New Jersey Assignment of Principal Obligation and Guaranty: A Comprehensive Overview In the state of New Jersey, an Assignment of Principal Obligation and Guaranty refers to a legal transfer of the responsibility for the principal obligation and the corresponding guarantee from one party to another. This legal document plays a crucial role when it comes to transferring rights, liabilities, and obligations associated with a loan or contractual agreement. It outlines the terms and conditions under which the transfer occurs and ensures that all parties involved understand their rights and responsibilities. Types of New Jersey Assignment of Principal Obligation and Guaranty: 1. Absolute Assignment: With an absolute assignment, the entire principal obligation and corresponding guarantee are transferred to the assignee, relieving the assignor from any further liability or responsibility. This type of assignment allows the assignee to enforce the debt against the original debtor and seek remedies in case of default. 2. Collateral Assignment: In a collateral assignment, only a portion of the principal obligation and guarantee is transferred to the assignee. The assignor retains an interest in the remaining portion, allowing them to still exercise some control over the loan or contractual agreement. This type of assignment is often used as security when the assignor needs to secure another loan or create a financial arrangement by pledging a specific amount of the principal obligation. 3. Assignments for Security: Assignments for security are commonly used in cases where the principal obligation involves the repayment of a loan. In this type of assignment, the assignor transfers the guarantee to the assignee as security against default by the original debtor. If the debtor fails to meet their obligations, the assignee can enforce the guarantee and seek repayment directly from the guarantor. Key Elements of a New Jersey Assignment of Principal Obligation and Guaranty: 1. Parties Involved: The assignment document must clearly identify the assignor (the party assigning the obligation), the assignee (the party receiving the obligation), and the guarantor (individual or entity providing the guarantee). The debtor (original party responsible for the principal obligation) should also be identified. 2. Principal Obligation: The assignment must specify the nature of the principal obligation being transferred. This can include the repayment of a loan, fulfillment of a contractual agreement, or any other specified obligation. 3. Guaranty Terms: The guarantees provided by the assignor must be clearly defined, including the extent of liability, timeframes, and specific conditions for invoking the guarantee. 4. Consideration: Any consideration provided in exchange for the assignment, such as a payment or another financial arrangement, should be clearly stated. 5. Governing Law and Jurisdiction: The assignment should specify that it is governed by New Jersey law and outline the jurisdiction where any disputes arising from the assignment will be resolved. Overall, a New Jersey Assignment of Principal Obligation and Guaranty is a critical legal document that ensures the smooth transfer of rights and responsibilities associated with a loan or contractual agreement. It protects the interests of all parties involved and provides a framework to address any potential issues that may arise during the course of the agreement.

New Jersey Assignment of Principal Obligation and Guaranty

Description

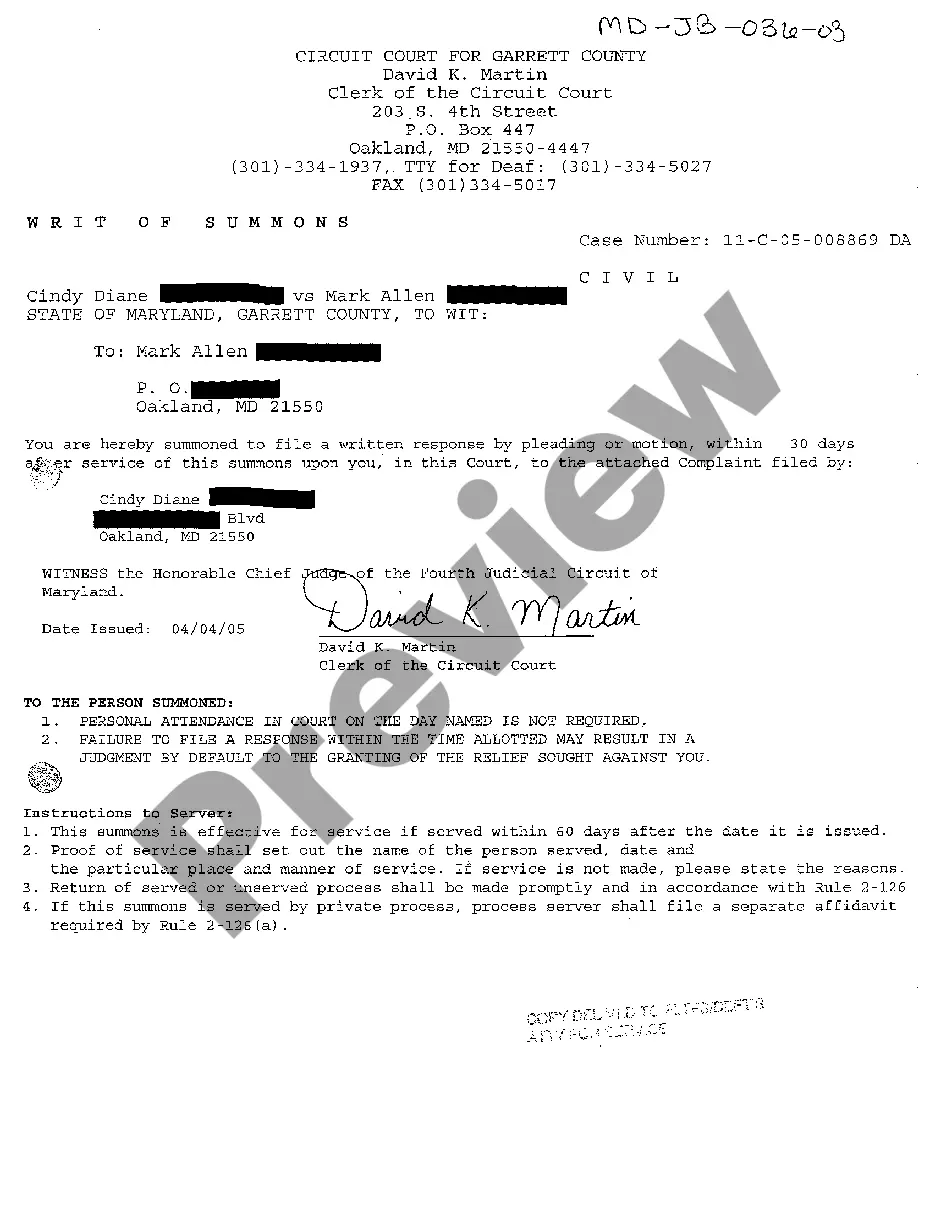

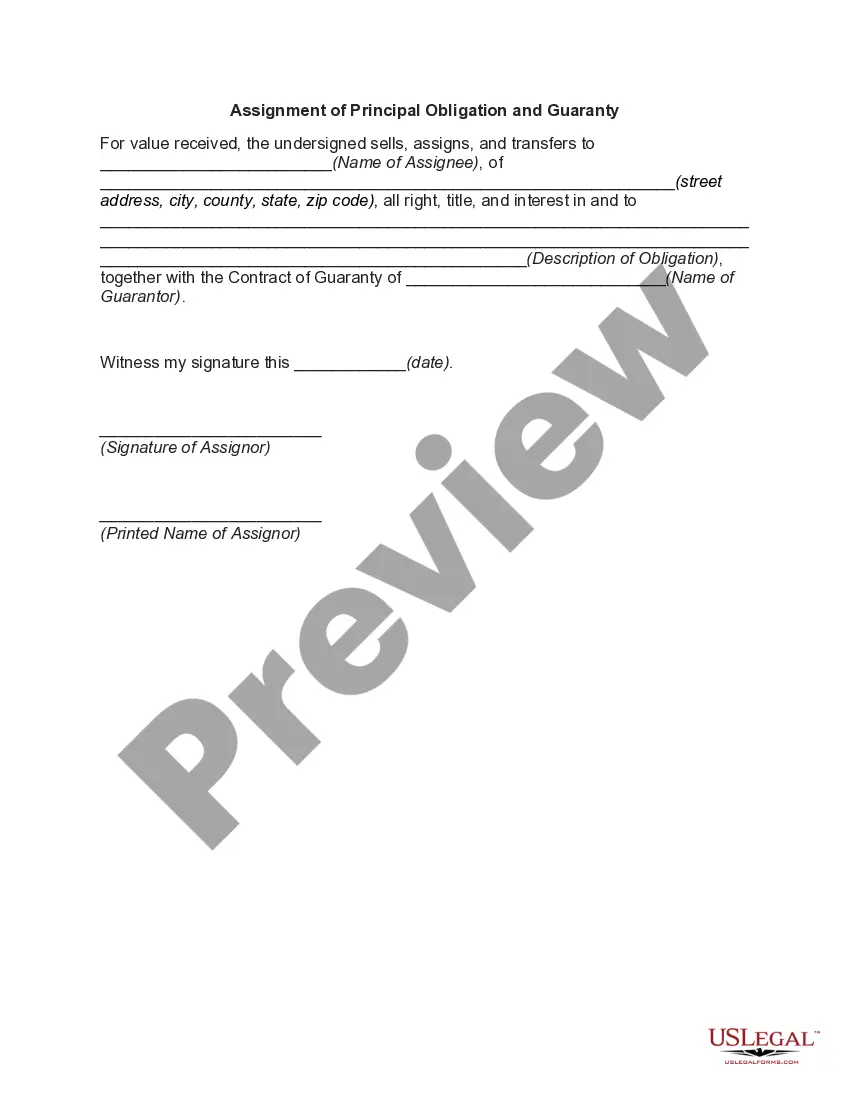

How to fill out New Jersey Assignment Of Principal Obligation And Guaranty?

If you want to complete, obtain, or print out lawful document themes, use US Legal Forms, the biggest selection of lawful kinds, which can be found on the web. Utilize the site`s simple and easy handy look for to obtain the files you will need. Different themes for company and individual functions are categorized by types and says, or search phrases. Use US Legal Forms to obtain the New Jersey Assignment of Principal Obligation and Guaranty in just a few mouse clicks.

When you are currently a US Legal Forms client, log in to the bank account and then click the Down load option to obtain the New Jersey Assignment of Principal Obligation and Guaranty. You may also entry kinds you previously downloaded in the My Forms tab of your bank account.

If you work with US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the form for your correct city/country.

- Step 2. Use the Preview method to examine the form`s content. Never forget about to learn the description.

- Step 3. When you are not happy with the kind, utilize the Look for area at the top of the screen to locate other models of the lawful kind design.

- Step 4. Once you have discovered the form you will need, go through the Get now option. Opt for the pricing strategy you favor and add your accreditations to sign up for an bank account.

- Step 5. Approach the deal. You should use your Мisa or Ьastercard or PayPal bank account to finish the deal.

- Step 6. Pick the format of the lawful kind and obtain it on the device.

- Step 7. Complete, modify and print out or indication the New Jersey Assignment of Principal Obligation and Guaranty.

Each lawful document design you get is your own eternally. You have acces to each kind you downloaded with your acccount. Select the My Forms area and choose a kind to print out or obtain once more.

Remain competitive and obtain, and print out the New Jersey Assignment of Principal Obligation and Guaranty with US Legal Forms. There are many professional and condition-certain kinds you can utilize for your personal company or individual requirements.