New Jersey Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares

Description

How to fill out Legend On Stock Certificate With Reference To Separate Document Restricting Transfer Of Shares?

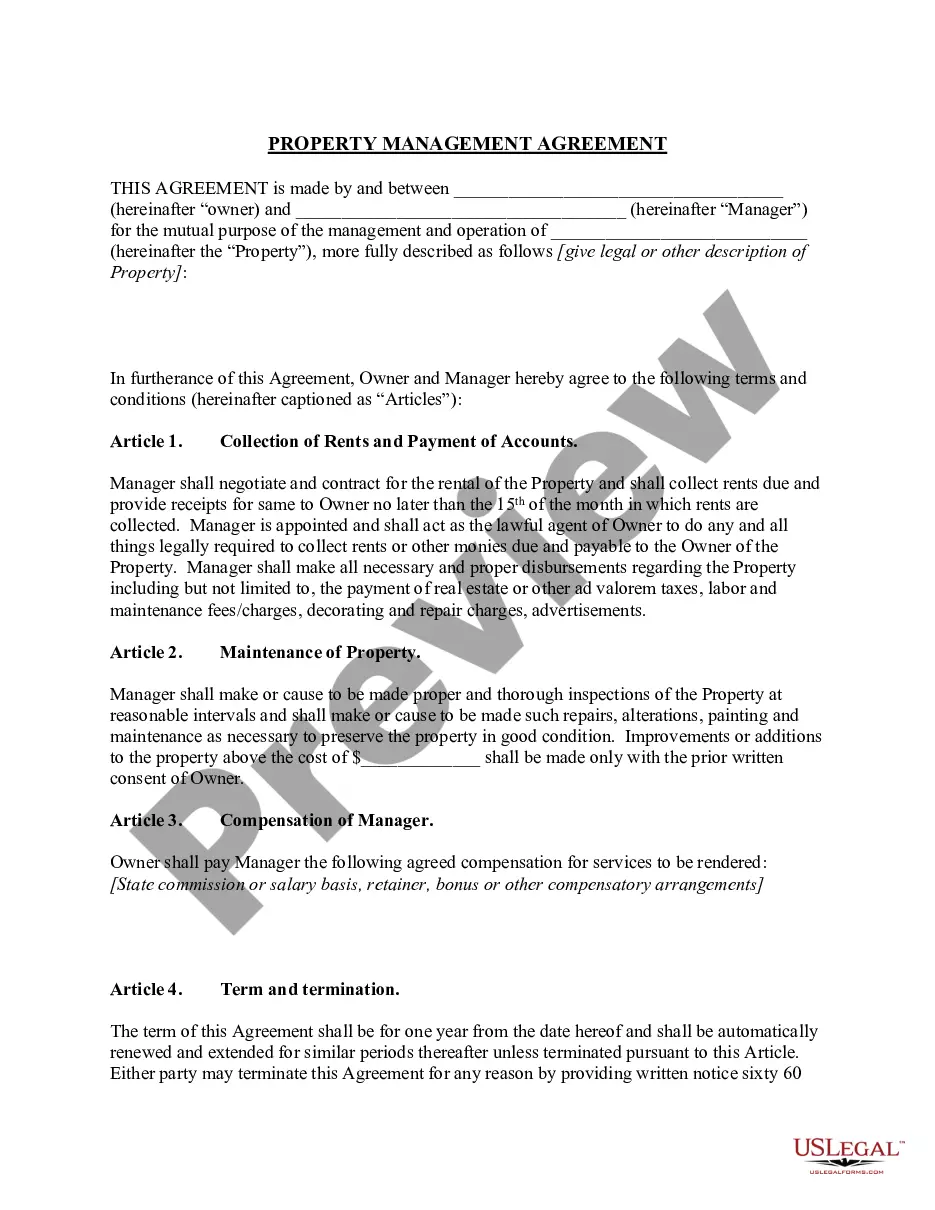

You may spend several hours online searching for the lawful file template that suits the federal and state requirements you need. US Legal Forms provides a huge number of lawful types that happen to be evaluated by experts. You can easily download or print out the New Jersey Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares from the assistance.

If you have a US Legal Forms bank account, you can log in and click the Obtain key. After that, you can complete, change, print out, or indicator the New Jersey Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares. Every lawful file template you buy is the one you have permanently. To obtain an additional backup of the acquired type, visit the My Forms tab and click the related key.

If you work with the US Legal Forms website the first time, keep to the straightforward recommendations under:

- Very first, make certain you have chosen the right file template for that region/metropolis that you pick. See the type information to ensure you have picked out the correct type. If readily available, use the Review key to look through the file template also.

- In order to locate an additional edition from the type, use the Search discipline to obtain the template that meets your needs and requirements.

- Once you have discovered the template you want, simply click Buy now to move forward.

- Find the costs prepare you want, type your accreditations, and register for a merchant account on US Legal Forms.

- Complete the purchase. You may use your credit card or PayPal bank account to pay for the lawful type.

- Find the format from the file and download it to your device.

- Make alterations to your file if possible. You may complete, change and indicator and print out New Jersey Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares.

Obtain and print out a huge number of file layouts utilizing the US Legal Forms web site, which offers the largest selection of lawful types. Use specialist and express-particular layouts to deal with your company or specific needs.

Form popularity

FAQ

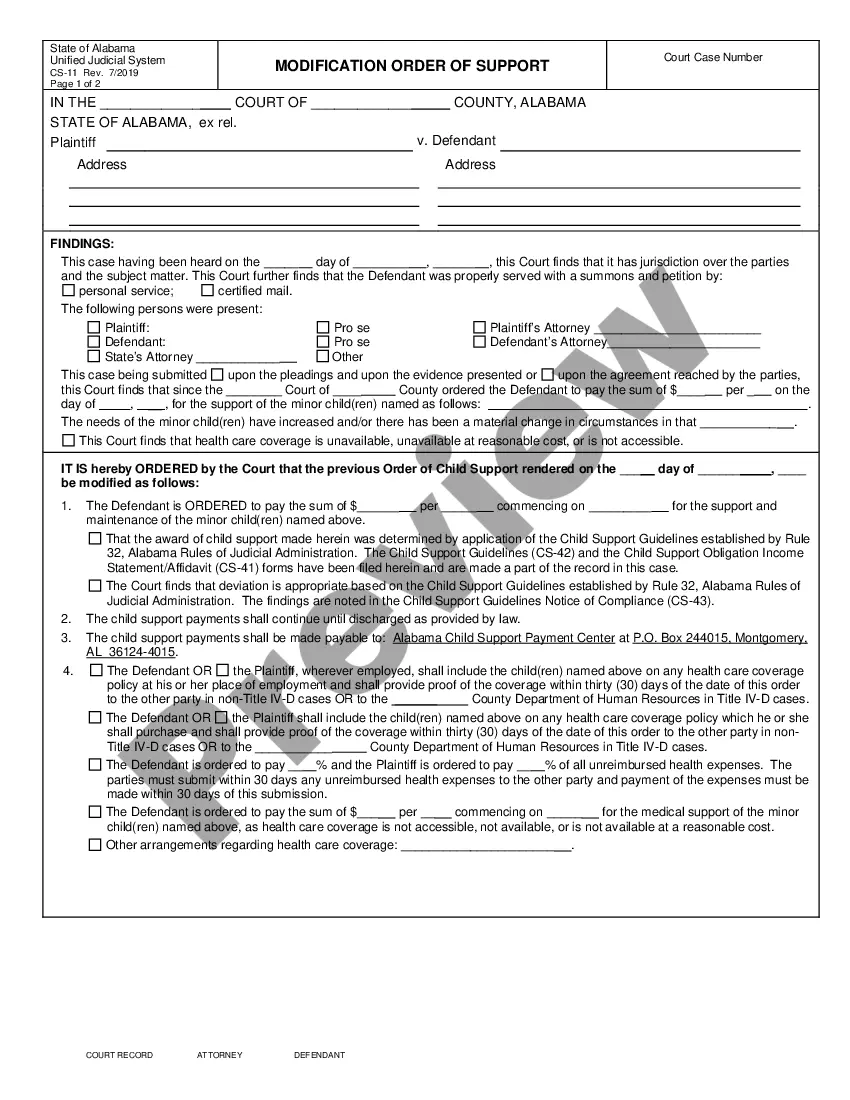

A legend is a statement on a stock certificate noting restrictions on the transfer or sale of a company's stock.

The purpose of the restrictive legend or notation is to protect the issuing company from loosing its private placement exemption for the initial sale of the securities and to notify the investor that the restricted securities cannot be resold into the public securities market without satisfying certain requirements.

The transfer agent will require an opinion letter from the issuer's counsel or from his or her own lawyer plus 144 papers completed by a broker?stating that the restricted legend can be removed.

Rule 144 is a set of regulations that outline the conditions in which the sale of unregistered or restricted stock shares can be sold. Typically, criteria must be met before a sale is allowed, including a minimum period in which the stock should be held, which can be up to one year.

Removing a restricted stock legend is a matter solely in the discretion of the issuer of the securities. State law, not federal law, covers disputes about the removal of legends. Thus, the SEC will not take action in any decision or dispute about removing a restrictive legend.

What Is Restricted Stock? Restricted stock refers to unregistered shares of ownership in a corporation that are issued to corporate affiliates, such as executives and directors. Restricted stock is non-transferable and must be traded in compliance with special Securities and Exchange Commission (SEC) regulations.

A restricted security must bear a legend giving notice of the restrictions. That legend which must be removed after the restrictions are lifted. A security with a legend cannot be transferred or sold and must be removed before any transaction.