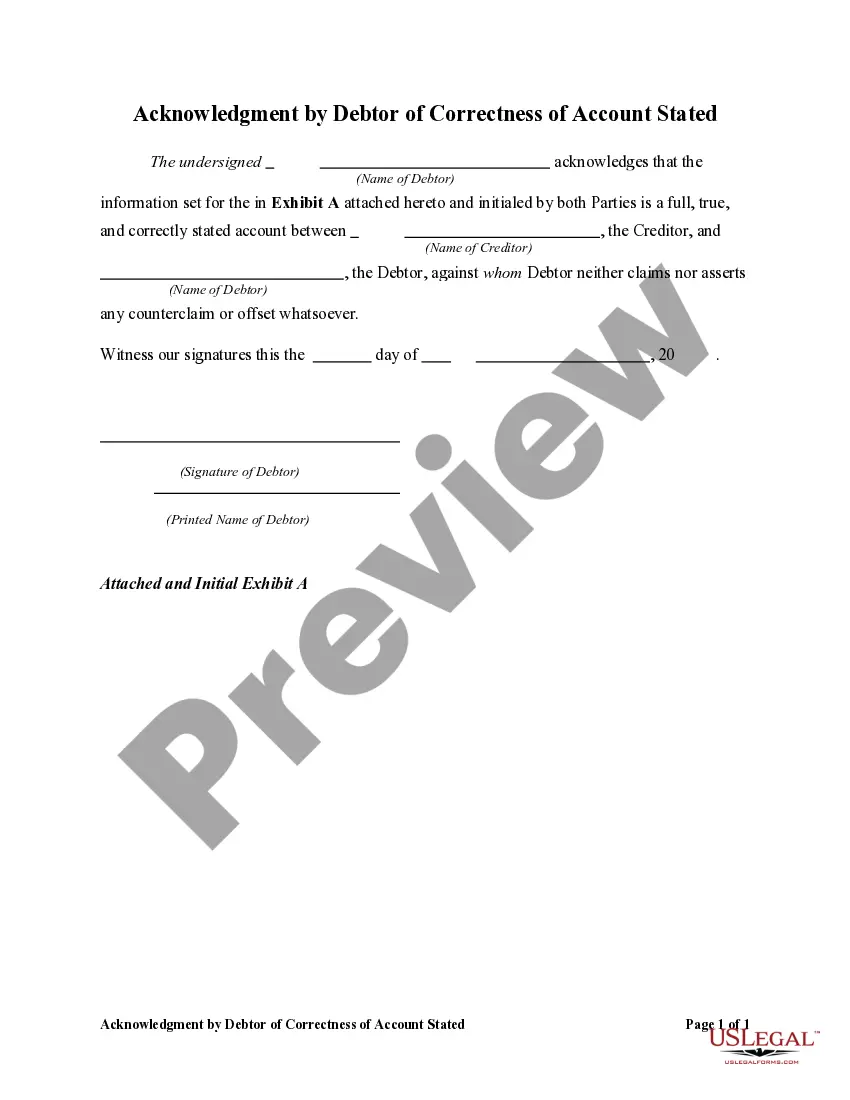

New Jersey Agreement that Statement of Account is True, Correct and Settled

Description

How to fill out Agreement That Statement Of Account Is True, Correct And Settled?

You can spend numerous hours online attempting to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of legal forms that can be reviewed by experts.

You can download or print the New Jersey Agreement that Affirms the Account Statement is Accurate, Correct, and Settled from our service.

First, ensure you've selected the correct document template for your chosen state/city. Review the form details to confirm you have chosen the appropriate type. If available, use the Review option to browse through the document template as well. If you wish to find another version of the form, utilize the Search field to locate the template that meets your criteria and specifications. Once you've found the template you need, click on Buy now to proceed. Select the pricing plan you desire, enter your credentials, and sign up for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal document. Choose the format of the record and download it to your device. Make adjustments to your record if applicable. You can complete, modify, and sign and print the New Jersey Agreement that Affirms the Account Statement is Accurate, Correct, and Settled. Acquire and print a vast number of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to manage your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and then select the Acquire option.

- After that, you can complete, modify, print, or sign the New Jersey Agreement that Affirms the Account Statement is Accurate, Correct, and Settled.

- Every legal document template you purchase is yours forever.

- To obtain another copy of any purchased form, visit the My documents tab and select the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

Requesting a default judgment in New Jersey involves filing an application with the court after the defendant fails to respond to your complaint. You will need to provide proof of the New Jersey Agreement that Statement of Account is True, Correct and Settled. It is advisable to seek guidance from legal experts to ensure your documents meet all necessary requirements.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

How to file a W-4 form in 5 StepsStep 1: Enter your personal information. The first step is filling out your name, address and Social Security number.Step 2: Multiple jobs or spouse works.Step 3: Claim dependents.Step 4: Factor in additional income and deductions.Step 5: Sign and file with your employer.

Since your home was your principal residence for at least 24 out of the prior 60 months there will be no taxable gain and no estimated tax payment will be required, Kiely said. Email your questions to Ask@NJMoneyHelp.com.

Exemptions to the NJ Exit Tax If you remain a New Jersey resident, you'll need to file a GIT/REP-3 form (due at closing) and it will exempt you from paying estimated taxes on the sale of your home. Instead, any applicable taxes on the gain from the sale are to be reported on your New Jersey Gross Income Tax Return.

How to fill out a W-4 formStep 1: Personal information.Step 2: Account for multiple jobs.Step 3: Claim dependents, including children.Step 4: Refine your withholdings.Step 5: Sign and date your W-4.» MORE: See more about what it means to be tax-exempt and how to qualify.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

A removed or discharged fiduciary must deliver to his or her successor all assets as of the date of discharge generally and then he or she must prepare, file and settle his/her accounts within 60 days after entry of judgement or within such time as the court may direct.

You must respond to each numbered paragraph in the complaint and either admit the allegation, deny the allegation, or state that you do not have enough information to know whether the statement is true. In the area for Affirmative Defenses, you can list the facts which defend your action or inaction.