on each and every type you view. You have access to all in the past downloaded varieties from the My Forms tab of the bank account.

If you want to use US Legal Forms initially, listed here are basic guidelines to get you started out:

- Ensure you have picked out the best type for the city/region. Click the Review switch to examine the form`s information. See the type information to ensure that you have selected the right type.

- In case the type does not satisfy your needs, make use of the Research discipline towards the top of the display to discover the one that does.

- If you are content with the form, confirm your option by visiting the Purchase now switch. Then, opt for the rates program you like and give your qualifications to register on an bank account.

- Method the purchase. Utilize your credit card or PayPal bank account to accomplish the purchase.

- Select the format and acquire the form in your product.

- Make adjustments. Fill out, modify and printing and signal the downloaded New Jersey Bond to Secure against Defects in Construction.

Each and every template you included in your money lacks an expiration particular date and it is yours forever. So, in order to acquire or printing yet another duplicate, just check out the My Forms portion and click on the type you require.

Get access to the New Jersey Bond to Secure against Defects in Construction with US Legal Forms, the most extensive local library of authorized record templates. Use thousands of expert and status-particular templates that meet up with your business or specific requirements and needs.